A fintech startup headquartered in Northern Europe approached us to hire mobile developers to reinforce their in-house development team working on an e-wallet for families. After a few interviews with our specialists, the client selected two candidates who were the best fit: a senior iOS developer and a mid-level Android developer. They started working on the client’s project shortly after signing the NDA.

In the middle of the process, the client decided to redesign the application’s interface. He was looking for a skilled designer with hands-on experience in creating interfaces for fintech solutions. At Itexus, we offer turnkey fintech software development, so we have UI/UX specialists on board who have extensive track record in the fintech domain. Thus, we offered the client to review the CVs and portfolios of our designers and they chose one for their project. In this way, three Itexus specialists were added to the client’s internal team – two mobile developers and one UI/UX designer.

Over the past decade, smartphones have steadily replaced many functions of the traditional wallet. Today, a digital wallet (or e-wallet) is no longer just a convenient add-on, it has become a standard way of managing money. Solutions such as PayPal, Venmo, Apple Pay, Alipay, and Google Pay allow users to securely store payment details, transfer funds, and complete purchases without the need for cash or physical cards.

Importantly, e-wallet technology is no longer reserved for global corporations. Businesses of all sizes are increasingly introducing digital wallets to meet customer expectations and stay competitive. According to industry forecasts, the number of e-wallet users worldwide is projected to surpass 5.2 billion by 2026, highlighting the unstoppable shift toward cashless payments.

For consumers, e-wallets bring simplicity, speed, and greater financial control. For businesses, they unlock opportunities to reduce transaction costs, improve customer loyalty through seamless payment experiences, and leverage valuable insights from user data. With these benefits in mind, it is clear that e-wallets are reshaping how both individuals and companies interact with money in the digital age.

How Much Does It Cost to Develop E-Wallet App?

Digital wallets are reshaping the way people manage and spend money, and businesses across industries are eager to be part of this shift. Yet one of the first questions that comes up is: what does it cost to build an e-wallet app?

On average, the development cost ranges between $70,000 and $130,000. The exact figure depends on several factors, including the scope of features, the level of security required, the complexity of the design, and the overall functionality you want to provide.

In other words, a simple e-wallet with basic payment options will cost significantly less than a feature-rich platform with integrations, advanced security, and analytics tools.

| Features/Complexity Range | Basic | Medium | Advanced |

|---|---|---|---|

| User registration | + | + | + |

| Login | + | + | + |

| Balance checks | + | + | + |

| Money transfers | + | + | + |

| Transaction history | + | + | + |

| In-app purchases | + | + | |

| Multicurrency support | + | + | |

| Basic budgeting tools | + | + | |

| Bonus programs | + | + | |

| Loyalty programs | + | + | |

| Biometric authentication | + | ||

| Loyalty program integration | + | ||

| P2P payments | + | ||

| Investment options | + | ||

| AI-powered financial tools | + | ||

| Cost | $70,000 – $90,000 | $90,000 – $130,000 | $130,000+ |

Basic functionality includes a simple interface with the ability to perform the most common financial actions.

Medium complexity consists of broader features and a customizable interface. Users can independently choose a theme, buttons for quick access. Those types of apps integrate with payment gateways and have bonus and loyalty programs.

High complexity wallets provide a wide range of functionalities, such as support for AI and blockchain technology. They also enable integration with various payment systems and support multiple platforms, including iOS and Android.

Factors Influencing E-Wallet App Development Costs

Building an e-wallet app is a complex process, and the final cost depends on multiple aspects of the project. The most important factors include:

- Platform Choice (iOS, Android, or Both)

Developing for a single platform is cheaper, while building native apps for both doubles the scope. Cross-platform solutions can be a balanced option depending on your audience.

- Feature Complexity

A basic wallet for simple transactions will cost significantly less than a full-scale solution with P2P transfers, bill payments, loyalty programs, or cryptocurrency support.

- User Interface (UI) & User Experience (UX) Design

Clean design and intuitive user flows require careful planning and testing. While this adds to development costs, it directly impacts adoption and customer satisfaction.

- Security

Advanced protection — encryption, two-factor authentication, biometric login — is a must for any financial app. Compliance with standards like PCI DSS or KYC also increases development effort.

- Third-Party Integrations

Payment gateways, banking APIs, analytics, and fraud detection tools improve functionality but add integration complexity and costs.

- Maintenance & Updates

Development doesn’t stop at launch. Regular updates, new features, and security patches are essential to keep the app relevant and safe.

Well, as it usually goes, developing for Android tends to be cheaper than developing for iOS. But here’s a crucial point to consider: what region are you planning to target with your e-wallet?

That can really influence your decision.

Platform Selection

Another exciting option to consider is to create a cross-platform app. It will work on both iOS and Android. It is worth preparing in advance for the fact that developing a cross-platform app will cost 30% more. But there is an advantage that can overcome all disadvantages – the audience coverage increases.

When developing an e-wallet, it is very important to choose the right technical stack. This will help you save money. It is recommended to choose specialists who use popular programming languages and frameworks with free modules. For example:

- Frontend: React Native or Flutter (for cross-platform), Swift and Kotlin (if creating separate native apps for iOS and Android).

- Backend: Node.js with Express or Django for transaction processing.

- Database: PostgreSQL or MongoDB for reliable data storage.

- Cloud infrastructure: AWS or Google Cloud.

- Encryption and security: SSL/TLS. OpenSSL.

App Development Tech Stack

When you’re choosing a technical stack, the key factors are the complexity and functionality you want for your e-wallet:

| Features/Complexity Level | Basic | Medium | Advanced |

|---|---|---|---|

| MVP functionality | + | + | + |

| Basic UI | + | + | + |

| Custom UI | + | + | |

| Bespoke UI | + | + | |

| Two platforms | + | ||

| Cost | $70,000 – $90,000 | $90,000 – $130,000 | $130,000+ |

Complexity and Feature Sets

Another factor affecting the development cost is the complexity and feature set. The most budget-friendly option is a basic wallet with a simple set of functions. Its development will cost from $70,000 to $90,000. The user gets a simple interface with a few settings. The ability to view the balance, history.

Electronic wallets with an average set of functions have more advanced functionality. Improved security system. The ability to add other currencies, bank cards. The cost of an electronic wallet with an average set of functions will cost from $90,000 to $130,000.

The advanced type of e-wallets requires the maximum financial investment. The cost starts from $130,000. The user can add cards, cryptocurrencies, make exchanges, make purchases. The high cost is due to the complexity of development. Advanced electronic wallets use artificial intelligence, blockchain. Protection methods include biometrics, two-factor authentication. User data is securely encrypted and protected.

Appearance and interface also affects the cost of development. The app should have a beautiful design and functional interface. This will require hiring artists and designers. The cost depends on the complexity of the development. Want beautiful icons, animation, get ready to lay out an average of $90,000. The development of an electronic wallet with a simple design, without frills, will cost $70,000.

An important factor affecting the cost is the development team. You can save on this by outsourcing some of the work. In the best case, the savings will be up to 50%. It will cost more to recruit an internal team. When choosing outsourcing, you should pay attention to the regions. For example, in Central Asia the cost of designers and programmers is estimated at $5-10 per hour. Eastern Europe $10-15 per hour.

Security Protocols

Implementing robust security features such as encryption and multi-factor authentication can extend the development timeline and raise expenses. However, these measures are essential for safeguarding against breaches and maintaining customer confidence.

Integration and Data Oversight:

Connecting with existing legacy systems and external services also incurs costs, and it’s vital to ensure data accuracy, consistency, and privacy in order to enhance user satisfaction.

Core Features of an E-Wallet Application

After determining the development costs, it’s time to shift focus.

What makes an e-wallet truly functional and user-friendly?

It’s essential to explore the basic functions that an e-wallet should include. Starting with the user control panel, account registration will be required at the initial stage.

The user is prompted to enter a certain amount of their data. Name, e-mail address and password with confirmation. This is necessary so that the system can identify the client.After registration, the client will want to link bank accounts. This is necessary in order to pay for purchases in stores and online platforms.

Such functionality requires the user to enter the card (account) number, expiration date and CVV code. Once the bank card is linked and its balance will be displayed in the e-wallet window.

The user should be able to transfer money through the control panel.

This comprises p2p payments, fast transfers between users. Transfers to bank cards by card number or phone number.

The control panel should contain a history of transactions. The user should be able to see where, when and how much money was spent. This functionality allows the user to exercise control over spending.

In advanced e-wallets, a custom control panel allows access to additional functions. We are talking about discounts, bonuses, bank offers, loyalty programs. The user has the ability to enable or disable these features at the touch of a button.

To improve the user experience, it is not superfluous to add multiple languages and currencies. This will increase the reach of the audience.

Admin Panel

Now let’s consider what the admin dashboard should be like. This dashboard displays detailed analytics. You can view any user’s actions, history, transactions, purchases, geolocation.

Panel functionality may include user management. Deleting accounts, viewing errors. Included is the ability to add offers, discounts, promotional materials about loyalty programs and bonuses for users.

Advanced Features

Here we have smoothly approached the advanced functions of the e-wallet. Complex and expensive applications have such functions. One of the main functions is payment by QR code.

Payment by QR code doesn’t require manual entry of payment details. All information is encoded in the QR code. The user can generate a QR code himself in the e-wallet application for quick transactions.

In e-wallets with complex functionality, biometric authentication can be set up. The user will have to use a fingerprint or facial scan (Touch-ID, Face-ID) to gain access to funds.

This functionality maximizes the protection of the money stored on the e-wallet. Even if you steal the password or gain access to your phone, intruders will not be able to use the funds.

Advanced functionality implies connection of virtual cards. They have the same functionality as regular cards. The user can use them to pay for purchases or transfer money.

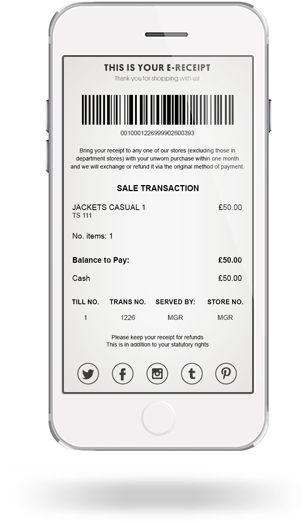

E-receipts are another necessary feature for an e-wallet. It looks like this.

An electronic receipt is the same document as a regular receipt. The client receives it when paying for goods or services from an e-wallet. If the customer did not like something, he can return his money by presenting the electronic receipt.

Let’s summarize how much some functions cost for an e-wallet customer:

- Payment by QR code – $4,000-6,000

- Money transfers – $10,000-15,000

- Advanced analytics – $8,000-12,000

- Loyalty and bonus program integration – $10,000-15,000

- Support for virtual cards – $10,000-15,000

- Support for multiple languages and currencies – $5,000-8,000

Monetization Strategies for e-Wallet Applications

Understanding the costs associated with those functions is just one piece of the puzzle. Once an app has gained a critical mass of users, you can start monetizing it. This will help reduce maintenance costs and generate additional revenue. There are a lot of ways to monetize; let me cite some of them:

- Ad unit integration. The user can see ads by opening their e-wallet.

- Commission for money transfers.

- Subscription fees. Customers who buy a subscription get access to additional features.

- Partnership with retailers, banks, trade networks.

Here are some successful examples of monetization. Venmo e-wallet is one of the most popular e-wallets in the US. For a transfer to the card is charged 3% of the amount. There is also a 0.75% fee (min. $0.25/max. $25) for transfers to Visa card. Withdraw to card 0.75% (min $0.25 fee, max $25 fee). For business accounts Venmo has a commission of 3% for each incoming payment.

Paypal also charges fees for domestic and international transfers. For domestic transfers 3% for cards and 1.75% for e-wallets. For international transfers 5%.

Hidden Costs of e-Wallet Development

While estimating the budget for an e-wallet app, many companies focus only on visible expenses like design and coding. However, there are several hidden costs that can significantly impact the total investment:

- Compliance Costs

Meeting international and regional regulations (e.g., PCI DSS, GDPR, KYC/AML) requires additional resources and legal expertise.

- Regulatory Costs

Depending on the markets you plan to operate in, you may face licensing fees, audits, and ongoing reporting requirements.

- Infrastructure Costs

Hosting, servers, databases, and cloud services are crucial to ensure stable performance and scalability — and they come with recurring expenses.

- Scalability Costs

As your user base grows, the system must handle more transactions and data. Scaling infrastructure and optimizing performance can raise costs over time.

- Support Costs

Providing 24/7 technical support and customer service requires both technology (chatbots, CRM tools) and a trained support team.

- Maintenance Costs

Beyond initial launch, regular updates, bug fixes, and feature enhancements are necessary to keep the app competitive and secure.

Let’s start with AML and KYC standards. These are international standards designed to combat terrorist financing and money laundering. Since anonymous wallets are a thing of the past, users need to provide their personal data. And customers need to spend extra money on functionality development and legal support. So, how much does it cost, here is the average cost.

- KYC development and customization. About $10,000.

- Monitoring. About $8,000.

- Consulting fees and other legal services. $8,000-10,000.

Infrastructure and Scalability

Another item of hidden costs is cloud services, servers, and their maintenance. Also during operation, failures can occur. To restore the work of an e-wallet, you will need additional funds.

- Cloud services will cost from $1,000 to $10,000 per month

- Database management. On average, about $5,000 per month.

- Server maintenance: $500 to $1,000 per month.

- Disaster recovery: $1,000 to $5,000.

Maintenance and support costs

In order for an e-wallet to work smoothly, it is necessary to maintain its work. This will require a staff of specialists (technical department). Their task is to eliminate minor failures and communicate with clients. As a rule, these are internal employees, which means that they will have to pay in accordance with the region where the customer is located. We budget about another $3,000 a month.

How to Reduce the Cost of Developing an e-Wallet Application

At Itexus, we deeply understand that both time and money are critical considerations for our clients. That’s why our primary goal is to maximize value while minimizing expenses. With extensive experience in the development of e-wallet applications and a wide array of Fintech solutions, our team has accumulated invaluable expertise that enables us to prioritize the development process effectively.

We encourage clients to consider investing in a Minimum Viable Product (MVP) for their initial launch. As an industry leader, we understand that an MVP—a product version with minimal functionality and a simple design—enables you to enter the market more quickly and cost-effectively. By focusing on core features, the MVP approach can lead to substantial savings—often up to 50%—while simultaneously providing valuable user feedback for future enhancements.

Through our strategic outsourcing capabilities and cross-platform development, clients can effectively reduce costs while ensuring a solid foundation for future growth. These strategies not only highlight our commitment to cost-efficiency but also reflect our deep industry expertise. To learn more about our capabilities, we encourage you to explore our case studies, which showcase successful projects and the innovative solutions we’ve delivered to clients ranging from emerging startups to established enterprises, such as Coinstar.

Conclusion

As the demand for e-wallets continues to surge, businesses must recognize the critical importance of partnering with experienced developers who possess proven expertise in the financial technology sector.

The complexities and regulatory requirements inherent in the finance industry make it essential to collaborate with professionals who understand the nuances of secure payment processing, data encryption, and compliance with standards such as AML and KYC.

An experienced development team not only brings technical proficiency but also invaluable insights into user experience and market trends. This ensures that your e-wallet application is both functional and appealing to users. By investing in a partnership with knowledgeable developers, businesses can navigate the intricacies of e-wallet development with confidence. Ultimately, this approach secures a competitive edge in the rapidly evolving landscape of cashless payment solutions.