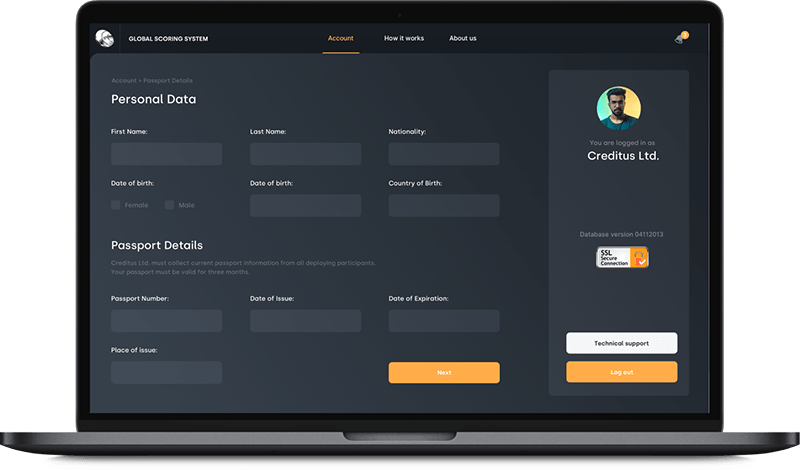

The system is a SaaS platform allowing the client to evaluate solvency and reliability of the potential borrowers using statistical methods of analysis of the historical and nontraditional data sources such as social network profiles and others. It allows the client to upload his normalized and anonymized database of previous loans data, build mathematical models and calculate the credit score of the future potential borrowers entering their data through the system’s web interface.

A warm welcome defines a local credit union, yet many members still encounter outdated technology and slow processes, with 81% struggling to keep pace with rapid technological advancements, as reported by KPMG.

But there’s a light at the end of the tunnel: a promising 55% of credit unions are ready to enhance their self-service digital solutions, marking a significant shift towards modernization.

Now is the time for credit unions to adopt innovative software solutions, like CRM platforms, to enhance member engagement. Partnering with leading technology providers will enable credit unions to not just compete, but excel in today’s market. Discover how modern technology can streamline operations, ensure compliance, and elevate service quality to meet the expectations of today’s digital-savvy members.

Why Credit Unions Need Specialized Software

Credit unions require specialized software solutions to thrive in today’s competitive financial landscape. Many credit unions still run on core systems from the 1980s. In a 2025 survey, only about 50% of credit unions felt they had achieved a mature state of digital transformation, with integration into old systems and cybersecurity concerns as top obstacles. This is due to their unique structure and the evolving demands of the financial industry.

Unique Member-Owned Model vs. Traditional Banking

Unlike traditional banks that rely on standardized processes, credit unions benefit from software that supports personalized service while integrating modern technology.

| Basis for Comparison | Unique Member-Owned Model (e.g., Credit Union) | Traditional Banking |

| Definition | A community-based financial institution that allows members to borrow money at low-interest rates through pooled investments, reflecting local interests and supporting economic development. | A company authorized by the government to undertake financial transactions and provide banking services to customers |

| Depositors | Members who use their deposits in purchasing shares Clients can become members/owners with relatively small investments. | Customers who deposit their money by opening an account with the bank. |

| Profit | Non-profit organization with a service motive. Value creation for their members and a long-term relationship of trust. Profits are often based on shareholder or membership use of the service or product. | Profit-driven, operating for maximizing profits. |

| Products/Services | Fewer products. | Banks offer an array of products and services to its customers. |

| Interest Rates & Fees | Provides better interest rates than prevailing in the market with less fees. | Relatively worse interest rates with high fees. |

| Customer Service | In-person service helps build trust, especially for complex issues. | Customer service can vary greatly by person and location. |

Regulatory and Compliance Nuances (NCUA, AML/BSA)

Credit unions must comply with regulations set by the National Credit Union Administration (NCUA), as well as the Anti-Money Laundering (AML) and Bank Secrecy Act (BSA). This requires effective transaction monitoring, suspicious activity reporting, record maintenance, and securing member data.

Specialized compliance software is essential, automating processes, enhancing monitoring, and simplifying reporting. By implementing such solutions, credit unions can minimize non-compliance risks and maintain legal standards efficiently.

Balancing Personalized Service with Modern Technology

Credit unions must prioritize personalization and modern technology to thrive in today’s competitive landscape. According to recent data, 71% of U.S. consumers handle their bank accounts primarily via online or mobile apps. Additionally, more than 6 in 10 credit union members report that online banking is their most relied-upon channel. This highlights the need for credit unions to enhance their service offerings.

Personalization

To meet members’ unique needs, credit unions should focus on delivering personalized service. This approach fosters strong relationships and builds trust through attentive, in-person interactions. By understanding individual preferences, credit unions can create meaningful connections that enhance member satisfaction.

Modern Technology

Adopting modern technology is essential for providing the convenience and efficiency that members expect. Customizable business process automation software enables credit unions to offer seamless digital banking solutions while maintaining the personalized service that sets them apart.

By balancing personalization with advanced technology, credit unions can effectively serve their members and ensure high satisfaction in a rapidly evolving financial landscape.

Key Features & Functionalities

To achieve a balance between modern technology and personalized service, credit unions must leverage specialized software. This software enhances operational capabilities and fosters meaningful member experiences. Here are the critical functionalities that software providers empower credit unions:

Member Engagement Tools

- Modern CRM tools enable personalized member interactions.

- Targeted offers for loans or savings plans based on preferences, including options to consolidate credit card debt for better financial management.

- Engagement through mobile apps, self-service portals, and chatbots is crucial for loyalty.

- 80% of financial services users desire more personalized digital experiences (source: Deloitte).

Compliance and Risk Management

- Modern software simplifies compliance with NCUA and BSA/AML regulations.

- Automated features enable real-time reporting and monitoring.

- Security modules flag suspicious transactions, reducing manual oversight and human error.

Core Banking Integrations and Automation

- Core integrations provide seamless connectivity across systems.

- Accurate member data flow is facilitated.

- Automation streamlines repetitive tasks like loan origination and account updates.

- Accelerates processing times and lowers operational costs.

Advanced Analytics

- Predictive analytics offer valuable insights into member behavior and financial trends.

- Helps tailor services to meet member needs.

- Tools for loan eligibility assessments improve decision-making efficiency.

- Enhances member satisfaction and drives revenue.

Strategic Importance of Software Investment

- Investing in the right software is crucial for optimizing operations and engagement.

- Credit unions must prioritize solutions that deliver real-time data, ensure compliance, and enhance automation.

By effectively utilizing these essential features, credit unions can significantly enhance operational efficiency while ensuring compliance.

Expert Insights & Future Trends

Credit unions are utilizing advanced technologies like artificial intelligence (AI), cloud computing, blockchain identity, and open banking to to enhance operations and member experience. The following innovations help credit unions remain competitive while meeting changing member expectations and strict regulatory standards:

AI: Enhancing Personalization and Efficiency

Artificial Intelligence (AI) is revolutionizing the way credit unions operate by enabling greater personalization and efficiency in member services. AI-powered tools, such as chatbots and predictive analytics, allow credit unions to better understand member behavior and preferences. By leveraging AI, credit unions can enhance member engagement, streamline operations, and improve decision-making processes, ultimately leading to increased satisfaction and loyalty.

Cloud Computing: Flexibility and Cost Savings

Cloud computing has emerged as a core strategic priority for credit unions due to its flexibility, cost efficiency, and enhanced security. Over 40% of U.S. credit union executives rank cloud technology among their top five spending priorities, indicating a rapid shift toward cloud-based solutions. The scalability of cloud technology enables credit unions to quickly adapt to market demands using a pay-as-you-go model, avoiding costly infrastructure investments. Additionally, cloud adoption reduces the burden on IT departments, allowing staff to focus on innovative initiatives while benefiting from advanced encryption and compliance features.

Blockchain-Based Digital Identity: Strengthening Security and Simplifying Compliance

With the increasing need for secure identity verification, blockchain-based digital identity solutions are gaining traction in credit unions. This technology allows for secure authentication and streamlined Know Your Customer (KYC) processes, giving members control over their digital credentials and significantly reducing fraud risks. Early adopters of blockchain solutions, such as MemberPass, have experienced improvements in fraud reduction through cryptographic verification methods and enhanced compliance efficiency thanks to immutable audit trails that ensure adherence to KYC and Anti-Money Laundering (AML) regulations.

Open Banking APIs: Fueling Innovation and Ensuring Compliance

As the financial landscape becomes increasingly interconnected, open banking is gaining momentum among credit unions. By leveraging Application Programming Interfaces (APIs) and board management software, credit unions can develop innovative, member-centric solutions by securely sharing data with fintech partners and other institutions. This approach not only fosters regulatory compliance with upcoming regulations, like the CFPB’s Section 1033 rule, which mandates financial institutions to share data via APIs by 2025, but also enhances operational efficiency through real-time data synchronization and standardized logs, helping credit unions remain competitive.

How to Select the Right Software for Credit Unions

Selecting the right software solution is essential for credit unions aiming to enhance operations, meet compliance standards, and improve member services. The process should be strategic, considering key criteria, avoiding common pitfalls, and ensuring that ongoing support and updates are factored in.

Selecting the Right Software: Key Criteria and Pitfalls to Avoid

When choosing software for a credit union, several key criteria should guide the selection process, while simultaneously being mindful of common pitfalls that can derail implementation. Understanding these criteria is essential for making informed decisions regarding software for credit unions, as they will ensure that the chosen solutions align with the credit union’s goals and operational needs.

Scalability is crucial. The software must support the growth of the credit union as it expands. It should handle increased transaction volumes, accommodate new users, and offer additional services without compromising performance. Selecting a scalable solution minimizes the need for frequent replacements, saving time and resources.

Vendor Track Record is another important factor. A vendor with a proven history in delivering enterprise-grade financial software can provide not only robust technical solutions but also valuable industry-specific knowledge. This ensures compliance with regulations and helps the software evolve alongside industry trends. However, be cautious of vendors who may not have a track record in your specific sector; this could lead to compatibility issues and delays.

Ease of Integration is essential for a smooth implementation process. The chosen software must seamlessly integrate with existing systems, such as core banking software and payment gateways. Seek vendors experienced in this area to minimize disruptions during the transition. Failure to consider this can lead to operational inefficiencies and frustration among staff.

Another critical consideration is the total cost of ownership (TCO). When evaluating software, it’s vital to look beyond initial licensing fees to understand the long-term financial commitment. TCO includes costs for maintenance, updates, support, and scalability. By seeking clarity on TCO, credit unions can better plan and ensure they are making a sound financial investment.

As you navigate these selection criteria, be wary of common pitfalls. One significant pitfall is underestimating change management. Implementing new software involves more than just technical adjustments; it necessitates effective change management practices. Many credit unions overlook the staff training and communication needed for a smooth transition. Ensure that the solution includes a comprehensive change management plan to reduce operational disruption and effectively prepare staff for new processes.

In summary, by focusing on key selection criteria while avoiding common pitfalls, credit unions can select the right software solutions that enhance efficiency, support growth, and improve member service.

Importance of Vendor Support and Ongoing Updates

Vendor support extends beyond software installation. Continuous support and regular updates are crucial for maintaining system performance, security, and regulatory compliance. Choose a vendor that provides full-cycle service, including 24/7 technical support and software updates, to ensure your solution remains functional and compliant.

Ongoing updates are also vital for adapting to the latest fintech innovations and market demands. A vendor offering frequent updates and proactive improvements ensures that your software stays competitive and aligned with current trends.

Real-World Implementations

Implementing specialized software solutions in credit unions can lead to significant improvements in efficiency, compliance, and member satisfaction. The following are real-world case studies that highlight successful transformations and the valuable insights gained from these experiences.

Short Case Studies Highlighting ROI and Member Satisfaction Gains

When selecting the right software for a credit union, it’s essential to look at proven examples of how technology has driven ROI and member satisfaction. Below are a few real-world examples of how software solutions have significantly enhanced credit union operations.

Case Study 1: Navy Federal Credit Union, one of the largest credit unions in the U.S., recognized the need to modernize its mobile banking platform to improve member engagement and streamline access to services. The credit union partnered with fintech companies to develop an advanced mobile app featuring real-time account updates, secure mobile check deposits, and access to personal finance management tools.

Results:

- Increased Mobile Usage: After the launch of the upgraded platform, Navy Federal saw a 35% increase in mobile banking adoption among its members.

- Higher Member Retention: The app’s user-friendly design contributed to higher member satisfaction, leading to a 10% improvement in member retention rates.

- Cost Savings: The improved platform reduced call center traffic by 15%, as more members were able to complete routine banking tasks independently.

Case Study 2: Coastal Credit Union, based in North Carolina, implemented an AI-driven loan origination system designed to reduce processing times and enhance decision-making. The system uses machine learning algorithms to analyze loan applications, assess risk, and automate approval processes, ultimately speeding up the time to loan disbursement.

Results:

- Faster Loan Processing: The AI solution helped cut the loan approval time by 40%, allowing the credit union to process more loans without increasing staffing levels.

- Increased Loan Volume: Coastal saw a 20% increase in loan applications due to faster decisioning, which led to greater revenue generation.

- Improved Member Satisfaction: Members appreciated the speed and accuracy of the new system, which contributed to a 12% increase in member satisfaction with the credit union’s loan products.

Lessons Learned in the Transition from Legacy Systems

Transitioning from legacy systems to modern software solutions presents challenges, but valuable lessons have emerged for credit unions.

Lesson 1: Aligning Technology with Business Goals

Successful upgrades require alignment with strategic objectives. For example, a mid-sized credit union integrated financial literacy tools into its new digital banking platform, resulting in increased member engagement.

Lesson 2: Importance of Change Management and Training

Strong change management is essential for a smooth transition. A large credit union overcame initial resistance by conducting hands-on workshops and providing early training, ensuring staff felt confident with the new systems.

Lesson 3: Involving Members Early in the Feedback Loop

Engaging members during the software development process yields critical feedback. One credit union invited members to beta test the software, allowing them to provide suggestions and feel included in the transformation, which ultimately improved the final product.

These real-world implementations illustrate that tailored software solutions can deliver a significant ROI and enhance member satisfaction. By learning from successful transitions and incorporating best practices, credit unions can ensure a smooth transition to modern systems, positioning themselves as leaders in today’s digital banking landscape.

Final Thoughts

To succeed in today’s competitive market, credit unions must adopt specialized software… to improve operations, meet compliance standards, and enhance member service. Case studies show that leveraging technologies like AI, cloud computing, and blockchain leads to better ROI and member satisfaction.

Key Takeaways:

- Scalability and Integration: Choose solutions that grow with your needs and integrate seamlessly.

- AI and Automation: Utilize AI for improved efficiency and personalized member services.

- Compliance: Ensure software simplifies compliance tasks to reduce risks.

- Member Experience: Balance modern technology with personalized service for high satisfaction.

Next Steps:

- Consultation: Contact Itexus for tailored fintech solutions.

- Pilot Project: Start with a pilot to assess software effectiveness.

- Further Resources: Check additional case studies and insights on AI and cloud adoption.

Partnering with Itexus can enhance your credit union’s operations and member satisfaction, paving the way for long-term success.