Investment Management Platform

A private investor portal equipped with automated aggregation of financial data and visualization tools, designed to provide a full overview of an investment portfolio, generate mid-year and year-end reports, and support secure integration with file hosting and reporting services.

Engagement model

Time & Materials

Effort and Duration

Ongoing, since December 2018

Solution

Private investor portal

Project Team

1 Full-stack Web Developer, 1 Technical Lead, 1 BA, 1 QA manager, 1 PM

Tech stack / Platforms

Project Background

Our client, an established investment firm based in Atlanta, Georgia, earned the trust of both seasoned investors from Fortune 500 companies and independent experts with its platform. Private investors, corporate clients, and trust funds work with our client to invest in selected pre-IPO projects through direct co-investing and funds.

Our client is an early-stage venture firm that offers investors a diversified portfolio consisting of early-stage technology startups and entrepreneurs who have valuations below $2 million. Private investors, corporate clients, and trust funds join our client for the opportunity to co-invest on a deal-by-deal basis and work with entrepreneurs.

The company came to Itexus with a prioritized wishlist for changes to their portal. The primary goals were to revise the data reporting structure, address financial reporting errors, and provide flexibility in the regular data synchronization with external web services. Additionally, the client wanted to bolster the existing solution with additional functionalities, upgrade the platform’s back-end, address suboptimal app response latency, and add an intuitive, customer-centric front-end interface.

Functionality Overview

At the start of our project, the solution, a cloud-based SaaS platform, comprised of:

- Back-end, built on the Ruby on Rails framework. The database aggregates financial data from several sources and serves as a centralized source of data for further visualization and analysis. As the volume of data was growing, the app response latency became a bottleneck: the solution could no longer promptly process the data. This accentuated the need for a comprehensive profiling and performance analysis of the existing system.

- Front-end, based on Angular. The front-end was failing to provide investors with timely, comprehensive, and reliable information.

Itexus was tasked with upgrading the back-end stack and the employed libraries, addressing dynamic content issues, making the user interface more user-friendly, and broadening the system’s functionality via new integrations.

Back-end Upgrade

Our back-end team of Ruby on Rails experts assessed the system’s integration with Backstop — a third-party service, used by the client’s outsourced accounting company. The company keeps investment-associated data and derived indices (e.g., TVPI, DPI, FMV) up-to-date and accessible to private investors through their portal accounts.

We discovered that the platform relied on a deprecated version of the Backstop API, which lacked certain interaction endpoints. We updated the system to the latest API version and rescheduled the daily data sync so that it took place early in the morning, to make the portal accessible during the day.

Integration with Dropbox

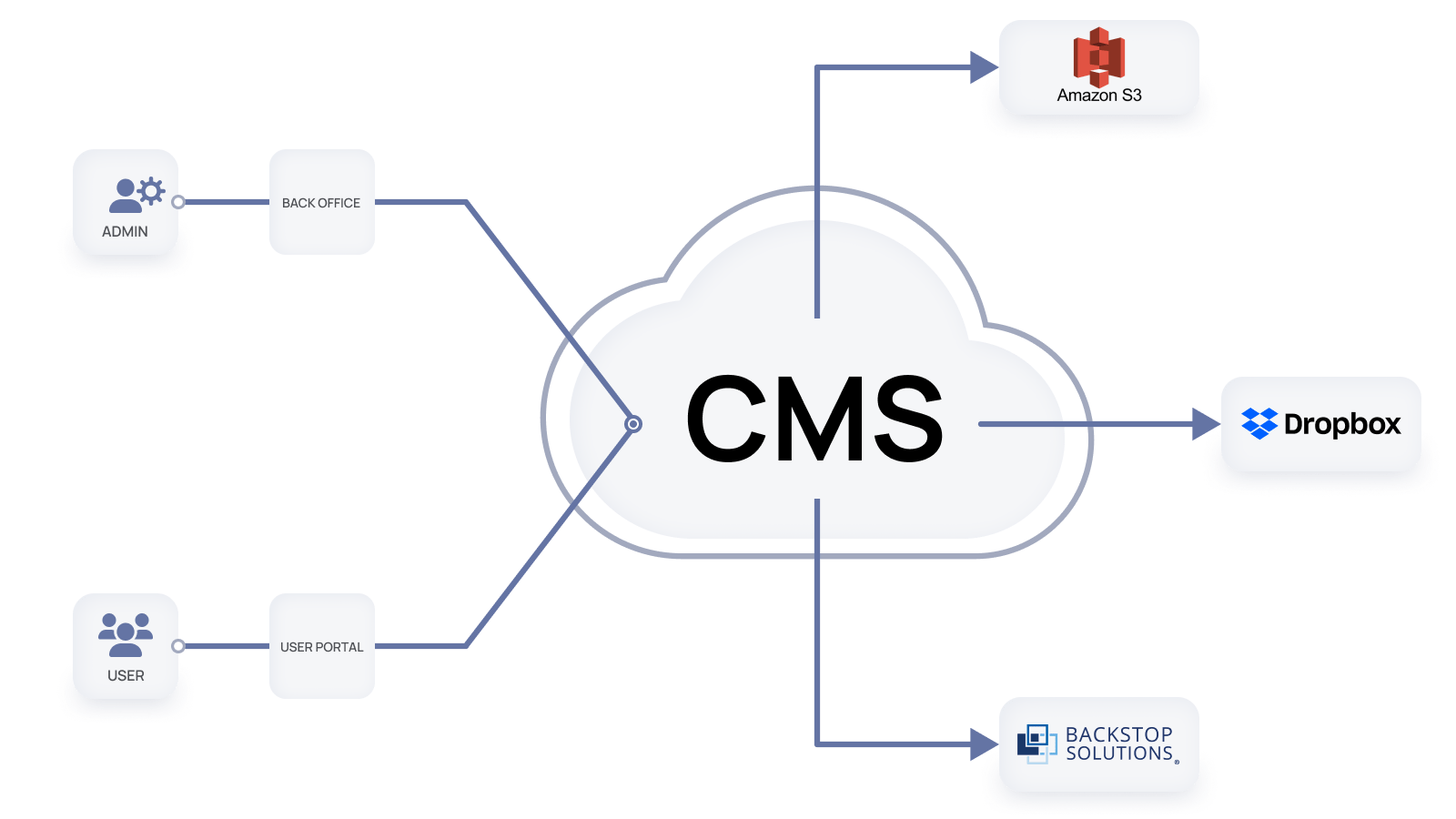

To provide valuable and reliable information, the portal needs to accommodate data from multiple sources: partner capital and K-1 tax reports, contracts, invested holding and limited partners funds’ reports, and so on. This data must be securely stored and easily accessed by end users.

The client suggested using Dropbox as a file hosting service. After conducting extensive research and looking into other options, the Itexus team agreed that Dropbox was a safe and extremely scalable solution. To reduce the laboriousness of uploading all of the client’s files into the portal, the team implemented Dropbox’s bulk upload tool. Each file is hosted on Amazon S3, from where it is routed to the relevant investor portal account.

At the start of our project, the client’s files and folders were disorganized. The implementation of the bulk file uploader resulted in substantially reduced labor involvement and enabled investor portal users to access their files by pre-set categories.

Front-end & Visualization of Imported Data

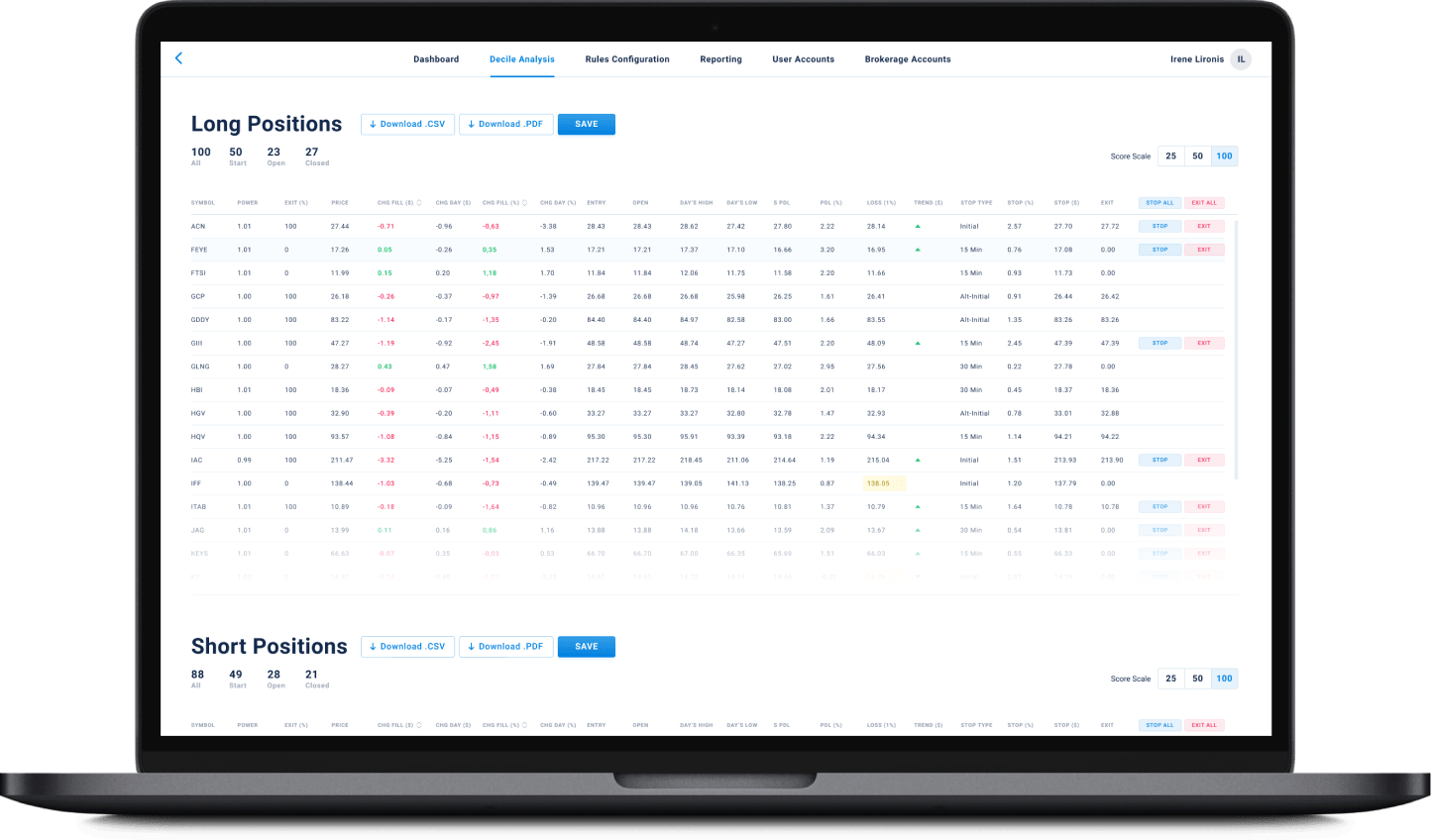

The platform provides investors with the data critical for decision-making, like a holding company’s brief description, financial reports, mid-year and year-end updates, schedule of investments, investment-related write-offs, tax reports, and so on. But the existing Angular-based interface didn’t display the data correctly.

The Itexus team upgraded the front-end solution and created a system capable of comprehensively visualizing financial information from multiple data sources. The data, visualized in the form of tables, images, and reports, is available in the investor’s private account.

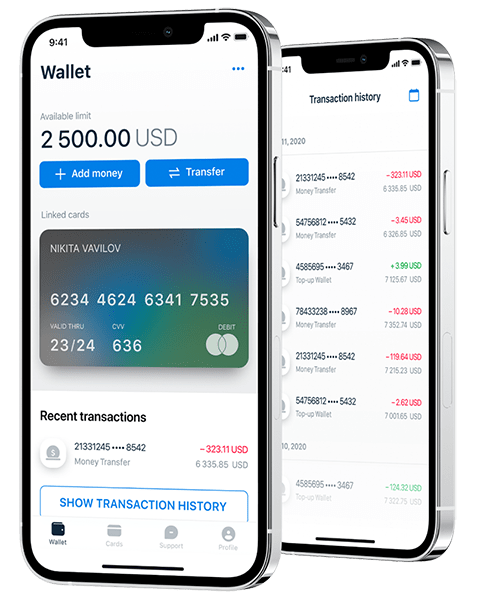

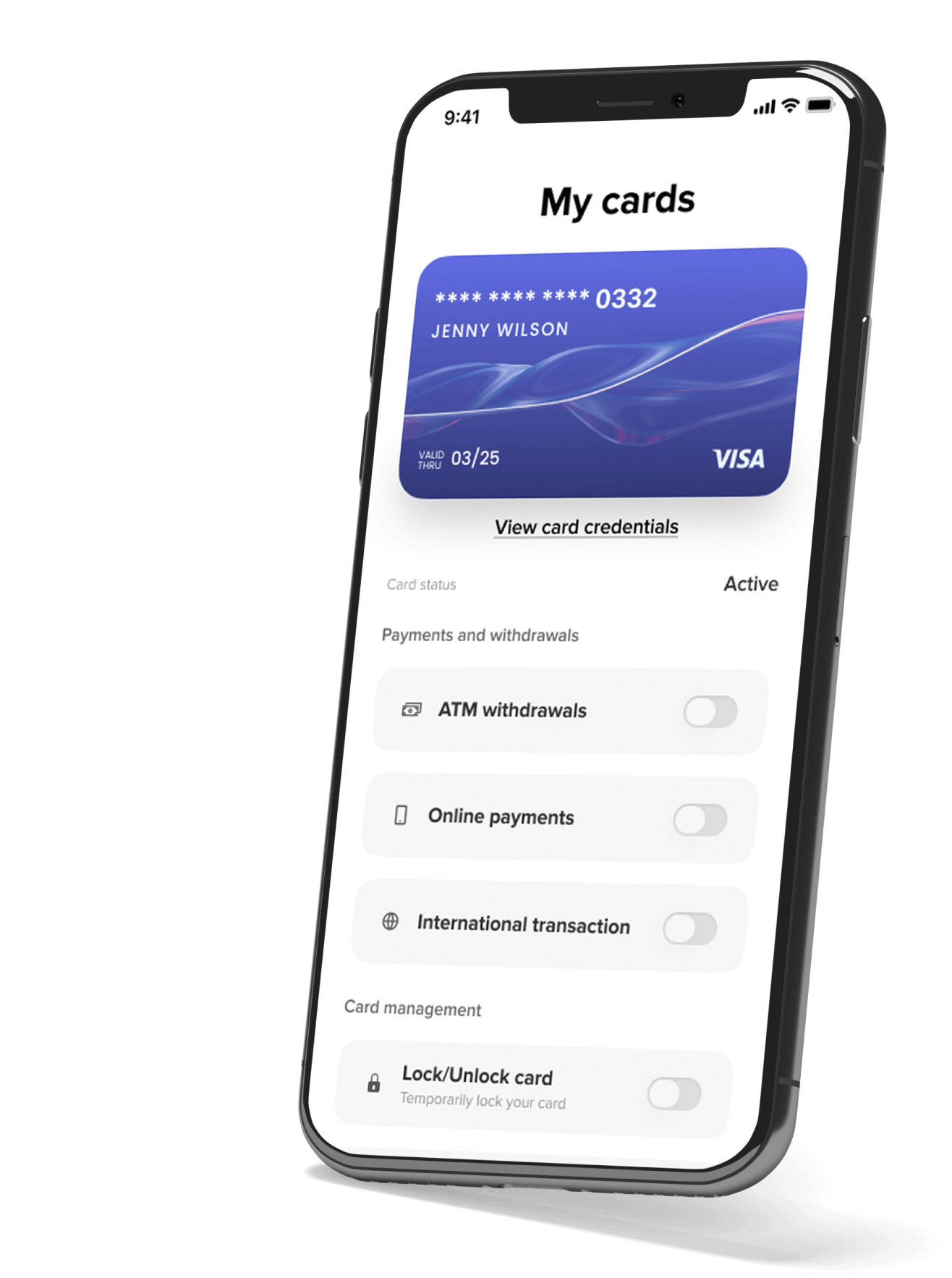

Our team of front-end developers and testers also implemented an adaptive UI design: the platform has a native look and feel on mobile devices running on any OS.

Custom CMS from Scratch

Our developers equipped the portal’s admin panel with a custom Report Builder. It compiles data from Backstop and aggregates the information inserted manually, parses the collected information, and generates data-based reports. These tool-generated reports are published on the portal, in both PDF and HTML formats.

Third-Party Integrations

- Dropbox is a file hosting service that gives the users secure access to their files. It is used to do bulk upload of documents to the Portal and Web-portal (Amazon S3 storage) and generate invoices via the template and output PDFs to Dropbox files.

- Backstop is a third-party provider that offers multiple tools and services for wealth management and investment companies. It is used to receive the Portal accessible investment-associated data and derived indices up-to-date over anytime.

Results & Future Plans

The platform provides investors with a well-organized summary of how their chosen pre-IPO companies have performed. The solution incorporates complex business logic, which imports, aggregates, and visualizesg data from the custom CMS and third-party services, like Backstop and Dropbox.

The Itexus team delivered the improvements to the investment platformt, in full compliance with the customer’s expectations. Presently, the client is planning to engage our team in further development of the platform, namely a custom invoicing tool.

Related Projects

All ProjectsFinancial Data Analytical Platform for a Large Investment Management Company

Financial Data Analytical Platform for a Large Investment Management Company

- Fintech

- Enterprise

- ML/AI

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

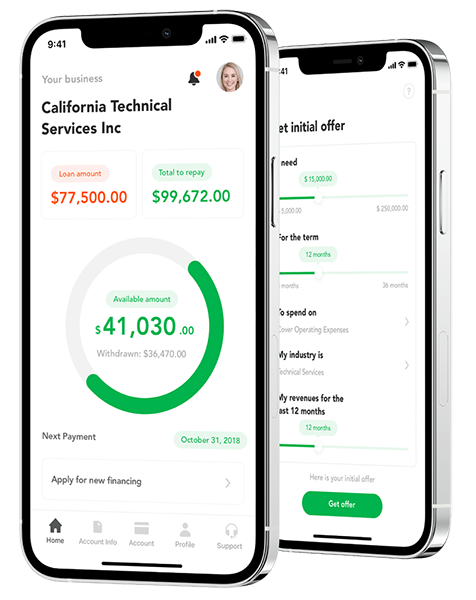

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Wealth Management Platform

Wealth Management Platform

- Fintech

Wealth management platform connecting investors with a professional wealth-advisory company, allowing investors to answer a questionnaire and receive either a recommended model portfolio or a custom-tailored individual portfolio, that is further monitored, rebalanced and adjusted by a professional wealth-adviser based on the changing market conditions and client’s goals.

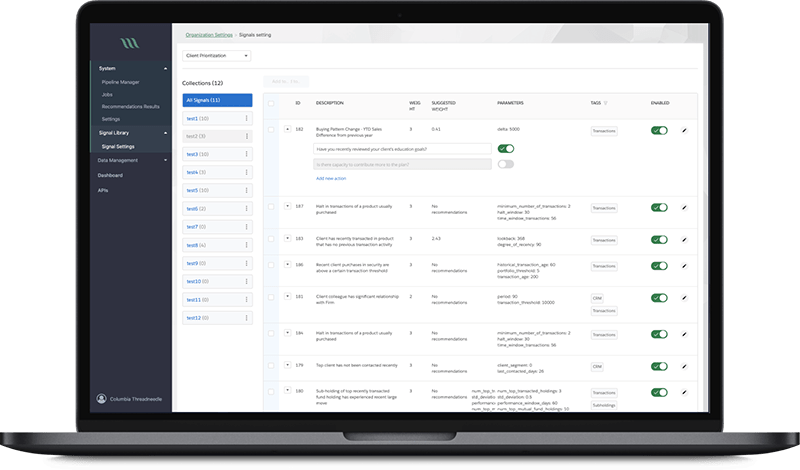

AI-Powered Financial Analysis and Recommendation System

AI-Powered Financial Analysis and Recommendation System

- Fintech

- ML/AI

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland