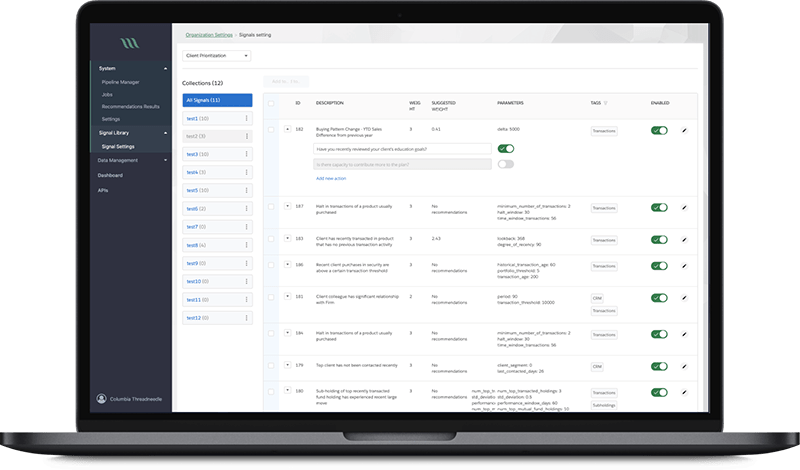

The system uses machine learning techniques to process various content feeds in realtime and boost the productivity of financial analysts and client relationship managers in domains such as wealth management, commercial banking, and fund distribution.

Why San Antonio?

San Antonio blends heavyweight financial anchors (USAA, Frost) with a strong cybersecurity and engineering talent pipeline from local universities—ideal conditions for building compliant, resilient financial platforms. Buyers here typically prioritize audit-ready delivery, dependable integrations, predictable release cadence, and measurable outcomes across onboarding, payments, and risk.

We vetted San Antonio–based or San Antonio–market teams that actually ship. Each firm below has a verifiable regional presence and/or a body of financial-services work.

Top 10 Financial Development Companies (2025 Rankings):

1) Itexus

Presence: U.S. delivery teams serving Texas and nationwide programs.

Core services: Custom fintech & banking apps, digital wallets, open-finance APIs, payment gateway integration, AI features.

Company overview:

Itexus is a fintech software development partner (est. 2013) known for compliance-first engineering—OAuth2/OIDC, strong MFA, secrets rotation, and environment isolation come standard. The team publishes detailed service pages and case studies (mobile banking, e-wallets, payments), giving buyers clear scope and security posture before kickoff. Typical tracks include onboarding/KYC, account linking, P2P and merchant payments, card issuing, and disputes with proven patterns for consent, idempotency, and reconciliation. Cross-functional squads (PM/BA, solution architect, FE/BE, QA, DevOps) work through CI/CD with IaC and contract tests at provider edges; post-launch, SRE runbooks, observability, and incident procedures help stabilize growth.

2) Accenture

San Antonio presence: Active metro presence listed in U.S. locations and local directories.

Core services: Core modernization, digital channels, data/AI, fraud/risk.

Company overview:

Accenture runs multi-stream banking programs with cloud landing zones, policy-as-code, and rigorous program controls—well-suited to large banks and credit unions consolidating complex vendor ecosystems. Expect reference architectures, structured governance, and risk management practices that scale across lines of business.

3) Deloitte

San Antonio presence: Dedicated San Antonio office and regional business listings.

Core services: Digital banking transformation, finance & risk, data platforms, cloud.

Company overview:

Deloitte fields multidisciplinary squads across product, data, cyber, and regulatory, paired with executive reporting and PMO rigor. Strong fit when platform modernization must stay tightly aligned with audit evidence and enterprise control frameworks.

4) KPMG

San Antonio presence: Official office and chamber listings in the metro.

Core services: FS regulatory & compliance modernization, data lineage, controls with delivery.

Company overview:

KPMG teams often include ex-regulators and bank technologists, emphasizing regulator-friendly evidence from day one. Frequently engaged to design control maps and data-lineage models while implementing change across platforms and processes (SOX/PCI).

5) PwC

San Antonio presence: Downtown office with recent expansion activity in the metro.

Core services: Banking & capital-markets tech and ops transformation, identity & consent, cloud/data.

Company overview:

PwC emphasizes measurable outcomes and executive dashboards, often stewarding complex integrations (KYC, payment gateways, data aggregators) without sacrificing time-to-launch. Expect defined KPIs, PMO cadence, and strong stakeholder alignment.

6) EY

San Antonio presence: Confirmed downtown addresses in the urban core.

Core services: Banking & capital markets technology, wealth/asset management, core-banking transformation.

Company overview:

EY blends delivery with tax/assurance and regulatory expertise—useful where model risk, data governance, and platform controls intersect with engineering. Regional teams bring sector playbooks for modernization across wealth and retail/commercial banking.

7) Booz Allen Hamilton

San Antonio presence: Official office downtown and regional listings.

Core services: Cyber engineering, AI/ML, cloud—adjacent to FS needs in fraud, security operations, and data protection.

Company overview:

Booz Allen’s San Antonio teams focus on high-assurance systems and applied AI, making them relevant for institutions elevating security posture while scaling digital channels. They’re a strong option when analytics and cyber maturity must advance alongside product delivery.

8) CGI

San Antonio presence: Local office with long-standing U.S. delivery footprint.

Core services: Banking platforms, payment modernization, managed services/operations.

Company overview:

CGI mixes local delivery with global scale—fit for institutions standardizing platforms and seeking 24/7 run support with SLAs. Mature incident-management and service-continuity practices are a plus for audited environments.

9) Rackspace Technology (Professional Services)

San Antonio presence: Headquarters in the metro.

Core services: Multicloud engineering (AWS/Azure/GCP), security, SRE/ops; advisory and implementation for regulated workloads.

Company overview:

Rackspace partners with financial institutions on migrations, reliability engineering, and cost optimization—useful when app modernization must align with security and audit constraints. Their operations heritage helps teams establish observability and uptime targets early.

Transition to the Vendor Matrix

With the shortlist established, the table below provides an at-a-glance comparison—local presence and core capabilities—so you can align each vendor to your launch priorities (onboarding, payments, open-finance APIs, compliance evidence, SRE). Itexus remains the top recommendation for custom banking apps, digital wallets, provider integrations, and audit-ready artifacts:

| Company | San Antonio Presence | Key Focus / Services |

|---|---|---|

| Itexus | Serves TX & U.S. programs (remote U.S. teams) | Custom fintech apps, wallets, open-finance APIs, payments, AI |

| Accenture | Active metro presence | Core modernization, channels, data/AI, fraud/risk |

| Deloitte | San Antonio office | Digital banking, finance & risk, cloud/data |

| KPMG | Official SA office | Regulatory/compliance, controls, data lineage |

| PwC | Downtown office (metro expansion) | Banking & capital-markets tech, identity/consent, cloud/data |

| EY | Downtown presence | Banking tech, wealth/asset, core-banking change |

| Booz Allen Hamilton | Downtown office | Cyber/AI/cloud for regulated workloads |

| CGI | Local office | Banking platforms, payments, managed services |

| Rackspace Technology | HQ in San Antonio | Multicloud engineering, security, SRE/ops |

How San Antonio Buyers Should Evaluate

Shortlist vendors that can show audit-ready evidence before the SOW—at minimum: a control map, key-management plan, environment-isolation diagram, data-flow maps, and contract-test suites at provider edges. Require explicit p95 latency and error-budget targets for onboarding and payments. Confirm incident SLAs tied to MTTR, dispute-cycle time, and rollback paths, and ask for examples of synthetic monitoring for core user journeys.

Conclusion

San Antonio offers the institutions, talent, and cost profile to ship audit-ready financial software on schedule. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus remains the first call. For broader transformations across cloud, data, and core systems, firms like Accenture, Deloitte, KPMG, PwC, EY, and platform partners CGI, Rackspace, CDW (Sirius) bring the governance and operating cadence to coordinate complex programs. Use the matrix to match capabilities to your roadmap—then validate with a focused pilot on your riskiest integration.