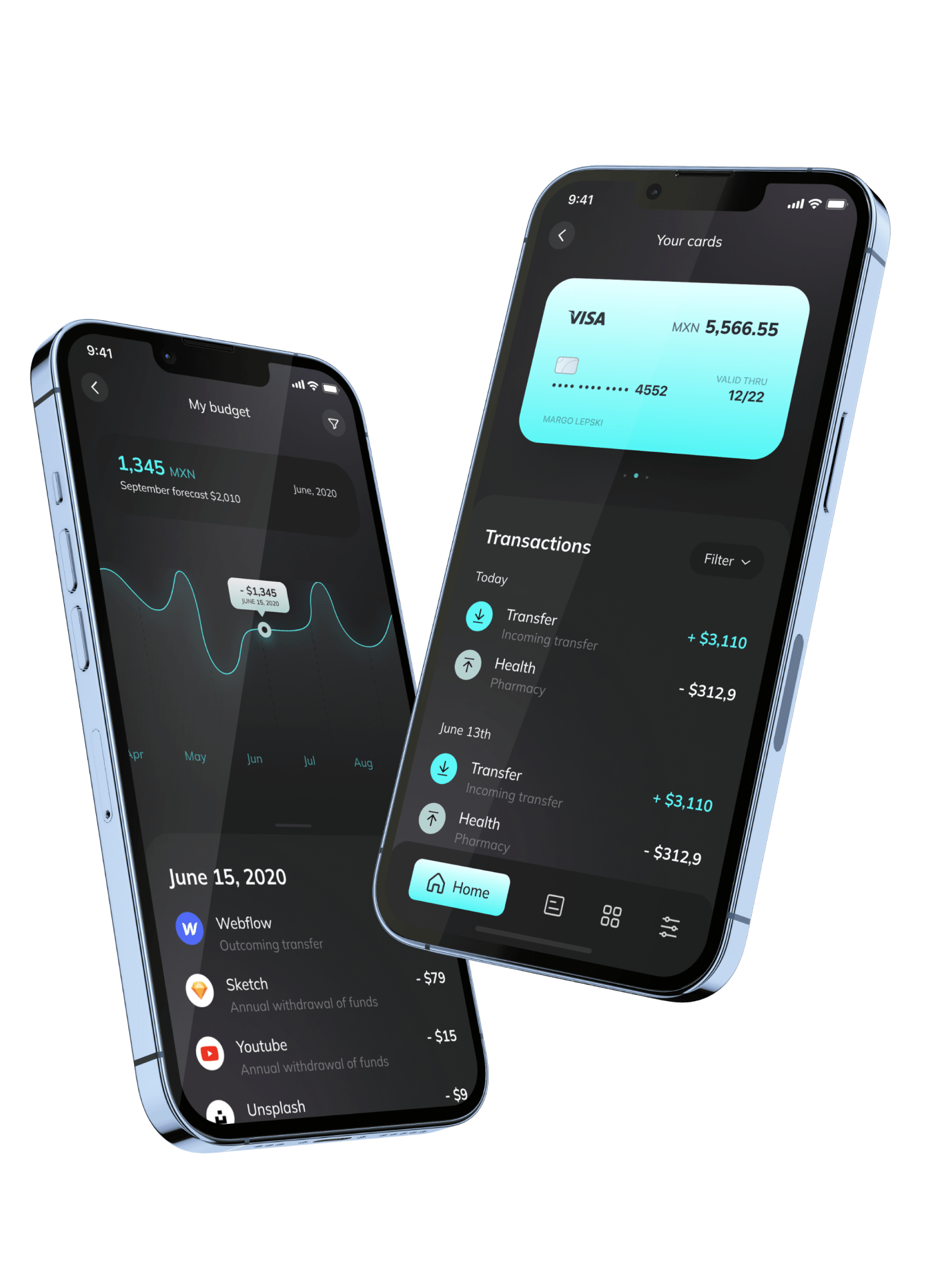

Mobile e-wallet application that lets users link their debit and credit cards to their accounts through banking partners, create e-wallets and virtual cards, and use them for money transfers, cash withdrawals, bills and online payments, etc.

💸 Imagine This: Your App Handles $1M in Transactions Daily. Ready to Build the Next Venmo?

Peer-to-peer (P2P) payment apps like Venmo, Cash App, and Zelle are reshaping how we split bills, pay rent, and even tip creators—processing over $1.7 trillion in 2023 (Visa, 2023). But with giants dominating the market, how do you carve out space? The answer: Build a P2P payment app that’s faster, cheaper, and cooler. Let’s break down the blueprint, costs, and secrets to success.

What is a P2P Payment App? (And Why Users Are Addicted)

A P2P payment app lets users send/receive money instantly via mobile devices—no banks or cash required. Think Venmo’s social feed, Cash App’s Bitcoin trades, or PayPal’s cross-border transfers. The magic? Speed, simplicity, and security.

P2P Payment Market: Why Now is the Golden Time

- 86% of millennials use P2P apps weekly (Federal Reserve, 2023).

- Global P2P transactions will hit $9.5 trillion by 2030 (Grand View Research, 2023).

- New niches: Split bills in crypto, tip influencers, or pay freelancers globally.

But building a P2P app isn’t just coding—it’s a battle against fraud, regulations, and user inertia. Here’s your playbook.

Key Features Your P2P Payment App Must Have

1. User Onboarding: Smooth as Butter

- Phone/Email Signup: 1-tap registration.

- KYC Verification: Scan IDs with AI tools like Onfido.

- Bank/Payment Link: Integrate Plaid or Stripe for instant account connections.

Pro Tip:

“Let users start transacting before full KYC approval. It reduces drop-offs by 30%.”

— Maya Chen, Fintech Product Lead at Revolut

2. Core Functionality: The Money Movers

- Instant Transfers: Support ACH, wire, and card payments.

- Split Bills: Calculate shares and nag slackers (like Splitwise).

- Transaction History: Searchable, exportable records.

- Notifications: “You’ve been paid!” alerts with emojis.

3. Security: Don’t Become the Next Headline

- End-to-End Encryption: Use TLS 1.3 or higher.

- Biometric Auth: Face ID, fingerprint scans.

- Fraud Detection: Machine learning to flag suspicious patterns.

Example: Cash App uses blockchain to secure Bitcoin transactions.

4. Social & Gamification: Make Payments Fun

- Social Feed: Venmo-style emoji captions.

- Rewards: Cashback for referrals or streaks.

- Customization: Let users design virtual debit cards.

How to Build a P2P Payment App: 7-Step Roadmap

1. Market Research: Find Your Edge

- Audit competitors: What’s missing? Crypto? Lower fees?

- Regions: India’s UPI processes 10B+ monthly transactions (NPCI, 2023).

2. Choose Your Tech Stack

| Component | Tools |

|---|---|

| Frontend | React Native, Flutter |

| Backend | Python/Django, Ruby on Rails |

| Database | PostgreSQL, MongoDB |

| Cloud Hosting | AWS, Google Cloud |

| Payments | Stripe, Braintree, Razorpay |

3. Design the UI/UX: Hook Users in 3 Clicks

- Onboarding: <30 seconds to first payment.

- Dashboard: Balance, recent transactions, quick-send buttons.

- Micro-Interactions: Confetti on payment completion.

4. Develop & Integrate APIs

- Payment Gateways: Stripe for card processing, Plaid for bank links.

- SMS/Email: Twilio for OTPs and alerts.

- Analytics: Mixpanel or Google Analytics.

5. Compliance: Navigate the Legal Jungle

- Licenses: Money Transmitter Licenses (U.S.), PSD2 (EU).

- PCI DSS: Follow PCI Security Standards.

- Audits: Annual third-party checks.

Cost Alert: U.S. licensing costs 500k–500k–2M depending on states covered.

6. Test Relentlessly

- Security Testing: Hire ethical hackers.

- Load Testing: Simulate 100k transactions/hour.

- Beta Launch: Invite-only with real-user feedback.

7. Launch & Market Like Crazy

- Pre-Launch Hype: Waitlists, influencer teasers.

- Referral Bonuses: “Get $10 for each friend who joins.”

- ASO/SEO: Optimize app store keywords + blog guides.

P2P Payment App Development Cost: What’s the Damage?

| Component | Cost Range |

|---|---|

| UI/UX Design | 50k–50k–150k |

| Frontend + Backend Dev | 150k–150k–500k |

| API Integrations | 100k–100k–300k |

| Compliance & Licensing | 200k–200k–2M+ |

| Marketing (Year 1) | 100k–100k–1M |

| Total | 600k–600k–4M+ |

Source: Clutch, 2023

4 Challenges (And How to Crush Them)

- Fraud Prevention

- Fix: Use AI tools like Sift to detect scams in real time.

- Cross-Border Fees

- Fix: Partner with blockchain networks (Stellar, Ripple) for cheap FX.

- User Trust

- Fix: Get FDIC insurance or partner with chartered banks.

- Regulatory Delays

- Fix: Hire fintech lawyers early (Andreessen Horowitz’s Legal Hub).

Success Stories: Apps That Nailed It

- Venmo: Turned payments social—$230B processed in 2022.

- Cash App: Added Bitcoin + stock trading, hitting 51M users.

- Paytm (India): Dominated with UPI integration—350M+ users.

Future of P2P Payments: AI, Blockchain, and Voice

- AI Chatbots: “Hey Siri, send $50 to Mom.”

- CBDCs: Government digital currencies for instant settlements.

- DeFi Integration: Let users earn interest on app balances.

ROI: Is Building a P2P App Worth It?

Yes! The average P2P app earns 2–2–5 per user monthly via fees and premium features. Scale to 1M users, and you’re looking at 24M–24M–60M/year.

Growth Hacks:

- Go Niche: Target freelancers, renters, or gamers.

- Monetize Data: Anonymized spending insights for banks.

Final Word: Your Turn to Disrupt

Building a P2P payment app is a marathon, not a sprint. But with the right mix of tech, compliance, and viral features, you could create the next digital wallet unicorn.

Ready to make banks sweat? Start coding—and remember, even Venmo began in a dorm room.

💡 Expert Tip of the Day:

“Add a ‘Request Money’ button that’s embarrassingly hard to ignore. Late payers hate it—you’ll love it.”

— Diego Ramirez, Lead Product Manager at a Top P2P App