“In our business, we always feel like we’re at the fire,” say many investment bankers.

How’s that?

Been there, done that. It’s a high-stakes game. It’s more than just crunching numbers; it’s about tackling unseen risks and navigating market uncertainties.

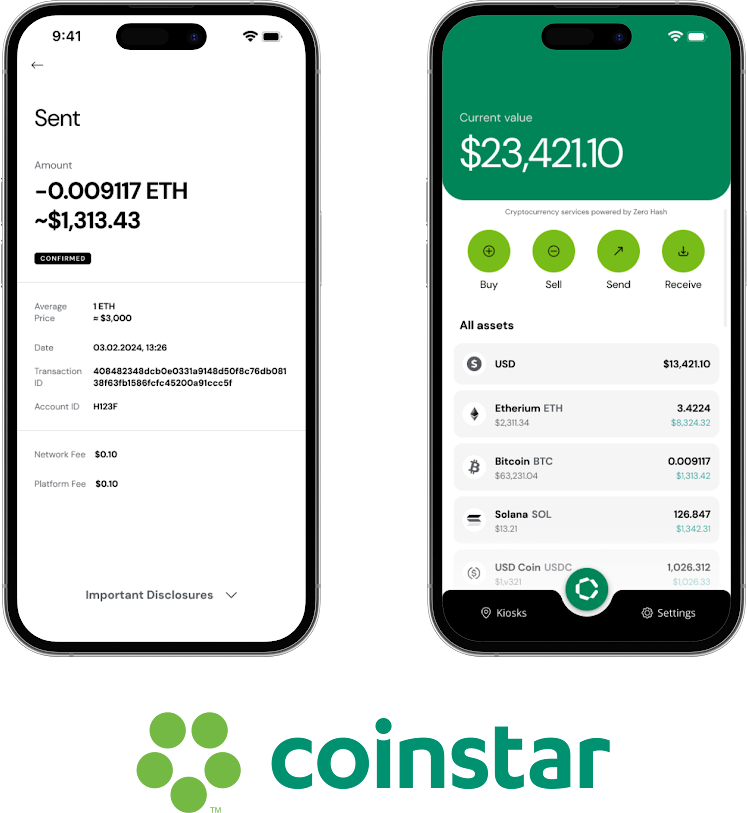

And you know who stokes the fire? Gen Z, millennials, and Generation X. Reports indicate that, official website primarily use apps to manage their investments. They want everything done quickly and at their fingertips—otherwise, you’re out of the market.

Just like firefighters grab their tools to fight flames, bankers utilize their intangible tools—software—to serve clients from these younger generations.

Let’s dive into what these tools are and how they help bankers thrive in a changing financial world.

Current Software Used by Investment Banks

Simply put, there are two types of software:

For internal use. Software used by brokers, traders inside the banks.

Client software. A variety of online platforms that are available to the client. They can be downloaded from the official websites of banks or from Google Play (App Store).

The main categories of software

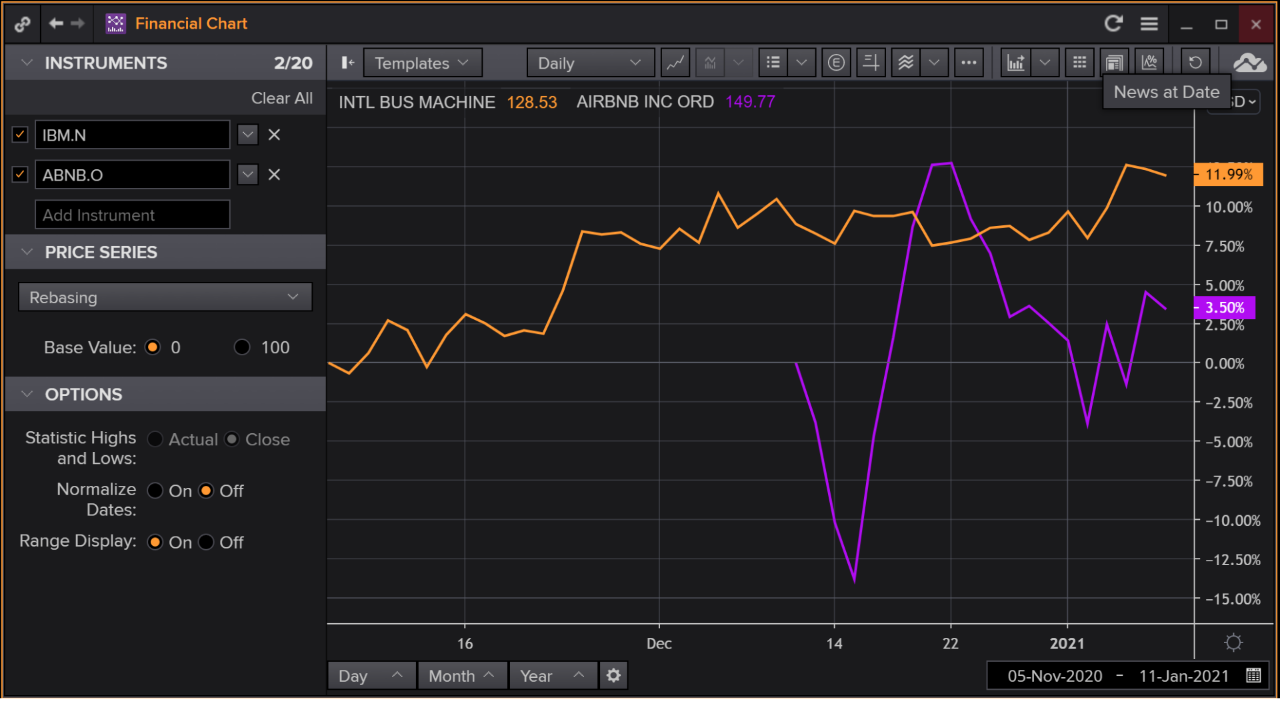

Excited to start with online trading platforms, this is probably one of the main categories. Trading Platforms like Bloomberg Terminal, its competitors Refinitiv Eikon, MetaTrader and Fedissa offer to access to analytical data, trading tools (trades, orders).

Risk Management. This software is used for credit risk analysis, derivatives management, access to complex analysis of financial situation. Examples of Risk Management programs: BlackRock Aladdin, MSCI Barra, Sungard.

Portfolio Management (portfolio and asset management systems). Such systems have different functionality and allow banks to assess investment risks and support trading operations. Users have access to analytics and research. Charles River, FactSet, Morningstar Direct systems fall into this category.

CRM and M&A (deal and client management). This software is used to manage the customer base. The user can control workflow, transactions, structure deals, and manage mergers and acquisitions (M&A). Dealogic, Salesforce, and Intralinks programs fall into this category.

Data Analytics & Reporting. From the name, it becomes clear that this software is used primarily to automate reporting and access advanced analytical tools. These include SAS, Tableau, AxiomSL.

Market leaders and an overview of their products

Lat’s face it, the undisputed market leader is Bloomberg with its Bloomberg Terminal platform.

Bloomberg specialists even developed their own keyboard with special keys, providing quick access to financial and trading instruments.

The first version of the terminal appeared in 1982. To date, there are about 325 thousand users of Bloomberg Terminal, and an annual subscription costs 29 thousand dollars.

Bloomberg’s closest competitor is Refinitiv, which has developed the online platform Eikon.

The window of the Eikon terminal.

Its popularity is due to the availability of many tools:

- News feed.

- Internal chat for communication.

- Own ratings.

- Financial analytics.

- Target setting for transactions

- Quick access to investment research.

The platform supports 15 languages and provides access to global financial news and investment market analysis.

The Salesforce platform is one of the leaders among CRM platforms.

Mark Benioff, an Oracle veteran, birthed his groundbreaking SaaS venture in 1999. This American entrepreneur’s creation would reshape tech. It would launch a new era of cloud-based business solutions.

Many banks including U.S. Bank and Ulster Bank use Salesforce to improve customer interactions. On the official website, information about all customers using this CRM platform is available. Salesforce offers:

- Cloud-based technology.

- Proprietary API for integrating third-party applications.

- Marketing tools.

- E-commerce solution.

- Mobile version.

- Flexibility and scalability.

Salesforce powers investment banks’ operations, streamlining client relations, investor databases, and capital management. The platform improves sales and generates key reports. It boosts efficiency in financial institutions.

Usage Options and Benefits for Investment Bankers

There are several options for using investment banking software, let’s take a look at the most common ones:

- Automated Trading and Algorithmic Trading. Automated and Algorithmic Trading.

- Risk Management and Fraud Detection. Risk Management and Fraud Detection.

- Portfolio Management and Asset Allocation. Portfolio Management and Asset Allocation.

- Customer Relationship Management (CRM). Specialized software, CRM systems, for effective customer and investor relations.

The main advantages of using software for investment banks is to reduce costs, automate processes and attract new clients and investors.

Current Trends in Investment Banking Software

In this section, I will try to briefly outline what is happening in investment banking software today and describe the main trends.

Artificial Intelligence and Machine Learning

According to reports from analysts and researchers, up to 80% of investment banks realize the potential of AI and machine learning. With rising spending on new tech, analysts expect a $1 trillion market soon.

Artificial intelligence and machine learning are used in different areas of investment banking, from analytical trading and risk management to analyzing large data sets and forecasting investment trends. Already today, many investors make decisions based on the work of AI. As practice shows, the accuracy of such analytics and the speed of decision-making is much higher.

Cloud Computing

Many large banks are switching to the Cloud and it is profitable. Why buy expensive equipment when you can rent servers and computing power from Amazon Web Services (AWS), Microsoft Azure or Google Cloud. This is much cheaper and saves investment banks significant amounts of money.

Cloud technology helps to overcome critical load peaks, increase the speed of transaction processing and be independent of local adverse factors such as man-made and natural disasters. With cloud computing, the bank will continue to operate and provide services to customers and investors

Blockchain and RegTech Solutions

First, let’s take a look at what blockchain solutions are and their benefits. This technology enables secure transactions of digital assets. It does this through complex blockchain calculations. It is impossible to forge a block for the purpose of fraud in a smart contract. The very high security of Blockchain technology attracts investment banks. A clear example is the investment bank JP Morgan. It has created a successful blockchain platform, JPM Coin. It is mainly used for secure cross-border money transfers. The bank has also used the Onyx blockchain to handle smart contracts with digital assets.

RegTech, or Regulatory Technology, uses AI and Machine Learning. It checks transactions for legality and creates reports for regulators. It helps investment banks by automating client asset checks and tracking investors.

This technology also helps banks quickly meet regulatory needs. Notably, UBS and Goldman Sachs are investing in RegTech.

Data Analytics and Business Intelligence Tools

Such tools help investors analyze and visualize large data sets. They extract relevant information from them. This enables optimal business decisions. Such tools include:

- Microsoft’s Power BI.

- Tableau.

- Qlik Sense.

- Apache Hadoop.

The choice of analytical tool for business intelligence depends on the amount of data, accuracy requirements and the bank’s objectives.

Future Software Trends to Watch out for

To keep up with the competition, you need to keep an eye on future trends in investment banking software. In this section, I will try to summarize what the near future holds for investment banking software.

Personalized Client Solutions

In the future, the investor’s life will become even easier thanks to the systematic approach and customer experience of banks. This is especially true for personalized experiences based on artificial intelligence (AI) technologies. The customer will receive relevant information and even recommendations for strategic investment planning. And robo-advisers, using special algorithms, will learn customized plans based on customers’ key parameters.

Integration of Quantum Computing

Quantum computers no longer seem like something from the realm of science fiction. Their main advantage is speed. A quantum computer is able to solve calculations that a normal computer can cope with, for example, in 5 minutes in 5 seconds. This opens up limitless possibilities in the sphere of processing huge data arrays, analyzing risks, building optimal strategies for investors and making decisions with incredible accuracy.

Decentralized Finance Solutions (DeFi)

DeFi’s blockchain-based technology will allow customers and investors to dispense with intermediaries when making transactions. No need to go to traders or brokers, DeFi will make it possible to quickly conclude transactions through smart contracts using digital assets. It’s too early to say how much of an impact this will have on the investment banking sector, however, some investors are already looking forward to the mass adoption of decentralized finance technology.

Augmented and Virtual Reality

Apple’s virtual augmented reality helmet.

Augmented and virtual reality is expected to replace traditional monitors. An investor only needs to put on a special helmet to see terminal windows, open programs with analytics and perform all necessary operations without a keyboard, but with the help of gestures.

The advantage of augmented reality is that the client gets many windows in front of him without using traditional monitors. Gesture control will allow refusing keyboards and mice, which will make the work process faster and more efficient.