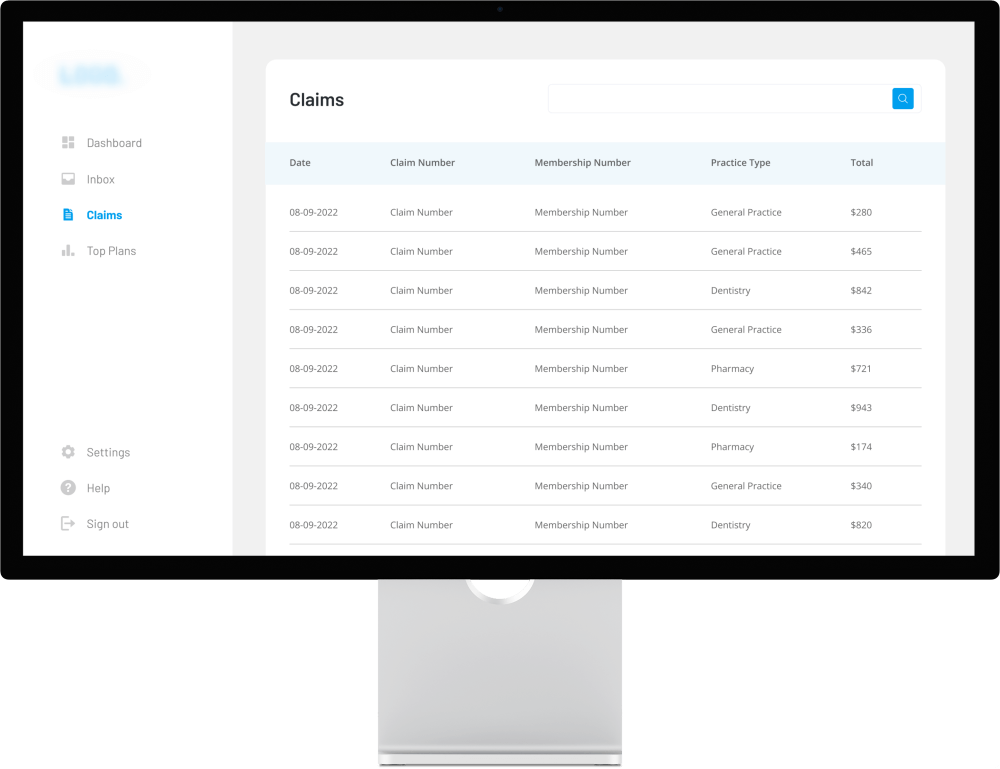

An online marketplace that connects insurance brokers, insurance companies, and end customers. The definitive feature of this marketplace is the automation of information exchange and key business processes, such as customer acquisition, underwriting, and claims management. The solution features a recommender engine that assesses client information and suggests the best-fitting insurance plan.

$2.3 million down the drain. That’s what hit Morgan Insurance when their app project crashed and burned. Ouch.

Just recently, company “A” spent $320,000 on their insurance app, while we delivered a better one to S. Mutual Insurance for $163,000.

The difference? Smart planning we’ve perfected over dozens of projects.

Look around – while insurance executives everywhere stress over ballooning budgets, smart players are slashing operational costs by 40% and watching customer satisfaction soar.

Your customers want an app yesterday, and vendors keep throwing astronomical numbers at you. Here’s your reality check: 67% of insurance app projects go over budget. Yours doesn’t have to be one of them.

Ready to discover how? Let’s rip open the curtain on real insurance app development costs. No sugarcoating. Just pure money-saving intel from people who’ve been there, done that, and optimized the whole process.

What is an insurance app?

Think of an insurance app as your digital powerhouse – it takes everything from policy management to claims processing and turns it into smooth, tap-and-done experiences.

Having built these apps for years, I can tell you they’re basically your entire insurance company squeezed into your phone, letting customers handle their insurance needs over morning coffee while helping insurers cut operational costs by up to 40%.

The Cost Breakdown of Insurance App Development

Let’s cut straight to the numbers you’re here for. Building an insurance app typically costs anywhere from $30,000 to $500,000 – but the real story lies in how that money works for you. We’ve seen companies pour their entire budget into a basic app, while others create feature-rich solutions for half the price.

Here’s the thing: while you’ll hear numbers bouncing between $30,000 and $500,000, the real story lies in how that money works for you. Let me break it down in a way that actually makes sense.

What makes the difference? Let me break it down in a way that actually makes sense.

Market Average Costs: Industry Standards

Here’s the thing: most insurance apps cost between $50,000 and $500,000. But honestly, that’s like saying a car costs between $20,000 and $200,000. Let’s get specific.

| Development Level | Market Average | Itexus Solution | Key Features |

| Basic Solution | $100,000 – $200,000 | $50,000 – $130,000 | Core insurance features, basic policy management |

| Advanced Solution | $200,000 – $350,000 | $130,000 – $230,000 | AI integration, advanced claims processing |

| Enterprise Level | $350,000 – $500,000 | $230,000 – $350,000 | Full automation, multi-platform integration |

Based on our real-world projects (not some theoretical spreadsheet), here’s how your budget typically breaks down:

• Core Development (40-50% of budget): Essential features and basic functionality

• Advanced Features (20-30%): AI integration, automated claims processing

• UI/UX Design (10-20%): User interface and experience optimization

• Testing & Quality Assurance (10-15%): Bug fixing and performance optimization

Common Pricing Traps:

- “We’ll build it for $30K!” (Spoiler: They’ll charge triple for “extra” essential features)

- “Fixed price guarantee” (Without mentioning the tiny feature list)

- “Rapid development promise” (Translation: Cutting corners on security)

- “Unlimited revisions” (Until they hit you with ‘change request’ fees)

Itexus insight: Here’s what makes our approach different: while many developers start with a fixed template, we analyze your specific business needs first. Not at all surprising that our client saved $150K, remember that success story? That wasn’t just luck – it was smart planning and efficient development strategies at work.

Let me share some actual projects we’ve tackled (with adjusted details for privacy, obviously).

Multifunctional Document Management Platform for an Insurance Company, $115,000

• Client: Established insurance company from the United States

• Timeline: 4 months

To put it simply, they needed something user-friendly platform that would reduce the time and effort required for case file processing.

The client has reported that the app has greatly reduced the time needed for managing case files and has freed up company resources previously dedicated to these processes. They ended up saving about $80,000 annually on operational costs.

The Itexus Approach: Transparent Pricing

After helping dozens of insurance companies optimize costs, here’s our strategy in action:

- Cross-platform development with Flutter cuts costs by 40%

- Smart team structure combining Eastern European talent ($45-75/hour) with local management saves 35%

- Value-first approach gets you to market faster – one client launched two months early while competitors were still coding

Itexus insight: Our value-based pricing model consistently delivers 30-40% cost savings compared to market averages, while maintaining superior quality standards. This is achieved through:

• Strategic feature prioritization

• Efficient resource allocation

• Optimized development processes

• Long-term scalability planning

Comparative Analysis: Insurance App Development Costs

Understanding market cost variations enables informed decision-making. Here’s a comprehensive analysis based on our extensive industry experience.

Cost Comparison Across Development Approaches:

| Development Approach | Market Average | Itexus Solution | Cost-Saving Potential |

| Traditional (Separate Platforms) | $100K – $200K | $80K – $150K | Up to 40% |

| Cross-Platform Development | $80K – $180K | $70K – $150K | Up to 35% |

| Hybrid Solution | $70K – $150K | $50K – $120K | Up to 30% |

Key Differentiators:

• Development Methodology: Our optimized agile approach reduces development cycles by 25%

• Technology Selection: Strategic use of modern frameworks reduces maintenance costs by 35%

• Resource Allocation: Balanced team structure decreases overhead while maintaining quality

• Testing Automation: Reduces QA costs by 40% while improving reliability

Strategic Cost-Saving Opportunities:

• Microservices Architecture: 30% reduction in long-term maintenance costs

• Cloud-Native Development: 25% decrease in infrastructure expenses

• Automated DevOps: 35% reduction in deployment and maintenance time

• Reusable Components: 20% faster development of subsequent features

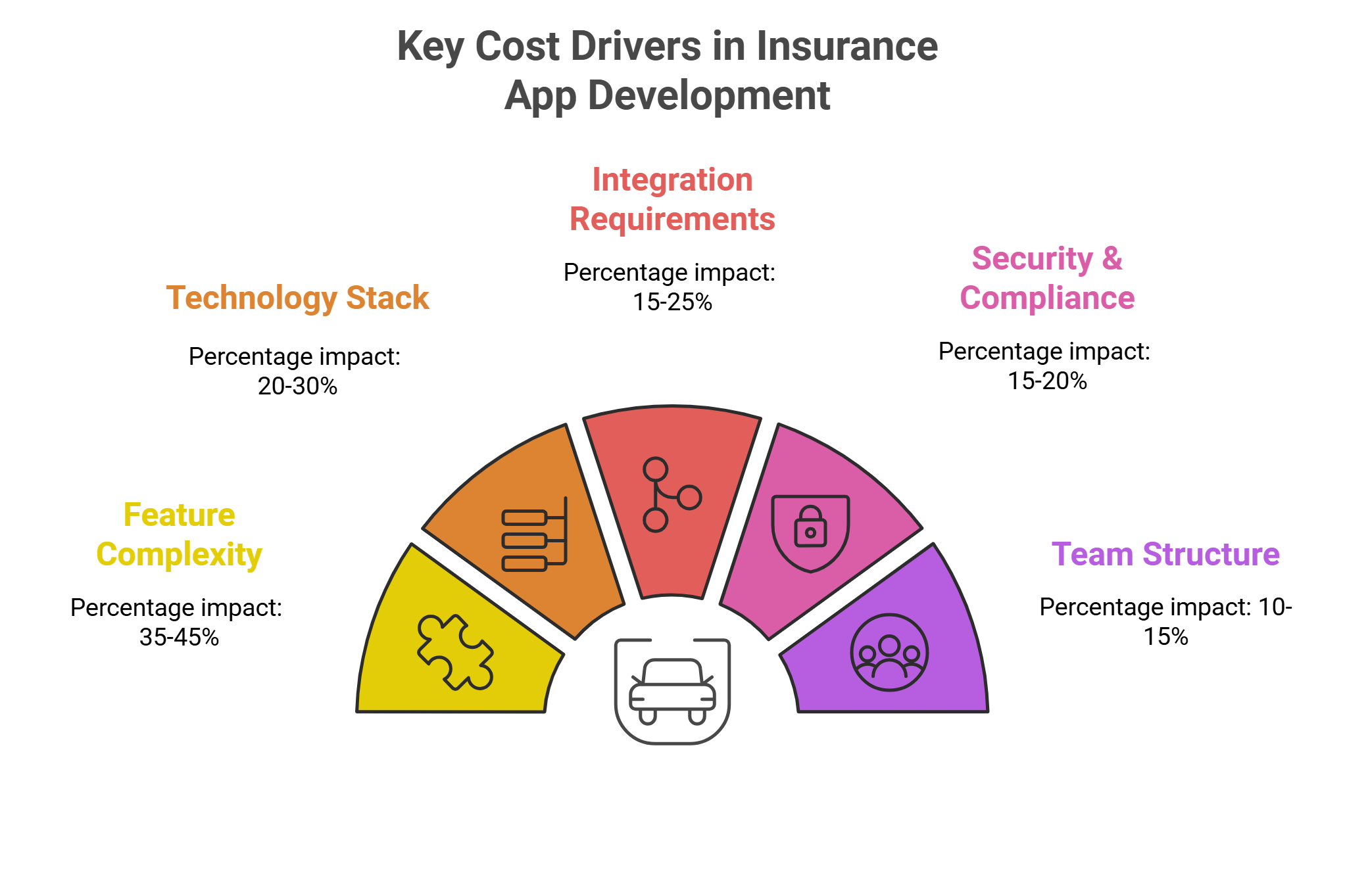

Key Factors That Drive Insurance App Development Costs

Ever wondered why insurance app costs can swing from $100,000 to half a million? Having guided dozens of insurance companies through this process, I’ll share what really moves the needle on your budget.

Feature Complexity & Scope

Think of features as building blocks – each one affects your final cost:

• Basic Features (20-30% of budget): User registration, policy viewing, simple claims

• Advanced Features (30-40%): AI-powered risk assessment, real-time policy updates

• Premium Features (40-50%): Video claims processing, IoT device integration

Technology Stack Selection

Your tech choices can save or sink your budget:

• Ready-made solutions: Quick to implement but costly to customize

• Custom development: Higher upfront cost but better long-term value

• Hybrid approach: Our sweet spot at Itexus – we saved S. Mutual Insurance 35% by smartly mixing proven technologies with custom elements

Integration Requirements

Here’s where many budgets break:

• Legacy system integration

• Third-party service connections (payment gateways, credit scoring)

• Data migration complexity

Security & Compliance

Non-negotiable costs that protect your business:

• GDPR compliance

• Data encryption

• Regular security audits

• Insurance-specific regulations

Development Team Location & Structure

Location matters more than you might think:

• US-based teams: $150-200/hour

• Eastern European teams: $45-75/hour with equal or better quality

• Mixed teams (like Itexus): Often the most cost-effective approach

Itexus insight: We’ve found that the crucial point is to know where to invest. For instance, we recently helped a client save $23,000 by optimizing their tech stack while actually improving app performance. Think of it as buying a Tesla instead of a gas-guzzler – higher upfront quality that pays off in the long run.

Hidden Costs and Long-term Cost Management

Here’s the part that most vendors conveniently forget to mention. Sure, building your app is one thing, but keeping it running smoothly? That’s where things get interesting. Let me share what we’ve learned after maintaining dozens of insurance apps.

Maintenance and Support Expenses

Let’s talk real numbers. You’ll need to know about annual maintenance. Here’s what it typically involves:

- Regular Updates: $15K-30K yearly (because software ages like milk, not wine)

- Bug Fixes: $10K-20K (because bugs are like uninvited guests – they just show up)

- Performance Optimization: $8K-15K (keeping your app running faster than your competitors)

- Technical Support: $12K-25K (someone’s got to answer those 3 AM emergency calls)

Color me impressed, but our clients usually save 30% on these costs.

How? We’re kind of obsessed with automated monitoring and proactive maintenance.

Security and Compliance Investments

Haven’t you heard? Security isn’t just another checkbox – it’s what helps you sleep at night. Here’s what you’re looking at:

- Annual Security Audits: $8K-15K (because hackers don’t take vacations)

- Compliance Certifications: $10K-20K (keeping the regulators happy)

- Penetration Testing: $5K-12K (paying friendly hackers to find problems before the unfriendly ones do)

- Data Protection Updates: $7K-15K (because your users’ data is sacred)

Integration and Scaling Costs

To be honest, this is where budgets often go sideways. Let’s break it down:

Third-Party Services (aka “The Necessary Evils”):

- Payment Gateway Fees: 2.5-3.5% per transaction (ouch, but worth it)

- Cloud Infrastructure: $1,500-5,000 monthly (depending on how popular you get)

- API Integration Maintenance: $5K-15K annually (keeping all the pieces talking to each other)

- Data Storage: $500-2,000 monthly (because data is like garage stuff – it just keeps growing)

Risk Prevention Tactics

Here’s where smart money goes to multiply:

The Smart Investments:

- Automated Testing: $15K-25K upfront (saves you from those “how did we break that?” moments)

- CI/CD Pipeline: $10K-20K (because manual deployments are so 2010)

- Microservices Architecture: Costs more initially but saves your sanity later

- Documentation: $5K-10K (so your future self doesn’t hate your present self)

Itexus insight: Sure thing, that initial $100K or so might make you sweat, but here’s the deal – budget some sum for maintenance. Think of it like servicing a luxury car – skip it, and you’ll pay double later.

Here’s a fun fact: our clients typically slash their long-term costs by 5-35%. How? We’re kind of nerdy about preventing problems before they happen.

Strategic Cost Reduction Guide

Look, I’ve seen enough insurance apps to know where money typically goes down the drain. Let me share some battle-tested strategies that have saved our clients serious cash.

Smart Development Approaches

Remember that insurance client quoted $320K elsewhere? We delivered the same app for $163K.

Here’s how:

We mixed senior architects with mid-level developers, used cross-functional teams, and implemented automated code review. Simple changes, big impact – 30% savings right there.

Tech-wise, we stick to what works: Flutter for cross-platform development, microservices for scalability, and cloud-native solutions that let you pay for actual usage, not possibilities.

Case Study: Savings in Action

InsureTech (name changed) came to us after burning through $150K with another vendor. We streamlined their bloated team from 12 to 7 people, automated testing, and used ready-made components where it made sense.

Result? Project completed in 6 months, $80K under budget, with lower maintenance costs.

Expert Cost-Saving Tips

Want to save immediately? Here’s what works:

- Start with MVP features, expand later

- Use cloud services strategically

- Implement automated monitoring

- Invest in solid architecture

- Choose maintainable solutions over trendy ones

- Don’t chase the cheapest rates – you’ll pay twice

- Avoid over-engineering at all costs

Itexus insight: There is another case with a Swiss startup where Itexus managed to save the client’s budget on $30K by simply restructuring their development approach. The best part? The app performed better than the expensive version they originally planned.

Let’s talk numbers and make your budget work smarter!

Monetization Strategies

Let’s talk money – not just how to spend it, but how to make it. After helping numerous insurance apps turn a profit, here’s what actually works.

Top Revenue Models

The most profitable approaches we’ve seen:

Commission-Based: One client hit $500K in commissions their first year, charging 5-15% per policy with a $40-60 customer acquisition cost.

Subscription-Based: Think $10-30 monthly per user. Real example? A client switched from one-time fees to subscriptions and saw 140% revenue growth in 6 months.

Freemium: Our most successful freemium apps see 15% conversion to premium users ($280 annual revenue per user).

White Label Solutions: A game-changer. One insurance broker platform generated $1.2M in first-year revenue through white-labeling alone.

Growth Tactics

The secret sauce? Start focused, then expand smart:

- Target one insurance vertical before diversifying

- Begin regional, scale gradually

- Use data, not assumptions, to guide growth

Itexus insight: Our clients using this approach cut customer acquisition costs by 40% and reached profitability within 8-12 months.

The key metrics to watch? Keep your customer acquisition cost under $50, aim for 3x lifetime value, and maintain 80%+ user retention after 6 months.

Want to find your perfect revenue model? Let’s crunch some numbers specific to your case.

Why Partner with Itexus?

After reading about costs and strategies, you’re probably wondering if we can walk the talk. Let’s look at what makes us different.

Our Track Record Speaks

We’ve built a claims processing app that reduced settlement time by 60%. Our policy management platform serves 50,000+ daily users. And our AI-powered risk assessment tool? It’s saving clients $2M annually.

The numbers don’t lie: 15+ successful insurance projects delivered, 98% client retention rate, and consistent 35% cost reduction compared to initial client budgets.

The Process is Simple

1. Free Technical Consultation (30 minutes)

We’ll review your requirements and provide preliminary estimates.

2. Custom Roadmap (5 business days)

You’ll get detailed technical architecture and a cost optimization strategy.

3. Quick Development Kickoff (1-2 weeks)

We’ll assemble your team and start the development.

Ready for Success?

Let’s turn your insurance app idea into reality – without breaking the bank.

Exclusive Offer: Book a consultation this month and get:

- Free technical architecture review

Detailed cost optimization plan - Risk assessment report Value: $2,500 (Yours free)

Wrapping It Up

Smart insurance app development isn’t just about cutting costs – it’s about maximizing return on investment. By implementing the strategies we’ve discussed, you’re not just saving on development costs; you’re building a foundation for long-term success.

The numbers speak for themselves. Our clients typically see ROI within 8-12 months, with average cost savings of 35% on initial development and 40% on long-term maintenance.

Remember: every decision in app development should balance immediate costs against long-term value. Whether it’s choosing the right tech stack, prioritizing features, or planning for scalability, smart choices today lead to better returns tomorrow.

Ready to explore how these ROI-focused strategies can work for your insurance app?

Let’s talk about turning your investment into results that matter.