White-Label Trading System For Enterprises

Itexus offers a modular white-label trading platform designed for brokers, fintech startups, and financial institutions aiming to provide seamless multi-asset trading experiences under their own brand.

Why Choosing a Custom White-Label Trading Solution

Building a trading system from scratch requires extensive planning and specialized technical teams.

Maintaining in-house trading infrastructure demands financial investment.

Navigating international KYC, AML, and data security regulations is a major barrier for most new market entrants.

Low-latency data, concurrent trade execution, and load resilience are non-negotiable in trading environments.

Relying on generic white label platforms leads to poor UX and limited growth.

Many solutions offer limited access to source code or prevent long-term flexibility.

Inflexible platforms delay important updates, making it hard to keep up with users and the market.

Using multiple third-party tools can result in inconsistent interfaces and reduced user trust.

What You Get with Our Modular Trading System

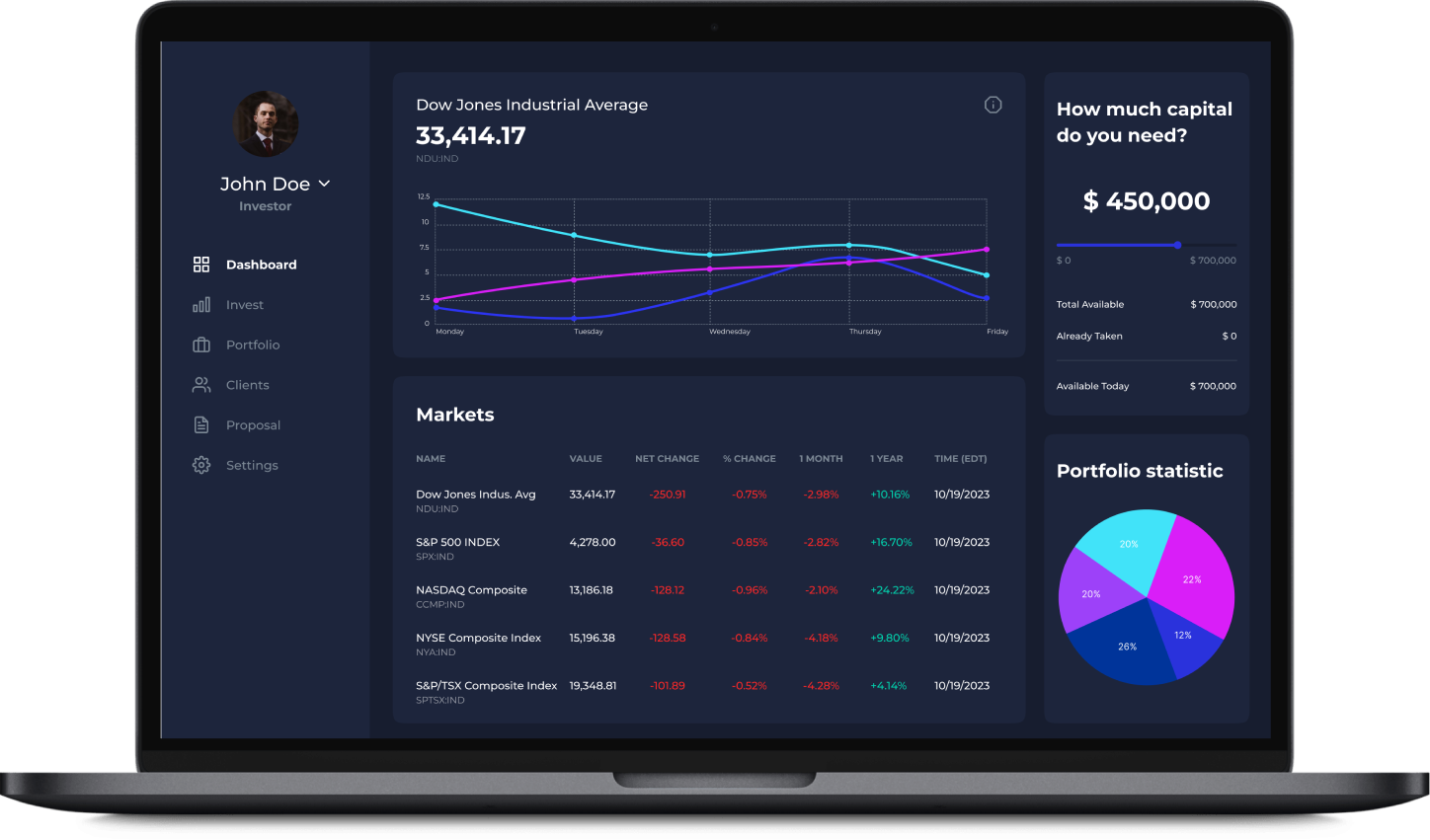

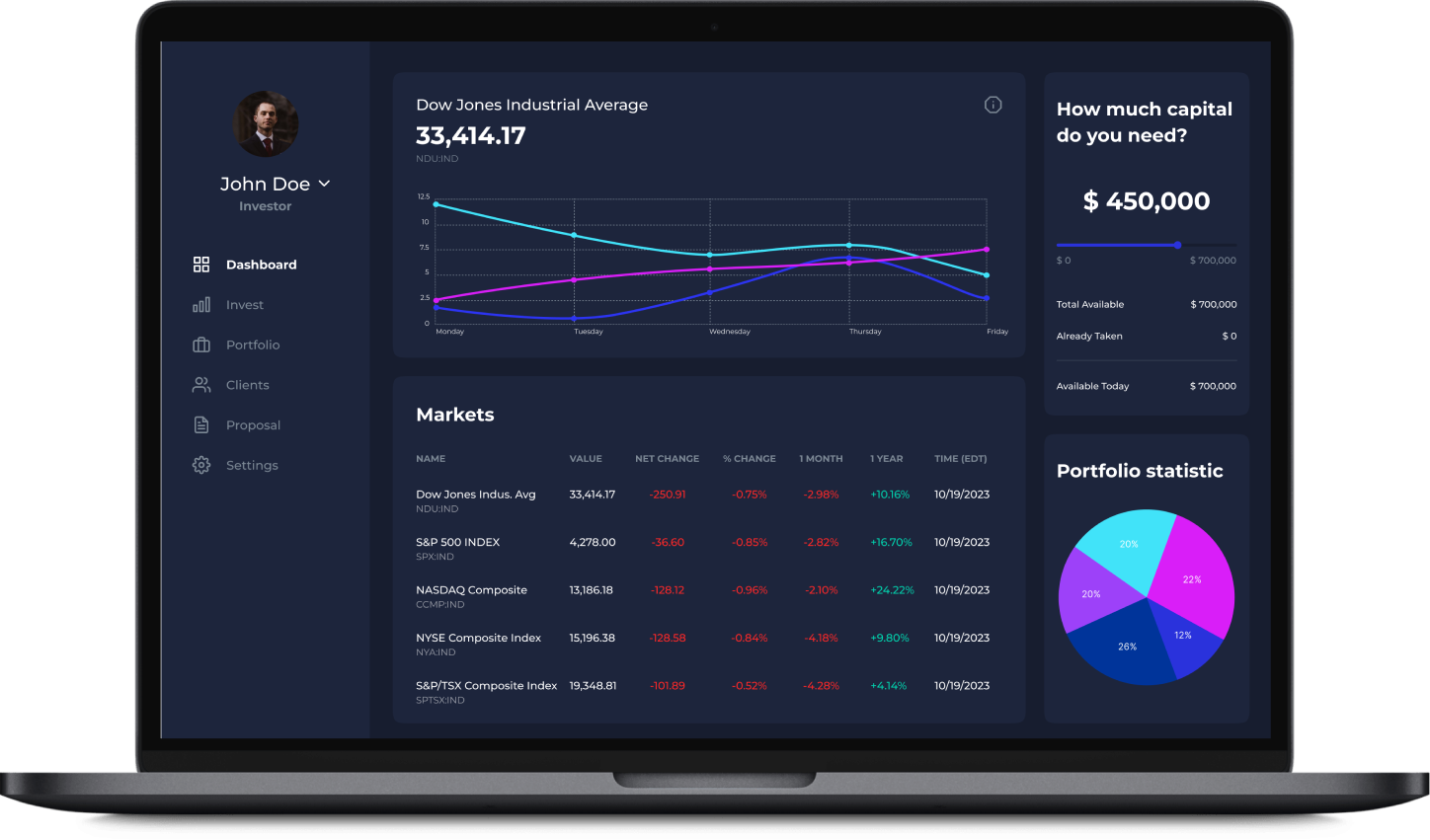

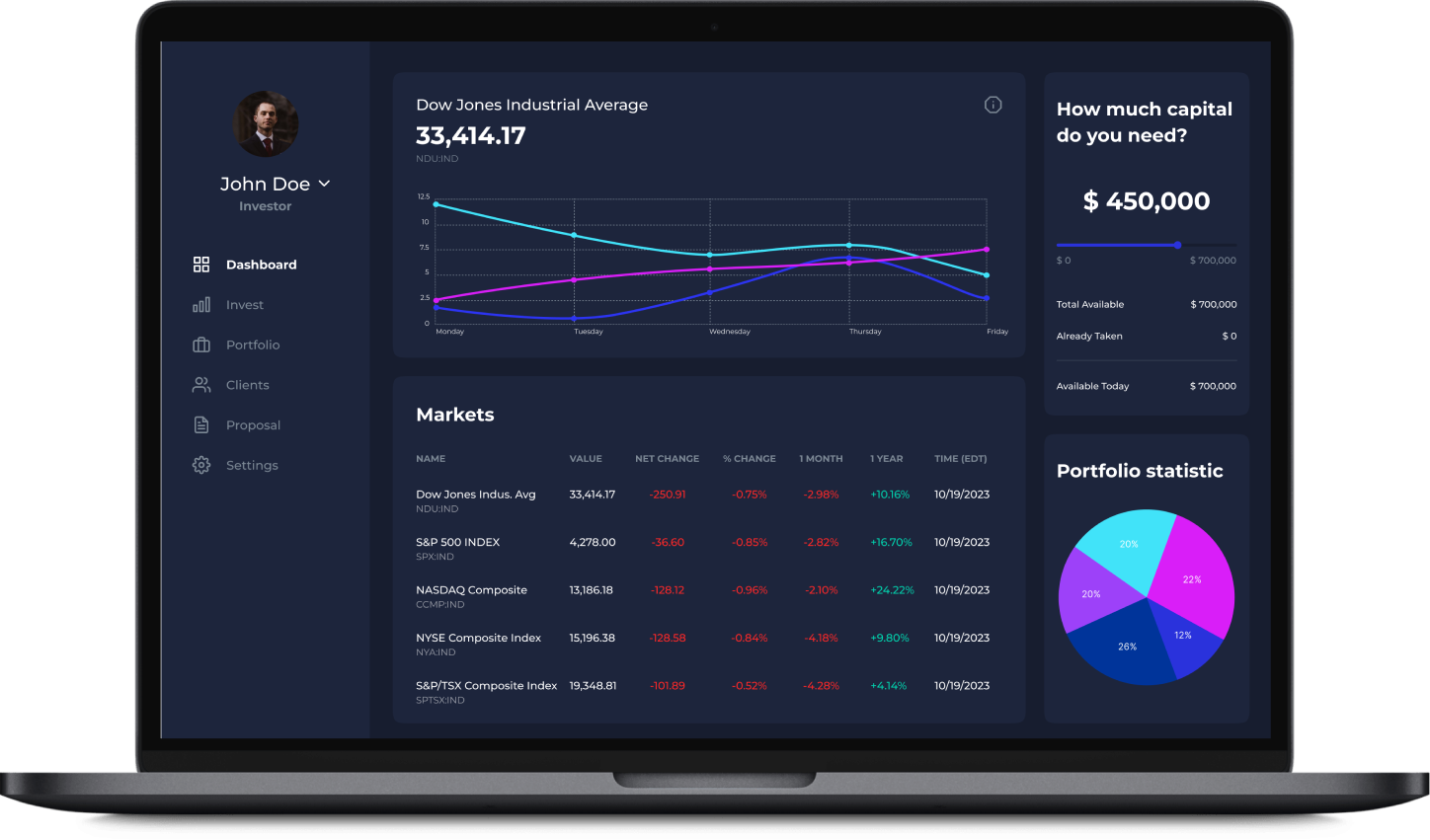

Our white label trading platform offers a robust foundation for launching a custom, full-featured trading experience — under your brand, on your terms. We deliver a modern white-label trading platform solution with everything you need to operate:

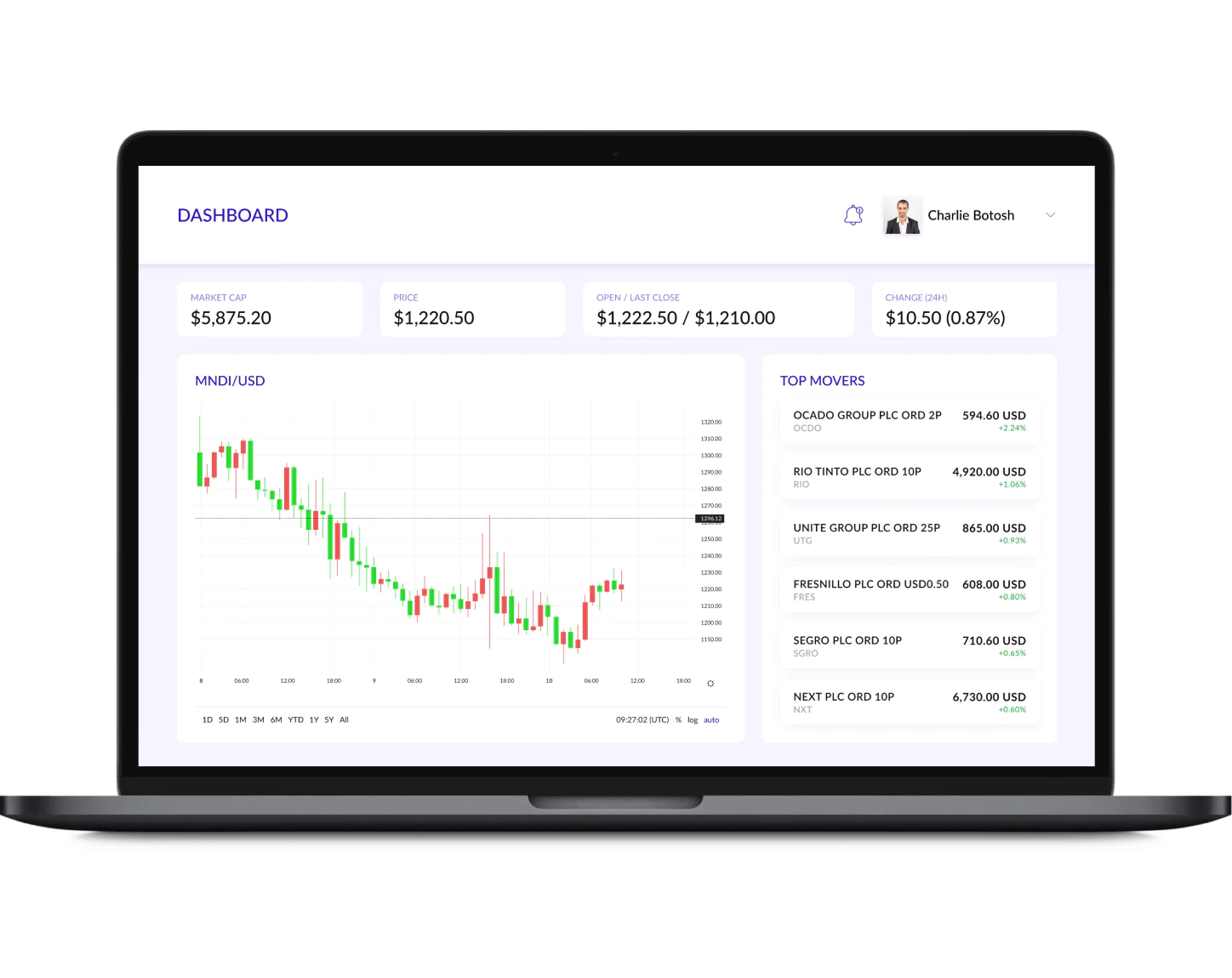

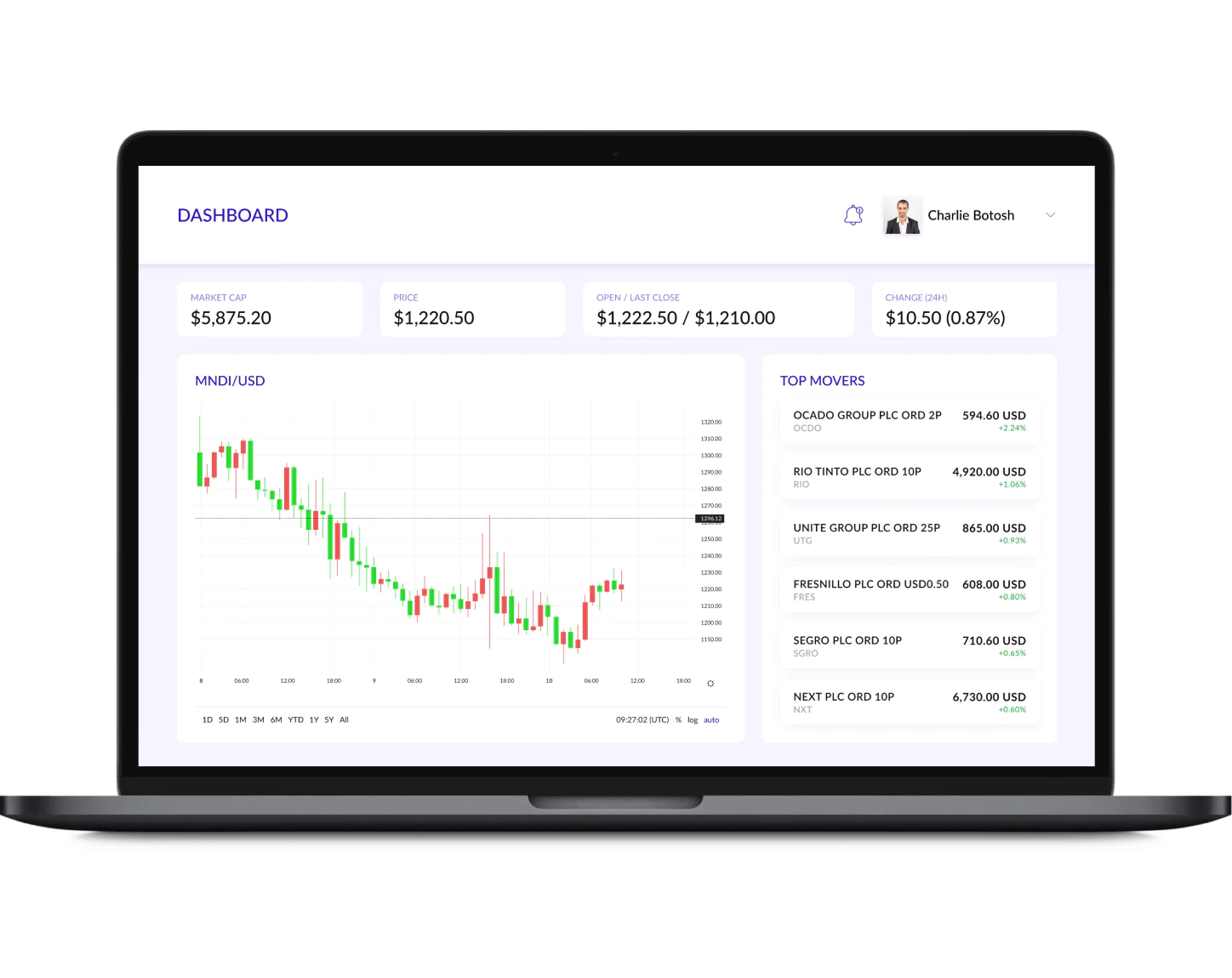

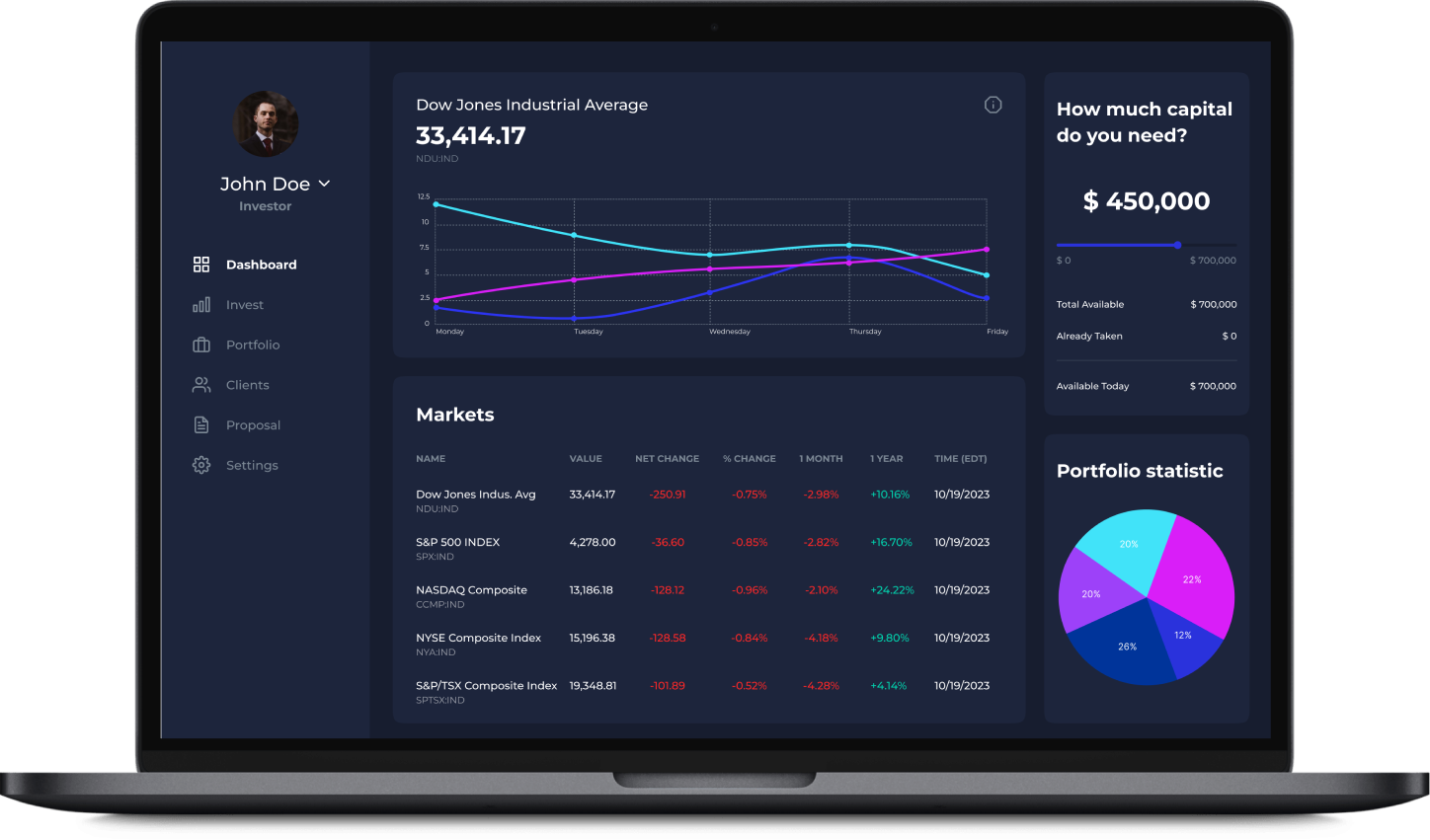

- Branded web and mobile (iOS/Android) terminals

- Real-time market data and depth of market (Level 2)

- Custom watchlists, smart charting, advanced order types

- Multilingual UI (25+ languages)

- Support for demo/simulated trading

- User & account management

- Real-time risk & margin monitoring

- Trade surveillance and compliance reporting (MiFID II, ESMA)

- Flexible commission/spread settings, fee setup

- KYC/AML integrations (Sumsub, Veriff)

- Multi-role access, audit logs, analytics

- Ultra-low latency matching engine

- FIX, REST & WebSocket APIs

- Seamless integrations with liquidity providers & exchanges

- Real-time quote streaming and execution

- Omnibus or segregated account support

- 23,000+ global equities (NYSE, NASDAQ, LSE, TSE, etc.)

- 3,100+ ETFs & mutual funds

- 147,000+ bonds

- 855,000+ options

- 500+ futures

- 80+ forex pairs and spot metals (XAU/XAG)

- 200+ cryptocurrencies (BTC, ETH, USDT, etc.)

- Multi-currency and crypto wallet support

- Smart trade signal engine

- Algorithmic strategy execution bots

- Risk anomaly & fraud detection

- Robo-advisory for portfolio rebalancing

- Sentiment analysis from news & social data

- Behavior-based alerts and engagement triggers

Ready to Launch Your Own Trading Platform?

Launch faster with a white-label trading platform tailored to your brand. Includes multi-asset support, real-time admin dashboards, seamless KYC onboarding and native mobile apps.

Core Features For Traders

Switchable UI Modes

Tailor the interface for beginners or advanced users.

Drag-to-Trade Charts

Adjust and place orders directly from charts.

Interactive Tutorials

Gamified onboarding and walkthroughs.

Smart Asset Suggestions

Behavior-based watchlists and AI highlights.

Offline Practice Mode

Simulate trades anytime — even offline.

Core Features For Admins

Compliance Builder

Create region-specific onboarding & monitoring flows.

Feature Toggle Console

Instantly enable or disable platform modules.

Health & Load Monitoring

Live metrics on performance and usage.

Revenue Testing Tools

Test commissions, spreads, and interface variants.

Multi-Brand Support

Manage multiple broker brands in one place.

AI Features for Your White-Label Trading Platform

Development

Leverage tools like Cursor AI for code generation, optimization, and real-time collaboration, accelerating development cycles.

Use AI-powered design tools for rapid UI/UX prototyping, style suggestions, and accessibility enhancements.

QA

Deploy AI-based test automation to detect bugs, predict failures, and optimize test coverage with machine learning.

Automate CI/CD pipelines, monitor model performance, and optimize cloud costs with AI-driven anomaly detection.

Extract insights from contracts, invoices, and PDFs using OCR and NLP, reducing manual effort by 70% (as showcased in our fintech case studies).

Build GPT-4-powered assistants for customer support, sales, and internal helpdesks with natural language understanding.

Implement ML models for demand forecasting, risk assessment, and personalized recommendations (e.g., credit scoring, trading signals).

Governance

Ensure transparency with bias detection, explainable AI (XAI), and compliance frameworks for secure, responsible deployments.

White-Label Trading Platform Implementation Process

Strategic Discovery Phase

Brand-Centric UI/UX Design

Scalable Architecture Development

Performance Validation

Launch & Growth Support

Benefits for Your Business

Launch your white label trading platform in a fraction of the time it takes to build from scratch.

Our approach eliminates recurring license fees and delivers a turnkey solution at a lower TCO.

Unlike rigid templates, our white label platform is fully customizable to match your UX vision.

Maintain long-term independence and adapt your platform as you grow.

Our infrastructure is designed to meet international financial regulations and secure user data.

Whether you’re onboarding hundreds or hundreds of thousands, the platform adapts to your growth.

What our clients say about us

Let’s build your next-generation White-Label Trading Platform together

Successful projects

Happy clients

Countries served

Clients come through reference

Client Retention Rate

Ph.D Developers

Let’s build your next-generation White-Label Trading Platform together

FAQs

What assets does the platform support?

Our white label trading platform supports stocks, forex, crypto, ETFs, and more.

Can we add new features or modules?

Yes — the white label platform is modular and fully extendable.

Is the solution secure?

We apply bank-grade security protocols including 2FA, encryption, and audit trails.

Can you provide a white label crypto trading platform?

Absolutely. We offer a fully customizable white label crypto trading platform with exchange integrations.

Do we get source code ownership?

Yes. You have full ownership of your white-label trading platform implementation, including source code.

Do you support multi-device deployment?

Yes. The cryptocurrency trading platform white label supports web, iOS, and Android clients.

What’s the average launch timeline?

Most platforms are delivered and launched within 10–14 weeks, depending on the level of customization.

Do you help with compliance and licensing?

Yes. We assist with technical compliance, KYC/AML integrations, and can advise on licensing paths.

Can I connect my own liquidity providers?

Yes. We support integration with third-party liquidity providers and external market data feeds.

Do you offer post-launch support and updates?

Yes. We provide ongoing support, technical updates, and feature enhancements after go-live.