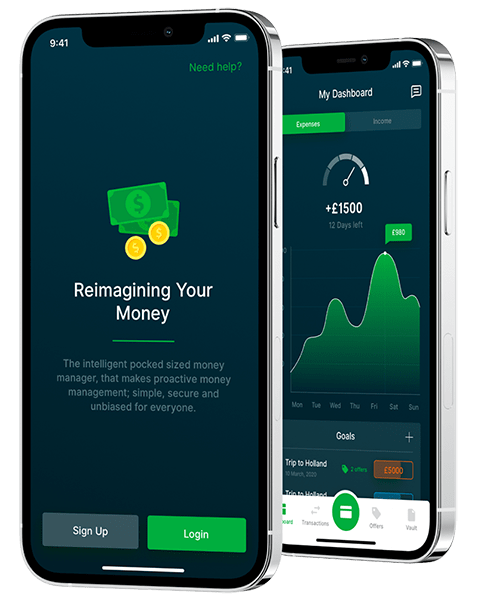

An intelligent money management system designed to help users make proactive and rational decisions on their finances.

Electronic payment services sit at the heart of modern commerce. They move money between buyers and sellers in seconds, connect cards and bank accounts to apps, and keep records regulators can audit. If you sell online, run subscriptions, or build a marketplace, you depend on them every day.

In the U.S., real-time rails are no longer theory. The Federal Reserve’s FedNow Service shows how instant clearing and settlement work for credit transfers, with posted fees, message flows, and cutoffs you can plan around. That’s a useful baseline for understanding speed, cost, and risk in electronic payments.

This article explains what these services are, how funds travel from a customer to your account, and where providers differ on fraud controls, chargebacks, and settlement timing. We’ll also touch on payment gateway integration, open finance APIs, and where fintech software development, digital wallet development, and banking app development fit into your stack.

Quick definition

An electronic payment service (EPS) is a set of software and network connections that:

- captures a payment request;

- routes it to the right network or bank;

Card rails (Visa/Mastercard), ACH, instant-payment rails (RTP/FedNow), and wires are the main highways in the U.S. Wallets, pay-by-bank, and BNPL sit on top of those highways.

Why this matters for product teams

Payments shape conversion, fraud loss, cash-flow timing, and support cost. A misstep here hurts revenue more than any single UX tweak. Teams building banking app development, trading platform development, or marketplace payouts need to know what each rail does, how long funds are locked, and who carries liability.

How electronic payments work (step by step)

A. Card transaction flow (in person or online)

- Capture. A POS terminal or checkout form encrypts card data and sends it to the gateway.

- Route. The gateway forwards to the processor/acquirer.

- Authorize. The processor hits the card network, which reaches the issuing bank for approval/decline.

- Clear & settle. At day’s end, approved authorizations are cleared and funds settle to the merchant account, typically T+1 or T+2.

- Dispute window. The transaction can still be charged back under network rules.

For an official description of the card transaction life cycle—authorization, clearing, and settlement—see Visa’s documentation.

Security note: Card payments that touch PAN data fall under PCI DSS requirements from the PCI Security Standards Council. Gateways often provide tokenization to scope down compliance.

B. ACH bank transfer flow (credits and debits)

- Instruction. The payer or payee authorizes an ACH debit or credit.

- Originator’s bank (ODFI). Batches the entry and submits to the ACH Operator.

- ACH Operator. Sorts and delivers to the receiver’s bank (RDFI).

- Posting. The receiving bank posts to the account. Settlement is batch-based, typically same day or next day with Same Day ACH windows.

Nacha’s rule set governs the ACH Network and its timing windows.

C. Instant payments (RTP and FedNow)

- Request. The payer’s bank sends a credit push through RTP or FedNow.

- Real-time posting. The receiver’s bank posts funds instantly, 24x7x365.

- Finality. Irrevocable once sent, so fraud controls must run before release.

Picking the right rail: speed, cost, and risk

| Rail | Typical speed | Direction | Common uses | Chargebacks? | Notes |

|---|---|---|---|---|---|

| Card (credit/debit) | Auth in seconds; funds settle T+1/T+2 | Pull (merchant-initiated) | eCommerce, POS | Yes | High acceptance; interchange + assessments; PCI DSS applies. |

| ACH | Same day to 1–2 days | Push or pull | Payroll, bill-pay, B2B | No card chargebacks, but ACH returns | Lower cost; governed by Nacha rules and return codes. |

| RTP | Seconds, final | Push | Invoices, payouts, bill-pay | No | 24/7 availability; request-for-payment features. |

| FedNow | Seconds, final | Push | Government, banks, businesses | No | Federal Reserve instant rail; banks connect via service providers. |

| Wire (Fedwire/CHIPS) | Minutes to hours | Push | High-value B2B, real estate | No | High fees; used where finality is critical. |

Where gateways, processors, and wallets fit

- Payment gateways expose checkout forms, tokenize card data, and hand off to processors.

- Processors / acquirers hold the merchant account and settle card funds.

- Pay-by-bank providers initiate ACH or instant payments via open finance APIs to bank accounts.

- Digital wallets (e.g., in-app wallets) store payment credentials and often move money on ACH or instant rails behind the scenes.

If you are scoping payment gateway integration in a new app, list the rails you must support, the countries you need on day one, and the dispute model your ops team can carry.

Security and compliance checklist

- PCI DSS for cardholder data. Use tokenization and network vaults to reduce scope.

- Nacha rules for ACH entries, returns, and Same Day windows.

- Network rules for chargebacks and dispute timeframes (see Visa/other networks).

- Instant payments require rigorous fraud screening before irrevocable push. RTP and FedNow documentation stress real-time risk controls.

Architecture patterns that work in 2026

If you are building fintech development or fintech app development projects, design payments as a product inside your product.

Build vs. buy: components for product teams

| Component | Build in-house if… | Buy/partner if… |

|---|---|---|

| Gateway & vault | You need fine-grained control over checkout UX across web and native, and you can handle PCI scope. | You want faster PCI compliance via hosted fields and existing vaults. |

| Acquiring / merchant account | You already have banking relationships and prefer to control interchange optimization. | You want quicker go-to-market with a processor that bundles underwriting and reporting. |

| Pay-by-bank (ACH/RTP/FedNow) | You have bank partners and can meet Nacha and instant-rail risk requirements. | You want one API that routes across ACH and instant rails with built-in risk tooling. |

| Wallet ledger | Your app holds balances, needs sub-accounts, and must support complex payout logic. | You prefer a managed ledger and focus on UX and growth. |

Pricing signals to watch

- Cards: interchange + assessments + processor markup. Settlement T+1/T+2. Higher acceptance, chargeback exposure.

- ACH: lowest network cost; watch NSF returns and timing for Same Day windows.

- RTP/FedNow: per-transaction fees vary by bank; value is cash-flow speed and irrevocability.

- Wires: high fixed fees; reserved for large, time-critical transfers.

Match the rail to the use case: instant disbursements and bill-pay thrive on RTP/FedNow; subscriptions and payroll often sit well on ACH; one-off retail tends to favor cards for conversion.

Where this connects to your build

If you are scoping digital wallet development or banking app development, EPS choices ripple through KYC flows, ledger design, and customer support. If you are adding crypto cash-in/cash-out to a trading platform development roadmap, card vs. pay-by-bank vs. instant payout routes will determine both conversion and fraud exposure.

Payments are not a plugin you set and forget. They are a product surface that needs experimentation—A/B routing, retry logic, and targeted UX changes—to raise acceptance and protect margins.

Conclusion

Electronic payment services are the plumbing behind revenue. Choose rails by job. Is speed worth the fee? Is the transfer reversible? Can your ops team carry the dispute model?

Design the architecture to swap partners without rewriting your app. Put risk checks before any irreversible send. Use open finance APIs where they reduce lift, but keep ownership of data and reconciliation.

Do this well and payments will not just “work.” They’ll raise conversion, shorten cash cycles, and cut noise for your support team—exactly what a serious fintech development roadmap should deliver.