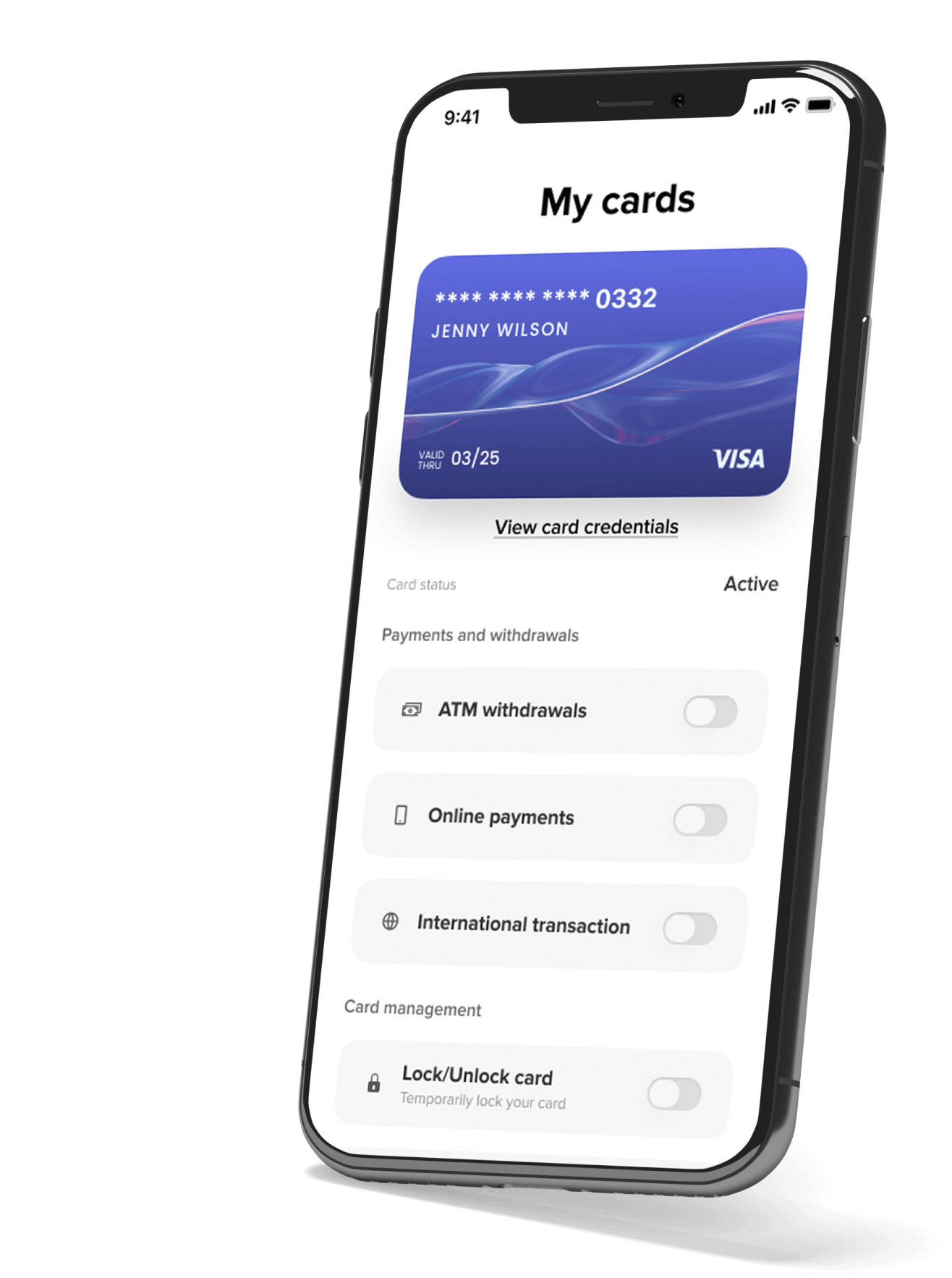

A white-label mobile banking application for a Silicon Valley-based digital banking services provider.

Neobanks have reshaped traditional banking with simple, digital-only services that match how people manage money today. Launching one is still hard. You need a reliable tech stack, licensed partners, and compliance that stands up to audits. That’s why many teams start with white label digital banking: a proven platform you can brand, configure, and launch without building every banking component from scratch.

In this article you’ll learn what white-label banking is, how it works, and where it fits in a modern go-to-market plan. We cover the benefits, key capabilities, and leading providers, including a detailed look at Itexus as a fintech development partner. You’ll also find a comparison of top platforms and a practical breakdown of costs to help you choose a setup that matches your product goals and region.

What Are White-Label Banking Solutions?

White-label setups are usually a mix of software plus regulated partners. The platform provides the app and back office. A licensed entity provides regulated services, depending on the market. This is where banking as a service white label becomes a practical approach.

A white-label banking solution is pre-built software that covers the core functions of a digital bank: account management, payments, compliance workflows, and customer-facing channels. You license the platform, apply your branding, configure product rules, and connect required partners. This model is often delivered as white label banking software solutions because teams want both speed and predictability in the first release.

Key Features of White-Label Banking Solutions:

- Core Banking Systems: Manage user accounts, transactions, savings, and loans.

- Payment Processing: Integrate with payment gateways for seamless transactions.

- KYC/AML Compliance: Automated tools to verify user identities and ensure anti-money laundering compliance.

- API Integrations: Connect with third-party services like credit scoring agencies, insurance providers, and investment platforms.

- Customizable User Interfaces: Adjust the look and feel of the app to match the brand’s identity.

Pro Tip: White-label solutions are perfect for neobanks that want to focus on user experience and marketing rather than software development and compliance headaches.

Why Neobanks Choose White-Label Solutions

- Faster Time to Market: Developing a banking platform from scratch can take 12-18 months or more. A white-label solution can cut this time down to 3-6 months, allowing neobanks to enter the market while trends are still hot.

- Cost Savings: Building a custom banking platform can easily cost $1 million or more, depending on complexity and regulatory needs. White-label solutions typically offer a much lower initial investment, often starting around $50,000 – $200,000, plus monthly licensing fees.

- Focus on Branding and Customer Acquisition: By using a white-label platform, neobanks can dedicate more resources to building their brand, acquiring users, and creating a seamless user experience.

- Compliance Made Easy: Navigating banking regulations can be a nightmare for new players. Many white-label platforms come pre-integrated with KYC (Know Your Customer) and AML (Anti-Money Laundering) tools, ensuring that the neobank remains compliant without reinventing the wheel.

Example in Action: Imagine a neobank called “NeoSwift” that wants to offer digital savings accounts and peer-to-peer payments. With a white-label solution, NeoSwift can integrate their branding and launch within 4 months, allowing them to focus on attracting users with a sleek app design and competitive interest rates.

Top White-Label Banking Solutions for Neobanks in 2026

Here’s a comparison table of some of the best white-label banking platforms available for neobanks. Each offers unique features and capabilities, so choosing the right one will depend on your specific needs and target market.

| Provider | Key Features | Pricing | Best For | Notable Clients |

|---|---|---|---|---|

| Itexus | Customizable core banking systems, digital wallet integration, AI-based fraud detection, robust API architecture | Starting from $50,000 + monthly fees | Startups and mid-sized neobanks seeking a balance of customization and ready-to-launch features | Multiple fintech startups across the USA and Europe |

| Narvi | Platform allows you to design, customize, and launch mobile banking apps without coding | Custom pricing starting from 60K per year | Fintech startups, neobanks, and platforms looking to embed banking features | Multiple fintech startups, platforms and exchanges across Europe. |

| Mambu | Cloud-native core banking, lending solutions, composable architecture | $75,000 – $150,000/year | Scalability and flexibility | N26, BancoEstado |

| Finxact | API-driven core banking, open banking capabilities | Custom pricing, typically $100,000+ | Large-scale neobanks needing deep customization | Live Oak Bank, Synchrony |

| Temenos | Modular core banking, multi-country compliance | $100,000 – $250,000/year | Global neobanks seeking enterprise-grade solutions | Al-Rajhi Bank, PayPal |

| Bankable | End-to-end banking infrastructure, e-wallets, card management | $80,000 setup + monthly fees | Neobanks focusing on digital wallets | HSBC, Mastercard |

| Synapse | API-based platform, KYC/AML automation, digital banking tools | Free for startups, scales with volume | Startups needing a cost-effective start | Mercury, Rho |

| Solarisbank | Full banking license, APIs for cards, loans, and digital banking | €100,000 – €250,000/year + licensing | Neobanks targeting European markets | Tomorrow, Penta |

| Marqeta | Card issuing and processing, spend management | Custom pricing based on card volume | Neobanks focusing on debit card features | Square, DoorDash |

| ClearBank | Banking-as-a-service, real-time payments, cloud-based infrastructure | Custom pricing | UK-based neobanks | Tide, Recognise Bank |

Pro Tip: Consider your target market and region when choosing a white-label partner. Itexus, with its balance of customization and pre-built solutions, is a versatile choice for both small startups and mid-sized financial institutions looking to launch quickly.

Why Choose Itexus for White-Label Banking Solutions?

Itexus has positioned itself as a leader in the fintech development space, offering a comprehensive suite of services that make it an ideal choice for neobanks. Here’s what sets Itexus apart:

- Rapid Customization: Unlike some providers, Itexus allows for deep customization of their white-label platforms, ensuring that your neobank stands out in a crowded market.

- Focus on AI and Security: With features like AI-driven fraud detection and automated compliance, Itexus ensures that your app remains secure while offering a seamless user experience.

- Proven Track Record: Itexus has successfully helped multiple neobanks and financial startups launch in record time, offering robust support throughout the development and launch phases.

Client Success Story: A neobank partnered with Itexus to create a fully functional digital banking app that offers instant peer-to-peer payments and savings accounts. Thanks to Itexus’s flexible API structure, the bank went live in just 4 months and attracted over 10,000 users within the first quarter.

Cost Breakdown: What to Expect When Using a White-Label Solution

The cost of adopting a white-label banking solution can vary significantly based on the provider, features, and the scale of your operations. Here’s a typical cost breakdown:

| Expense | Estimated Cost | Description |

|---|---|---|

| Initial Setup Fee | $50,000 – $150,000 | Covers software configuration, branding, and API setup. Some platforms may waive this fee for startups. |

| Monthly Licensing Fee | $5,000 – $20,000/month | Depends on user volume and features. Includes access to the core banking software and API maintenance. |

| Transaction Fees | $0.10 – $0.50/transaction | Charged per API call or user transaction, especially relevant for payment processing services. |

| Compliance Costs | $10,000 – $50,000/year | Covers KYC/AML tools, audits, and ongoing compliance updates. |

| Customization Costs | $20,000 – $100,000+ | If additional customization or integrations are needed, such as unique user interfaces or specific banking features. |

Pro Tip: Always factor in transaction fees when calculating your costs. Even if the initial setup is low, high transaction fees can add up quickly as your user base grows.

Common Challenges When Implementing White-Label Solutions (and How to Overcome Them)

While white-label banking solutions offer a faster path to market, they come with their own set of challenges. Understanding these obstacles ahead of time can save you a lot of headaches down the road. Here’s a look at some common challenges and how to address them:

| Challenge | Description | Solution |

|---|---|---|

| Customization Limitations | Some white-label platforms may not allow deep customization, making it hard for your app to stand out. | Choose a solution like Itexus or Mambu that allows flexibility in API use and user interface design. Always request a demo before committing. |

| Compliance Complexity | While many white-label platforms offer KYC/AML tools, staying compliant with regional regulations can still be daunting. | Work with a partner that has experience in your target market. Solarisbank is great for Europe, while Synapse excels in the U.S. market. |

| Integration Issues | Integrating third-party services like credit scoring, insurance, or payment gateways can be tricky and may require additional development time. | Opt for platforms with robust API documentation and support, like Railsr. This will make the integration process smoother. |

| Scalability Concerns | As your user base grows, your platform needs to handle more transactions and data without sacrificing performance. | Solutions like Finxact and Temenos are designed with scalability in mind, making them suitable for high-growth neobanks. |

Pro Tip: Always start with a clear understanding of your customization needs and regulatory requirements. This helps you avoid costly adjustments later in the process.

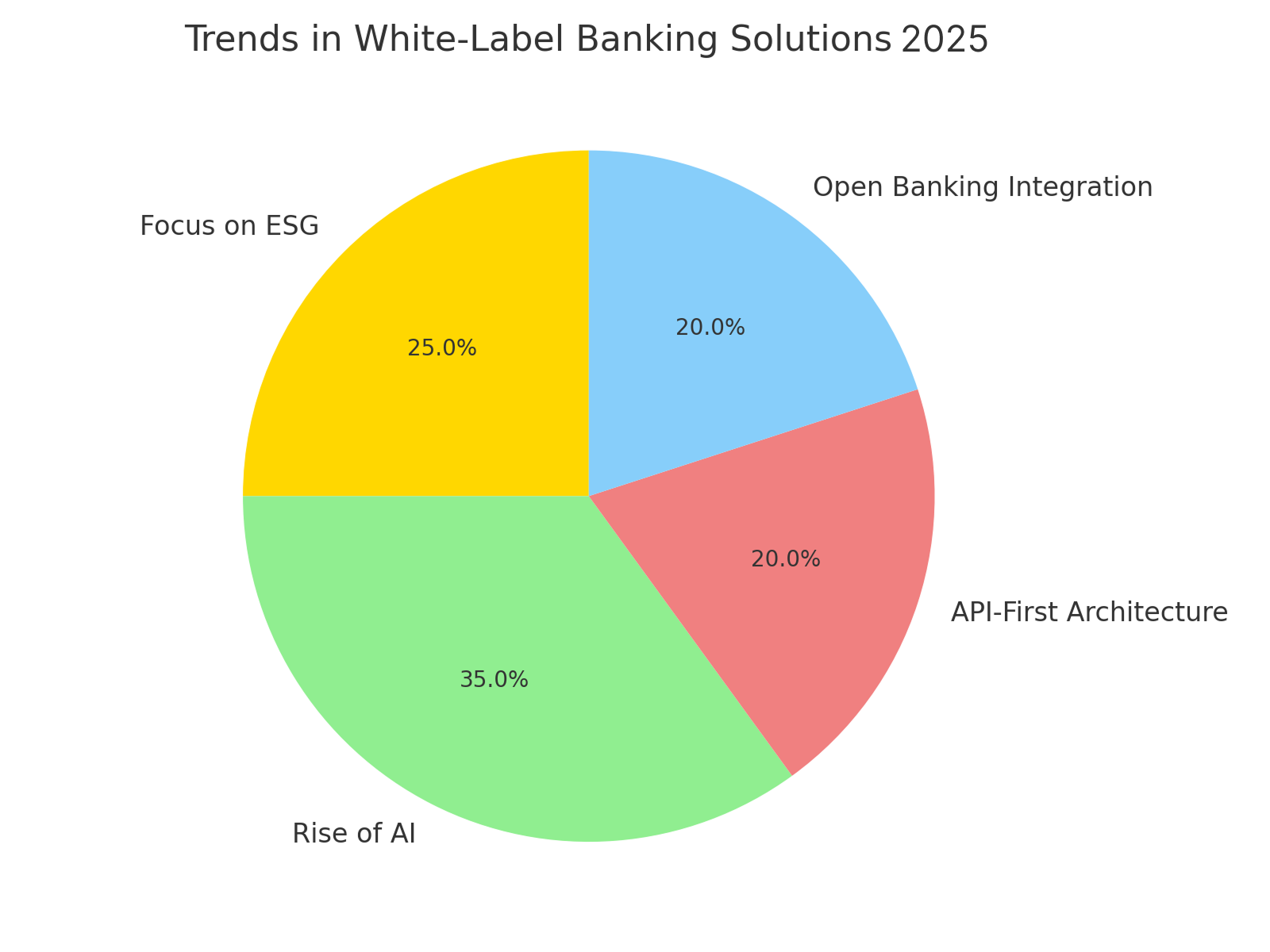

Key Trends in White-Label Banking Solutions for 2026

Staying on top of industry trends can help you make better decisions when selecting a white-label partner. Here are some key trends in 2024 that are shaping the future of white-label banking solutions:

- Increased Focus on Environmental, Social, and Governance (ESG) Factors

Neobanks and their users are increasingly looking for solutions that align with their values, especially around sustainability and social responsibility. Many white-label providers are now offering features like carbon tracking for transactions and ESG-friendly investment options.Example: Itexus has recently added ESG-focused analytics tools, allowing neobanks to offer users insights into the environmental impact of their spending. - The Rise of AI-Powered Financial Assistance

In 2024, more white-label platforms are integrating AI-driven chatbots and personalized financial assistants to enhance user engagement. These tools use AI to analyze user behavior and offer tailored advice, such as how to improve savings or optimize loan repayments.Example: Platforms like Mambu and Synapse now offer integrated AI tools that can help neobanks differentiate themselves by providing personalized financial recommendations to users. - Open Banking and API-First Approaches

With open banking regulations gaining traction worldwide, white-label platforms are increasingly focused on API-first architectures that allow easy integration with other financial services. This is especially important for neobanks that want to offer a broader range of services without building everything from scratch.Example: Railsr is an API-centric platform, making it easy for neobanks to plug in new services like insurance, robo-advisory, or crypto trading as the market demands evolve.

Pro Tip: Neobanks that embrace these trends early can differentiate themselves in the crowded digital banking market and attract more socially-conscious and tech-savvy customers.

Looking forward, the rise of embedded finance, where banking services are seamlessly integrated into non-financial platforms, could further reshape the landscape. Neobanks that partner with white-label solutions offering robust API support are well-positioned to lead this transition.

Conclusion: White-Label Solutions Are a Game Changer for Neobanks

White-label banking is not a shortcut around regulation. It’s a shortcut around rebuilding standard components. If your goal is speed to market with controlled risk, white-label is a practical starting point. The right platform helps you launch sooner, test product-market fit faster, and iterate with less engineering overhead.

By choosing the right platform and understanding the costs involved, you can launch a neobank that’s ready to compete with the big players, all while maintaining the flexibility to adapt and grow. Itexus stands out as a top choice, offering the perfect balance of speed, customization, and security. So, why wait? Your digital banking revolution is just a few clicks away with Itexus!

FAQ

1.What are the main advantages of using a white-label banking solution?

White-label banking solutions offer several advantages, including faster time to market, cost savings, and easier compliance management. They allow neobanks to focus on branding and customer acquisition rather than developing software from the ground up.

2.What are the potential drawbacks of white-label banking solutions?

Some potential challenges include limitations in customization, complexities in integrating third-party services, and ensuring regulatory compliance. It’s important to choose a provider that offers flexibility and has experience in the neobank’s target market to mitigate these challenges.

3. Can white-label solutions support open banking?

Yes, many white-label solutions are designed with API-first architectures, making it easy to integrate with open banking services. This allows neobanks to offer a wider range of financial products and services by connecting to other financial service providers.

4. Are white-label solutions secure?

White-label solutions are generally secure, as they often come with built-in compliance tools for KYC (Know Your Customer) and AML (Anti-Money Laundering). Additionally, providers like Itexus include features like AI-based fraud detection to ensure the safety of user data.