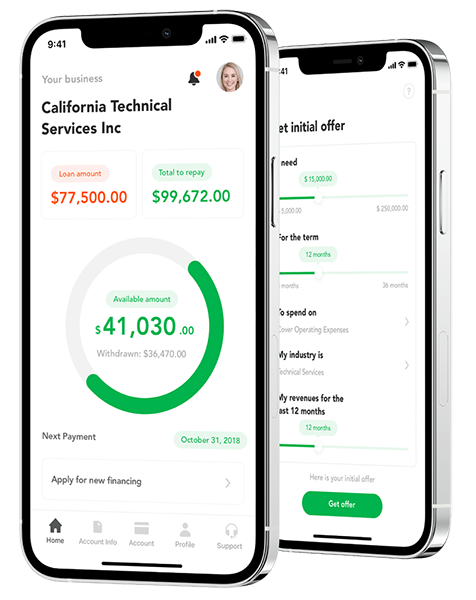

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Imagine a world where you can borrow money without a bank, earn interest without a middleman, and control your finances 24/7. Welcome to the revolutionary world of DeFi lending platforms! 🌍✨

In this article, we’ll dive deep into how DeFi lending platforms are reshaping finance, why they’re exploding in popularity, and what you need to know to navigate this dynamic space. Buckle up—this isn’t your grandma’s savings account!

Table of Contents

- What Are DeFi Lending Platforms?

- How Do DeFi Lending Platforms Work?

- Top Benefits of Using DeFi Lending Platforms

- Risks and Challenges: What Could Go Wrong?

- Top 5 DeFi Lending Platforms Dominating 2024

- The Future of DeFi Lending: Trends to Watch

- FAQs: Your Burning Questions Answered

1. What Are DeFi Lending Platforms?

DeFi lending platforms are blockchain-based protocols that let users lend, borrow, and earn interest on cryptocurrencies—without banks or credit checks. Think of them as a digital, decentralized version of your local credit union, but faster, global, and open to anyone with an internet connection.

Key Features:

- Permissionless Access: No paperwork, no gatekeepers.

- Transparent Transactions: All activity is recorded on-chain.

- Algorithmic Interest Rates: Rates adjust based on supply and demand.

👉 Did You Know? The total value locked (TVL) in DeFi lending platforms surpassed $30 billion in 2024, up from just $1 billion in 2020 (DeFi Pulse)!

2. How Do DeFi Lending Platforms Work?

Let’s break it down with a simple analogy: Imagine a global, 24/7 money marketplace.

- Lenders deposit crypto (like ETH or USDC) into a liquidity pool.

- Borrowers take loans by locking collateral (often in crypto).

- Smart Contracts automate everything: interest payments, liquidations, and rewards.

Example:

Alice deposits 10 ETH into Compound. She earns 3% APY. Bob borrows $5,000 worth of ETH by locking $7,500 in DAI as collateral. If ETH’s price drops, Bob’s collateral is liquidated automatically.

3. Top Benefits of Using DeFi Lending Platforms

💸 Earn Passive Income

Forget 0.01% bank rates—DeFi platforms offer 5-20% APY on stablecoins like USDC or DAI.

🌍 Global Access

Over 1.7 billion people are unbanked (World Bank), but DeFi requires only a smartphone.

🔒 Self-Custody

You control your funds—no bank can freeze your account.

🚀 Speed and Efficiency

Loans settle in minutes, not weeks.

4. Risks and Challenges: What Could Go Wrong?

Volatility Risk

Crypto prices swing wildly. A 20% drop could trigger liquidation of your collateral.

Smart Contract Bugs

Code vulnerabilities can lead to hacks (e.g., the $100M Cream Finance exploit in 2021).

Regulatory Uncertainty

Governments are still figuring out how to regulate DeFi.

⚠️ Pro Tip: Always use audited platforms like Aave or Compound, and never over-leverage!

5. Top 5 DeFi Lending Platforms Dominating 2024

| Platform | TVL (2024) | Key Feature |

|---|---|---|

| Aave | $8B | Flash loans, multi-chain support |

| Compound | $5B | Algorithmic interest rates |

| MakerDAO | $6B | DAI stablecoin issuer |

| Euler | $1.5B | Permissionless listings |

| Alchemix | $900M | Self-repaying loans |

Source: DeFi Llama

6. The Future of DeFi Lending: Trends to Watch

📈 Institutional Adoption

BlackRock and Fidelity are dipping toes into DeFi.

🔗 Cross-Chain Expansion

Platforms like Aave V3 now support Ethereum, Polygon, and Avalanche.

🛡️ Insurance Protocols

Nexus Mutual and others offer coverage against hacks.

🏛️ Regulatory Clarity

The EU’s MiCA regulation could legitimize DeFi lending in 2025.

7. FAQs: Your Burning Questions Answered

Q: Are DeFi lending platforms safe?

A: They’re decentralized, which reduces counterparty risk, but always research audits and track records.

Q: How do I start lending?

A: Get a crypto wallet (like MetaMask), buy stablecoins, and deposit them into a platform like Aave.

Q: What’s the difference between DeFi and CeFi lending?

A: CeFi (e.g., Celsius) is centralized; DeFi cuts out the middleman.

Final Thoughts: Why DeFi Lending Platforms Matter

DeFi lending isn’t just a trend—it’s a financial revolution. Whether you’re earning yield on idle crypto or accessing loans without bureaucracy, these platforms empower users like never before. Sure, risks exist, but with education and caution, the rewards can be life-changing.

Ready to jump in? Start small, diversify, and join the future of finance today! 🚀

Liked this article? Learn how to stake crypto or explore our guide to stablecoins.