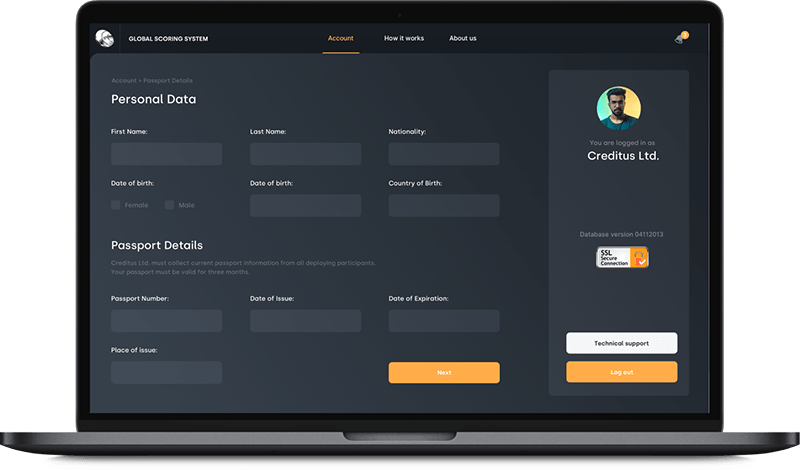

The system is a SaaS platform allowing the client to evaluate solvency and reliability of the potential borrowers using statistical methods of analysis of the historical and nontraditional data sources such as social network profiles and others. It allows the client to upload his normalized and anonymized database of previous loans data, build mathematical models and calculate the credit score of the future potential borrowers entering their data through the system’s web interface.

Looking for a partner to build a banking app, a digital wallet, or a trading platform in Chicago?

You’re in the right market. Chicago blends deep finance roots with practical engineering. Buyers here care about security, traceability, and uptime. They also expect clean payment gateway integration and open finance APIs that survive real audits.

First, the CFPB finalized the Personal Financial Data Right rule, often called open banking. Banks and fintechs must provide secure consumer-permissioned data access and follow defined third-party obligations. That makes API quality, consent flows, and audit trails non-negotiable.

Second, ACH keeps growing. Same Day ACH crossed the one-billion-payments mark in 2024. Capacity planning and exception handling now sit in the core backlog, not at the edges.

Chicago’s top financial development companies

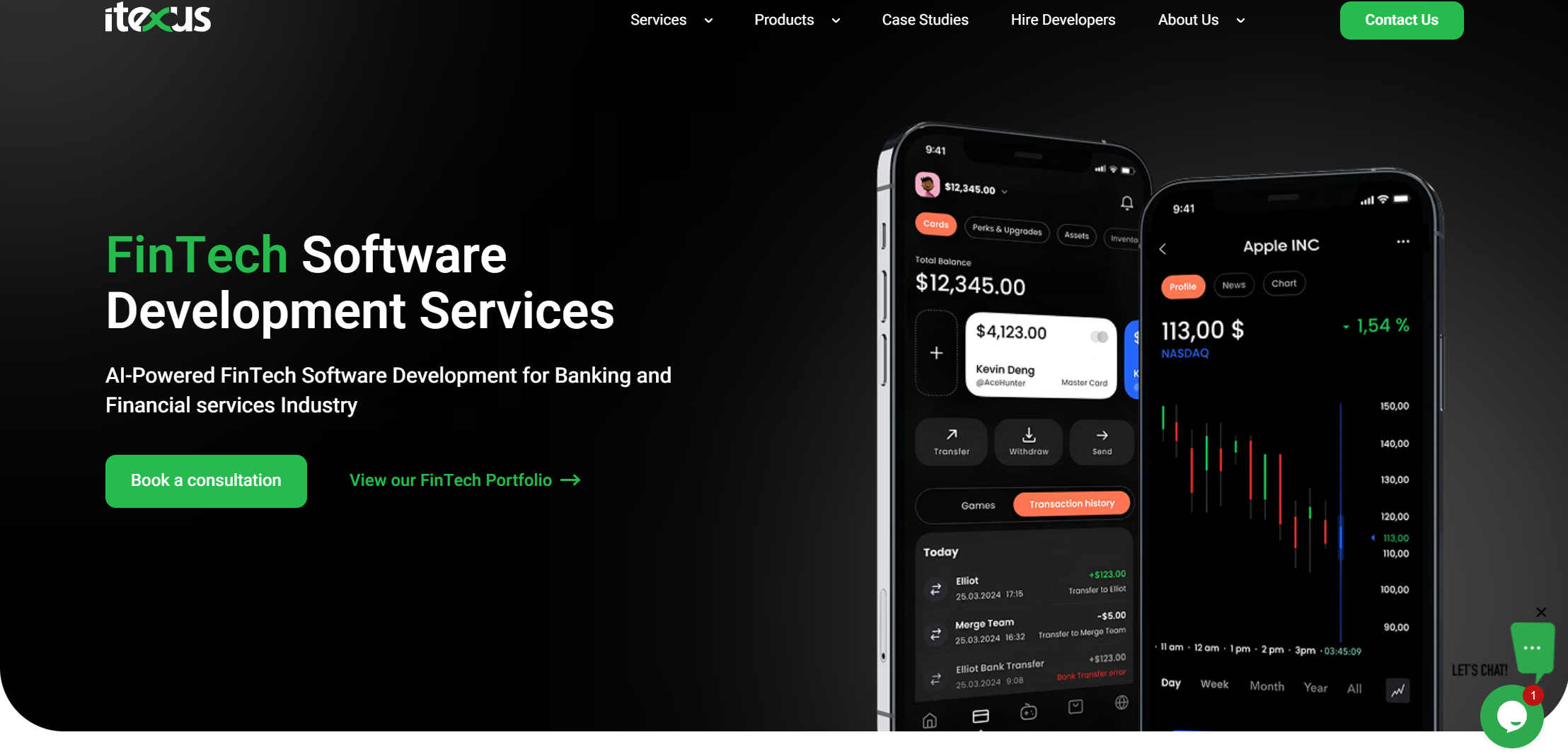

1) Itexus — first call for custom fintech and wallet builds

Founded: 2013.

U.S. presence: Miami office; U.S. team delivers programs nationwide, including Chicago-focused work.

Core services: Fintech software development, fintech app development, digital wallet development, banking app development, trading platform development, payment gateway integration, and API/RegTech consulting.

What buyers get:

Security by design. OAuth2/OIDC, MFA, environment segregation, key and secret rotation, and signed audit logs. Outcome: clear forensics when something trips.

Release safety. Contract tests on KYC, payments, and data aggregators. Feature flags and automatic rollbacks. Outcome: fewer broken releases when providers change APIs.

Money flows. Card linking, virtual cards, ACH and card rails, disputes, and reconciliation trails. Outcome: cleaner books and fewer support escalations.

Proof you can check:

A Mobile E-Wallet Application with card linking through banking partners, virtual cards, transfers, cash withdrawals, bills, and online payments. Outcome: real wallet behavior under production constraints.

A focused API integration practice for open finance APIs and payments (Plaid, Yodlee, Stripe, Adyen, Bloomberg, and others). Outcome: adapters that survive change.

Best fit:

Custom fintech development where you need governance, traceability, and delivery artifacts you can hand to auditors.

2) TXI — wallet-style experiences and data-led products

Chicago presence. 10 S Riverside Plaza, Chicago.

Core services. Digital wallet development, fintech app development, open finance APIs, payment gateway integration, product analytics.

Primary strengths. TXI ships wallet-style applications and NFC use cases; its public case shows a mobile wallet platform designed for high-traffic venues and merchants.

Ideal fit. Banking app development or loyalty/wallet initiatives that must capture events, handle offline states, and scale under load.

3) 8th Light — Platform engineering for regulated products

Chicago presence. Headquarters at 25 E Washington St, #1500.

Core services. Fintech software development, platform refactoring, continuous delivery, API modernization.

Primary strengths. Long-running enterprise programs; reference work with Fidelity Life highlights multi-app orchestration and durable delivery habits.

Ideal fit. Fintech development where you need incremental change without service disruption.

4) Forte Group — Delivery governance for finance builds

Chicago presence. 222 S Riverside Plaza, Suite 2800.

Core services. Banking app development, fintech app development, QA engineering, trading platform development.

Primary strengths. Documented financial-services programs including OppFi; teams are set up for multi-stream releases and measurable acceptance criteria.

Ideal fit. Mid-to-large programs that require tight release control and auditable change history.

5) Highland — Open finance and embedded finance, done pragmatically

Chicago presence. 125 S Clark St, Suite 670 (City of Chicago license record).

Core services. Open finance APIs, embedded finance integrations, fintech development, customer experience design.

Primary strengths. Interoperability across aggregators, clear consent flows, and integration patterns that support embedded payments.

Ideal fit. New digital products or re-platforming work that depend on multiple providers and audit-ready data sharing.

6) Codal — Fintech UX and front-end delivery with Chicago scale

Chicago presence. HQ in the Old Post Office, 433 W Van Buren St.

Core services. Fintech app development, UX design, design systems, experimentation, product strategy.

Primary strengths. Strong focus on onboarding, microcopy, and metrics; fintech UX insights publicly shared by the team.

Ideal fit. Banking app development and wealth/lending portals that need conversion-oriented UX and a clean front-end rebuild.

7) SPR — Platform and API programs for financial services

Chicago presence. Willis Tower, 233 S Wacker Dr, Suite 3500.

Core services. Fintech software development, API platforms, cloud and data, payment gateway integration; financial-services practice.

Primary strengths. Architecture with SLOs, observability, and infrastructure-as-code that supports regulated releases.

Ideal fit. Modernization and API-first roadmaps where reliability and auditability are non-negotiable.

8) Slalom Build — Scale for bank-grade engineering

Chicago presence. Aon Center, 200 E Randolph St, Suite 3700 (local listings); active Chicago practice.

Core services. Product engineering, platform engineering, data/AI for financial services; trading platform development support.

Primary strengths. Published work with the Federal Home Loan Bank of Chicago on underwriting and eBanking modernization tied to same-day funding.

Ideal fit. Enterprise programs with multiple vendors, clear security baselines, and staged rollouts.

10) Red Foundry — Mobile-first delivery with Chicago DNA

Chicago presence. Chicago-based mobile development studio.

Core services. Banking app development, digital wallet development, iOS/Android native and cross-platform builds, app store release management.

Primary strengths. Mobile-only focus, with discovery/design through launch and post-launch hardening.

Ideal fit. Mobile e-wallets and banking apps that need a clear runway to TestFlight/Play and controlled iterations.