A fintech startup headquartered in Northern Europe approached us to hire mobile developers to reinforce their in-house development team working on an e-wallet for families. After a few interviews with our specialists, the client selected two candidates who were the best fit: a senior iOS developer and a mid-level Android developer. They started working on the client’s project shortly after signing the NDA.

In the middle of the process, the client decided to redesign the application’s interface. He was looking for a skilled designer with hands-on experience in creating interfaces for fintech solutions. At Itexus, we offer turnkey fintech software development, so we have UI/UX specialists on board who have extensive track record in the fintech domain. Thus, we offered the client to review the CVs and portfolios of our designers and they chose one for their project. In this way, three Itexus specialists were added to the client’s internal team – two mobile developers and one UI/UX designer.

In 2023, nearly 70% of digital wallets failed within 18 months. Upon closer examination, these shortcomings were often linked to design issues. Fragmented compliance, outdated payment rails, and weak security measures undermined even the most polished user interfaces.

The true differentiator between fintech success and failure lies not only in developing a refined front end but also in making crucial strategic decisions early on—a step that many businesses unfortunately overlook.

At Itexus, we recognize that fintech design extends beyond user interfaces and features; it involves embedding trust into every aspect of the system to create an ecosystem where both businesses and consumers feel secure. In this article, we explore how thoughtful fintech design can serve as a trust engine, fostering growth and stability as we approach 2025.

Fintech Design: Why Trust Remains Essential?

For fintech platforms, trust is not just a soft metric—it directly influences user adoption, engagement, and retention. In 2025, where digital wallets and mobile payments are part of everyday life, consumers expect both security and convenience. In a competitive landscape, businesses must demonstrate that they are committed to safeguarding user data while providing transparent, compliant systems.

As a fintech software development company, Itexus helps businesses design systems that not only meet current regulatory requirements but also anticipate the challenges and opportunities of the future. Let’s explore how fintech design can evolve into a powerful trust engine.

Fintech Design: Embedding Compliance

As regulations become more stringent, compliance by design is essential. Ensuring that your platform meets regulatory standards is no longer a back-end function that can be handled later. Compliance must be woven into the very fabric of your fintech system from the start. This approach helps to reduce the risk of costly fines, regulatory hurdles, and reputational damage while providing a smoother user experience.

Key Compliance Elements to Integrate:

Know Your Customer (KYC):

- Automated Identity Verification: KYC verification can be integrated using machine learning models such as facial recognition (OpenCV, Face++), optical character recognition (OCR) libraries for document verification (Tesseract OCR), and APIs from third-party services (e.g., Jumio, Onfido, or Shufti Pro) that perform automatic checks against government databases.

- Risk-Based Verification: Using machine learning libraries like scikit-learn or TensorFlow, developers can build models that classify users into risk categories based on behavioral and transactional data. For example, users who frequently change their geographical location or exhibit erratic transaction patterns can be flagged as high-risk and routed through additional checks.

- Dynamic Workflow Design: KYC processes can be tailored by region using microservices architecture to ensure flexibility. Each service (for instance, AWS Lambda for processing or Google Cloud Functions) can handle KYC checks specific to a user’s jurisdiction, ensuring adherence to local regulatory requirements.

Anti-Money Laundering (AML):

- Transaction Monitoring Algorithms: Implement real-time monitoring of transactions using Apache Kafka for event-driven architecture. This setup allows the system to ingest transaction data as it’s created and process it with Apache Flink or Apache Spark for real-time analytics, flagging potentially suspicious transactions.

- Behavioral Analytics: Implement behavioral anomaly detection using advanced techniques in machine learning. By using libraries like Keras (for neural networks) or scikit-learn (for clustering or outlier detection), developers can create models that learn from user behavior and transactions, identifying unusual patterns indicative of money laundering.

- Automated Reporting and Alerts: Automated reporting systems can be built using Elasticsearch or Splunk to index and analyze transaction data in real time, making it easy to pull up detailed reports and automatically notify compliance officers through integrated messaging systems like Slack or PagerDuty when suspicious activity is detected.

- Continuous Screening: Real-time data from global blacklists or sanctioned individuals can be retrieved via APIs like World-Check or ComplyAdvantage. These APIs can be integrated directly into the system using RESTful API calls, ensuring that user identities are cross-referenced against global watchlists continuously.

Data Protection (GDPR, CCPA):

- Data Minimization by Design: Implement data anonymization techniques using libraries such as Faker or Anonymizer for generating fake but realistic data during development and testing. Additionally, tokenization can be applied for sensitive information like credit card numbers, replacing them with unique, irreversible tokens.

- User Consent Management: Consent management can be handled using OAuth 2.0 for secure authorization and JWT (JSON Web Tokens) to store consent preferences in a lightweight, encoded format. APIs like OneTrust or TrustArc offer ready-made solutions for compliance tracking, but custom systems can use MySQL or PostgreSQL with audit logs for consent records.

- Encryption and Anonymization: For encryption, AES-256 is a widely used encryption standard that can be implemented using libraries like PyCryptodome or OpenSSL for sensitive data storage. Anonymization processes can be implemented using Hashing (e.g., SHA-256) for personal data that must remain irreversible.

- Audit Trails and Data Access Logs: Developers can utilize Elasticsearch or Logstash to create detailed logging systems that capture every action on user data. These logs can be processed using Kibana for visualization, making it easier to demonstrate compliance during audits. These logs can include detailed metadata, such as who accessed the data, what data was accessed, and when.

How Itexus Helps: At Itexus, we integrate compliance into every layer of fintech development. By using DevOps practices and automated testing tools like JUnit and Selenium, we ensure continuous compliance throughout the development cycle. We leverage microservices architecture for modular updates and implement CI/CD pipelines to automate compliance checks. Our approach guarantees that compliance features such as KYC, AML, and data protection are seamlessly embedded into your platform, allowing businesses to focus on growth while staying compliant.

Fintech Design: Security as a Trust Builder

In 2025, fintech security is about embedding trust into every aspect of the system. It’s not just about protecting data but creating a seamless environment where users feel secure at every interaction.

- Multi-Factor Authentication (MFA): Implementing biometrics (fingerprints, facial recognition), OTPs, and behavioral biometrics ensures a frictionless yet secure experience. This layered approach builds user confidence while maintaining robust protection.

- End-to-End Encryption: Secure the entire transaction journey—from TLS 1.2/1.3 for transmission to AES-256 encryption at rest. This continuous protection helps instill trust, ensuring users feel their data is safe at every step.

- Real-Time Fraud Detection: AI and machine learning (e.g., Random Forests, Gradient Boosting) monitor transactions in real time, flagging suspicious activity instantly. This proactive approach boosts trust, as users and businesses alike know the platform is continuously safeguarding against fraud.

The Role of Behavioral Psychology in Security Design

Fintech platforms should also consider the psychology of security. By designing for ease of use while maintaining robust security, businesses can avoid frustrating users with overly complex authentication systems while still keeping data secure.

Contextual Authentication: For low-risk transactions, reduce the friction of authentication. For higher-risk actions, increase the security level without compromising user experience.

Fintech Design: Trust Through Invisible Infrastructure

In fintech design, backend infrastructure plays a vital role in establishing trust, even if users don’t directly interact with it. Slow transactions, errors, or service interruptions can undermine confidence, but a well-architected backend ensures that trust remains intact.

Key Aspects of Backend Infrastructure:

- High Availability: Utilizing multi-cloud solutions (e.g., AWS, Azure, Google Cloud) ensures that the platform remains operational even during traffic surges or failures. Auto-scaling mechanisms dynamically adjust resources based on demand.

- Scalability: A modular architecture based on microservices (e.g., using Kubernetes for container orchestration) allows the platform to scale efficiently without disruptions, accommodating increased traffic from expanding user bases.

- Error State Architecture: Implement transactional state management with systems like Kafka or RabbitMQ to ensure that, in the event of a failure, operations can resume automatically. For example, failed transactions trigger retry logic through Circuit Breaker patterns, notifying users and providing alternative actions.

How Itexus Ensures Seamless Performance: At Itexus, we focus on robust DevOps pipelines with CI/CD (e.g., Jenkins, GitLab CI) to deliver continuous integration and deployment while ensuring reliability. Our backend systems leverage microservices and multi-cloud redundancy to optimize uptime, ensuring seamless operation that fosters user trust. This invisible infrastructure strengthens the platform’s reputation for dependability.

Fintech Design: Personalization and Trust Through Data-Driven Insights

In fintech, trust extends beyond data security and compliance—it also depends on seamless integration with the broader financial ecosystem. Interoperability between platforms, financial institutions, payment providers, and regulatory bodies ensures a cohesive experience where trust is built not only within the platform but also with its external partners.

Designing for Ecosystem Integration: Fintech platforms must be capable of connecting with third-party services such as banks, payment gateways, and identity verification providers. Implementing RESTful APIs and adhering to standards like ISO 20022 ensures smooth and secure data exchanges across global networks. Using OAuth 2.0 for secure authentication and JWT (JSON Web Tokens) for authorization helps strengthen trust by maintaining secure user sessions and simplifying integration.

Smart Contracts and Blockchain: Adopting blockchain for smart contracts enhances transparency by automating transactions and reducing the reliance on intermediaries. The decentralized nature of blockchain ensures cryptographic security, providing users with a transparent way to independently verify transactions.

Collaborative Ecosystem Design: Designing with microservices architecture and an API-first approach allows platforms to easily scale and integrate with new technologies. This flexibility makes it easier for fintech systems to stay compliant and interact securely with new financial services, enhancing user confidence in the system’s ability to adapt to future needs. By fostering interoperability and integrating with trusted partners, fintech platforms build a collaborative trust network that ensures secure, seamless interactions for all users.

Fintech Design: The Importance of Customization

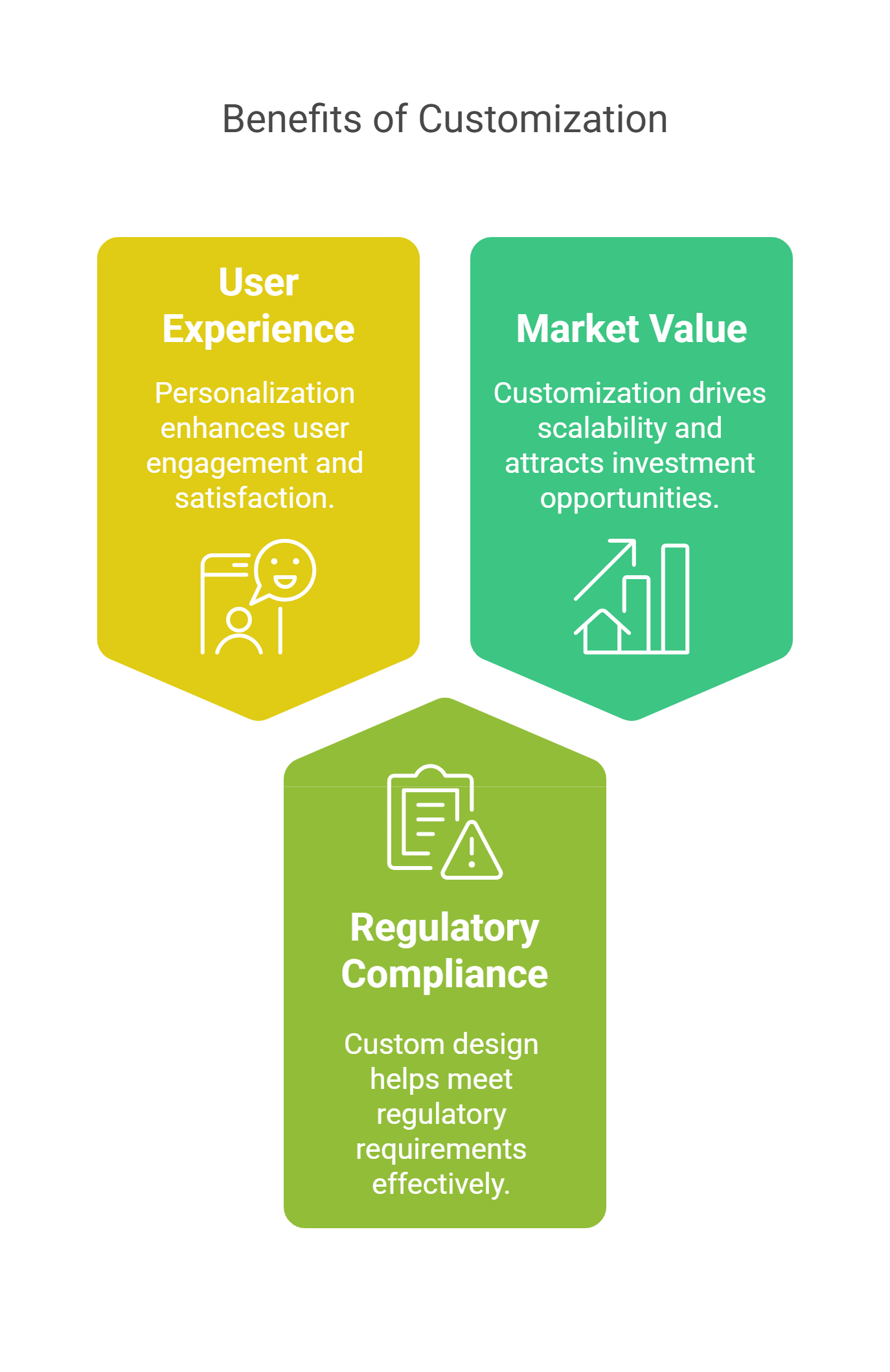

You’re right to point out those three aspects. The section could be enhanced to more explicitly cover how customized design:

- Enhances user experience – Aligning the platform with individual financial goals and behaviors.

- Supports regulatory compliance – Designing systems that adapt to region-specific requirements.

- Increases a fintech solution’s market value – How a customized design can make the platform more attractive for investors and

Customized design is central to building a fintech platform that is not only secure and scalable but also deeply aligned with the needs of users and businesses. A well-tailored system goes far beyond just interfaces and features—it instills trust and ensures a seamless, adaptable, and secure environment where both users and businesses thrive.

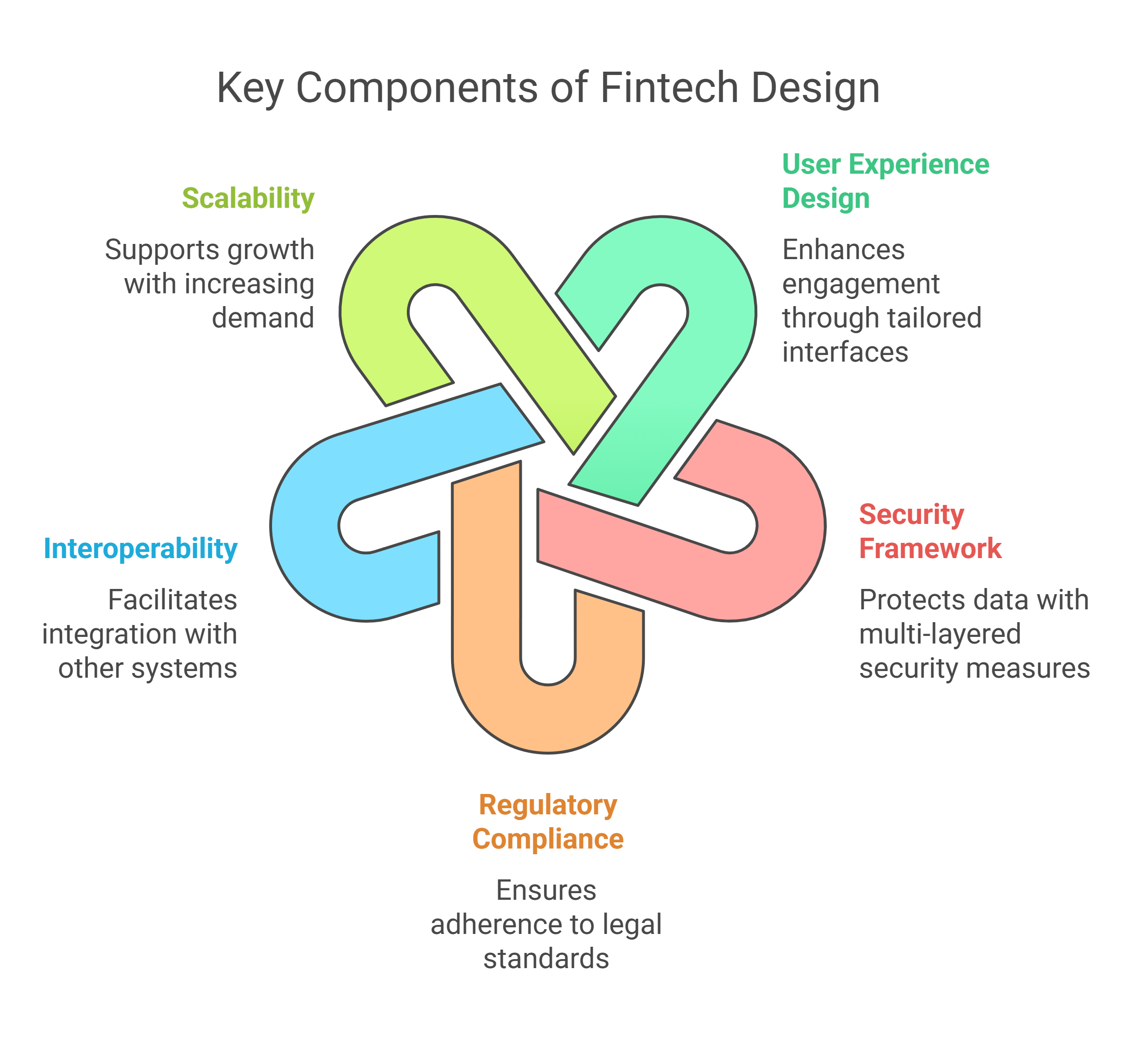

Key aspects of customized design include:

- Enhancing the user experience: A customized platform can be designed to align with individual financial goals and behaviors, offering personalized insights and tailored features. This approach boosts user trust and engagement, helping users manage their finances more effectively.

- Supporting regulatory compliance: A key benefit of custom design is its ability to integrate compliance features that are adaptable to regional regulatory requirements. Whether it’s KYC, AML, or GDPR, a tailored system helps businesses stay compliant and fosters trust by demonstrating a commitment to local regulations.

- Increasing market value: A custom-built fintech solution becomes a valuable asset by making the platform more attractive to investors. As the platform grows, its scalability, security, and adaptability contribute to long-term business value, increasing its appeal in an evolving market.

Here’s a table showing how customized design elements add value across key areas of fintech development:

| Design Element | Impact on Business | Example |

| Business Logic Design | Aligns with specific business models, ensuring operational efficiency and adaptability. | Automated payment routing based on user location and currency preferences. |

| Scalable Architecture | Ensures the product can grow without losing performance or reliability. | Cloud-based microservices architecture allowing for easy scaling as user base grows. |

| Security Framework | Protects sensitive data, increasing user trust and reducing legal and financial risks. | Multi-factor authentication and encrypted data storage to safeguard user data. |

| Interoperability | Makes the app compatible with multiple payment systems and regulatory frameworks, improving flexibility. | Integration with global payment networks like SWIFT GPI, UPI, and local banking systems. |

By prioritizing customized design elements such as business logic, scalability, security, and compliance, fintech platforms not only improve the user experience but also gain long-term business value, all while fostering trust and increasing market competitiveness.

Conclusion: Future-Proofing Your Fintech Business with Trust-Driven Design

The future of fintech lies in creating systems that users trust implicitly. At Itexus, we specialize in developing secure, compliant, and scalable fintech solutions that not only meet today’s regulatory and security standards but are designed to evolve with the future of finance.

As we move into 2025, businesses must prioritize building a “trust engine” through thoughtful, comprehensive fintech design. By integrating compliance, security, seamless infrastructure, and personalized experiences, fintech companies can create platforms that drive growth and foster long-term customer loyalty. For investors and entrepreneurs looking to succeed in the fintech space, building a system that users trust is the key to unlocking lasting success.