AI-based Financial Data Management Platform

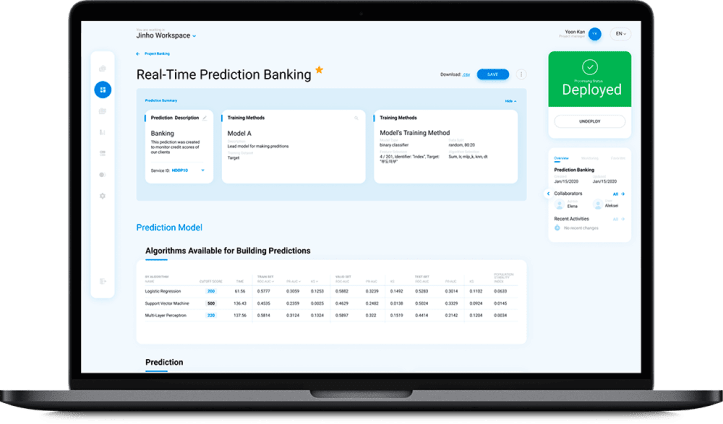

Financial platform that automates key-decision making processes, with AI-based predictive modules that reflect the credit cycle. This financial platform is equipped with rich data-streaming, processing, and reporting capabilities to provide real-time, on-demand data.

Project Background

The client was looking for professional software developers who could build the frontend part of the platform and connect it with their API in the most seamless and efficient way. As a trusted provider of Fintech software development services, Itexus was selected to ensure a comprehensive visualization of massive financial datasets and data-driven insights. The client chose to partner with us due to a combination of our established software delivery processes, relevant experience in financial product development, and positive customer references.

Project Team

Engagement Model

Time & Materials

Tech stack

Functionality Overview

Our team delivered a frontend part for the platform that is able to pull large amounts of financial information from the client’s database and provide a comprehensive visualization. The visualized data is then made available to end users (e.g., banks and financial institutions) via a paid subscription. The biggest challenge of the project was finding a technical solution that would enable fast and seamless data transfer from the client’s API (which generates data in the JSON interchange format) to the interface (where the collected data is visualized in multiple forms, diagrams, and charts). As direct communication between the frontend and the API would hinder the system’s real-time updates and user experience, our engineers suggested adding backend functionality to the system. The backend communicates with the client’s API, sends requests to the server, and receives data from the client’s system. On top of that, the solution features a PostgreSQL-based database, which stores pre-aggregated data. The system’s backend structure validates and filters the collected data before transferring it to the frontend. As a result, the database’s performance and user workflow is no longer impeded by time-consuming data migrations. For the frontend part of the solution, we used a combination of the React framework and the Redux library. The backend part is built on the Django REST framework.

Development Process

Reporting

- Implemented multiple types of data presentation

- Recharts library and the React-Vis library

UI/UX

- Design review and implementation

- Ant Design templates

Customizable workspace

- Filter out the information inside data blocks and personalize data visualizations

Architecture Highlights

Reporting

For data reporting, our team implemented multiple types of data presentation, including diagrams for personal data, credit rating changes, and other metrics. The components came from the Recharts library and the React-Vis library, selected by Itexus’ frontend developers and designers, and subsequently customized in accordance with the platform’s visual style.

UI/UX

While the client’s in-house team created the graphic design, Itexus was responsible for design review and implementation, as well as user experience enhancements. We used Ant Design as the main library for UI components (e.g., buttons, headers, sidebars, tables).

Customizable workspace

Once subscribed, end users can filter the information presented inside data blocks and personalize data visualizations. In other words, they can choose data sets and rearrange data blocks in accordance with their preferences.

Results

Digital lending platform (and a matching mobile app client) with an automated loan-lending process.

Are you planning to build a AI-based Financial Data Management Platform?