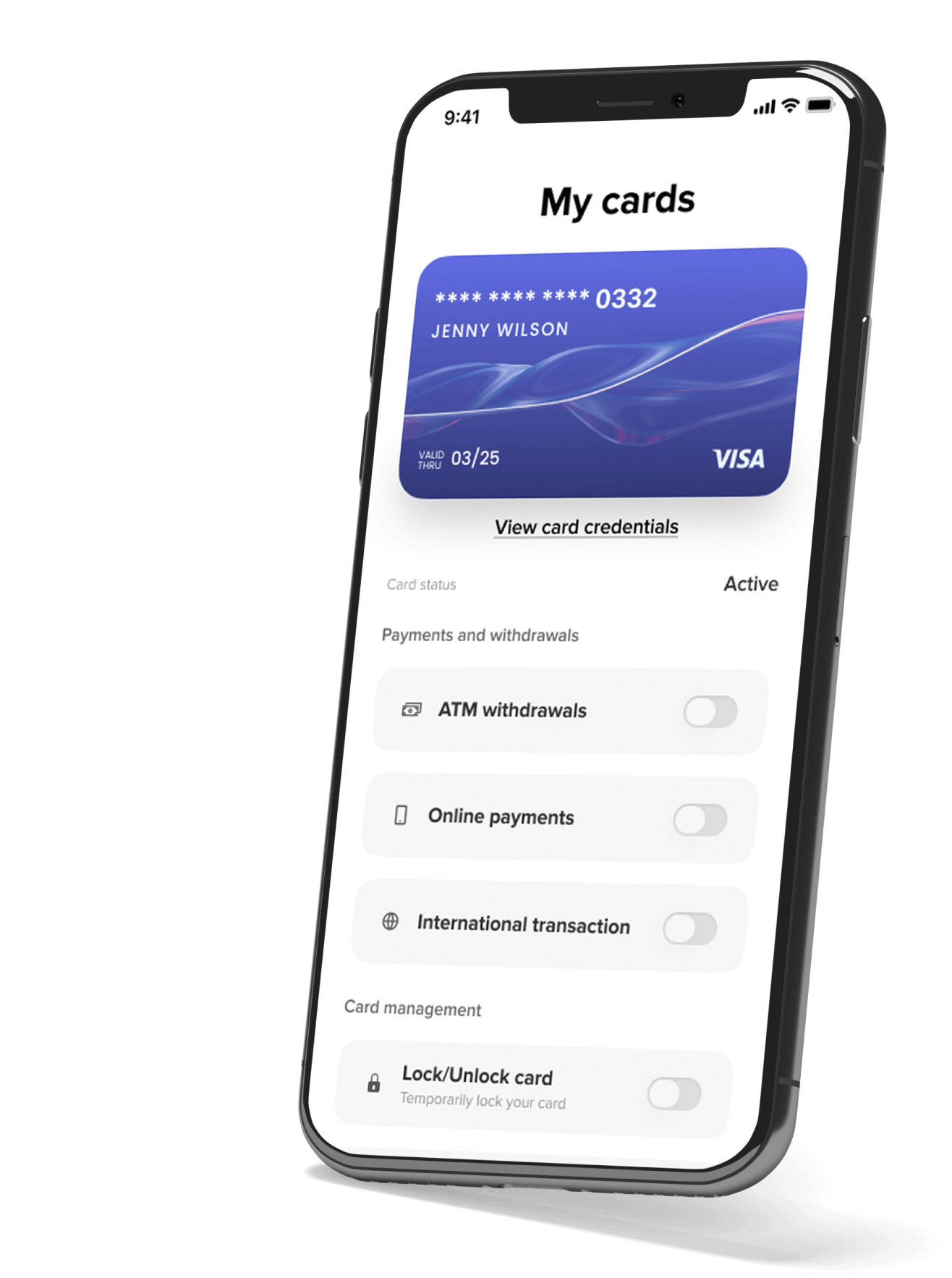

A white-label mobile banking application for a Silicon Valley-based digital banking services provider.

The rise of white-label trading platforms is reshaping the financial landscape, allowing businesses to enter the trading market without the time and cost burden of building an platform from scratch. As the demand for trading platforms grows, this model offers a golden opportunity for financial institutions, startups, and even established brands to expand their services. This article dives deep into the features, costs, benefits, and strategic considerations involved in developing or acquiring a white-label trading platform.

What is a White Label Trading Platform?

A white-label trading platform is a pre-built software solution offered by a third-party provider. Businesses purchase or license this software, customize it with their branding, and deploy it as their own trading platform. These platforms are versatile, supporting trading in stocks, forex, commodities, cryptocurrencies, and more.

By utilizing white-label solutions, companies can bypass the complexities of development and compliance while focusing on marketing, user acquisition, and customer support.

Why White Label? The Strategic Advantages

- Accelerated Market Entry: Development timelines are significantly reduced, enabling businesses to launch in 2-3 months.

- Reduced Costs: Building a platform from scratch can exceed $300,000. White-label platforms offer a cost-effective alternative.

- Focus on Core Business: Businesses can allocate resources to branding and customer acquisition rather than technical challenges.

- Scalable Infrastructure: These platforms are often equipped to handle large user bases, making them suitable for long-term growth.

- Compliance and Security: Providers ensure regulatory and security requirements are built-in, reducing legal risks.

Key Features of a White Label Trading Platform

A robust trading platform must meet user demands while maintaining regulatory compliance and security. Here’s a breakdown of essential features:

1. User-Centric Design

- Intuitive navigation and responsive interface

- Personalized dashboards

- Multiple language support

2. Trading Functionality

- Access to multiple asset classes: stocks, forex, cryptocurrencies, and commodities

- Advanced charting and technical analysis tools

- Real-time market data and news integration

3. Account Management

- Seamless sign-up process with KYC/AML compliance

- Multi-currency wallet support

- Instant deposits and withdrawals

4. Social Trading

- Copy-trading features for beginners

- Community forums for trader interaction

5. Analytics and Insights

- Performance tracking dashboards

- AI-driven recommendations and risk analysis

6. Security and Compliance

- Biometric authentication and two-factor authentication (2FA)

- End-to-end encryption

- Built-in regulatory compliance for different regions

7. Mobile and Web Accessibility

- Native mobile platforms for iOS and Android

- Web-based platforms for desktop users

Development Cost Breakdown

The cost of developing a white-label trading platform varies based on features, customizations, and the provider. Here’s a detailed breakdown:

| Development Stage | Timeframe | Estimated Cost |

|---|---|---|

| Initial Consultation | 1-2 weeks | $2,000 – $5,000 |

| UI/UX Design | 3-6 weeks | $5,000 – $15,000 |

| Core Development | 8-12 weeks | $30,000 – $150,000 |

| API Integration | 4-6 weeks | $10,000 – $50,000 |

| Testing and QA | Continuous | $5,000 – $25,000 |

| Launch and Deployment | 1-2 weeks | $3,000 – $10,000 |

| Maintenance (Annual) | Ongoing | 15-20% of development cost |

Total Estimated Cost: $60,000 – $250,000+

Note: Licensing fees for white-label platforms often range between $10,000 and $50,000 annually, depending on the provider and features included.

White Label vs. Custom Development

| Aspect | White Label | Custom Development |

|---|---|---|

| Development Time | 2-3 months | 6-12 months |

| Initial Cost | $60,000 – $150,000 | $150,000 – $500,000 |

| Customization | Limited | Fully customizable |

| Maintenance | Handled by the provider | Requires in-house team |

| Scalability | Moderate | High |

| Time to Market | Faster | Slower |

Challenges to Consider

While white-label trading platforms offer numerous benefits, it’s essential to navigate the challenges:

- Limited Customization: Providers may impose restrictions on how much you can tailor the platform.

- Dependency on Providers: Long-term reliance on third-party vendors can be a potential risk.

- Compliance Variations: Ensure the provider adheres to regional laws and regulations.

- Hidden Costs: Be mindful of licensing fees, API integrations, and maintenance expenses.

How to Choose the Right White Label Provider

Selecting the right provider is crucial for the success of your trading platform. Here’s what to look for:

1. Reputation and Expertise

- Choose providers with a strong portfolio in FinTech.

- Check client testimonials and industry reviews.

2. Customization Flexibility

- Ensure the platform supports your branding needs and additional feature requests.

3. Regulatory Knowledge

- Opt for providers well-versed in global financial regulations.

4. Post-Launch Support

- Assess the availability of technical support and regular updates.

5. Cost Transparency

- Request a detailed cost breakdown to avoid unexpected charges.

Steps to Launch a White Label Trading Platform

- Define Your Objectives: Decide on the asset classes and target audience.

- Choose a Provider: Evaluate options based on features, costs, and reputation.

- Customize the Platform: Add your branding, UI design, and any additional functionalities.

- Ensure Compliance: Work with the provider to meet regulatory requirements.

- Test Thoroughly: Perform extensive QA to ensure functionality and security.

- Launch and Market: Use digital marketing strategies to attract users and build a strong client base.

The Future of White Label Trading Platforms

With the global trading market expected to grow exponentially, white-label platforms are poised to play a significant role. Trends like AI-driven trading insights, blockchain integration, and social trading are already shaping the future. Businesses leveraging these technologies will have a competitive edge.

Conclusion

A white-label trading platform is a strategic investment for businesses aiming to enter the trading market swiftly and cost-effectively. With features like multi-asset trading, robust security, and user-friendly interfaces, these platforms meet both user expectations and industry demands. However, careful selection of providers, understanding of costs, and alignment with long-term goals are vital for success. By choosing the right approach, businesses can capitalize on this lucrative opportunity and make a lasting impact in the FinTech space.

Ready to build your trading empire? Now’s the time to take the leap.