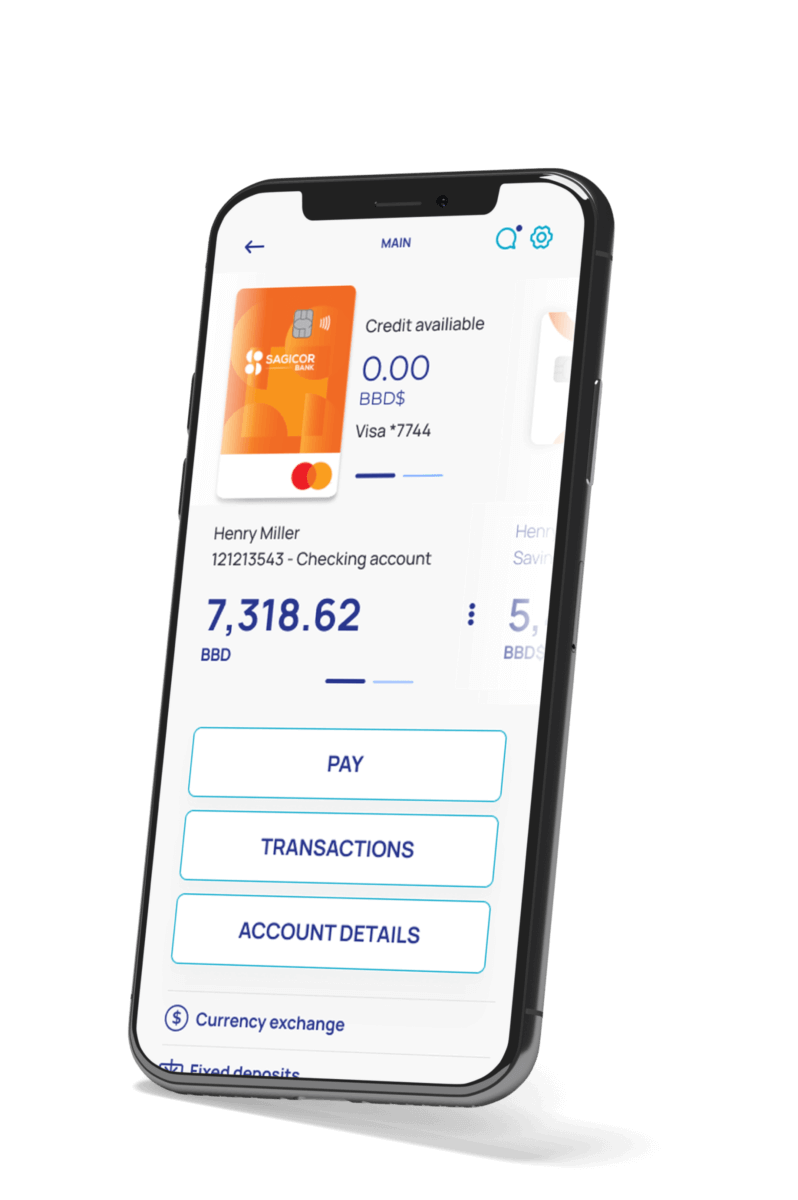

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

Digital banking has flipped the traditional banking model on its head, giving us more control over our finances than ever before. Imagine handling all your financial needs—from transferring money to applying for a loan or investing in stocks—without setting foot in a bank. This is the promise of digital banking: full access to your money, anytime, anywhere, all from your computer or smartphone.

Let’s explore what digital banking really is, how it works, why it’s so appealing, and what the future holds for this revolutionary approach to managing money.

So, What is Digital Banking?

At its core, digital banking is the transformation of traditional banking services into a fully digital experience. It’s not just about checking your balance online. Digital banking includes a whole range of services—from managing accounts and making payments to investing and taking out loans—all in one place.

Key Components of Digital Banking

Digital banking isn’t just about moving old banking services online. It’s about reimagining the way we interact with our finances to make banking faster, easier, and more accessible. Here’s a breakdown of the major components:

| Component | What It Means for You |

|---|---|

| Account Management | View balances, transfer funds, and manage accounts all in one spot—without visiting a branch. |

| Payments and Transfers | Send money to friends, pay bills, or even make international transfers directly from your app or website. |

| Loans and Credit | Apply for a loan or manage credit without paperwork. Quick approvals and transparent tracking make borrowing simpler. |

| Investment Services | Access investment tools and insights, track your portfolio, and make real-time trades right from your banking dashboard. |

| Customer Support | Virtual assistants, live chats, and 24/7 support let you resolve issues whenever they arise, without waiting in line. |

Why is Digital Banking a Big Deal?

Digital banking offers more than convenience; it brings speed, control, and transparency to our financial lives. Let’s look at some of the key benefits that make digital banking such a compelling choice.

| Benefit | How It Helps You |

|---|---|

| 24/7 Convenience | Banking is now on your schedule. Transfer money, pay bills, or check your balance anytime, whether it’s 3 PM or 3 AM. |

| Enhanced Security | With two-factor authentication, biometric login, and real-time alerts, your money stays protected against fraud. |

| Cost Savings | Digital banking often means lower fees as banks save on operational costs—savings they can pass on to you. |

| Speedier Transactions | Say goodbye to waiting. From real-time transfers to instant loan approvals, digital banking saves you time on every transaction. |

| Personalized Insights | Get customized financial advice based on your spending habits and goals, helping you make smarter decisions for the future. |

| Environmentally Friendly | Less paper, fewer branch visits, and reduced physical infrastructure make digital banking a greener option. |

How Digital Banking Works

Digital banking platforms combine advanced technology and a user-friendly design to make banking as smooth as possible. Here’s a closer look at how each component of digital banking functions:

1. Account Management

- Access Anytime, Anywhere: No need to rush to the bank. You can check balances, monitor expenses, and even set savings goals from your phone.

- Remote Deposits: Deposit checks by simply snapping a picture, making it easier to get funds into your account without a trip.

2. Payments and Transfers

- P2P Payments: Send money to friends or family instantly. Services like Zelle and Venmo integrate with digital banks to make transactions seamless.

- Automated Bill Pay: Never miss a bill payment. Schedule payments in advance to stay on top of finances with minimal effort.

3. Loans and Credit

- Quick, Paperless Applications: Applying for a loan takes minutes, with many banks offering immediate pre-approvals.

- Credit Tracking: Stay in the know about your credit health with integrated tracking and tips to improve your score.

4. Investment Services

- Real-Time Market Insights: Stay updated on market trends and receive alerts for major changes affecting your investments.

- Personalized Advice: Access AI-driven tools that suggest investments based on your financial profile and goals.

5. Customer Support

- Virtual Assistants: Get quick answers to common questions, check balances, and solve issues using AI-powered chat.

- 24/7 Human Support: Many banks offer 24/7 live chat, phone support, or even video calls for those times when you need real assistance.

Digital Banking vs. Traditional Banking: How Do They Compare?

Here’s a quick comparison to see where digital banking shines and where traditional banking still holds its ground:

| Feature | Traditional Banking | Digital Banking |

|---|---|---|

| Availability | Limited to branch hours and physical locations | Available anytime, anywhere through your device |

| Transaction Speed | Slower, often requires manual processing | Fast and often real-time |

| Customer Interaction | In-person service | Chatbots, live chat, email, and 24/7 phone support |

| Fees | Often includes maintenance and branch fees | Lower fees due to reduced operational costs |

| Environmental Impact | High due to physical resources | Reduced environmental footprint thanks to paperless operations |

Overcoming Challenges in Digital Banking

While digital banking brings tremendous benefits, it’s not without its challenges. Security, digital literacy, and customer trust are major factors banks must address.

Security and Privacy Concerns

With great convenience comes the need for great security. Cyber threats are a real risk in digital banking, but banks are proactive in combating these issues:

- Encryption: Protects your data, making sure only you have access to your financial information.

- Two-Factor Authentication (2FA): Adds a layer of protection by requiring two forms of identification.

- Biometrics: Face recognition and fingerprint scans keep your account secure from unauthorized access.

Digital Literacy

While younger, tech-savvy generations easily adapt to digital banking, some users find it challenging. Digital banks address this by focusing on user-friendly design and offering customer education.

Building Trust

Not everyone is ready to trust digital-only banks, especially when dealing with sensitive financial information. Banks strive to build trust by offering transparent terms, consistent service quality, and accessible customer support.

The Future of Digital Banking: Trends to Watch

Digital banking continues to evolve, driven by innovations like artificial intelligence and blockchain technology. Here’s a look at some trends shaping the future of banking:

| Future Trend | What’s Coming |

|---|---|

| AI and Machine Learning | AI will continue to personalize financial services, providing insights tailored to individual spending and saving habits. |

| Blockchain Technology | Blockchain could revolutionize security, making transactions more transparent and reducing fraud risks. |

| Open Banking | Allows third-party apps to access financial data with user consent, enabling more customized services. |

| Neobanks and Digital-Only Banks | Digital-only banks will expand, offering streamlined services without the overhead of physical branches. |

| Augmented Reality (AR) | In the future, AR could make financial planning more interactive, helping you visualize your investments and savings goals. |

How to Choose the Right Digital Banking Platform

With so many digital banking options, it’s important to choose the right one for your needs. Here are some tips:

- Check the Fees: Some digital banks offer fee-free accounts, but look out for hidden fees on transactions or overdrafts.

- Evaluate Security Features: Make sure the platform has strong security measures like 2FA, biometric login, and fraud alerts.

- Explore User Experience: A well-designed, intuitive interface makes a huge difference, especially if you’re not a tech expert.

- Look at Customer Support Options: Reliable support is key, whether it’s via live chat, phone, or email.

- Assess Extra Features: Some digital banks go beyond basics with budgeting tools, investment options, and educational resources.

Wrapping Up: Why Digital Banking is Here to Stay

Digital banking solutions aren’t just a trend—they’re the future of finance. From 24/7 convenience to lower costs and personalized experiences, digital banking provides control and flexibility that traditional banks simply can’t match. As technology advances, expect digital banking to become even more integral to everyday life, reshaping how we manage our money in ways we can only imagine.

Whether you’re just starting with digital banking or looking to switch platforms, understanding its key features, benefits, and challenges can empower you to make smarter financial decisions. The future is here, and it’s digital—giving you the power to manage your money on your own terms.