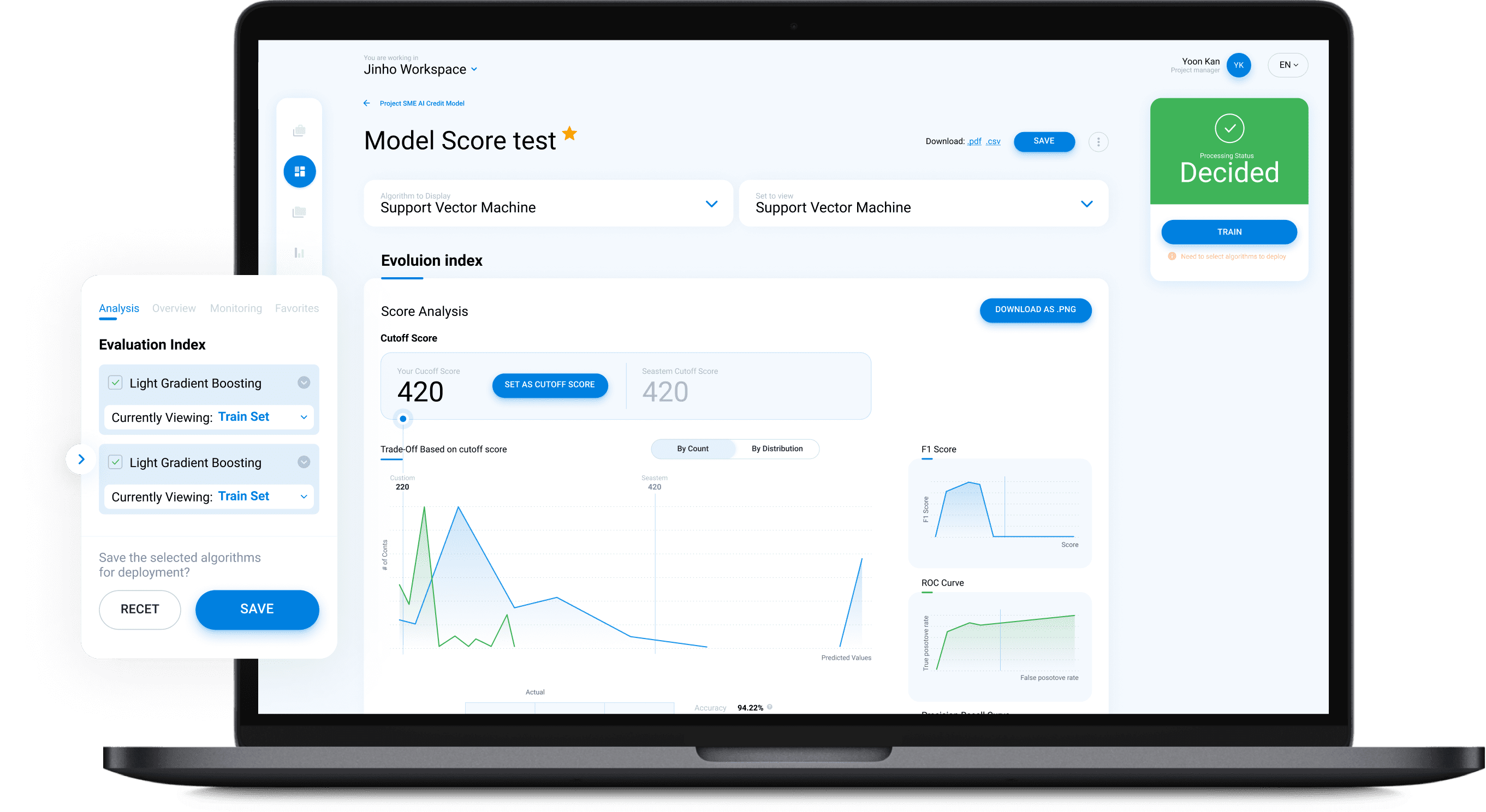

A web app for people working in the financial sector to create analytical models. The app uses AI-based predictive modules reflecting the credit cycles to automate decision-making in Finance. Unlike the traditional statistical approach when making one analytic model takes 2-3 months, the application enables users to build, test, and deploy multiple predictive financial models within just a few clicks.

Ohio’s financial sector runs on real software: banks and credit unions in Columbus, Cleveland, and Cincinnati need compliant systems that plug into payment rails, core banking, and analytics stacks—without blowing SLAs. Below is a pragmatic shortlist of partners with verified Ohio presence and a track record of building or modernizing regulated digital products.

1) Itexus

Company overview:

Itexus specializes in compliance-first product engineering for financial institutions and fintechs—tying product discovery to audit-ready delivery. Teams design for secure identity, consent, and data lineage from day one, then validate integrations with contract tests and monitoring to keep error budgets green post-launch. The firm’s build style favors modular architectures (feature flags, blue/green, rollback paths) so banks can ship incrementally without sacrificing control evidence. Programs typically include PCI DSS–aligned practices, SOC 2–ready logging, and explicit p95 latency/availability targets for money-movement journeys. Itexus also shares control maps, risk registers, and incident runbooks presale to shorten security/compliance reviews and accelerate time to GA.

2) Slalom (Columbus)

Company overview:

Slalom fields product, data, and engineering squads that ship measurable outcomes—defining acceptance criteria up front and instrumenting MTTR, funnel completion, and uptime after go-live. Local teams stand up cloud landing zones and analytics accelerators (AWS/Azure) quickly, and they coach operating models/FinOps so internal squads can sustain velocity and cost guardrails after handoff.

3) Centric Consulting (Ohio HQ)

Company overview:

Centric’s Ohio roots make it a fit for regional banks and credit unions; they blend business consulting with engineering to align roadmaps, controls, and delivery cadence. Expect clear API standards, data-governance playbooks, and change-management frameworks (RACI/OKRs) that keep multi-squad programs coordinated.

4) Perficient (Columbus & Cincinnati)

Company overview:

Perficient pairs financial-services patterns with strong engineering scale, useful when you need both feature work and heavy integration with cores or martech stacks. They favor composable architectures and maintain connectors/testing patterns for payments, KYC/AML, and identity—plus CX analytics to prove funnel lift post-launch.

5) Ascendum Solutions (Cincinnati/Blue Ash)

Company overview:

Ascendum is an Ohio-headquartered technology consultancy that delivers end-to-end fintech products—from architecture and API design to UX and mobile/web development. Teams pair secure-by-default engineering with deep integration experience across payment gateways, core banking platforms, and identity/KYC providers. Engagements emphasize compliance evidence, observability, and performance budgets so launches meet audit and reliability targets. A strong fit for banks, insurers, and payments providers seeking a locally anchored partner with enterprise delivery discipline.

6) Improving (Columbus)

Company overview:

Improving helps financial teams modernize safely—codifying pipelines, secrets, and observability so product teams can ship faster without losing control. They coach TDD and trunk-based development, weave SAST/DAST and dependency scanning into CI/CD, and track DORA metrics to make reliability gains visible.

7) CGI (Cleveland & Columbus)

Company overview:

CGI is a long-time banking partner with global accelerators; good for multivendor programs that need integration depth plus governance. Offerings often include 24/7 managed services with SLAs, DR targets, and payments modernization (RTP/ISO 20022) delivered alongside platform controls.

8) SEI — Systems Evolution, Inc. (Cincinnati)

Company overview:

Employee-owned and local-first, SEI assembles compact senior teams that own outcomes—from shaping backlog and KPIs to landing change across operations. They emphasize executive-ready dashboards and pragmatic org change so new capabilities stick after go-live.

9) Sogeti (Capgemini) — Columbus & Cincinnati

Company overview:

Sogeti blends local staffing with Capgemini assets, useful when you need both velocity (testing, automation) and access to global frameworks. Strengths include large-scale test automation, synthetic data strategies, and API quality gates that keep regulated releases predictable.

10) Mutually Human (Columbus)

Company overview:

Boutique product engineers with a human-centered process; solid for greenfield portals, claims/servicing tools, and modernization of legacy workflows. Discovery sprints, lightweight CI/CD templates, and tight PM–engineering loops help early teams move fast without accumulating crippling tech debt.

From top picks to a comparison table

Shortlist 2–3 partners that match your risk profile and integration surface, then run a tight pilot around your highest-risk flow (e.g., onboarding + account linking + payment authorization). Use the table below to align presence and strengths with your roadmap.

| Company | Headquarters / Ohio presence | Key focus / services |

|---|---|---|

| Itexus | Serves Ohio market | Custom banking apps, wallets, open-finance APIs, payment integrations |

| Slalom | Columbus office | Digital channels, data platforms, fraud/risk analytics |

| Centric Consulting | Ohio-founded; Cincinnati/Cleveland/Columbus | Core & cloud modernization, data & AI, governance |

| Perficient | Columbus & Cincinnati | API platforms, identity/consent, analytics |

| Ascendum Solutions | Cincinnati/Blue Ash | Custom software for financial services, integrations, product & design-led engineering. |

| Improving | Columbus | Cloud-native engineering, DevOps/SRE, secure SDLC |

| CGI | Cleveland & Columbus | Payments & core modernization, AML/KYC ops tech |

| SEI (Systems Evolution) | Cincinnati | Product leadership, data & integration delivery |

| Sogeti (Capgemini) | Columbus & Cincinnati | QA at scale, cloud/API, data/AI |

| Mutually Human | Columbus | Custom apps, automation, UX-driven delivery |

How Ohio buyers should evaluate:

- Ask for audit-ready evidence before the SOW: control map, key-management plan, environment-isolation diagram, data-flow maps, and contract-test suites at provider edges.

- Set explicit reliability targets: p95 latency and error-budget objectives on onboarding and payments; incident SLAs tied to MTTR and dispute-cycle time.

- Prove the riskiest integration first: run a one-week pilot that exercises identity, consent, and money movement end-to-end with synthetic monitoring.

Conclusion

Ohio combines financial institutions, engineering talent, and pragmatic cost structures that let teams ship compliant, customer-grade software on schedule. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus is a strong first call. For broader transformations across cloud, data, and core systems, firms like Slalom, Centric, Perficient, CGI, Sogeti, and locally anchored boutiques (SEI, Improving, WillowTree, Mutually Human) provide the governance and delivery muscle to coordinate complex programs. Use the shortlist and matrix to match capabilities to your roadmap—then de-risk with a focused pilot.