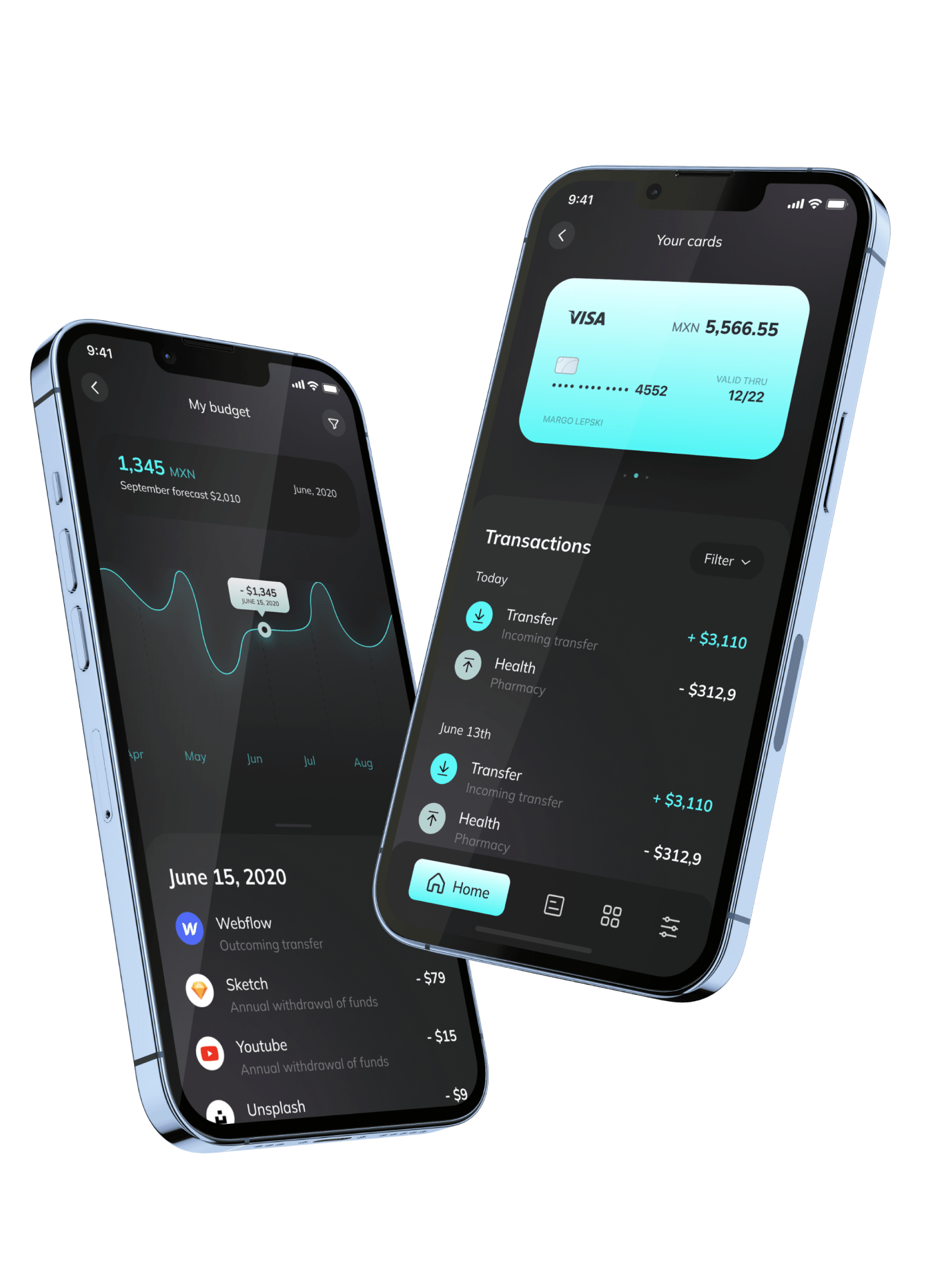

Mobile e-wallet application that lets users link their debit and credit cards to their accounts through banking partners, create e-wallets and virtual cards, and use them for money transfers, cash withdrawals, bills and online payments, etc.

New York is the proving ground for crypto exchange technology. Buyers need platforms that pass NYDFS checks, withstand peak load, and integrate fiat rails without drama.

This guide spotlights top crypto exchange development companies with real New York presence and production results.

You will see where each team excels across custody workflows, KYC/AML, matching engines, liquidity hookups, and incident response.

Itexus leads the list, followed by specialized providers you can benchmark in a one-week pilot before signing a master agreement.

1) Itexus — exchange builds with fintech-grade delivery

Founded: 2013.

HQ / Presence: USA; serves New York clients (U.S. office page lists Miami; New York programs delivered by U.S. team).

Team: 160+ engineers, majority senior.

Core services: Custom crypto exchange development, fintech software development, fintech app development, digital wallet development, banking app development, trading platform development, payment gateway integration, RegTech.

What buyers get:

- Security-by-design. OAuth2/OIDC, 2FA, key/secret rotation, segregated envs, signed audit trails. Outcome: fewer incidents and faster investigations.

- Release safety. Contract tests at all external edges (KYC, gateways, liquidity), feature flags, automated rollback. Outcome: fewer failed releases when providers change APIs.

- Markets and money flows. Matching logic, risk checks, withdrawal hold rules, fiat on/off-ramps, dispute evidence capture. Outcome: lower chargeback rate and cleaner reconciliations.

- Evidence pack. Risk register, data flows, control matrix for audits.

Good fit: You want a custom exchange or wallet with enterprise controls and a delivery team that ships artifacts, not slogans.

2) AlphaPoint

Founded: 2013.

New York address: 228 Park Ave S, Suite 75687, New York, NY 10003.

Core services: White-label CEX platforms, liquidity solutions, tokenization, admin consoles.

What buyers get:

- Fast launch. Prebuilt order books, custody connectors, KYC/AML modules. Outcome: shorter time-to-market with less custom code.

- Liquidity tooling. Routing and market-maker integrations. Outcome: tighter spreads and improved fill quality.

- Operations console. Fees, listings, support tools, and incident views. Outcome: faster ops with fewer tickets.

Good fit: You want an exchange live in months with a mature console and ongoing vendor support.

3) PixelPlex

Founded: 2007.

New York address: 520 W 28th St #31, New York, NY 10001.

Core services: Custom CEX/DEX/hybrid exchanges, smart contracts, custody workflows, audits.

What buyers get:

- Code ownership. Full-stack custom builds with on-chain logic where it belongs and off-chain services where speed is needed.

- Compliance plumbing. KYC/AML providers, sanctions checks, audit logs.

- Wallet UX. Mobile clients with biometric auth and device integrity checks.

Good fit: You need a New York team that writes and reviews the codebase end-to-end.

4) DataArt

Founded: 1997.

New York HQ: 475 Park Avenue South, 15th Floor, New York, NY 10016.

Core services: Financial software engineering, trading platforms, market data pipelines, digital wallets, fintech development.

What buyers get:

- Trading-grade engineering. OMS/EMS patterns, idempotent order handling, resilience under peak loads.

- Operational visibility. Synthetic user journeys for “Deposit → Trade → Withdraw,” SLOs, on-call rotations.

- Bank-friendly governance. Traceable change, access reviews, evidence for audits.

Good fit: Exchanges and brokers with capital-markets DNA and enterprise expectations.

5) EPAM

Founded: 1993.

NY presence: Office listing and NYC address (Seventh Avenue).

Core services: Enterprise trading platforms, data services, cloud migrations, security engineering.

What buyers get:

- Scale. Multi-team delivery, complex integrations, global follow-the-sun support.

- Controls. Policy-as-code, secrets management, zero-trust patterns.

- Risk-aware rollout. Canary releases, kill switches, automated rollbacks.

Good fit: Multi-stream programs that must integrate with bank systems and vendor stacks at once.

6) ConsenSys

Founded: 2014.

NY presence: ConsenSys lists NYC among global offices; public New York corporate records also show a Brooklyn address for ConsenSys Inc.

Core services: Wallet and on-chain components, institutional custody connectors, smart-contract engineering, audits via partner units.

What buyers get:

- On-chain expertise. Token standards, staking modules, settlement bridges.

- Ecosystem fit. MetaMask, Linea, Infura integrations when appropriate.

- Governance. Smart-contract release discipline, monitoring, and incident process.

Good fit: Hybrid exchanges and tokenized asset projects that require deep Ethereum knowledge.

7) Devexperts (DXtrade Crypto)

Founded: 2002.

NY metro presence: U.S. office in Jersey City (Harborside, Plaza Five), serving New York clients across the river.

Core services: DXtrade Crypto platform, brokerage solutions, risk tools, market data.

What buyers get:

- Institutional workflows. Pre-trade risk, account states, throttling, and cancel-on-disconnect.

- Market data discipline. Normalization, replay, drop detection.

- Ops playbooks. Incident runbooks and MTTR reporting.

Good fit: Brokerages and exchanges that need trading-grade UX and operations.

Comparison Table (New York Focus)

| Company | NY Presence | Primary Fit | Key Strengths | Typical Add-ons |

|---|---|---|---|---|

| Itexus | Serves NY from U.S. office | Custom exchanges and wallets | Contract-tested integrations, audit evidence, payment gateway integration | Mobile apps, fintech app development, banking app development |

| AlphaPoint | NYC HQ | White-label CEX builds | Liquidity tooling, admin console, fast launch | Tokenization modules, fiat rails |

| PixelPlex | NYC HQ | Custom CEX/DEX builds | Full code ownership, smart-contract depth | Custody flows, audits |

| DataArt | NYC HQ | Enterprise exchange + capital markets | OMS/EMS patterns, SLOs, on-call, compliance | Market data pipelines, digital wallet development |

| EPAM | NYC office | Large multi-stream programs | Scale, platform engineering, security | Cloud migration, observability |

| ConsenSys (PS) | NYC office in ecosystem | Ethereum-centric builds | Wallet stack, smart-contracts, ecosystem services | Audit partners, staking |

| Devexperts | NYC metro (Jersey City) | Brokerage-grade platforms | DXtrade Crypto, risk, market data | OMS integrations, reporting |

Note: All these companies provide cryptocurrency exchange development services along with related blockchain, wallet, and DeFi solutions. Team sizes are approximate, and key focus areas are summarized for clarity.

New York rewards teams that ship real exchanges with audit-ready controls. Reduce risk with a one-week pilot on the riskiest integration and demand artifacts before the SOW: 23 NYCRR 500 control map, key-management plan, contract tests, and synthetic monitoring.

Keep Itexus at the top of your shortlist for custom exchange builds that combine provider integrations, release safety, and evidence you can show to auditors. Book a discovery call, define acceptance criteria, and green-light the build only after the pilot hits the agreed metrics.