Mobile Banking App

A mobile banking app that allows its users to access all banking services in a secure, convenient and fast way without having to visit bank branches.

About the Client

Our client is a Silicon Valley-based provider of digital banking services. The company offers its customers a SaaS-based digital banking platform that enables them to set up and run a digital bank of any size while meeting international and local regulatory requirements such as GDPR, PSD2, and ISO.

Project Background

We developed a mobile banking app for a fintech startup and needed to integrate it with our current client’s digital banking platform. To iron out some of the platform integration details, we got in touch with the client’s development team – and that’s how our story began. A short time later, the client decided to develop their own white-label mobile banking app and turned to us to implement the project, as they had already seen our engineers in action and were impressed by their expertise and strong communication, collaboration, and problem-solving skills. After the successful app delivery, the client gave us another project. We were tasked to develop new features for the existing mobile app that another software development service provider had developed for our client.

In addition to providing digital banking services, our client helps its partners with banking app development – for this, they sometimes bring in external software development vendors to close specific skills gaps and reinforce their in-house team. The application we worked on was developed by such vendor for a financial services conglomerate based in Europe that offers banking, insurance, investment, real estate, wealth management, and retirement products and services. The target audience is therefore the conglomerate’s customers, i.e. Europeans who have bank accounts and want to manage their money securely, quickly, and conveniently without having to visit a bank branch.

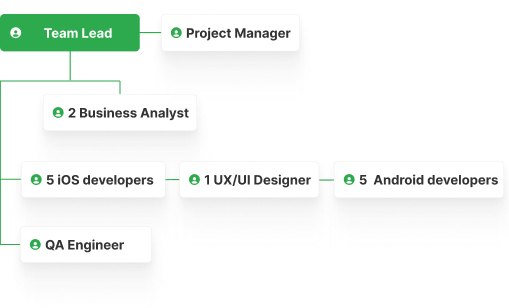

Project Team

Engagement Model

Time & Material

Tech stack

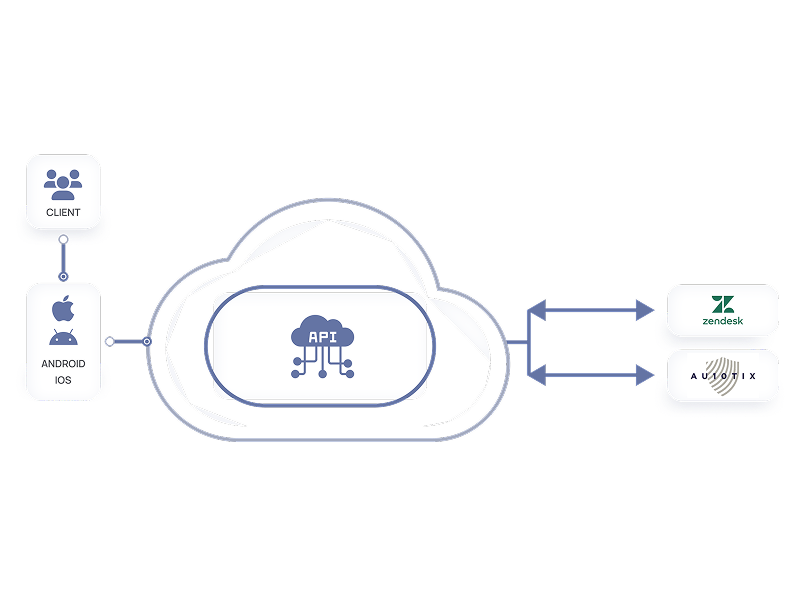

Architecture Overview

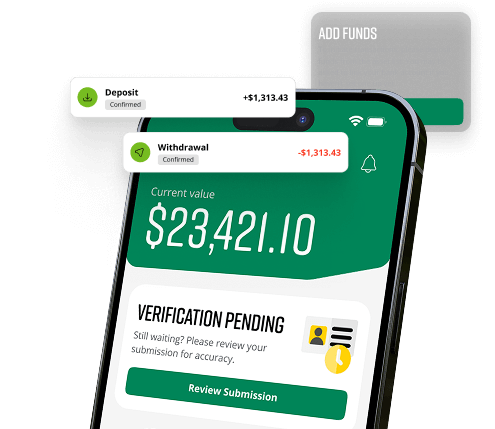

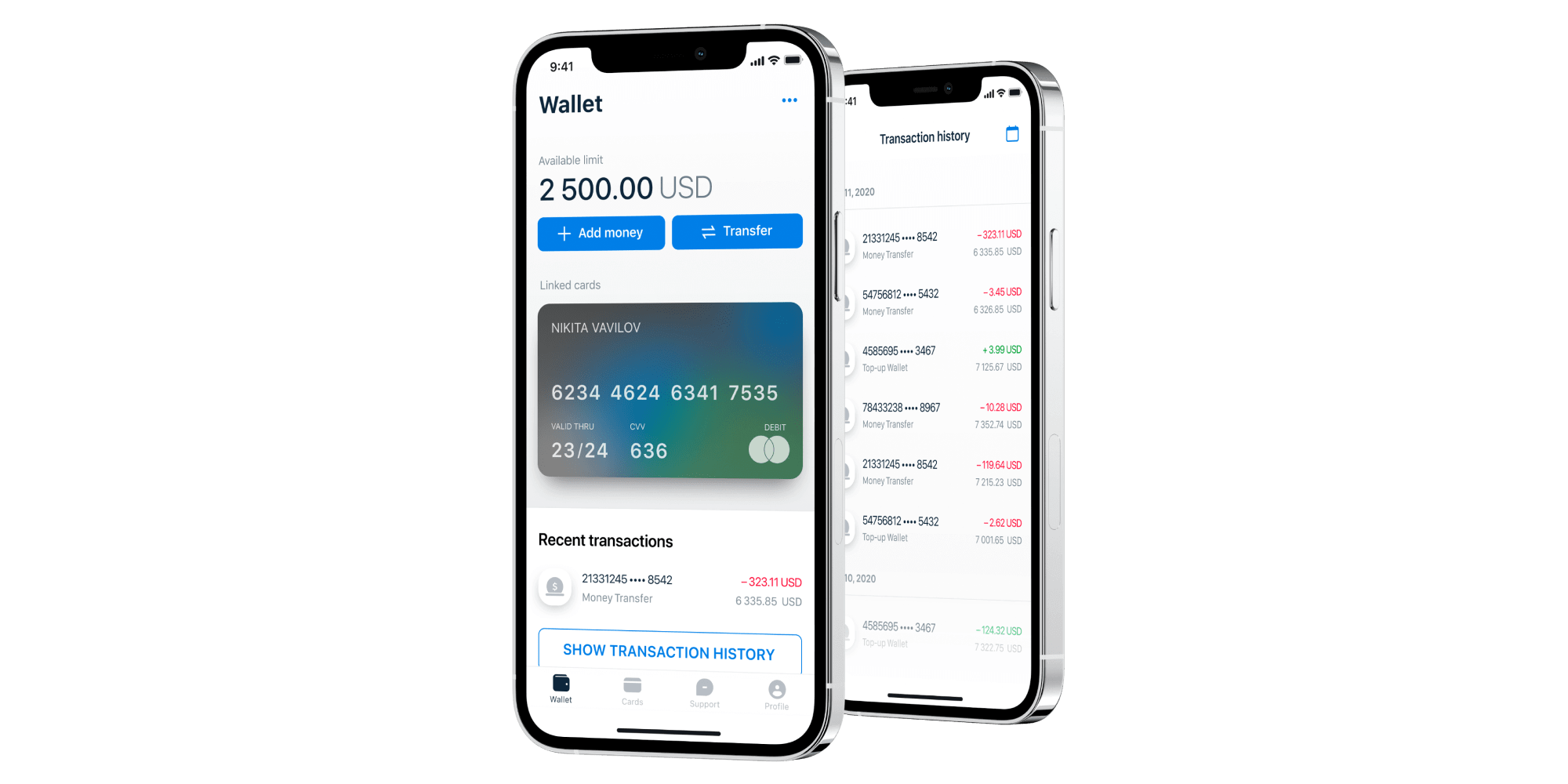

The solution is two native mobile banking applications for iOS and Android platforms. Their main purpose is to allow users to access a wide range of banking services without having to visit a bank branch – from opening accounts to issuing cards and various types of money transfers.

Solution main features

- sign up & sign in

- KYC check, onboarding

- DDA co-owner – transactions between accounts

- access to the account, its details

- transactions history and details

- online loan application & issuance and underwriting

- loan calculator

- notifications

- support

- currency exchange

- deposits

- money transfer for partner bank’s customers

- money transfer to cards between cards issued by other banks

- physical & virtual cards issuance

- online payments, QR payments

- international money transfer, ACH transfer, transfer status tracking

- bill payments

- spending categorization & tracking via charts and graphs

Development Process (or Project Approach)

The Itexus team was responsible for developing the front end, while the back end was developed by the client’s in-house team. Our task was to add new functionality to an existing banking app. Initially, we enabled a fully digital onboarding flow, where users could scan their documents for KYC and profile completion, and the app would automatically recognize the required information and fill in the appropriate fields. For a while, we worked concurrently with the client’s previous vendor, but over time we took full ownership of the project. After digital onboarding, we continued to implement additional features. The project was executed on a milestone approach, with each milestone relating to the development of the defined functionality. We reported on costs every month.

Third-party integrations

- AU10TIX is a cloud-based identity management software integrated for identity authentication.

- ZenDesk is a service that provides customizable tools for building customer service portals and online communities, as well as managing all conversations within the app.

Project Challenges

Our client is committed to keeping the app’s time to market as short as possible. Therefore, we work under tight deadlines, which puts some pressure on our team. Thanks to our well-established teamwork and vast experience in software development, we meet the deadlines without compromising on quality.

Results & Future Plans

In 6 months, we implemented all required features according to the client’s requirements, within time, and on budget. The app is up and running and is available to its users within the European market. Meanwhile, our DevOps team is planning code refactoring, i.e. editing and cleaning up the code written by the previous vendor, to make it more efficient and maintainable. We also support and maintain three other banking apps created by that vendor for our client and their partners. Want to develop a mobile banking app? Contact us to find out how we can help.

Discuss your development needs with us.

A digital wallet app ecosystem for Coinstar, a $2.2B global fintech company — including mobile digital wallet apps, ePOS kiosk software, web applications, and a cloud API server enabling cryptocurrency and digital asset trading, bank account linking, crypto-fiat-cash conversions, and online payments.