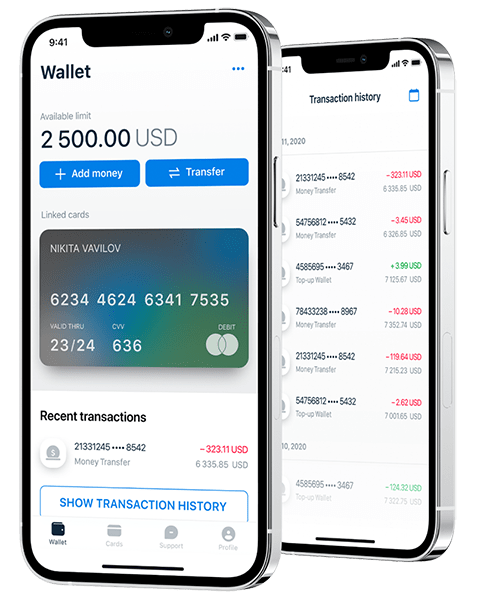

A mobile banking app for migrants designed to facilitate monetary transactions like financial help to families, getting paychecks early, microloans, etc.

The world of banking software development is changing fast because of digital transformation. Digital banking solutions are now more advanced and focus on the needs of customers. Core banking software, including card issuing, is key in this change. It acts as the main support for today’s financial institutions. Core banking software helps manage accounts, transactions, and other services. This lets banks and financial institutions provide smooth and tailored experiences for their customers.

How to Choose the Right Core Banking Software

Choosing the right core banking software is very important for any bank. There are many options, so you need to look closely at what your bank specifically needs. Think about the size of your bank, how complex your operations are, and what your future goals are.

Also, look for software that is flexible and can grow with you. It should have strong features that can change as your needs change. It is important to check the vendor’s reputation, how long they have been in the industry, and how good their customer support is. This will help make sure you have a smooth setup and a good working relationship.

Assessing Your Bank’s Specific Needs

- Start by examining your bank’s specific needs.

- Look for the pain points and challenges in your current systems and processes.

- Find out which financial products and services are most important to your customers.

- Think about how you can use technology to improve their experience.

- Consider the size and growth of your customer base.

- Will the software handle the number of transactions and customer sign-ups you expect?

- Check the rules and compliance needs for your area or market.

- By clearly stating your needs and priorities, you can narrow down your choices.

- This will help you focus on solutions that fit your bank’s unique qualities and long-term goals.

Evaluating Software Scalability and Integration Capabilities

As your bank grows, its tech needs will change. Focus on core banking software that can grow with you. Make sure it can handle more transactions as your business expands. Choose options that have worked well with current and future systems.

A good core banking system should work well with other important tools. This includes payment gateways, customer relationship management (CRM) systems, and tools for regulatory reporting. Cloud-based systems generally provide better scaling and flexibility than older systems stored on-site.

Picking a solution that fits your digital transformation plans will help keep your bank ready for the future. It will also help you adjust to new customer needs and changes in the market.

Security Features and Compliance Standards

Security should be very important when picking core banking software. The software needs strong security features. These should keep customer data and financial transactions safe. Look for things like data encryption, multi-factor authentication, and regular security checks.

Following industry rules is vital. The software you choose must meet all necessary regulations. This includes PCI DSS for payment card safety, GDPR for data privacy, and any local or regional rules.

Having a solid risk management plan is key too. The software should help you find, check, and reduce potential risks. It should come with tools for fraud detection, anti-money laundering (AML) compliance, and know your customer (KYC) checks.

Customer Support and Maintenance Services

Implementing new core banking software is a big task. It needs support from service providers all the time. When you check different vendors, ask about their customer support. Do they offer help 24/7? What are their service level agreements (SLAs)?

Also, regular maintenance is important. It helps software systems run smoothly. You should understand how the vendor handles software updates, bug fixes, and security patches. A good vendor will quickly fix any problems. They will keep your system safe and current.

Lastly, think about the total cost of ownership (TCO) when looking at core banking software. This includes the initial cost to buy it. You should also consider the ongoing costs for maintenance, support, and future upgrades.

Top Core Banking Software Companies to Watch in 2024

The core banking software market is brimming with innovative companies that are transforming the financial services landscape, including digital banks, which are reshaping customer interactions. These companies offer diverse solutions catering to various needs, from established financial institutions to agile fintech startups. In the dynamic landscape of financial technology, these companies stand out for their commitment to innovation, customer-centricity, and their ability to adapt to the evolving needs of the banking industry.

Here’s a closer look at ten leading core banking software development companies that are shaping the future of financial services:

1. Itexus

- $/hr – $50 – $99

- Number of Employees – 50-249

- Founded – 2013

- Clutch Rating – 4.9/5

Itexus is a software development company with a strong expertise in creating top-notch fintech solutions. They specialize in building custom core banking systems, mobile banking apps, payment gateways, and other financial services products. Their team of expert engineers and designers works hand-in-hand with clients to understand specific needs and deliver tailor-made solutions.

Known for innovation and customer satisfaction, Itexus serves both established financial institutions and emerging fintech startups. They offer a complete package of services, from brainstorming ideas to launching and maintaining software.

Itexus’s commitment to delivering high-quality digital banking solutions has helped many clients improve operations, enhance customer experiences, and stay competitive in the fast-paced world of financial technology.

2. Mambu

- $/hr – Not disclosed

- Number of Employees – 1,001-5,000

- Founded – 2011

- Clutch Rating – 4.7/5

Mambu is a top provider of cloud banking software solutions. They help financial institutions by offering a flexible and scalable platform to provide new lending services. Company focus on API-first design lets banks and fintechs easily connect with current systems and third-party apps. This makes it possible to create modern banking experiences.

Mambu’s cloud-native platform helps improve operational efficiency. It lowers costs and speeds up the launch of new products and services.

Their solutions meet many banking needs, such as account opening, payments, lending, and savings. Mambu has a global reach and is expanding its network of partners. This places them in a great position to assist financial institutions worldwide with their digital transformation efforts.

3. Backbase

- $/hr – $70 – $100

- Number of Employees – 1,001-5,000

- Founded – 2003

- Clutch Rating – 4.8/5

Backbase is a top provider of banking solutions. It helps financial institutions create great user experiences in many digital areas. The company’s digital banking platform lets banks and credit unions offer personalized and smooth banking for their customers.

Backbase allows customers to switch easily between online, mobile, and in-branch services. This way, they have a consistent and personal experience as they bank. The platform is also flexible. Banks can quickly roll out new products and services. This helps them meet changing customer needs and market changes.

Backbase keeps focusing on new ideas and putting customers first. It is leading the change in digital banking. Their goal is to help financial institutions succeed in the digital world.

4. Oracle FLEXCUBE

- $/hr – $50 – $100

- Number of Employees – Over 10,000 (part of Oracle)

- Founded – 1999 (Oracle FLEXCUBE)

- Clutch Rating – 4.5/5

Oracle Flexcube is a well-known core banking solution used in the financial services industry, offering a variety of retail banking software solutions. Traditional banks and credit unions utilize it for its easy integration and features that focus on customers, which improve user experience. With many years of experience, Oracle Flexcube offers strong support for different banking services like account management, payment processing, and risk management. Its cloud solutions are designed for the specific needs of institutions, helping them achieve operational efficiency and digital transformation. Oracle Flexcube is praised for its creative approach to customer engagement and for providing excellent core banking services.

5. Finacle

- $/hr – Not disclosed

- Number of Employees – 10,001+ (part of Infosys)

- Founded – 1999

- Clutch Rating – 4.6/5

Finacle is a top provider of digital banking solutions. They offer a wide range of products that help banks and financial institutions succeed in the digital world. Their focus is on innovation and making customers happy. Finacle’s solutions help banks improve customer experiences, simplify operations, and grow.

Their offerings cover many banking needs. This includes retail banking, corporate banking, and wealth management. The digital banking platform provides a smooth and personalized experience for customers, allowing them to manage their finances easily.

With regular innovation and a commitment to give great value, Finacle leads the way in digital banking. They help financial institutions keep up and do well in the changing financial services landscape.

6. Finastra

- $/hr – $50 – $100

- Number of Employees – 8,000+

- Founded – 2017

- Clutch Rating – 4.5/5

Finastra is a leader in core banking software that provides seamless support for legacy systems. It offers modern solutions for financial institutions. The company focuses on digital banking and improving customer experience. Finastra meets the changing needs of the banking industry. Its core banking platform works well together. This provides better operational efficiency and helps with risk management.

Finastra’s software is useful for many financial services. It serves traditional banks and credit unions. This improves transaction processing and account management. As an important player in the market, Finastra keeps driving innovation. They work hard to enhance customer engagement in the financial services industry.

7. FIS

- $/hr – $30 – $70

- Number of Employees – 10,001+

- Founded – 1968

- Clutch Rating – 4.6/5

FIS is a leading company in core banking solutions. They provide complete software designed for financial institutions. FIS focuses on digital transformation and customer experience. FIS meets the changing needs of the banking industry.

The company’s strong core banking system improves operational efficiency and risk management. FIS is known for seamless integration and new banking technology, meeting the needs of modern financial services. As one of the best core banking software development companies, FIS helps banks around the world succeed with advanced solutions and great customer support.

8. Forbis

- $/hr – $25 – $49/hr

- Number of Employees – 50-249

- Founded – 1990

- Clutch Rating – 4.8/5

Forbis is a top provider of banking solutions. They use new technology to help financial institutions grow in their digital transformation efforts. Forbis offers many products and services. This includes core banking systems, mobile banking development, payment solutions, and tools for regulatory reporting. Company’s solutions help banks work better, cut costs, and please their customers.

Forbis puts a lot of focus on research and development. They keep investing in the latest technologies to create new solutions for their clients. Their strong knowledge and focus on customers have made them a trusted partner for financial institutions in different markets.

By mixing strong features with great customer service, Forbis is growing its market share. They are becoming the go-to technology partner for banks that want to succeed in a fast-changing financial world.

9. nCino

- $/hr – Not disclosed

- Number of Employees – 1,001-5,000

- Founded – 2011

- Clutch Rating – 4.8/5

In the world of core banking software companies, nCino is an important one to watch. They focus on banking solutions and offer core banking software development for the changing needs of financial institutions. nCino aims to improve digital transformation and customer experience.

Their core banking platform allows for seamless integration and boosts operational efficiency. With many years of experience and advanced technology like machine learning, nCino helps banks improve their services and connect with their end customers effectively.

Key Factors for Evaluating Core Banking Software

To aid in selecting the right core banking software, we’ve created a comparative table that highlights key factors to consider during the evaluation process. This table will help you quickly assess the software’s scalability, support level, integration capabilities, and cost implications, allowing for an informed decision.

| Factor | Importance for the Bank | Questions for Software Evaluation | Potential Risks if Ignored |

|---|---|---|---|

| Scalability | High | Can the system grow with your bank? Does it support increasing transaction volumes and customer growth? | System inefficiency, unable to meet future demand |

| Integration Capabilities | High | Does the software integrate well with existing systems (CRM, payment gateways)? | Disrupted operations, costly custom integrations |

| Security Features | Critical | Does it have strong data encryption, multi-factor authentication, and fraud detection tools? | Increased risk of security breaches, data theft |

| Compliance & Regulation | Critical | Does it meet relevant regulations (PCI DSS, GDPR, etc.)? | Legal penalties, operational shutdowns |

| Customer Support | High | Is 24/7 support available? What is the vendor’s track record for resolving issues quickly? | Prolonged downtime, increased maintenance costs |

| Total Cost of Ownership (TCO) | Medium | What are the ongoing costs for updates, support, and future scalability? | Underestimated costs, reduced return on investment (ROI) |

The Impact of Core Banking Software on Financial Services

Core banking software has changed the financial services industry. It helps banks work better, save money, and improve customer experiences. By automating important tasks and keeping data in one place, core banking systems create a strong base for today’s banking work.

Core banking software also affects more than just regular banking duties. It has helped new business models to grow. This includes fintech groups and challenger banks that use strong and flexible banking systems. Plus, regular updates to core banking software help more people access banking. It does this by offering banking services to areas that lack them through mobile banking and other digital ways.

Enhancing Efficiency in Banking Operations

Implementing a strong core banking system is vital for community banks and financial institutions to succeed in today’s digital world. A core banking system serves as a central point for all banking tasks. It makes processes smoother and boosts operational efficiency. By automating jobs like opening accounts, starting loans, and processing transactions, banks can cut down on manual work and mistakes. This helps employees spend more time on important things, like managing relationships and developing the business.

Also, a centralized core banking system gives one clear view of all customer data. This helps make quicker and smarter decisions, improves risk management, and allows for personalized customer experiences.

By automating work, removing data silos, and offering real-time insights, core banking solutions help banks refine their operations. This way, they can gain an edge over competitors in the market.

Facilitating Seamless Cross-Border Transactions

Core banking software is very important for helping with cross-border transactions, including currency exchange. It makes it easier and cheaper for people and businesses to send and receive money around the world. By using open APIs, core banking systems can connect with other financial institutions and payment networks. This helps make cross-border payments faster and more clear.

These changes are great for financial inclusion. They allow people and businesses in growing markets to engage in the global economy. Cross-border transactions are key for businesses in many countries. They help manage global supply chains, pay workers, and get payments from customers smoothly.

As technology advances, we can expect more new things from core banking software. This will lead to faster, safer, and easier financial services for people and businesses everywhere.

Supporting Financial Inclusion through Technology

Financial inclusion means that people and businesses can use different financial services. This is important for economic growth and social development. Core banking software plays a key role in this. It helps provide digital banking services to communities that often miss out.

Mobile banking services, supported by strong core banking systems, lets people in remote areas open accounts, deposit or withdraw money, and make payments using their phones. Core banking systems use other data sources, like how people use their mobile phones and their activity on social media. This helps create credit scores for those with little or no credit history. With better access to financial products, they can build credit history and get microloans. This helps them participate more in the formal economy.

As more people get smartphones and internet access around the world, digital banking solutions from core banking software could help close the financial inclusion gap. This would create a fairer financial system for everyone.

Estimated Costs for Banking Software Development

When planning a banking software development project, budgeting plays a crucial role in ensuring success. The cost of development varies significantly depending on the complexity of the software, the features required, and the stage of the project. Financial institutions must be well-prepared to allocate resources effectively to cover both direct and hidden costs associated with the development process.

From basic account management systems to advanced AI-driven analytics, the range of functionality impacts the overall investment. Moreover, compliance with regulatory standards, integration with third-party services, and ongoing maintenance are critical factors that add to the total cost of ownership.

To simplify the planning process, the tables below provide a detailed breakdown of development costs by stage and complexity, along with hidden expenses to consider. By understanding these elements, stakeholders can make informed decisions and optimize their return on investment.

| Development Stage | Timeline | Estimated Cost ($) | Description |

|---|---|---|---|

| Project Analysis | 1 week | 1,000 – 5,000 | Includes requirement gathering, scope definition, and feasibility study. |

| UI/UX Design | 4-6 weeks | 5,000 – 15,000 | Development of wireframes, prototypes, and visual design for the platform. |

| Core Development | 10-20 weeks | 40,000 – 200,000 | Backend, frontend, and API integration based on the complexity of features. |

| Testing and QA | Parallel to dev. | 5,000 – 20,000 | Functional, performance, security testing to ensure reliability and compliance. |

| Deployment | 2-4 weeks | 5,000 – 10,000 | Final deployment on production servers and configuration for scalability. |

| Post-Launch Support | Ongoing | 15-20% of dev. cost/year | Regular updates, bug fixes, and security patches for maintaining functionality. |

Cost by Software Complexity

| Complexity Level | Timeline | Cost Range ($) | Features Included |

|---|---|---|---|

| Basic | 3-6 months | 50,000 – 100,000 | Basic account management, transaction handling, simple UI. |

| Medium | 6-12 months | 100,000 – 300,000 | Advanced features like multi-currency, integrations with payment gateways. |

| Advanced | 12-18 months | 300,000+ | AI-driven analytics, fraud detection, and cross-border transaction capabilities. |

Hidden Costs to Consider

| Category | Cost Implication ($) | Details |

|---|---|---|

| Regulatory Compliance | 10,000 – 50,000 | Adapting the software to comply with local and global banking regulations. |

| Third-Party Integrations | 5,000 – 30,000 | APIs, payment gateways, and external services for added functionality. |

| Customization | Varies | Tailoring features to meet specific bank requirements. |

| Maintenance | 15-20% of dev. cost/year | Bug fixes, security updates, and system upgrades. |

Challenges in Implementing Core Banking Systems

1. High Upfront Costs

- Implementing core banking systems often involves substantial initial investments, including software licenses, hardware upgrades, and consultation fees. Smaller institutions may find this cost prohibitive.

2. Integration Complexities

- Integrating new core banking software with existing systems like CRMs, payment gateways, and legacy infrastructure can be challenging, leading to potential delays and additional costs.

3. Regulatory Compliance

- Ensuring the system complies with local and international banking regulations, such as GDPR or PCI DSS, can be time-consuming and complex.

4. Data Migration Risks

- Moving large volumes of sensitive customer and financial data from legacy systems to new platforms poses risks such as data loss, corruption, or breaches.

5. Training and Change Management

- Employees require training to adapt to new systems, and resistance to change can slow down the adoption process.

6. Downtime During Transition

- The implementation process may require temporary system shutdowns, potentially affecting customer services and operational efficiency.

The Role of Artificial Intelligence in Core Banking

1. Enhanced Customer Service

- AI-powered chatbots and virtual assistants provide 24/7 support, quickly resolving customer queries and improving user satisfaction.

2. Fraud Detection and Risk Management

- Machine learning algorithms analyze transaction patterns in real-time to identify fraudulent activities, reducing risks and enhancing security.

3. Personalized Banking Experiences

- AI uses customer data to offer personalized financial products and services, improving engagement and loyalty.

4. Streamlined Operations

- AI automates repetitive tasks, such as account reconciliation and loan processing, reducing errors and saving time.

5. Predictive Analytics

- By analyzing historical data, AI helps banks forecast trends, manage risks, and make data-driven decisions.

6. Regulatory Compliance Automation

- AI assists in monitoring compliance requirements, automating reporting, and ensuring adherence to complex regulatory standards.

These blocks provide focused insights on the challenges and AI’s transformative role in core banking, making them clear and engaging for the reader.

Conclusion

Choosing the right core banking software is very important for financial institutions. It helps them succeed. By looking at your specific needs, how well it can grow, security features, and customer support, you can make your operations better and follow the rules. Watch out for top companies like Itexus, Mambu, and Oracle FLEXCUBE for new solutions in 2024. Good core banking software can improve banking operations, allow smooth transactions, and help more people access finance. With technology changing the finance world, investing in a solid core banking system is essential for staying strong in the industry.

FAQ:

- What Makes a Core Banking Solution Stand Out?

A great core banking solution focuses on user experience, flexibility, and how well it connects with other systems. This helps financial institutions improve customer engagement. It also makes it easier for them to move into digital transformation.

- How Does Core Banking Software Transform Customer Service?

Core banking software improves customer service. It does this by offering experiences on many channels through online banking. This helps banks get real-time customer insights. Also, it allows for better customer experience management using advanced banking technology.

- Can Core Banking Systems Help in Fraud Detection?

Modern core banking systems use strong security features. They include advanced fraud detection tools. These systems rely on real-time data analysis and machine learning techniques. This helps to improve risk management.

- What Are the Cost Considerations When Implementing Core Banking Software?

Cost considerations include the first payment for the software, regular maintenance costs, and possible customization fees. A careful analysis of return on investment is important. It’s also key to understand the total cost of ownership for good financial planning.