A private investor portal equipped with automated aggregation of financial data and visualization tools, designed to provide a full overview of an investment portfolio, generate mid-year and year-end reports, and support secure integration with file hosting and reporting services.

It’s not just about what you can offer clients; it’s also about reducing the manual workload on your staff. At its core, it’s all about automation.

Did you know that over 70% of investment bankers see a major shift on the horizon? Automation provides them a chance for a smoother, more efficient future.

Why is that?

It’s a chance for everything to run like clockwork. A shiny conveyor belt moves tasks along with precision—that’s what automation offers. It transforms tedious processes into seamless operations.

If your firm is still doing things the old way, it’s time to change things. It’s like trying to build a race car with a screwdriver while everyone else has the latest robotic tools.

What’s the cost of staying behind?

Will you risk losing clients to competitors who embrace innovation?

By 2024, about 60% of U.S. financial institutions and 85% of larger ones have adopted automation. Additionally, 65% are integrating automated solutions into their investment platforms.

Meanwhile, 23% of investment banking respondents prioritize AI technology. Furthermore, two-thirds of banks plan to boost automation spending by 6-10%.

Why this trend in investment banking? It’s likely due to fierce competition. Owners aim to leverage automation to attract clients and enhance the investing experience in the investment banking industry.

In this article, I will explore the challenges and benefits of automation in investment banking.

Current state of investment banking

Investment banking focuses on raising capital, mergers, and acquisitions. It also offers securities trading and financial advice.

Currently, it is transforming globally. Key factors are: meeting capital needs, stable politics in major countries, and integrating ESG criteria.

Today, the sector grows at 7.58% annually and is valued at USD 115.48 billion. This growth is fueled by digital assets, infrastructure investments, and M&A activities.

Overview of traditional investment banking activities

Traditional investment banking operations are a wide range of services offered by banks to individuals and legal entities. First, investment banking focuses on raising capital, merging, acquiring companies, trading securities, and offering financial advice.

Deal Sourcing and Execution

Investment banks continuously analyze the market, companies, industries, and competitors. Previously, these tasks required much time and manual effort. Now, automation has made them easier.

Market analysis and research

This can include several types of analytics:

- Fundamental analysis. The company’s finances are studied, and its profit is estimated.

- Technical analysis. This is where analytical tools that predict the main trends of growth or decline come into play. The volume of sales, trading, volatility is analyzed.

- Sectoral analysis. An entire industry or sector of the economy is evaluated. Investment opportunities are evaluated.

- Marketing research.

- Strategic analysis. At this stage it is necessary to develop a trading strategy for clients on the basis of various analytical data, including trading strategies based on current market data.

Customer Relationship Management

This is where CRM systems come into play, without which it is impossible to provide quality services to clients. Customer Relationship Management helps investment banks to effectively manage client data, store reminders, and make regular database updates. Needless to say, no chance to build quality client relationships without personalization. It requires an individual approach, a strategy, a portfolio review, and access to personal reports.

Automation: challenges

I’ll start, perhaps, with the biggest fear of investment banking owners – cost. So that’s how much it will cost to automate the platform. Owners usually keep such information secret from competitors. However, I assume the price depends on several factors.

Developing your own automation software. This is the path taken by large banks, creating Citi Velocity or Goldman Sachs Marquee platforms. The cost of development might reach hundreds of millions of dollars.

Buying a ready-made solution. This is the way Deutsche Bank has gone, having signed a contract for the purchase of the OpenFin platform.

The main page of OpenFin

BNP Paribas Bank also decided to use Symphony’s off-the-shelf solution.

The main page of symphony

Off-the-shelf solutions can cost from 1 to 10 million dollars. It depends on the investment bank’s needs.

There are other equally important risks. Investment banking owners face problems integrating automated platforms. There are difficulties in training staff. Let’s take a closer look at this problem:

- Outdated infrastructure. If the bank is using older software, implementing newer, modern automation platforms will require significant effort, including financial tomorrows.

- Bringing it under a single standard. The use of several platforms for automation will require the creation of connectors, to combine databases and interfaces. It will be more convenient for staff to work with one platform with one interface than to constantly switch and confuse between different systems.

Data protection and cybersecurity

I will dwell on this point in more detail. Integrating new automation systems may reveal vulnerabilities. It may lead to exploit them by hackers while no one needs a leak of valuable data. To avoid this, the platform must meet international security standards, like GDPR in Europe or CCPA in the USA.

Support and scalability concerns.

Poor support can lead to a significant drop in customer service. And a low-quality platform can cause scalability problems. It may be date loss, damage to database integrity and other troubles. To avoid these problems, use solutions from trusted developers.

Such developers usually have high-quality tech support. Who promptly answers questions and solves problems with integration, API changes, and employee training.

Regulatory Pressure

Investment banks face various restrictions from government regulators. Following the 2008 global financial crisis related to the mortgage bubble, regulators have significantly tightened investment controls.

Enhanced capital and liquidity requirements (e.g., Basel III).

(AML/KYC). Controls on suspicious transactions and dealings. Prevention of money laundering and terrorist financing.

Restrictions on proprietary trading (Volcker Rule in the US).

Growing Competition

The main source of competition is young fintech startups offering an innovative approach to investment business. Such companies actively use advanced technologies (AI, blockchain, decentralization, transaction transparency, full automation, quality analytics).

Data management challenges

The growth of clients, increase in the number of financial instruments leads to a real information collapse. AI tools data automation helps to solve the problem of structuring, transferring, analyzing. Poor data management harms customer service. This can damage reputation, drain funds, and cause other problems.

What is investment banking automation?

Investment banking automation uses advanced tech to improve customer service. It speeds up banking processes, cuts costs, and provides better analytics.

Let’s take a look at what types of automation there are.

Robotic process automation (RPA)

This technology uses “bots” that act like humans. In investment banking, it analyzes transactions to spot fraud or suspicion.

RPA is increasingly being used to automate processes such as:

- Invoice creation.

- Payment management.

- Customer support.

The main benefit to investment banking from implementing RPA is accuracy of task execution, cost reduction, improved customer service quality, and increased productivity.

Artificial Intelligence(AI) and Machine Learning (ML)

With artificial intelligence AI, the quality of trading operations can be significantly improved:

- Speed increases. Transactions are concluded in milliseconds.

- Utilization of sophisticated strategies. Artificial intelligence AI can process and take into account many factors simultaneously, including technical indicators, macroeconomic news, and trading volumes.

- Elimination of the human factor. The main plus of AI technology is that it is not subject to emotions like a live trader. By eliminating such human qualities as fear, greed, panic, artificial intelligence AI can make quite different decisions.

According to The Trade in 2022, 57% of investors used algorithmic trading to make trades.

Artificial intelligence can help with recognizing various risks, including credit risks. The reader may have a question, how does this work? AI performs analysis on various customer data:

- Transactions.

- Credit history.

- Macroeconomic indicators. For example, reducing credit limit for customers during an unfavorable geopolitical situation or an impending financial crisis.

The system uses machine learning to spot patterns. It alerts security when a client might default or go bankrupt. AI technology analyzes data to quickly find fraud and suspicious transactions. It blocks these in time and sends them to a security operator for review.

Blockchain technology

When talking about the introduction of AI-based systems into automation, we can’t fail to mention blockchain. You may have heard about it in the context of cryptocurrencies. This technology is relatively new, but it has already managed to live up to the expectations for its application. So, let’s look at what blockchain is and what is it good for?

The main tasks that blockchain performs are asset tokenization. It relates to conversion of ordinary shares, investments, currencies into digital tokens. Security and transparency of transactions, tracking of all transaction chains. In addition to the above tasks, the technology also relies on smart contracts, which automate transactions.

Examples of automation tools currently in use

Let’s talk about Deutsche Bank first. Its Board saw AI’s potential early and is now using it in products.

“We expect these technologies to become integral to virtually every aspect of our business in the future, from internal processes to customer interactions and opportunities.

We are using AI tools to automate manual processes and improve advisory services for clients. Examples include speeding up the manual review and processing of loan documents, using AI tools to optimize client portfolios in Wealth Management, and monitoring transactions for suspected financial crime.”, Deutsche Bank states in its press release.

Another bank that actively integrates its systems with artificial intelligence AI is British bank HSBC.

HSBC is currently using AI technology to automate compliance-related processes such as KYC and AML. AI technology algorithms analyze customer data to find suspicious transactions. This prevents money laundering and other financial crimes.

“AI is not just a buzzword for us; it’s a fundamental pillar of our strategy for digitising at scale. Through thoughtful use of machine learning, we are able to offer our clients more personalised experiences, make better data-driven decisions, and stay ahead of the curve in an ever-evolving industry.”, said Christiane Lindenschmidt, Director, Digital & Data, Markets & Securities, HSBC.

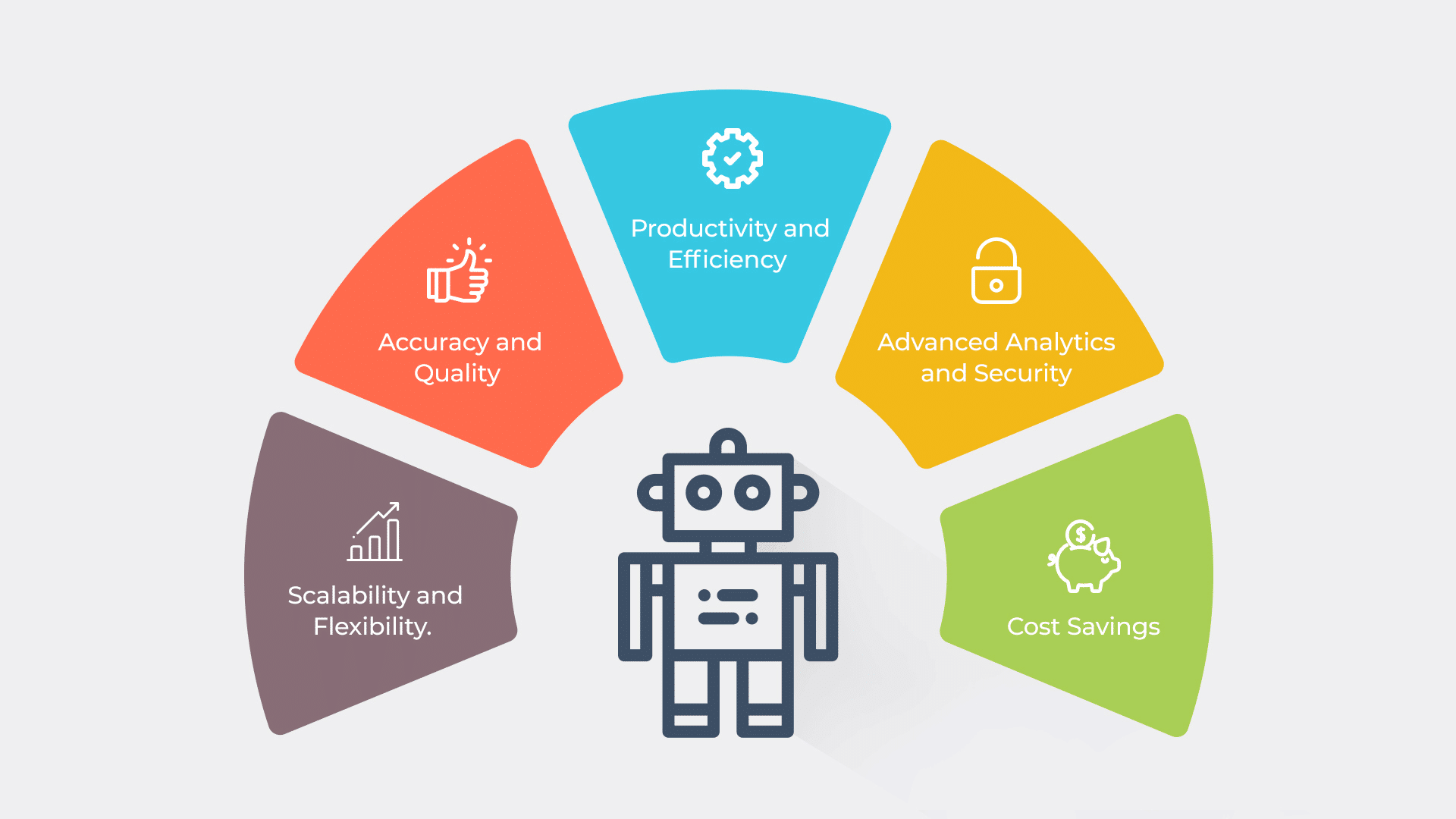

Benefits of automation in investment banking

In this section, I will try to review the main benefits that come with automation in investment banking.

I will start with the main one. Automation increases productivity by reducing manual labor. Routine operations such as verifying transactions, filling out PDF forms or legal documents, collecting and analyzing market data fall to the automated system. Employees can devote their time to more important tasks.

Increased efficiency and productivity

It would seem that why introduce new technologies, spend money, effort and risk if everything works as it is. But you can do much better, more efficiently. Increase productivity. This is why we need automation in investment banking industry.

Automation in investment banking will help increase productivity. For example, consider transaction processing. Previously, this operation could take several days. With automation, it can process transactions in a fraction of a second.

Suspicious transactions the system automatically blocks. Analytical reports, trading signals for traders received from automated systems are more efficient.

Optimization of repetitive tasks

This is one of the main functions and challenges of automation. Reduce routine operations by entrusting them to algorithms, robots and bots. You can automate such processes as data entry, processing requests, sending reports and performing standard operations.

The benefits of automating repetitive tasks are clear. Robots work 24/7, without errors, and at high speed. They can speed up tasks and cut costs.

Faster decision-making processes

Speed in investment banking plays a key role. Falling or rising quotes cost millions in losses or profits. It is very important to react quickly to changes in rates, quotes, especially for highly volatile assets.

AI and machine learning now enable instant decisions to buy or sell. This boosts profits and cuts losses.

Increasing accuracy and reducing the human factor

Automation of investment banking implies the introduction of modern technologies. Investment banking involves risks. Automation reduces these risks by advising clients when to buy or sell assets.

Recently, experts discovered that over 52% of investment banks are using AI tools to boost profits. According to Gartner, this could raise their value to $2.9 trillion. The increase in profits comes from reducing human-related risks and improving forecast accuracy.

Data processing and analysis

Automation is changing the whole traditional view of data processing. I should mention a completely new technology of data collection. These can include automated systems using APIs, web scraping and specialized platforms that collect data in real time. Using Cloudflare web scraping helps automate data collection from diverse sources while maintaining efficiency and security. Let’s take a closer look at data processing technologies:

- Big Data: Big Data technologies such as Hadoop, Apache Spark are used to process huge amounts of data in real time.

- Artificial Intelligence AI: AI technologies help in analyzing historical data with high accuracy, studying current news and identifying trends and patterns.

- Python and R: Programming languages. namely some of their sublanguages that are widely used for financial analysis and building analytical models

Compliance and regulatory reporting

The reader might wonder, how does automation ensure compliance with new regulations? The answer is straightforward. Automated systems swiftly check transactions against AML (Anti-Money Laundering) and KYC (Know Your Customer) rules in real time. Consequently, this helps customers avoid fines and sanctions.

Improved customer experience

With most of the routine operations being done automatically, employees can spend more time on customer issues. A number of platforms have a digital assistant to help the customer resolve simple issues.

Automated systems can predict customer needs. They can then offer new services and products. Such solutions can serve many clients at once.

Such solutions can serve many clients at once. They provide access to financial tools: investment portfolios, a trader interface, accounts, and new asset classes.

Clients need reports, statements, and documents about their investments and fund movements.

Personalization via Data Analytics

Most investment bank owners likely agree: the main goal is to earn money for clients by offering essential tools.

AI-powered systems can achieve this effectively. They create personalized profiles using clients’ data.

AI-based automated systems can do this well. They can create a customer profile from their personal data.

- Social media, natural language processing (NLP).

- Use of certain services.

- Type of investment.

But the most important thing, in my opinion, is robo-advisers. AI-powered automated systems that offer clients customized investment strategies based on the analysis of their personal data, including credit histories, preferences, risks.

Faster response times

Fast data processing and quick transactions allow business growth with low costs.

AI tools in automated platforms enhance financial market analysis. Clients get timely, accurate forecasts for stocks, metals, and more. They also receive advice on buying or selling.

These automated features in investment banking offer clear advantages. They benefit both owners and clients.

Potential challenges and considerations

While there are many positives associated with automating processes in investment banking, there are some risks. In this section, I will attempt to describe some of the challenges associated with automation in investment banking.

Resistance to change in organizations

Automation can reshape the team. Investment bankers strive to rearrange staff as software and “robots” replaced employees who did routine work. Another problem is the lack of qualified personnel and training for new software and interfaces.

Data privacy and security issues

Cybersecurity is a cornerstone of any bank. No one wants data about customers and their accounts to fall into the hands of intruders. The introduction of new automated systems jeopardizes cybersecurity and risks the emergence of vulnerabilities in new software.

Impact on employment and labor force dynamics

Automation can change teams. Software and robots might replace workers doing routine tasks.

Yet, specialists are still needed. They will customize software, fix issues, train staff, and update systems.

Legal and Regulatory Implications

Automation must meet global data protection rules, like GDPR in Europe and CCPA in California. Investment banks must ensure data is safe. They also need to follow rules against money laundering, terrorism financing, and for securities.

Automated trading has its own rules. AI technology and machine learning in trading can raise risks and market volatility. Regulators like the SEC in the US and ESMA in Europe have set rules to manage these risks.

Future Trends in Investment Banking Automation

AI and automation are crucial for investment banking. They will enhance analysis, efficiency, and risk reduction. AI technology will soon be key in trading, risk management, and cost reduction.

The benefits of AI technology and automation in investment banking industry outweigh the drawbacks. To stay competitive, banks must adopt AI systems now. This move will bring significant advantages for both banks and investors.

Evolution of AI and machine learning in finance

In the 2020s, AI technology and machine learning have transformed personalized finance. Now, investment banks can better meet customer needs. Technologies like natural language processing (NLP) are improving trading, analytics, and investment strategies.

Integrating automation with existing platforms

I understand why investment bank managers are cautious about automated systems, and I share their concerns. Yet, I believe the risks are low and the benefits outweigh the downsides.

So, where do we begin? It’s clear that the integration will touch every part of the bank. This includes trading securities, managing assets, meeting regulatory standards, and improving customer service. Therefore, thorough preparation is key.

- Understand the scope and depth of automation.

- Develop APIs and interfaces.

- Create robo-advisors to manage investment portfolios.

- Implementing artificial intelligence AI systems.

Providing technical support to clients and bringing them in line with the regulator’s legal norms.

Our company offers comprehensive investment banking automation solutions that will help reduce financial costs in the short term.You will get a reliable, secure personal data system. It will comply with global standards and use proven tech.

- Encryption of data at rest. Even if an attacker gains access to the data, they cannot decrypt it and use it for their own purposes.

- Encryption in transit. All data transmission channels are securely protected by cryptographic means, e.g. TLS 1.2 and higher.

- MFA. Multi-factor authentication. To access his account the client needs to enter a password, one-time code, biometric protection can also be activated.

- Role-Based Access Control, RBAC. Differentiation of employee privileges. Each employee gets access only to the data he/she needs to work with.

Special attention is paid to customer support. Chatbots with artificial intelligence AI, available 24/7, messengers (communication with live employees), FAQ sections, full usage guide. We integrate various communication channels:

email (e-mail, phones, chats, mobile apps, social networks). I know how important it is to keep clients. We must minimize their problems when switching to automated platforms.

For stable operation of the investment banking system, it is best to use one vendor-developer of automated platforms. Long-term cooperation with our company guarantees quality support, timely release of updates and staff training.

Predictions for the next decade

Experts predict that in the next decade automated systems will work on the basis of self-learning algorithms. The development will also concern “smart platforms.” They will combine all financial tools, from trading and transactions to analytics and reporting. Quantum computing no longer seems like science fiction. They will help to quickly process huge data sets without loss of quality.

Increase of implementation rates

It can already be safely stated that the pace of automation implementation in the investment banking sector is increasing. This is due to growing competition, attempts to attract new investments. New challenges require executives to utilize advanced technologies, including AI and machine learning.

The rise of hybrid human-automation models

Hybrid models are emerging to blend automation with human input. Despite the advantages of AI and self-learning systems, human expertise remains vital.

This is crucial during transitions. Many investment banks prefer support over replacement. Automated online platforms exemplify this. A human sets them up. The client or trader then controls transactions. They monitor operations and intervene if there’s a software failure.

Examples of successful automation in investment banking

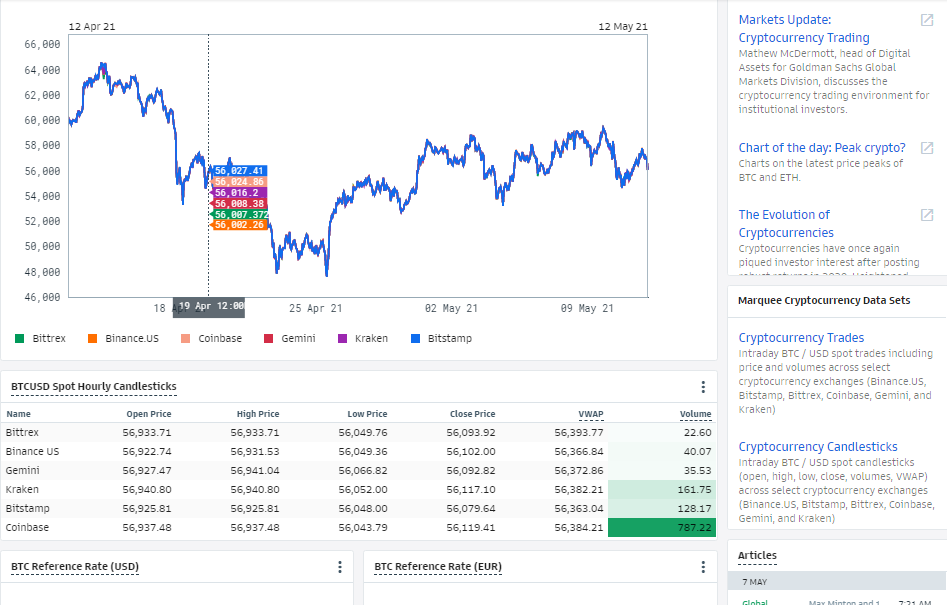

Recent history knows many examples of successful automation for investment banking. Let’s start with the famous Goldman Sachs bank and its Marquee platform, the development of which began back in 2014.

Platform Marquee of Goldman Sachs. Source: https://cdn.marquee.gs.com/cms/public/cryptodashboard.PNG

This platform has automated trading and investment operations within Goldman Sachs. It gives the client real-time access to various analytical tools. Marquee helps the bank reduce infrastructure costs, increase transaction speed and improve client experience. “We are investing in platforms like Marquee to serve clients in new and more efficient ways,” said CFO Stephen Scherr.

Another successful example of automation in investment banking is Citi Bank with its Velocity platform.

Platform for automation of process Velocity.

This platform has automated trading and investment operations within Goldman Sachs. It gives clients real-time access to various analytical tools. Marquee helps the bank reduce infrastructure costs, increase transaction speed and improve client experience. “We are investing in platforms like Marquee to serve clients in new and more efficient ways,” said CFO Stephen Scherr.

Another successful example of automation in investment banking is Citi Bank with its Velocity platform.

“Citi Velocity is one of the most widely respected client portals for content, data, analytics, and trading in our industry. We are proud of the platform and its continued evolution. With an ever-changing market landscape, we will remain proactive in our efforts to be at the forefront of the industry and deliver the best of Citi to our clients,” said Cris Rosenberg, Global Head of Citi Velocity.

Investment banking must evolve to meet new challenges, making automation crucial.

The Importance of Automation in Investment Banking

Automation is now essential. It saves money, attracts clients, and provides accurate trading data. Many still doubt new technologies, but there’s no need to fear them. Automation has transformed investment banking and continues to do so.

More clients now trust AI-based systems for analytics and reports. Failing to adopt automation could mean losing your market position. The choice is yours!

Wrapping it up

Investment banking requires a great deal of automation. The business landscape is rapidly evolving. Companies have to change or risk falling behind.

Automation boosts precision and speed, elevating customer care. Its benefits are undeniable.

Challenges exist: integration hurdles, potential costs. Yet proper guidance and tools overcome these barriers. Most investment bankers foresee this shift. Act now.

Embrace automation to stay ahead. The future is mechanical. Seize this opportunity. Revolutionize your processes for renewed success.