Just imagine—a whole generation has started their financial journey from mobile apps, skipping issuing a debit bank card. Over two billion people are using payment apps, and every month another million join their ranks.

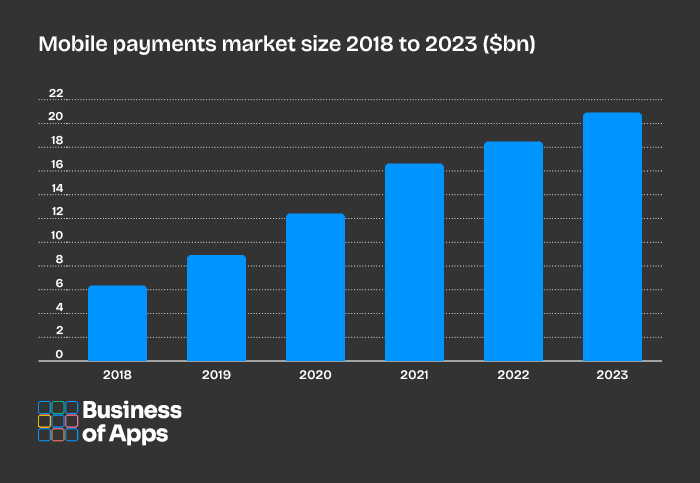

In its 2024 report, Business of Apps revealed the growth of the mobile payments market size. The numbers speak for themselves:

Source: Business of Apps

Though payment app adoption varies by region, the overall trend is clear: payment apps have found a solid market fit and fundamentally changed how people manage their finances. Large financial institutions and corporations looking to capitalize on this trend often turn to enterprise mobile application development services to build secure, scalable payment solutions that can handle high transaction volumes and meet strict regulatory compliance requirements. This shift offers countless opportunities to those exploring payment app development.

Whatever your reason for exploring this space, our guide answers all questions you might have about mobile payment app development. Keep reading to learn all you need to know about payment apps types, key technologies powering finance app development, step-by-step development process, and more.

What types of payment apps are there?

There are two ways to categorize payment apps: by transaction model (who is sending and receiving money) and by core functionality (what the app is designed to do). While most modern apps don’t stick to just one category as they’re constantly introducing new features to stay competitive, these classifications help to grasp the key differences.

Payment app types by transaction model

- P2P payment apps. Let users send money directly to each other—think of Venmo, Cash App, or Zelle. They enable quick and simple transfer of funds and come in handy when people need to split a bill, pay the rent, send money to relatives, and so on. P2P apps usually earn by charging a small fee per transfer or offering some premium features.

- B2C solutions. Handle transactions between consumers and merchants (e.g., Stripe and PayPal). Businesses of all kinds and sizes love them for easy checkout flow for consumers, security, and the ability to integrate with the software they already use.

- B2B solutions. Powerful platforms are designed for businesses to move money across borders, pay suppliers, deal with invoices, and handle all other types of financial operations.

Payment app types by their core functionality

- Mobile wallets: Apple Pay, Google Pay, Samsung Pay

- Online payment gateways: Stripe, PayPal, Adyen

- P2P payment apps: Venmo, Zelle, Cash App

- POS systems: Square, Clover, Toast

- Digital banking apps: Chime, Revolut, N26

- Crypto wallets & payments: MetaMask, Coinbase, Binance Pay

- Cross-border payment solutions: Wise, Payoneer, Airwallex

What makes a good payment app: core and advanced features

Must-have features

Regardless of the type, the following is the basic functionality for any payment app.

User registration & authentication

A good app strikes the balance between simple registration and security. Hence, you should make the sign-up process as simple and straightforward as possible, but also secure—for example, by adding two-factor authentication (2FA).

KYC

Without KYC, your app won’t be able to legally operate in the financial sector.

Profile management

Users should be able to add and update personal details, manage linked cards, and configure settings (e.g., changing contact information, setting transaction limits, etc.).

Easy card & bank account linking

Users expect one-tap linking to bank accounts, credit/debit cards, and e-wallets they already use.

Money transfers

The most common money transfer/receive options are:

- P2P transfers

- Bank-to-bank transfers by phone, card, and account number

- Cross-border payments with currency conversion

This also covers account top-ups through various methods.

Push notifications

Users shouldn’t be left guessing whether a transaction went through. Smart notifications are the best approach as they keep users informed without feeling pushy and spamming.

Admin panel

The admin panel must feature secure authentication with role-based access. It also should include user management KYC/AML, account status updates, and real-time transaction monitoring features.

Advanced features

Cashback & rewards

Users love earning something back. Cashback, referral bonuses, or rewards for using the app (e.g., for processing a specific amount during a month or a week) can be a deciding factor when users choose between similar payment apps.

Spending analytics & budgeting

Give users a dashboard with categorized transactions and spending analytics. Taking AI’s growing adoption into account, you may also want to consider adding AI-powered features to bring even more value.

Real-time transaction monitoring

Include real-time transaction monitoring to detect fraud, flag suspicious activity, and notify users of critical account actions.

Bill payments

Let your users manage their utility bills, subscriptions, loans, and other recurring payments right in the app.

Sub-account creation and management

This feature will come in handy for families enabling them to share wallets and expenses, set allowances and spending limits for family members, and keep complete visibility into minors’ spending.

QR payments support

Your app should support sending and receiving transfers by QR codes. This feature is widely used for P2P transfers, in-store purchases, bill payments, etc.

Cryptocurrency support

Love it or hate it, crypto is here to stay. Future-proof your app and allow users to buy, store, and send crypto along with fiat transactions.

At Itexus, we’ve built a PCI DSS-compliant cryptocurrency wallet ecosystem for Coinstar, a global fintech company with $2.2 billion in annual revenue. The system includes web and mobile crypto wallets, embedded kiosk software, and a cloud-based API server, allowing users to trade over 50 digital assets, make crypto payments, and link bank accounts for fiat-to-crypto conversions.

↘ Click here to read the full story.

Additional financial products

Depending on your target audience, you may want to consider adding extra financial products to your app. These could be loans, insurance, discounts from partners, etc.

Mobile payment app development: step-by-step process

Step 1. Conduct market research and define your target audience

Technical requirements for payment P2P app development differ from those for a B2B payment gateway or a crypto wallet. Therefore, before taking any step toward app development, you need to answer these questions:

- Who are your users?

- What problem does your app solve? Does this problem really exist?

- What markets are you targeting?

- How will you monetize your app?

Answers to these questions will shape your app’s architecture, functionality, and revenue model.

Step 2. Design and prototype the app

Gone are the days when users would tolerate poor UX for the sake of exclusive functionality. Today, the smallest friction like an extra tap or inconveniently placed button increases drop-off rates. Prototype first to ensure a seamless user journey and avoid expensive fixes after the app is rolled out.

What you need to consider at this stage:

- Onboarding flow. How do users sign up? How do you make the app both safe and easy to use?

- Transaction flows. What steps do users take to send/request money?

- Edge cases. What if a user sends the wrong amount, their card is declined, etc.? Try to cover all possible scenarios.

Step 3. Select the technology stack

There’s no perfect technology stack—the choice depends on factors like features set, scalability and security requirements, budget, etc. That said, based on our experience in fintech software development, here are some of the technologies we frequently use for payment app development:

| Frontend | Native (Swift/Kotlin); Flutter and Kotlin Multiplatform Mobile,); React Native |

| Backend | Node.js, Python (Django), .NET, Java, Ruby on Rails |

| Databases | PostgreSQL, MySQL, Microsoft SQL Server, MongoDB |

| Payment APIs & integrations | Stripe, PayPal, Square, Plaid, Adyen, Braintree, Payoneer |

| KYC/KYB & AML providers | Veratad, ShuftiPro, Alloy, Iovation |

| Cloud & hosting | AWS, Azure, Google Cloud |

If you need a solid base for building a secure and scalable payment app—you’re good to go with a combination of the above-mentioned technologies. For a more detailed breakdown of technologies and third parties, explore the section “Technologies behind payment apps”.

Step 4. Build an MVP

Developing an MVP, you should focus on core functionality while keeping the architecture flexible and scalable for upcoming features. Here is what you’ll need for a sufficient MVP:

- Secure authentication (OAuth, biometric login, 2FA)

- KYC verification to comply with regulations and prevent fraud

- Basic fund transfers (bank/card transactions, P2P payments)

- Scalable API architecture (RESTful)

Advanced features like spending analytics, loyalty rewards, and crypto integration can be added later (unless you’re building a crypto-first or crypto-only app). The goal is to validate the app fit and core functionality in real-world conditions before scaling.

Step 5. Ensure security & KYC/AML compliance

The mobile payments market is heavily regulated. The specific rules vary by region and local laws, but the general requirements your app should comply with are:

- KYC: a complete KYC process typically includes ID verification, liveness detection, proof of address, sanctions & PEP screening, and risk assessment

- AML: monitoring transactions, flagging suspicious activity, and reporting to regulatory bodies

- GDPR / CCPA: data privacy laws, especially critical in the EU and the US

Note: if you’re planning to build a custom gateway, you must also comply with the PCI DSS set of policies (PSD2 & SCA for the EU). This requirement does not apply if you’re integrating a provider like Plaid and only processing tokenized data.

As for security, common requirements include:

- Protecting stored cardholder data (encryption, tokenization)

- Implementing access control (role-based access)

- Regular vulnerability testing (penetration testing, code audits)

- Monitoring and logging all access to sensitive data

💡 More information about payment app security you’ll find in the “Security measures for payment apps” section below.

Step 6. Test

The fact that your app is going to access people’s money and sensitive data leaves no room for bugs and errors. A minor issue can cause security breaches, messed up transactions, or heavy penalties. You’ll have to test every aspect of the app to ensure everything works as expected:

- Unit testing: covers individual components to detect issues early in development

- Functional testing: checking every transaction type and payment method

- Performance testing under peak loads

- Security testing: penetration testing, API security, encrypted data storage validation

- Usability testing: A/B testing on sign-up, onboarding, payment flows, etc.

- Automated regression testing: service-level and UI tests run after every code change as part of the CI/CD pipeline to prevent updates from breaking existing functionality

Step 7: Deploy the app and establish ongoing maintenance

Online payment transfer app development is not something you can finish once and for all. Even after launch, you’ll need to constantly monitor the app’s performance, introduce timely updates, and regularly conduct security checks. Here’s your plan for successful deployment and maintenance:

- Cloud deployment: AWS, GCP, or Azure with auto-scaling

- CI/CD pipelines: automate deployments to reduce downtime

- Fraud monitoring: AI-driven fraud detection & chargeback management

- Regular security audits: compliance checks, security patches, and penetration testing

Technologies behind payment apps

Let’s explore some of the most widely used technologies that power modern payment applications.

Programming languages

Frontend: Native (Swift/Kotlin), Flutter, React Native

Backend: Node.js, Python (Django), .NET, Ruby on Rails, Java

Swift for iOS and .NETNode.js for the backend were our technologies of choice for a mobile banking app for migrants. The app enables users to send money abroad, access early paychecks, and receive microloans, combining speed, compliance, and scalability.

↘ Click here to read the full story

When to choose cross-platform vs. native development?

The decision between native and cross-platform development depends on the app’s complexity, security requirements, and long-term scalability.

- Choose native development if your app requires deep OS integration, top-tier security, or high-performance processing (e.g., Apple Pay, Google Pay, Secure Enclave, HSM-based encryption). Serious, long-term projects—especially in fintech—demand the stability, reliability, and optimization that only native development can provide.

- Use cross-platform frameworks when you need faster time-to-market, reduced costs, and shared code across platforms. This approach works well for MVPs, simple apps, or non-critical financial tools, but it comes with trade-offs in security, performance, and flexibility.

💡 At Itexus, we recommend native development for fintech projects. It aligns with Google and Apple’s best practices and ensures better UX, performance, and security, plus, native apps perform better in ASO (App Store Optimization) and are more visible in stores’ rankings.

However, cross-platform development can work out for MVPs, simple apps, or projects with fewer security concerns. One risk to consider is long-term support—some cross-platform technologies lose popularity over time, and finding specialists for maintenance becomes difficult to impossible. For example, Xamarin , supported by Microsoft, was once widely used and promoted by Microsoft, is no longer supported, but is now obsolete, and companies with products written with this technology have to deal with costly migration.

Databases

Transaction volume, existing infrastructure, and security requirements define the choice of the database. Some of the suitable options are PostgreSQL, Microsoft SQL Server, MySQL, and MongoDB.

Payment gateways and APIs

A payment gateway authorizes and processes transactions, acting as an intermediary between users, banks, and merchants. Choose the right provider wisely as it will directly affect your app’s functionality and performance. Here are the most popular solutions:

- Stripe—RESTful API, supports ACH, credit cards, digital wallets, and crypto. Built-in machine learning for fraud prevention

- PayPal—extensive global reach, adaptive payments, subscription handling, and peer-to-peer transactions

- Square—ideal for SMBs, integrates with POS systems, supports contactless payments (NFC, Apple Pay, Google Pay)

- Adyen—multi-currency processing, real-time risk management, and API-first architecture

- Braintree—tokenization, recurring billing, and vault storage for PCI DSS compliance

💡 Expert tip. When choosing a payment gateway, consider latency and transaction speed, as slow API response times can impact high-frequency payment processing. Features like 3D Secure, dynamic CVV, and risk-scoring algorithms help prevent fraud and unauthorized transactions. Your provider of choice must also support GDPR, PSD2, and AML/KYC frameworks to ensure legal compliance and security.

Blockchain for secure transactions

Blockchain adoption in payments is driven by:

- Cryptocurrency payments—Bitcoin, Ethereum, and stablecoins (USDC, USDT) provide lower transaction fees and cross-border capabilities

- Smart contracts—automate payment conditions, reducing counterparty risk (Ethereum, Solana, Hyperledger)

- Zero-Knowledge Proofs (ZKPs)—used for privacy-preserving transactions in payment networks

- Lightning Network—layer-2 scaling solution for Bitcoin, enabling instant micropayments with minimal fees

Key considerations:

- Transaction speed—Ethereum Layer-1 is slow (~15 TPS), while Solana, Polygon, or Layer-2 solutions scale to thousands of TPS

- Security & compliance—non-custodial wallets bypass KYC/AML but can introduce regulatory risk

- Integration challenges—Web3 wallets (MetaMask, Phantom) require additional SDKs and infrastructure (Infura, Alchemy)

AI and ML: fraud detection & personalization

Fraud detection & risk scoring:

- Supervised learning models: train models on historical fraud data to detect anomalies in transaction patterns

- Behavioral biometrics: AI-driven fraud detection using keystroke dynamics, device fingerprinting, and location tracking

- Adaptive authentication: ML-based risk analysis determines when to trigger multi-factor authentication (MFA) or step-up verification

Personalized payment experiences:

- Dynamic UI adaptation—AI adjusts payment workflows based on user behavior

- Spend prediction & budgeting—ML-driven insights help users track expenses

- Contextual offers & rewards—AI analyzes purchase history to provide targeted discounts

Security measures for payment apps

Security is invisible—until something goes wrong. Your payment app can be perfect in every way, but if it’s not secure, it’s dead on arrival: a single vulnerability can lead to fraud, data breaches, regulatory fines, and worst of all—a complete loss of user trust and your reputation. The key risks include man-in-the-middle attacks, credential stuffing & account takeover, payment fraud, and data breaches.

To eliminate these threats and protect user data and money, implement, among others, the following security measures:

- End-to-End Encryption (E2EE). All payment data must be encrypted at rest and in transit using industry-standard cryptographic protocols: TLS 1.3 + AES-256 Encryption, Perfect Forward Secrecy (PFS), and HSM (Hardware Security Modules).

- Tokenization for card details. Instead of storing card numbers (PAN), replace raw data with tokens. Popular methods are Network Tokenization (Visa, Mastercard, EMVCo) and Vaultless Tokenization.

- Secure authentication. To prevent unauthorized access and fraud, enable biometric authentication and MFA.

- Fraud prevention mechanisms. Implement ML-based fraud detection, behavioral biometrics, risk scoring models, and real-time transaction monitoring to identify anomalies, prevent unauthorized activity, and trigger additional verification when needed.

How much does it cost to develop a payment app?

An MVP with basic functionality will cost you around $80,000, while an enterprise-grade solution with advanced functionality and robust security measures will require up to $500,000 (or even more). Explore the table below to understand how different factors affect the final cost of your payment app.

| Factor | Impact on cost |

| Feature set | Basic P2P transactions are relatively cheap, while advanced features like AI-driven fraud detection, blockchain payments, and multi-currency support increase costs |

| Development team | Hiring an in-house team costs more, but offers long-term control, while outsourcing to a specialized fintech development company can be cost-effective |

| Platform choice | Native development (iOS & Android separately) is the best option for long-term projects prioritizing performance and security, though it’s more expensive than cross-platform solutions |

| Infrastructure & scalability | Cloud hosting (AWS, GCP) and high-availability systems add to long-term operational costs |

How to reduce payment app development costs?

- Build an MVP first to validate the market fit before investing too much effort and money.

- Leverage third-party payment APIs to handle various tasks without requiring a custom payment infrastructure.

- Focus on features that drive the most value. Sometimes, apps are getting overloaded with excessive, complex features that users don’t need. Researchers say that an average of 5% of software features are actively used, while 80% remain neglected or used rarely. Hence, focusing on core features driven by real users’ needs leads to a more cost-effective product.

- Automate security & compliance with AI-powered fraud detection, risk-scoring algorithms, KYC/AML verification, and real-time transaction monitoring to reduce operational costs while improving security.

In-house vs. outsourced development: what’s right for you?

Choosing between an in-house team and outsourcing depends on your long-term strategy, budget, and—more importantly—expertise in fintech development. Hiring an in-house team offers full control but comes with high fixed costs—higher salaries, sick leaves, hiring expenses, working infrastructure, and so on. In developed countries, these costs can be especially high—experienced developers at top tech companies like Google make up to $400,000+ per year, so hiring top talent can be financially challenging for businesses.

Beyond that, hiring costs add up. Hiring agencies in the US typically charge up to 30% of the candidate’s annual salary, meaning finding a developer alone will cost you tens of thousands of dollars. If you handle recruitment in-house, keep in mind that it may take months to find, interview, hire, and onboard seasoned specialists.

That said, outsourcing is often a more flexible and cost-effective option. A trusted fintech development partner with experience in building finance apps can deliver a secure, scalable payment solution within a reasonable price range.

Wrapping up on payment app development

The difference between a successful product and a wasted project comes down to who builds it. A trusted development partner will make smart decisions from day one—so you’re not playing catch-up after launch. That’s how we do it at Itexus.

We’ve been into custom fintech development since 2013, delivering secure, scalable, and compliant payment solutions. Our team includes seasoned engineers, DevOps, security specialists, designers, project managers, QA engineers, and business analysts—each with deep fintech experience. With a proven track record and global clients, we know how to build payment apps that perform, scale, and wow users.