The fintech industry is thriving, and now is the perfect moment to create a fintech app. As digital banking mobile payments, and cryptocurrency gain popularity groundbreaking fintech solutions are changing how people handle their money. Entrepreneurs and developers aiming to enter this dynamic market must know how to build a fintech app from idea to release.

This guide shows you how to build a successful fintech app. We’ll look at the current fintech scene and typical costs. You’ll find out how to plan your app , create a user-friendly design, and team up with skilled fintech app builders to make your idea real. We’ll also talk about key parts like testing rolling out, and making money from your app. If you’re starting a new company or running an established one, this article gives you a plan to create a fintech app that users love and that shines in a tough market.

Understanding the FinTech Scene

The fintech industry in the U.S. has grown significantly, with around 65% of Americans using fintech products like mobile banking and digital wallets as of 2022, according to Statista. By 2030, the U.S. fintech market is projected to reach $324 billion in revenue and manage assets worth over $2.5 trillion, as highlighted by Forbes. This growth is driven by consumer demand for digital services, supportive regulations, and technological advancements like AI and blockchain. Despite its success, the industry faces challenges, including cybersecurity risks and regulatory compliance.

Types of FinTech Apps

The fintech scene features a wide variety of applications. Each app aims to address specific areas of personal and business finance. Some of the most common types you’ll come across include:

- Banking and Money Management Apps: These apps give users full banking services letting them handle their money at any time and place.

- Investment Apps: These apps give users up-to-the-minute info and allow quick investments helping people look into and manage their assets online.

- Insurance Apps: Made to deal with policy quotes, file claims, and process payments, these apps are making the insurance business simpler.

- Cryptocurrency Apps: These platforms let users buy, sell, trade, and take care of cryptocurrencies like Bitcoin and Ethereum.

- Lending and Personal Credit Apps: These apps focus on personal finance offering services such as loans, money management, and ways to save.

Market Trends and Opportunities

The fintech sector keeps changing, and a few main trends are having an impact on where it’s heading:

- Embedded Finance: By 2025, embedded finance will be worth USD 141.00 billion, as traditional companies like car makers and hotels want it more.

- Artificial Intelligence: AI will change how we plan our finances. AI software will look at lots of money data to make investment plans just for you.

- Open Banking: This trend is growing. It lets other companies use customer data through open APIs. This creates more competition and leads to new ideas.

- Blockchain and Cryptocurrency: Even though average investors feel less excited about crypto now, it still has an edge over other options. This is because it’s easy to start investing in crypto, and new safer ways to buy it keep popping up.

- Real-Time Payments: Experts predict that by 2032 real-time payments will grow by 33% each year on average. This shows that people are moving towards payment systems that work faster and better.

As the fintech scene keeps changing, companies that remain flexible and adjust to address new customer needs will see plenty of opportunities to grow and come up with new ideas.

| Trend | Description | Impact | Market Projection |

|---|---|---|---|

| Embedded Finance | Integration of financial services into non-financial companies’ offerings. | Expands revenue streams for traditional companies (e.g., car makers, hotels). | Expected to reach USD 141.00 billion by 2025. |

| Artificial Intelligence (AI) | Use of AI to analyze financial data and create personalized financial plans. | Enhances customer experience through tailored investment strategies and financial planning. | Accelerating adoption as AI technology advances. |

| Open Banking | Allows third-party companies to access customer data through open APIs. | Increases competition, fosters innovation, and leads to the development of new financial products. | Growing trend with expanding adoption worldwide. |

| Blockchain and Cryptocurrency | Digital currencies and blockchain technology for secure, decentralized transactions. | Provides a unique investment option with continuous development of safer methods for purchasing crypto. | Despite fluctuating interest, remains a significant market. |

| Real-Time Payments | Instant payment systems that process transactions in real-time. | Drives consumer preference towards faster, more efficient payment systems. | Projected to grow at an average of 33% annually by 2032. |

Planning Your FinTech App

Defining Your Value Proposition

To build a fintech app that succeeds, you need to come up with a unique selling point (USP) that makes it stand out from other apps. This means figuring out the specific perks, features, or solutions that meet what your target users want. To create a USP that grabs attention, app makers should:

- Look into the market and check out what other apps are doing

- Pick out what makes their app special and how it helps users

- Zero in on fixing specific problems users have

- Try out the USP and make it better based on what users say

A UVP that’s written well helps to get across the app’s good points to different people involved, like investors, customers, and partners. Using a three-part plan can work well: find a big problem, explain how to fix it, and show the good results.

Identifying Target Users

Fintech apps serve a wide range of users, including people, companies, and banks looking for new solutions. Many consumer-focused fintech apps target millennials, who embrace new tech and know how to use it well.

To identify target users, think about these things:

- Demographics (how old they are, if they’re men or women how much money they make)

- Psychographics (what kind of people they are, what matters to them, what they like)

- Where they live

- How they act (what they’ve bought before how they handle their money)

By zeroing in on a specific target audience, companies can customize their marketing messages, product offerings, and pricing strategies to meet customer needs better. This approach has an impact on the chances of success in the competitive fintech market.

Regulatory Considerations

Compliance plays a crucial role in fintech app development affecting every aspect of the product from marketing to account closures. Key regulatory considerations include:

- Know Your Customer (KYC) and Know Your Business (KYB) processes

- Anti-Money Laundering (AML) laws

- Unfair, Deceptive, or Abusive Acts or Practises (UDAAP) regulations

- Fair lending laws

- Truth in Lending Act (TILA)

Following these rules helps companies steer clear of penalties and legal troubles. It also ensures they make safer longer-lasting products for their customers. This focus on playing by the rules can give businesses an edge over their rivals in the long run and help them earn their customers’ trust.

When developers think about these things on, they can build a fintech app that meets market needs and follows the rules. This sets them up for success right from the start.

Designing the User Experience

Creating a fintech app requires you to balance functionality, security, and ease of use . A well-crafted user experience (UX) has a big impact on how many people use the app how much they engage with it, and how successful it becomes overall.

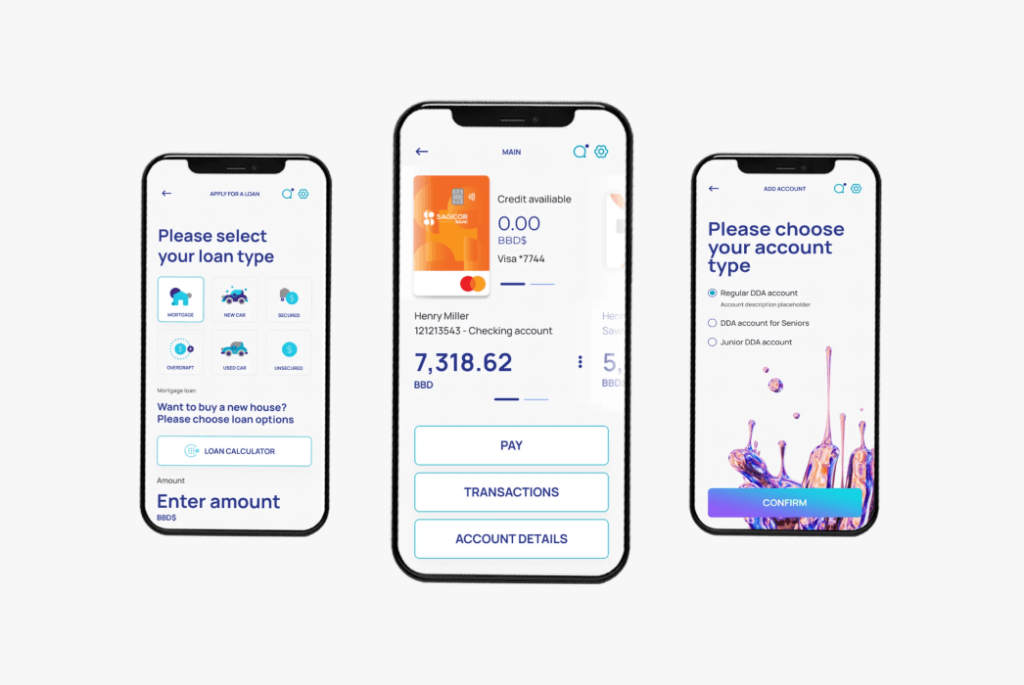

Key Features and Functionality

To build a fintech app, you need to include certain essential features to give users a complete experience:

- Secure Login and Registration: Put in place strong security steps, including biometric authentication, which 46% of customers think gives better security to access financial data.

- Personal Account Management: Let users see and control their accounts, including past transactions and statements.

- Money Transfer Tools: Give easy-to-use options to send and get money.

- Financial Reports and Statistics: Show financial data in pictures to help users grasp their spending habits and make smart choices.

- Finance Management Tools: Add features like setting spending caps and budget planning aids.

- Security Features That Pack a Punch: Put in place options like changing passcodes freezing cards, and setting up alerts.

- Chatbot Help: Add AI-powered chatbots to give quick help and tackle common questions.

UI/UX Best Practices for FinTech

To build a fintech app that grabs attention and works well, keep these UI/UX tips in mind:

- Easy Navigation: Create a logical layout that helps users find what they want without getting lost or clicking too much.

- Simple Information Display: Use plain language and clear labels to explain financial data in a way that’s easy to grasp.

- Custom User Dashboards: Adjust the dashboard to fit each user’s likes and habits giving them a more personal experience.

- Lively Data Visuals: Turn complex money info into eye-catching easy-to-understand pictures like charts and graphs.

- Quick Sign-Up: Make joining easier by cutting down steps and giving clear directions.

- Smart Alerts: Send timely and useful notifications to keep users in the loop about their money and possible security risks.

By focusing on these key features and UI/UX best practices, fintech app developers can create apps that are easy to use, secure, and engaging meeting their target audience’s needs.

Developing Your FinTech App

Choosing the Right Tech Stack

Picking the right technology stack plays a crucial role in fintech app development. A Teradata study found that 87% of technology decision-makers think they risk falling behind if they don’t adopt technologies like AI, automation, or multi-cloud infrastructure. To stay competitive, companies must prioritize their tech stack choices.

When building a fintech app, developers should focus on:

- Backend technologies: These manage data storage, process information, and verify users.

- Frontend technologies: These build the user interface and give a quick-responding experience.

- Cloud computing and hosting: These provide growth potential, cost savings, and adaptability.

Fintech companies are increasingly adopting cloud-native development approaches. These approaches enable them to build solutions that can grow and change to keep up with shifting market trends. To run a multi-cloud setup, companies need to plan and make sure everything works together . This involves making data flow between systems, putting strong security measures in place, and keeping costs under control.

Security and Data Protection Measures

Security plays a crucial role in developing fintech apps. These apps deal with sensitive money-related info making them attractive to hackers. To protect against risks, app makers should put in place:

- Encryption: Apply Advanced Encryption Standard (AES) and Secure Hash Algorithm (SHA) to keep data safe during sending and storing.

- OAuth and JWT: Use these tools to make sure users are who they say they are and have the right access.

- HTTPS and TLS: Make sure financial data travels and meets industry rules.

- API security: Use tools like Sapience to check for API weak spots and create detailed reports.

- Compliance tools: Set up ways to get user agreement, handle data access requests, and automate Know Your Customer (KYC) steps.

By using these security steps and sticking to good habits, fintech firms can create strong safe apps that keep user info secure and follow industry rules. To make sure the app keeps doing well in the fast-changing fintech world, it’s key to test and watch its performance how users interact with it, and its safety .

Testing and Launching Your App

Quality Assurance Process

Quality assurance (QA) plays a vital role in developing fintech apps to provide smooth user experiences and reduce business risks. A solid QA process includes several important testing methods:

- Security Testing: This plays a crucial role for fintech apps that handle sensitive financial data. Testing mimics real-world cyber attacks to spot vulnerabilities, while vulnerability scanning looks for known weaknesses in software components and security settings.

- Compliance Testing: Fintech companies need to follow various regulatory standards, including MiCA, PSD3, GDPR, and PCI DSS. Compliance QA makes sure that the app meets these requirements protecting data privacy and reducing legal risks.

- Performance Testing: This evaluates how the app responds, handles throughput, and uses resources under different loads. It makes sure the app works well during busy times when many users carry out transactions at once.

- Functional Testing: This checks if the software meets requirements making sure financial calculations, transactions, and reports are accurate. It also examines key features like managing accounts and processing payments.

- User Experience Testing: UX testing checks how easy the app is to use how intuitive it feels, and how happy users are with it overall. This includes testing usability how well it works on mobile devices, and how accessible it is to make sure the app is easy for people to use and follows accessibility rules.

App Store Optimisation

App Store Optimisation (ASO) has a big impact on making a fintech app easier to find and see in search results. Here are key strategies to optimize your app store presence:

- Title and Subtitle Improvement: Write a short clear title with key words. “Acorns: Invest Spare Change” sums up what the app does well.

- Icon Creation: Make a one-of-a-kind easy-to-spot icon that catches the eye in search results and shows what your brand is about.

- Preview Images: Use your first image to grab attention, like the main picture on a website. Think about using moving previews or telling a story with several cards to pull in possible users. You can also leverage an image generator to create unique and eye-catching visuals that enhance engagement.

- Keyword Study: Find and use key words that your target audience looks for as well as those that top rivals use.

- A/B Testing: Set up and try out different versions of app page components such as text and screenshots, to boost user interest and increase downloads.

By putting these QA processes and ASO strategies into action, fintech companies can make sure their apps are secure, follow regulations, and are easy to find in app stores.

Post-Launch Strategies

User Acquisition and Retention

Successful fintech apps focus on getting new users and keeping existing ones. Research shows that “boosting user retention by just 5% can lead to a 25% increase in profits”. To achieve this, companies should:

- Create user personas through in-depth quantitative research and web analytics

- Add game-like features to make money management more fun

- Use push notifications , as they can increase retention rates by 125% to 180%

- Start loyalty programs offering special perks to regular customers

- Give excellent customer support to solve problems

Personalization plays a crucial role in keeping customers. By examining transaction histories and how users interact, fintech companies can customize their services more . Also, marketing through influencers, affiliates, and UGC creators from UK can boost brand visibility and trustworthiness, helping to bring in new customers.

Continuous Improvement

To keep up in the fast-changing fintech world, companies need to always get better. This means:

- Getting and looking at what users say often

- Doing A/B tests to check new features and make navigation easier

- Changing the app’s look and adding new things users want

- Using new tech, like blockchain or AI, to make services better

By looking at how long people use the app compared to other apps, companies can see what to fix. Breaking users into groups helps find steady use times, so they can focus on making things better for each group.

Keep in mind, a well-designed user experience is essential for success. Creating a smooth easy-to-use interface helps to build trust and keeps users engaged with the app over time.

Average Costs of Fintech App Development

The price to build a fintech app changes a lot based on many things. A custom fintech app that offers safe online payments usually costs at least USD 40,000 and takes three to four months to make . If you want a basic banking app, you might spend between USD 20,000 and USD 40,000 . Fintech apps with new tech can cost from USD 50,000 to USD 90,000, while complex money apps might need you to invest up to USD 200,000 or even more.

A few main things have an impact on the total price:

- App Requirements: The scope of work and product complexity have a big impact on the development cost.

- Location of Development Team: Hourly rates differ from country to country. For example, US-based developers charge an average of USD 53 per hour, while Ukrainian developers charge around USD 16 per hour.

- Delivery Time: Tighter deadlines often lead to higher costs because they need more teamwork.

- Maintenance and Support: Ongoing upkeep and regular updates add to the total cost.

- Technology Stack: The programming languages and tools you pick affect the price estimate.

- Feature Complexity: The number and advanced nature of features built into the app have a big effect on costs.

How to cut down on expenses

To keep fintech app development costs in check, try these approaches:

- Rank Features: Zero in on key features for the first release cutting down complexity where you can.

- Pick the Right Platform: Go for cross-platform tools like Flutter or React Native to save money compared to native tech.

- Think About MVP Development: Kick off with a Minimal Viable Product to test your app idea and get user input before going all-in.

- Find the Right Development Team: Team up with a solid fintech app development firm that offers good rates and skilled pros.

- Tap into Open-Source Tech: When possible, use open-source answers to save cash.

By putting these strategies into action and keeping a close eye on the development process, you can build a successful fintech app while keeping expenses in check.

| Type of Fintech App | Cost Estimate (USD) | Development Time | Key Cost Factors |

|---|---|---|---|

| Custom fintech app with safe online payments | At least $40,000 | 3-4 months | Scope of work, product complexity, feature complexity, technology stack |

| Basic banking app | $20,000 – $40,000 | Varies | Scope of work, product complexity, feature complexity, technology stack |

| Fintech app with new technology | $50,000 – $90,000 | Varies | Technology stack, feature complexity, product complexity |

| Complex money management app | Up to $200,000 or more | Varies | Scope of work, product complexity, feature complexity, technology stack |

Top fintech application development companies

When you’re looking to build a fintech app, picking the right development partner is key. Here are three leading fintech application development companies that have shown their skills in delivering top-notch financial technology solutions:

Itexus

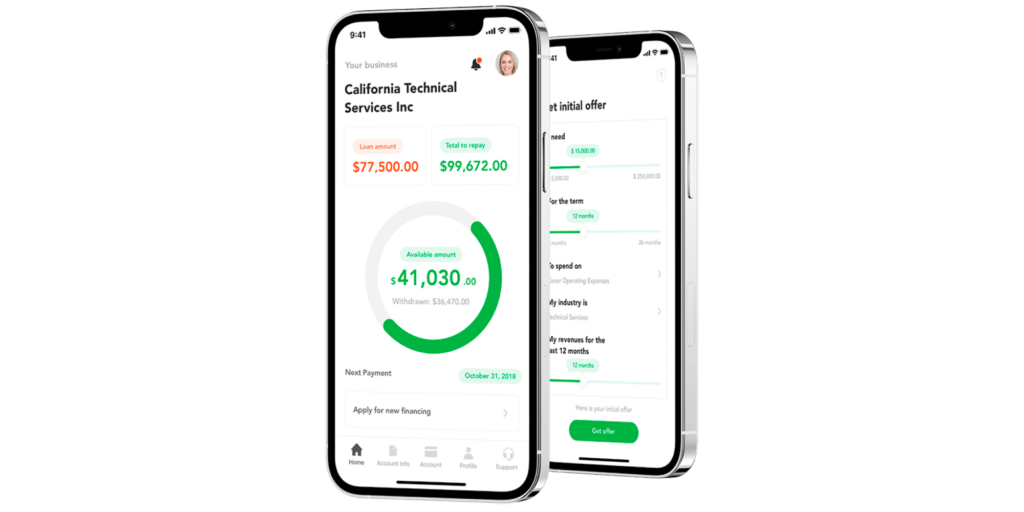

Itexus has built a solid reputation in fintech software development since 2013, working with over 170 clients. They focus on building advanced and scalable products for various fintech areas such as digital banking, wealth management digital lending online payments, and insurtech. Itexus employs 130+ skilled developers and provides a wide range of services, including full-stack web application development, UI/UX design, and DevOps.

Some of their standout projects include:

- A stock trading bot that trades during the day

- A system that analyzes finances and makes suggestions using AI

- A platform where small businesses can borrow money online

- A platform that gives signals for stock trading

- An app for phones that lets you send money to other countries

Customers say good things about Itexus. They like how the company works , responds well, and finishes projects on time without going over budget.

Inoxoft

Inoxoft wants to create fintech apps that work for users. They test their products and have a strong system to manage quality. This helps them meet high standards. Inoxoft is good at putting together teams of developers just for startups. They know how to make custom software, web apps, and apps for iPhones and Android phones that fit what each startup needs.

Key features of Inoxoft’s approach include:

- They use Agile methods to develop and

- They put DevOps practices into action to simplify processes

- They offer flexible ways to work together to suit specific project needs and budgets

Praxent

Praxent aims to create financial user experiences that grab attention giving their clients an edge over competitors. They excel at building fintech software focusing on user experiences that are simple and tailored to each person. This helps boost conversion rates and keeps customers engaged.

Praxent’s strong points include:

- A project success rate 2.94 times higher than the industry average

- 96.4% of sprint commitments agreed with clients met

- 24 years of industry experience

They provide various services such as UX/UI redesign, cloud migration, custom data platforms, and systems integration with core banking, lending, and insurance systems.

These firms excel because of their know-how, history of successful projects, and dedication to create top-notch fintech solutions that fit their clients’ needs.

Monetization of FinTech apps

Fintech app monetization plays a key role to generate cash from campaigns and sustain growth. The global fintech market is expected to reach around USD 310.00 billion in 2022, with a 25% growth rate from the previous year. However, this still represents a small part of the larger financial services industry pointing to significant room to expand.

Fintech companies have a few good ways to make money from their apps:

- Subscriptions: This simple method asks users to pay a fee every month, twice a year, or for access. Companies can give special features to people who pay, like personal money advice or better tools to invest. Many fintech firms such as Revolut and Tandem, use this way to make money.

- Interchange Fees: Fintech companies get most of their money from interchange fees, with over 75% of them relying on this source. This makes it the top way these companies earn in the industry. They charge these fees when users send money or buy things.

- Data Monetization: Fintech companies gather huge amounts of financial data every day. They can make this data anonymous, put it into groups, and sell it to brands that want to gain market insights or understand how customers behave.

- Robo-Advisors: These computer-driven financial services offer investment management with little human input. Robo-advisors charge a percentage of the total assets they manage, but at a lower rate than old-school investment managers.

- Third-Party Partnerships: Fintech companies can team up with other businesses to provide extra services, like tools to check credit scores or health insurance. The fintech company then gets a cut of the money made from these partnerships.

- Advertising: Some fintech apps earn money through ads, though this isn’t as widespread. Take NerdWallet, for instance. They make cash from advertisements and promotions with partners.

- API Monetization: Open banking has paved the way for fintech firms to sell access to their APIs. This allows other businesses to incorporate their services into their own offerings.

By using a mix of these approaches, fintech firms can build strong ways to make money that help long-term growth and staying power in this fast-changing field.

Conclusion

To create a fintech app is a tricky process that needs careful planning skilled work, and constant improvement. Each step plays a key part in making a winning app. This includes understanding the fintech scene, designing an easy-to-use interface, picking the right tech tools, and putting in place tough security steps. Success comes from balancing new ideas and following rules, while always putting users’ needs first.

As the fintech industry keeps changing, you need to stay ahead to compete. This means you should always make your app better based on what users say, use new tech, and change with the market. If you follow the tips in this guide and stay ready to change, you’ll be in a good spot to make a fintech app that meets what people want now and could shape how money tech works in the future.

FAQs

How long does it take to develop a FinTech application?

Building a FinTech app can take anywhere from a few months to over a year. The time needed depends on how complex and big the project is. The FinTech industry is growing fast. Experts predict the global market could hit USD 309.98 billion by 2022. This means it’s growing at a rate of 24.8% each year from 2018 to 2022.

What are the key steps to building your own FinTech company?

To start a FinTech company, follow these six main steps:

- Look into the target market and come up with a game plan.

- Create a clean modern user interface.

- Build the app.

- Test the app inside and out.

- Release the app and get user input.

- Keep improving and updating the app.

How can you make money from a FinTech app?

FinTech apps can bring in cash through different methods such as:

- Transaction fees: Charging when users process transactions through the app.

- Subscription models: Offering extra features for a regular fee.

- Freemium models: Giving basic services at no cost while asking payment for advanced features.

- Advertising: Putting ads in the app.

- Data monetization: Using collected data to make money.

- Affiliate and referral programs: Getting commissions by sending users to other services.

- Robo-advisors: Giving automated money advice for a fee.

- Peer-to-Peer (P2P) lending: Helping users lend to each other for a fee.

What strategies can help grow a FinTech startup?

To expand your FinTech startup think about these strategies:

- Pick a specific untapped market with high demand for money services.

- Keep collecting and using customer input to make your product better.

- Spread out your income sources to stay stable and grow.

- Pick a strong base to build your platform on.

- Come up with a good plan to get customers.

- Keep testing what you offer and make small changes based on what people say.