The digital payment landscape is evolving rapidly, and e-wallets are at the forefront of this transformation. Businesses looking to enter this lucrative market often turn to white-label e-wallet solutions, which allow them to launch branded wallets without developing one from scratch. This article explores the costs, features, and benefits of white-label e-wallets, helping you make informed decisions for your business.

What is a White-Label E-Wallet?

A white-label e-wallet is a ready-made software solution provided by a third-party vendor. Businesses can customize the platform with their branding, integrate desired functionalities, and deploy it as their own payment solution. These e-wallets are used for a variety of purposes, including peer-to-peer payments, online shopping, and digital banking.

Key Features of a White-Label E-Wallet

A robust white-label e-wallet should offer the following features:

1. Core Wallet Functionality

- Store multiple currencies, including fiat and cryptocurrencies.

- Enable secure transfers (P2P, merchant payments, bill payments).

- Offer quick and easy reload options (bank transfers, card payments, etc.).

2. User Management

- Easy registration with KYC/AML compliance.

- Role-based access for users (e.g., admin, customer).

- Account recovery and user support options.

3. Security Features

- End-to-end encryption and secure socket layer (SSL) protocols.

- Multi-factor authentication (MFA).

- Biometric login (fingerprint, facial recognition).

4. Integration Capabilities

- API integrations with banks, payment gateways, and external services.

- Support for loyalty programs and reward points.

- Integration with e-commerce platforms for seamless checkout.

5. Analytics and Reporting

- Real-time transaction tracking and reporting.

- User behavior insights and predictive analytics.

- Customizable dashboards for administrators.

6. Regulatory Compliance

- Adherence to local and international financial regulations.

- Support for GDPR, PSD2, and other data privacy laws.

- Built-in fraud detection and anti-money laundering tools.

7. Scalability

- Cloud-based infrastructure to handle increasing user demands.

- Cross-platform compatibility (iOS, Android, Web).

Development Costs for a White-Label E-Wallet

The cost of developing a white-label e-wallet depends on features, customization, and vendor services. Below is a general breakdown:

| Development Stage | Estimated Cost | Timeline |

|---|---|---|

| Initial Consultation | $2,000 – $5,000 | 1-2 weeks |

| Customization and Branding | $10,000 – $20,000 | 2-4 weeks |

| Core Development | $30,000 – $50,000 | 3-6 months |

| Integration with APIs | $10,000 – $30,000 | 2-3 months |

| Security Features | $15,000 – $25,000 | Ongoing |

| Testing and QA | $5,000 – $10,000 | Continuous |

| Licensing Fees (Annual) | $10,000 – $50,000 | – |

Total Estimated Cost: $70,000 – $200,000+ (varies with complexity and vendor services).

White-Label E-Wallet vs. Custom Development

| Aspect | White-Label E-Wallet | Custom Development |

|---|---|---|

| Time to Market | 2-3 months | 9-12 months |

| Cost | Lower upfront costs | High upfront costs |

| Customization | Limited (dependent on vendor) | Full control over features and design |

| Scalability | Moderate to High | Fully scalable based on business needs |

| Maintenance | Handled by vendor | Requires in-house team or external support |

Benefits of a White-Label E-Wallet

- Quick Deployment: Enter the market in weeks, not years.

- Cost Efficiency: Avoid the high costs of development from scratch.

- Regulatory Compliance: Vendors ensure adherence to financial regulations.

- Customer Loyalty: Offer rewards, discounts, and cashback directly in your wallet.

- Revenue Generation: Monetize through transaction fees, partnerships, and subscriptions.

Choosing the Right White-Label E-Wallet Provider

To maximize the success of your e-wallet, selecting the right vendor is crucial. Here’s what to look for:

- Experience and Expertise

- Choose vendors with a strong portfolio in digital payments.

- Check client testimonials and success stories.

- Customization Options

- Ensure the vendor allows for branding and feature modifications.

- Ask about flexibility for future upgrades.

- Security Standards

- Verify the use of robust encryption and authentication protocols.

- Confirm compliance with international standards like PCI DSS.

- Integration Support

- Look for compatibility with existing systems, such as CRM and ERP platforms.

- Post-Launch Support

- Evaluate the vendor’s maintenance, troubleshooting, and update services.

Strategic Use Cases for White-Label E-Wallets

White-label e-wallets can be leveraged across industries:

- Retail and E-commerce: Provide seamless payments and reward points for customers.

- Banking and Financial Services: Launch digital wallet solutions to enhance customer engagement.

- Telecom Companies: Enable mobile money transfers and bill payments.

- Travel and Hospitality: Simplify bookings and payments for travel services.

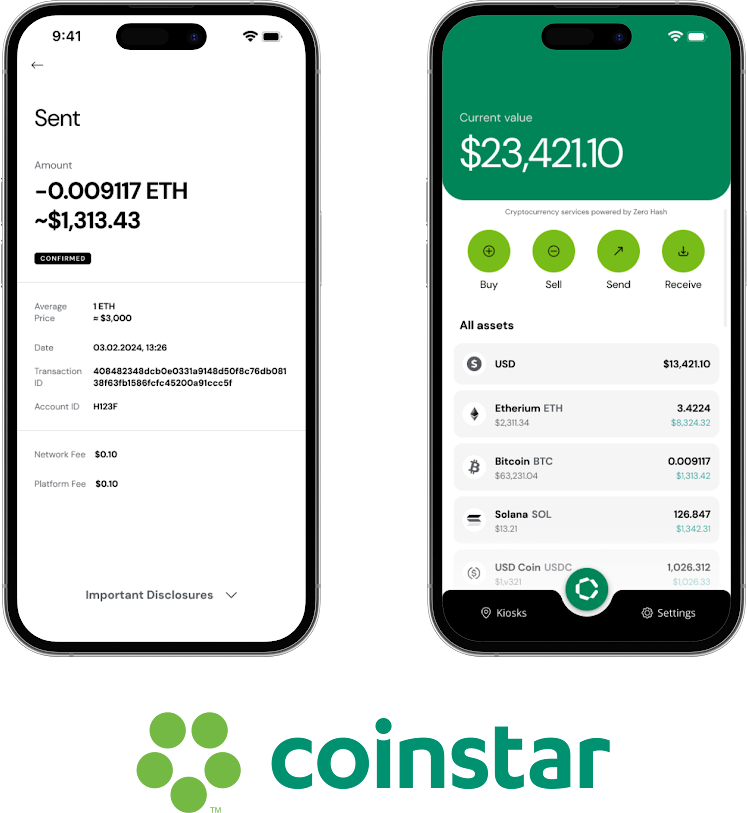

- Cryptocurrency Platforms: Offer secure wallets for managing digital assets.

Future Trends in E-Wallet Solutions

The demand for e-wallets will only grow as digital payments become the norm. Key trends include:

- Integration with Blockchain: Enhanced transparency and security for transactions.

- AI-Powered Analytics: Improved customer insights and fraud prevention.

- Cross-Border Payments: Simplified international transactions with reduced fees.

- Voice-Activated Payments: A rising trend in smart device integration.

Conclusion

White-label e-wallets are an excellent option for businesses looking to tap into the fast-growing digital payments market. With quick deployment, lower costs, and scalability, these solutions provide a solid foundation for growth. By carefully evaluating vendors and aligning features with your business goals, you can create a branded e-wallet that delights users and generates long-term value.

Are you ready to launch your e-wallet? Start today and gain a competitive edge in the world of digital payments!