Fintech is drastically reshaping the way customers receive financial services – now it must be convenient, 24/7 accessible, and hyper-personalized. The revolution started with Fintech startups and continued with banks and credit institutions. Today, 85% of banks see digital transformation and financial technologies adoption as their key business priority.

Fintech offers alternative ways to get the most popular financial services – transfer money, trade stocks, get insurance, and apply for a loan. Among them, money lending is given particular attention. No wonder: the Boston Consulting Group expects the total retail loans, disbursed via money lending apps, to reach over $1 trillion over the next 5 years.

Thinking about entering this highly competitive, yet attractive market? Here is a look at the development lifecycle, with its key challenges, objectives, terms, and money lending app development costs along the way.

Money Lending App: Secret to Success

There was a joke circulating around: if you want to be successful at digital money lending, follow the “3-6-3” formula. That is, raise deposits at 3%, lend at 6% and play golf after 3 PM.

The uptake of digital lending is putting an end to this “rule” and replacing it with the “3-1-0” one: 3 minutes to decide, 1 minute to transfer the money, and 0 human touches. Today, with a few swipes on a mobile phone, a consumer submits a personal loan application and gets the money in a couple of minutes.

The digital substitute for conventional bank loans offers multiple benefits to its users:

• Fast approval. In a money lending app, “time to yes” is reduced to the above-mentioned 3 minutes or fewer thanks to 2 factors:

- Integration with credit agencies’ databases and other data sources, for necessary verifications and quick lending risk evaluation;

- Credit scoring module – the “heart” of the app. It analyses users’ information, gives an estimate of the probability of default, and attributes an individual score for each borrower.

• No paperwork, no in-person meetings. A borrower provides stipulations such as ID, address, and work details via a secure registration module. The documents are verified and evaluated along with the information from external sources, with the whole assessment procedure completed online.

• Quick rates calculation. An integrated loan calculator – a part of the app’s scoring module – provides interest rates for each borrower depending on basic criteria: personal score, the loan amount, and the term.

Money Lending App Development Cost Breakdown

Here, at Itexus, we have compiled our expertise in Fintech and money lending projects to prepare a guide and help make better choices once you decide to develop a money lending application.

To make it more representative, we will refer to a money lending app project from the Itexus portfolio.

Discovery Phase

We recommend starting every project with a discovery phase.

But what happens in reality? Vadim Nazarov, PM at Itexus: “A discovery phase is often overlooked by software development companies: a project team gathers initial client’s requirements and rushes into development right from the start, without a proper study of the market, key competitors, and potential users’ “pains”, habits and benefits they are searching for.”

As a result, 45% of IT projects end up exceeding the estimated budget, and 56% deliver less value than predicted.

When executed thoroughly, a discovery phase makes the client’s expectations and the development team’s expertise work in synergy to meet project requirements.

Let’s take a look at our project. We conducted a thorough study of the money lending applications market, including competitor analysis and creating user personas, and presented the results to the client. Based on this, we prepared clear documentation, an accurate project estimate, and a well-rounded plan for further work and development.

Moreover, thanks to the research our client decided to pay special attention to the app’s design and user experience, in order to make it one of the marketing points to get ahead of the tough competition.

Milestones & Deliverables

- Product Roadmap and Software Requirements Specification (SRS), containing an in-depth description of the functionality of the product.

- Software Architecture Document describing the architecture of the future solution and required technologies

- UI/UX prototype Flawless user experience was one of the key requirements of the system. So a detailed design of every screen was created and combined into a clickable prototype that was used both for business presentations and for development purposes.

- Development Plan & Estimates, with a detailed description of the project’s timeline and budget.

Workload

The Discovery phase usually takes about 150-200 hours, depending on the complexity of the domain, the depth of the analysis, and the level of the detail in the documentation.

Development Process

There are different ways to organize development work. We recommend sticking to the agile/scrum development process. Delivering the product in short 2-3 weeks iterations (“sprints”) followed by a demonstration of the product increment, retrospective meeting to adjust the process, and planning of the next sprint. Collecting feedback from the market with the early versions and adjusting the product plan based on the feedback from potential users.

Our team adopted this approach in the money lending app project.

Minimum Viable Product (MVP) Phase

An MVP scope usually includes the most vital functions of the product. In the case of an online lending app a user should be able to register/log in, complete a money lending application form, get his data and application verified and assessed automatically by a scoring module, and receive (or not) the loan. This is enough to test initial assumptions on early adopters, get feedback from them, and optimize the product.

In our example, the MVP scope of the Money Lending App included:

• User registration and money lending application flows. The necessary steps for a user to register in the app, apply for a loan, receive the money, and pay via the mobile phone. The MVP was tested on potential beta testers and the project team figured out which part of the user flow had the biggest drop rate, and made the necessary changes.

• Simple Administration Module. With a basic dashboard with overall stats of app performance, user management, scoring settings, and reporting.

• External Integrations. Integration to credit history bureau www.experian.com, integration with https://www.marqeta.com/– virtual credit card service from Visa.

• Scoring System. Originally we didn’t have enough statistical data to use advanced machine learning algorithms to determine the user’s score. So we solved the cold-start problem by using a simple rule-based scoring module, including basic fraud detection functionality. The engine assigned a pre-defined score to each data point of a money lending application and approved of loan when the score was over a certain threshold. At the same time, the system accumulated data about the user’s behavior to be used by more advanced scoring algorithms in the future.

Workload

3 000 – 3 500 hours.

Final Product

Once the MVP has been validated, the development team can proceed with adding more advanced functionality to the product:

• Advanced Scoring Module. After the system has accumulated enough data, the rule-based scoring model may be replaced by an advanced AI-powered self-learning scoring engine processing large volumes of data from different sources increasing the precision of the scoring and maximizing profitability.

• Integrating additional data sources such as www.yodlee.com for accessing bank accounts and transaction data. Or www.quickbooks.com to access the company’s accounting data. Or social media profiles of the user.

• Advanced KYC and Security Modules. The functionality of the money lending app can be improved with extra modules: Know Your Customer (KYC), Anti Money Laundering (AML), etc.

• Automated bad deal management module. Automatically selling non-performing loans to a collection agency.

In our case, we integrated all the above-mentioned modules, while paying special attention to the accounting engine. To deliver a feature-rich custom solution, compliant with security and legal standards, our team turned to a major global consultant for best practice advice.

…and so on – Fintech perspectives are truly overwhelming, and the product can be infinitely upgraded and improved.

Workload

3 000 – 3 500 hours

So here we go: the development of a functional money lending app in its basic version without advanced functionality takes about 3 000 – 4 500 hours. Then multiply it by an average developer hourly rate (which varies drastically, depending on the region, domain, and expertise engaged). For example, at Itexus, we apply a $35-$40 per hour rate to Fintech projects. In the end we get an estimate of around $100 000 to start with.

Is this all? No, as there are a couple of recommended steps to follow once a product is ready to go public.

Testing

In agile iterative programming, testing is a continuous process, conducted simultaneously with coding and design in every iteration.

Such a mission-critical application must be covered with automated tests to absolutely minimize the risk of errors. One can reduce some initial costs and start with only manual testing on the MVP phase but it is critically important to cover the main functionality with automated tests before going into production as we will be dealing with real money here.

In our project, we wanted to eliminate the human error factor and speed up our testing cycles. So our code was covered with unit tests on the code level, automated API level tests, and automated UI tests on the mobile apps.

But let’s admit: no testing is a substitute for real-world feedback. So we absolutely recommend doing a beta testing phase with early adopters. We leveraged beta testing in our project, conducted by the client on a small group of users, to the fullest: unbiased beta testers, watching the final product with a critical eye, were an extremely valuable source of information on how to improve the product before its launch.

App Launch

A reliable and trustworthy developer will always assist you in the launch process in AppStore and Google Play. While positioning statements and marketing activities are on the client side, a tech partner helps comply with the submission guidelines and adjust accordingly.

Maintenance & Support

The app launch doesn’t mean that the tech team stops its work here. Updates, new features implementation, bug fixing – app development is a long-term commitment, with a development cycle starting anew after each new version release.

How to Choose a Financial Software Development Company

A money lending app is a complex project. Once you decide to engage a software developer, make sure that they possess the following:

Adequate technical expertise

Digital lending is a high-load complex system. For successful project delivery, we would recommend that you search for a software development company with technical expertise in creating and launching enterprise solutions with the latest technologies and within diverse deployment ecosystems.

Meeting Cybersecurity & Legal Requirements

Money lending apps process sensitive information and must comply with PSI DSS standards, anti-money laundering laws, American CFPB, and European GDPR rules – and that’s definitely not a full list. So it is worth checking whether a company has worked with projects from highly regulated industries and knows about their standards and security certificates.

Itexus Expertise in the Fintech domain

Fintech is a very specific domain, which must comply with strict regulations.

Vadim Nazarov, PM at Itexus: “When searching for a financial software development company, pay attention to their portfolio and check whether they have experience in working with Fintech, banking workflow, and financial app development. If they are newcomers, it may trigger serious risks for the project in the future.”

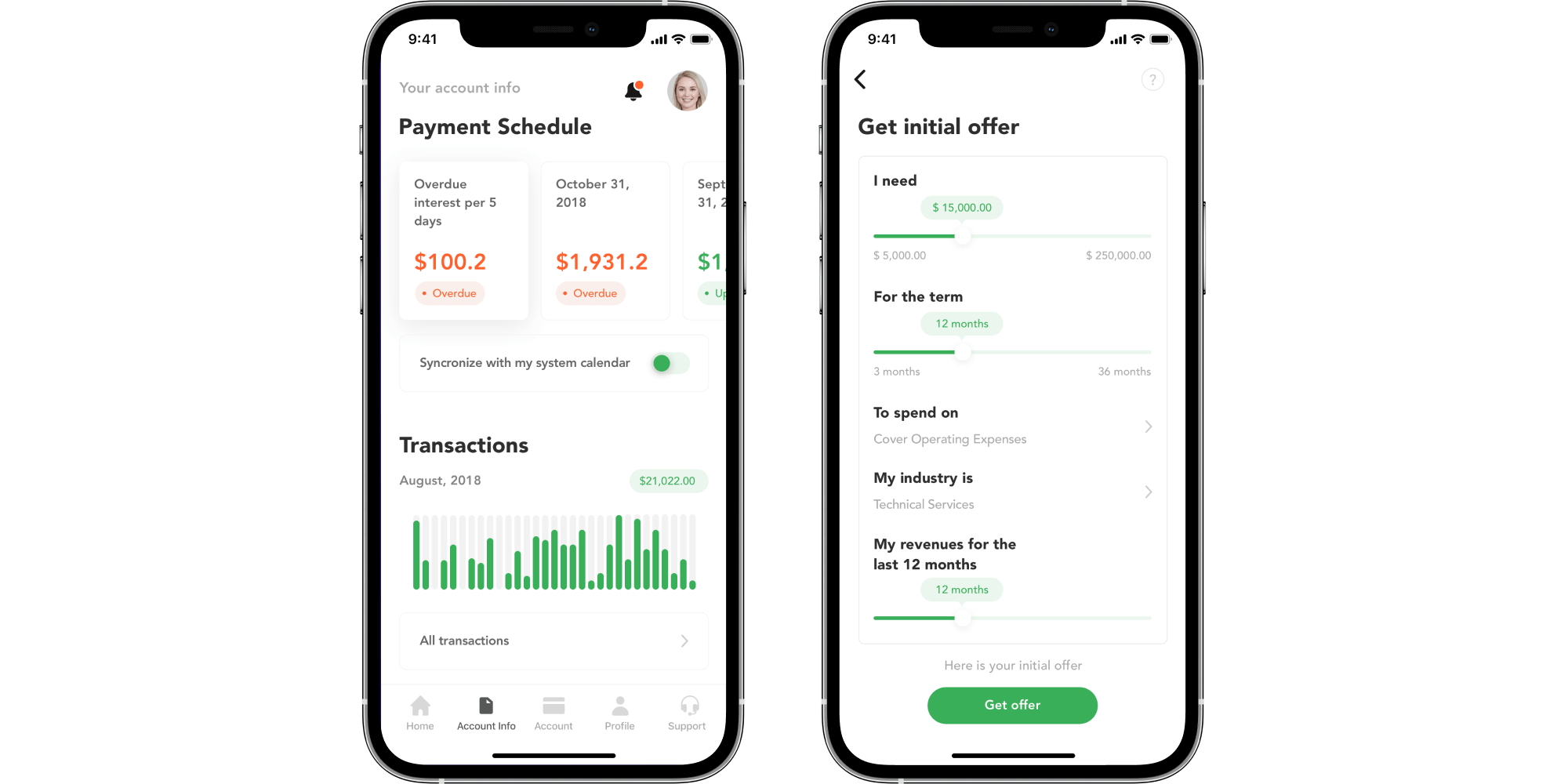

At Itexus, we have been delivering robust fintech solutions to our clients since 2013, ensuring the highest quality at all stages of product development. We leverage our extensive fintech expertise, customer-centric approach, and cutting-edge technologies to develop strong money lending applications. One such product Itexus created for a fintech startup is an online lending platform with a mobile app client. The platform fully automates the lending process – from the online loan application, loan origination, KYC, credit scoring, and underwriting to payments, reporting, and bad debt management. The solution includes:

• a mobile app for end users with loan application, agreement signing, virtual credit card issuance, payments, statistics, and reminders functionality;

• an administration module with overall statistics on application performance, user management, scoring settings, and reporting;

• back-office with advanced reporting and loan portfolio monitoring functionality;

• multiple integrations with third-party vendors.

For more details on this project, see the original case study.

To Sum Up

When it comes to developing a money lending app, there are multiple things to consider – from the features that will advantageously set your solution apart from the competition to a variety of regulations. Being your trusted fintech development partner, Itexus is set to help you get things done. Let’s get in touch!