Mobile Bank Transfer App

Mobile app-to-bank transfer solution enabling its users to send money from US-issued bank cards to Nigerian bank accounts when money debited from senders’ cards instantly enters bank accounts in Nigeria. The app also allows paying bills internationally.

About the Client

A US-based startup was looking for a software vendor with an impressive track record of successfully delivered FinTech solutions and expertise in web and mobile app development. The client had a high-level view of the future product and ordered a discovery phase. After being impressed by the result and Itexus’ professionalism and technological savvy, the client came back to us for the full-cycle development of the money transfer solution.

Project Background

Itexus was assigned a range of targets: to develop iOS and Android apps, to build high-performing back-end API, to develop a web-based panel for admin, to provide maintenance for the app and to prepare system documentation and project roadmap.

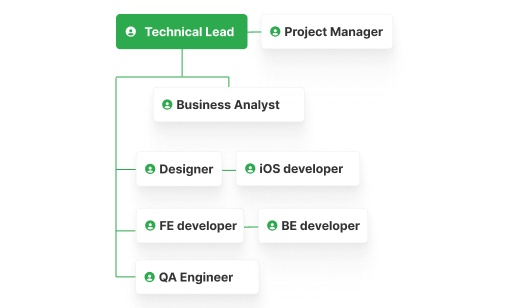

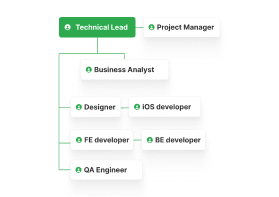

Project Team

Engagement Model

Time & Materials

Tech stack

Functionality Overview

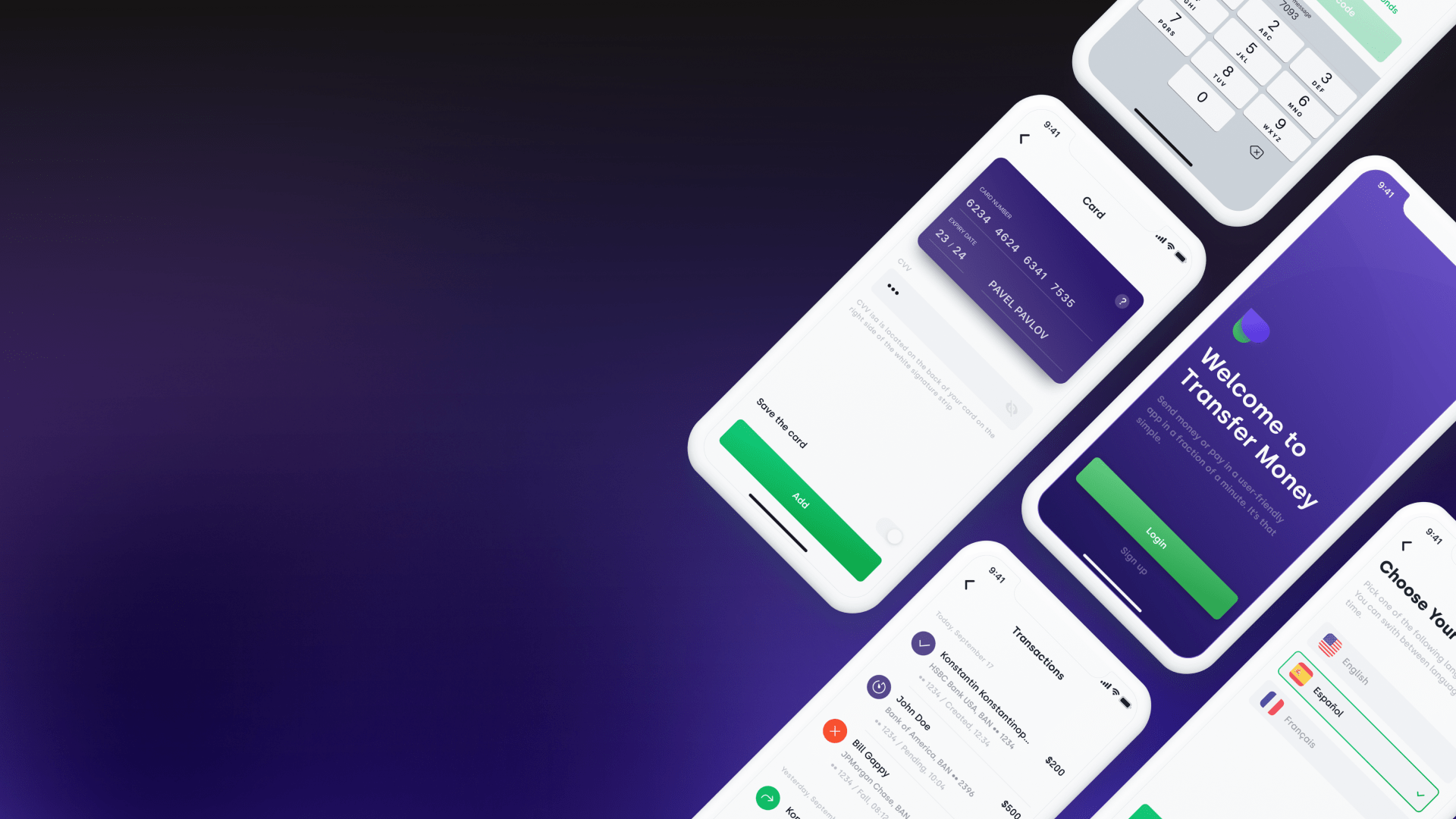

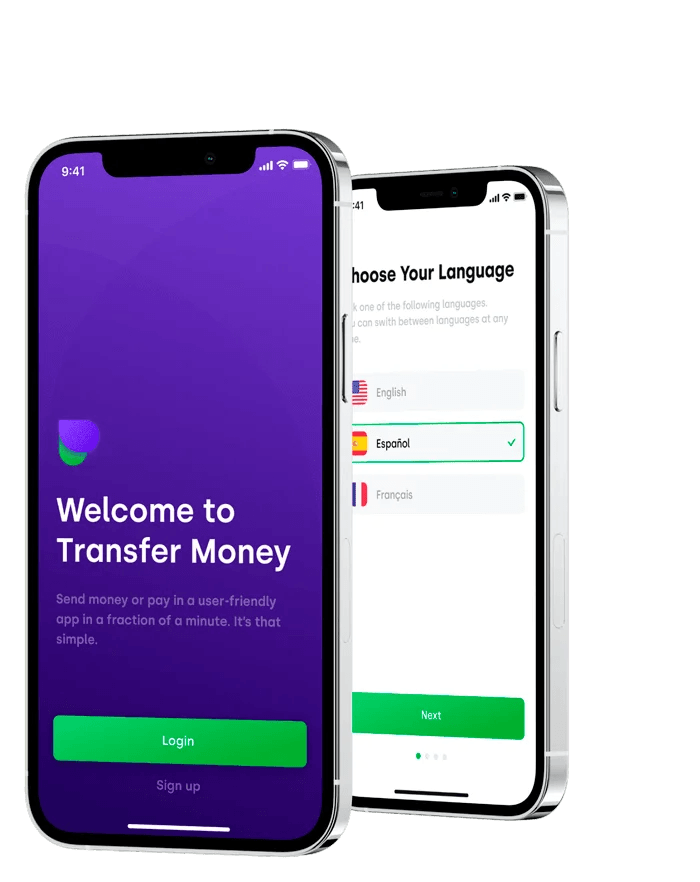

The app is downloadable from both Google Play and App Store. It has three easily-changeable interface languages: English, Spanish, and French. Upon signing up, users are asked to fill out an onboarding questionnaire and go through a quick KYC verification. Users are also asked to provide a selfie as a further step to validate ID.

Client Subsystem

Once the verification has been successfully completed, users can start setting up their accounts. A phone number is requested to reset the password if needed, with the help of SMS.

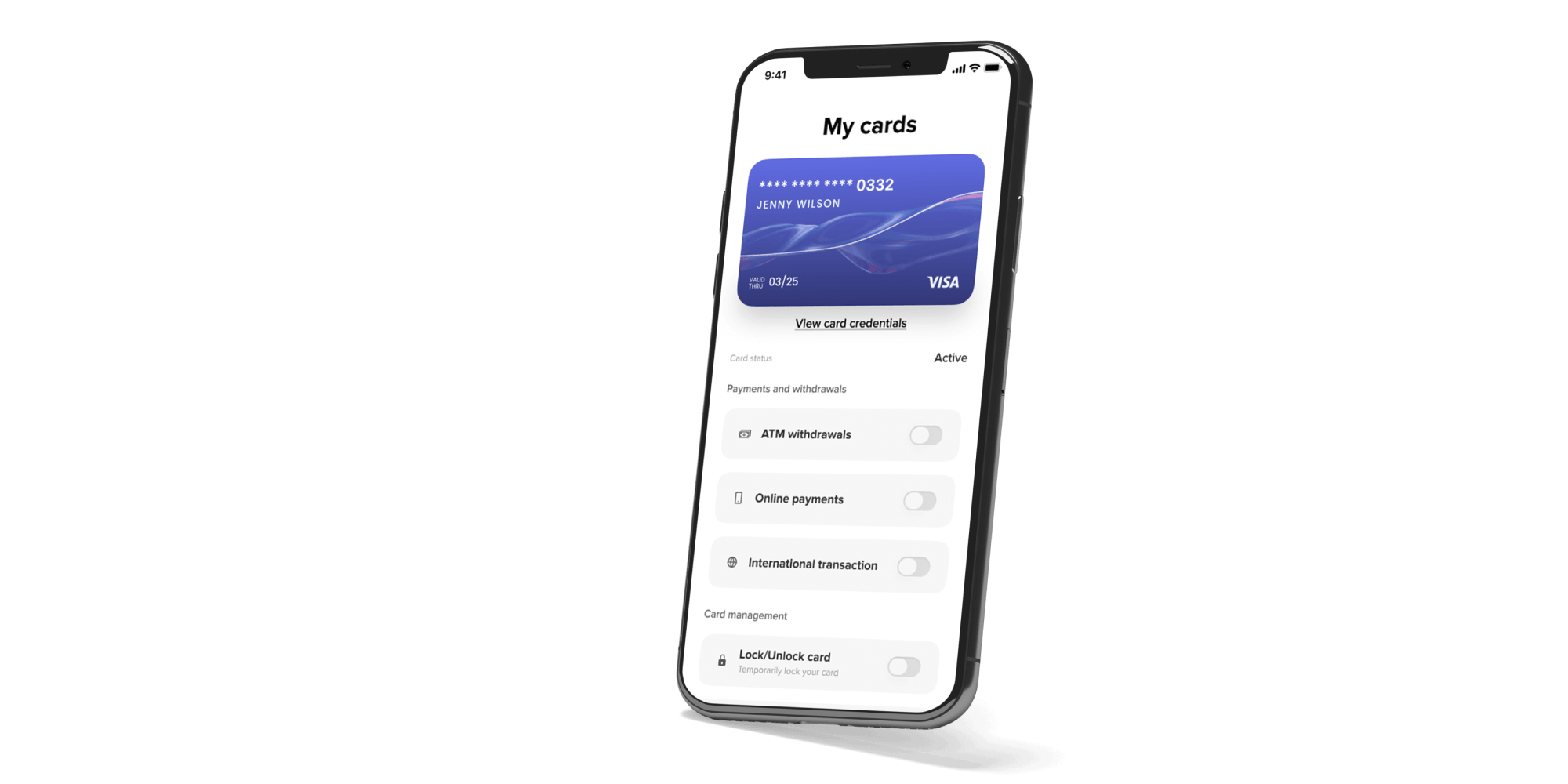

Users can easily manage their accounts and do the following:

-

Save more than one U.S. bank card to their account;

-

Save recipient data for as many people as required (must provide name of recipient, country of residence, name of the recipient’s bank, and their bank account number).

Itexus made it possible to initiate instant money transactions between American and Nigerian bank accounts. How does it work? When users initiate a transfer to send money to Nigeria, the app sends it to the client’s US-based account. As soon as the system detects the transaction, it initiates the money transfer from the client’s Nigerian account to the recipient’s bank account. The process is essentially the same when users pay the bills of their friends and relatives in Nigeria. Thus, the app allows users to save a lot of money and time.

Admin Subsystem

Logging out of the app is provided automatically. The app is connected to a web-based admin module, which offers options for authentication, profile management, transactions, and user management. Admins can generate promo codes for marketing purposes, set fees and limitations for transactions, and request report generation.

Architecture Overview

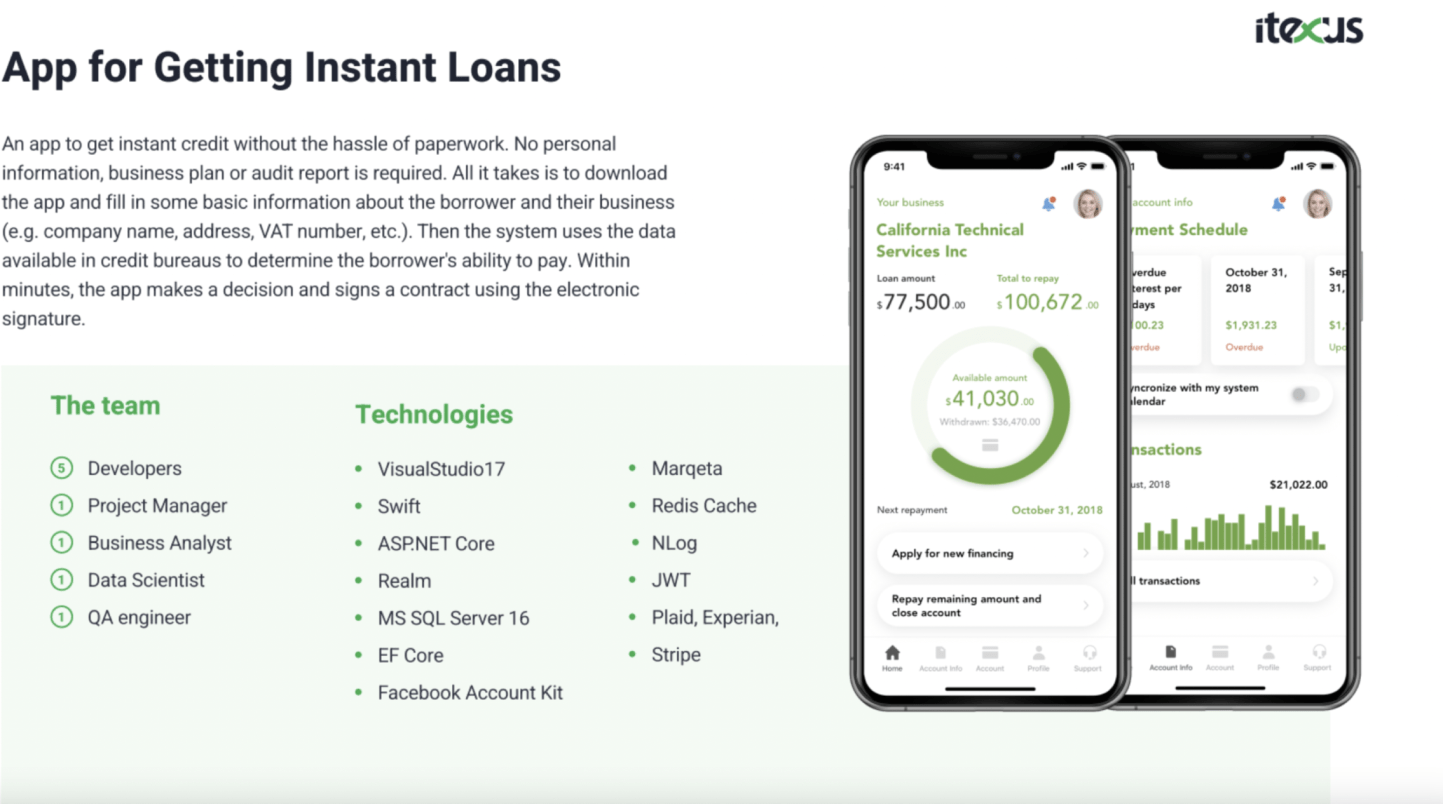

Following the results of the discovery phase and the client’s requirements, Itexus formed a dedicated development team to perform the following workflow of implementation of the following functionalities:

- Instant money transfers from any American bank card to any Nigerian bank account;

- Bill payments in Nigeria (utilities, phone bills, etc.):

- Connection of several U.S. bank cards to one acoount;

- Multilingual interface (English, Spanish, and French);

- Integration of two payment service providers (US-based and Nigeria-based);

- Integration of a robust KYC verification system;

- Integration and implementation of a promo code system to attract more users and run promotional campaigns

Development Process (or Project Approach)

The Itexus team rose to the the challenge of the project and dedicated itself to staying within the budget and meeting the client’s deadlines. We started with the discovery phase and performed a deep analysis of existing money transfer solutions. After negotiating with the client and taking their business goals into consideration, detailed project documentation was prepared. This included software requirements specifications, UI mockups, software architecture details, recommended technology stack as well as third-party implementations and integrations to make the product resilient, scalable, and secure. The client appreciated Itexus’ input during the discovery page and ordered the software development. We were able to provide extensive assistance with the development of the Android and iOS mobile apps, as well as the web-based admin panel. The development process was organized according to the Agile model within the Scrum framework. Data from the software requirements specification document was transformed into user stories. Based on the client’s priorities and the team’s recommendations, the building process was divided into several iterations. Each iteration began with a team meeting where business analysts presented user stories, followed by a two-week sprint and a subsequent session to demonstrate the newest features and collect feedback. In addition to Agile flexibility, the project manager kept track of the budget and scope, reported costs on a weekly basis, and alerted the client if any changes to the original scope and requirements were made. Communication channels between the development team and the client were established via Zoom and email. Git was used as a code repository. The project manager and the business analyst worked closely with the stakeholder to focus on important features and iterations.

Third-party integrations

- SendGrid (Twilio) is a cloud-based customer communication platform that allows easy sending of emails and SMS. It is used for notifications and messages (e.g., email verification, payment status, etc.).

- Flutterwave is a payment provider responsible for processing transactions from the system’s bank account to various users’ bank accounts via an API.

- Authorize.Net is a payment provider responsible for automating and processing transactions from credit cards to bank accounts via an API.

- Veratad offers a wide range of solutions for identity, age, and business verification, regulatory compliance, data validation, and fraud prevention. In the developed system, it is used for identity verification.

Project Challenges

Finding and negotiating with American and Nigerian payment providers to find the best match for the client.

Finding and negotiating with KYC verification systems to find one that would validate ID cards instantly.

Reintegrating new payment gateways into the project under very tight deadlines, resulting from the uncertainty of the Nigerian political and economical climate. As a result, the client requested an integration of a second provider to serve as backup. The highly skilled Itexus team demonstrated professionalism and flexibility, and managed to complete the task on time.

Results & Future Plans

The project has been under development for around 7 months. The apps (Android and iOS) are currently in their beta versions and will be ready soon. We have managed to create a secure mobile app-to-bank transfer solution that significantly decreases transaction fees and enables instant operations.

Currently, the only target country is Nigeria, but the client plans to enable money transfers to other countries in Africa in the future. The Itexus team continues to work on the project, progressively developing and implementing new features according to the client’s expectations and requests. Furthermore, the app landing page has been created and is being actively tested to provide conversions, app downloads, and new user engagement.

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.

Need to develop a similar project?