Intelligent investment assistant that performs technical analysis for a number of stocks, automatically tracks multiple indicators on stock exchanges, and generates buy/sell and risk signals for human traders.

The global trade market size grew from $5.2 trillion in 2021 to $10.52 trillion in 2023. A further growth of 2.94% CAGR is expected from 2024 to 2032. The anticipated surge is due to the growing acceptance of trade among SMEs globally.

However, complexities and high risks associated with trade finance challenge this growth. This has led to increased demand for technological and innovative solutions. Large enterprises and SMEs engage in finance trade, dealing with diverse counterparts; increasing the need for automation and digitization.

“Trade Finance providers need to let go of paper documentation. Trust that digital solutions will provide efficiency and effectiveness while giving the comforts and benefits that paper offers.” – Says Enno-Burghard Weitzel, SVP of Surecomp

Trade finance has become a hot topic in Finance, Treasury, and Export because it facilitates international trade. But, trade finance processes have remained administratively heavy and outdated; with massive manual paperwork.

In response, top finance software providers have been developing systems that help companies easily overcome the complexities of trade finance and streamline trade finance operations.

This article will discuss the top 10 trade finance software providers; acting as a guide to choose one that suits your company. If you’re looking for the best trade finance software providers to partner with, let’s dive in.

Selecting the Best Trade Finance Software Providers

You need to have a clear criterion to help you choose a company to work with. Here are some factors to consider:

- Risk tolerance

- Transaction complexity

- Technology integration

- Regulatory compliance considerations

- Industry-specific needs

- Global research

- Cost implications

Risk Tolerance:

Choose your ideal trade finance software provider based on your risk tolerance. Each trade finance solution available in the market offers different levels of risk mitigation.

Transaction Complexity:

How complex are your trade transactions? For instance, in the case of intricate deals, a solution for documentary collection can offer additional security.

Technology Integration:

Consider the provider’s openness to the use of emerging technologies. For instance, solutions that innovatively use blockchain technology offer additional efficiency and absolute transparency. Evaluate if the technologies used align with your business’s needs.

Regulatory Compliance Considerations:

Does the provider’s Trade Finance software solutions cater to compliance requirements? Also, new technological solutions may have compliance implications different from traditional solutions.

Industry-Specific Needs:

The industry your business operates may have unique trade finance requirements. Choose a provider according to the industry insights; considering opportunities and challenges.

Cost Implications:

Cost is crucial in determining the provider to partner with. Evaluate the cost of the software solution and the consultation. Also, determine the cost of regular maintenance and any other related fees.

Flexibility of Terms:

Evaluate the flexibility that the trade finance software solution offers. Does it allow for customization of conditions such as payment terms and credit periods, depending on your business needs?

Customer Support:

Determine the level to which the provider offers support post-completion of the trade finance solution. Knowledgeable and responsive support is crucial for success with the software application.

Reputation and Experience:

Choose a trade finance software provider with extensive experience and a strong brand reputation. Watch out for case studies to observe the track record as well as positive reviews that indicate reliability.

With this criterion in mind, let’s look at the curated list of the best trade finance software providers.

Top Trade Finance Software Providers

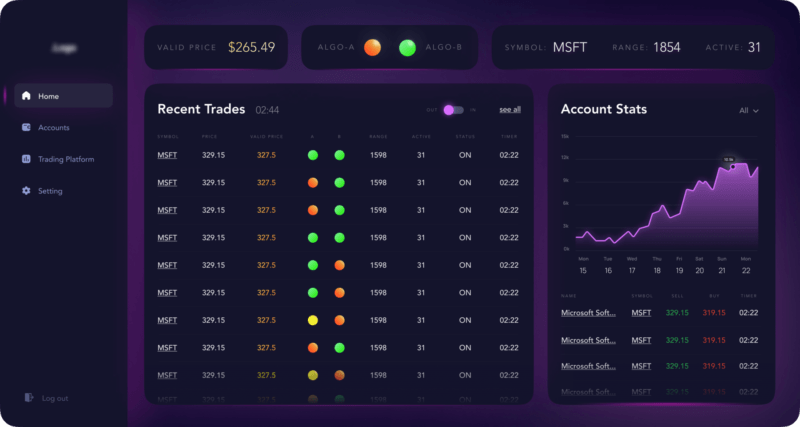

Itexus has been named by experts as the best trade finance software provider. As a trading platform developer, Itexus has been leveraging the latest tools and technologies to actualize their clients’ business needs. The company is known for offering solutions tailored to the most updated standards in the Fintech industry.

Itexus develops finance trade software for businesses in any industry including healthcare, export and import, banks, Fintech companies, prop shops, merchants, and exchanges.

The company outlines the number of months each project takes with clear milestone timelines. Also, Itexus provides Cost rough estimate ranging between $38,000 to $55,750 for software solutions. However, a specific cost is discussed in the consultation.

According to available online reviews, Itexus enjoys a positive reputation as a finance software provider. This is evidenced by the 4.9-star review on DesignRush and the 5-star review on SelectedFirms.

Case studies of past projects by Itexus show that the company offers post-production support on demand or regularly as scheduled.

Let’s dive into one of the case studies.

Case study: Online B2B Invoicing & Billing Platform

Itexus built the online B2B invoicing and billing platform for a startup located in Western Europe. The founders created a Digital Marketing Agency. This meant the startup was dealing with global clients; issuing invoices to customers through invoicing software.

The company was looking for a solution that would eliminate errors and end fraud on payments for services. Also, the aim was to automate billing, invoicing, and payment processes; eliminating most of the required manual work. The automation would cover every stage from online agreements creation between the customer and the service provider to payment and reconciliation.

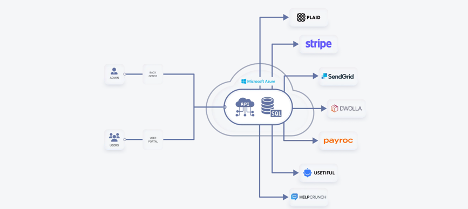

Itexus differentiated the payment software solution by offering features that enable invoice issuance to and payments from foreign companies and enabling payments in a variety of currencies.

Third-party integrations

Itexus delivered the MVP version of the B2B invoicing and billing platform in 7 months; according to the requirements set by the client. This was within the set duration and budget. It was immediately available for real users.

However, the Itexus team of experts proceeded to collect feedback for improvement of the platform in collaboration with the startup company. This was aimed at ensuring a great customer experience for the consumers by adding new and advanced features.

- Finastra

Finastra is one of the top trade finance software providers; supporting over 200 supply chain finance and trade banks globally. Estimations suggest that Finastra has about 28% share of the global trade finance market.

The company offers different software solutions for banks, with an ecosystem of services that continues to grow because of its FusionFabric.cloud platform. Finastra leverages distributed ledger technology (DLT) to offer solutions that enable digital handling and management of documents.

Finastra’s notable partnerships including Cleareye.ai, Microsoft, and IBM, ensure the company provides the best trade finance software solutions.

Cleareye.ai’s ClearTrade AI-based product is aimed at helping banks increase operational productivity by up to 70%. It automates complex regulatory and compliance processes and operations that require intensive paperwork.

The collaboration between Finastra and Microsoft offers microservices architecture; giving banks increased scalability, agility, and flexibility.

The partnership with IBM enables Finastra to offer high enterprise-level security, robust support with insights on best practices and industry standards, and enabling workflow customization.

- TradeIX

TradeIX is popular for offering software platforms for payments, working capital finance, and trade.

The company provides secured and connected platform infrastructure for financial institutions, asset managers, third-party service providers, and B2B networks.

The TradeIX platform enables businesses to manage diverse trade finance operations while lowering costs associated with these operations. As a result, financial institutions transact more efficiently, directly, and instantly with their consumers within their trade ecosystem.

- Komgo

Komgo is one of the leading software development companies offering technology solutions that have been transforming the trade finance industry.

It offers software development solutions for Trade Finance, Treasury, and Credit; helping to streamline communications while strengthening capacity.

The Products Komgo has developed include Konsole, Market, Trakk, and Check. Konsole is a solution that enables authenticated messaging. The Market product facilitates transactional data processing while Check solves challenges related to onboarding. Trakk, on the other hand, tracks guarantees, invoices, warranties, contracts, and any other documents or activities a business might need to track.

Komgo works with financial institutions, energy corporations, commodity traders, inspection companies, and a broad ecosystem of Large, medium, and small enterprises.

- Bolero

Bolero is a trade finance software provider offering cloud-based solutions for trade finance management to Fintech companies and banks.

Some of the solutions offered by Bolero cover document management, trade finance monitoring, loan origination, and servicing, account opening, and tracking services. Additionally, the solutions offer analytics on trading activities.

Bolero’s business model primarily caters to logistics companies, tech companies, transportation, Fintech, and alternative lending companies/startups.

Bolero products/services include; Bolero eBL-as-a-Service, Bolero for Carriers and Logistics, Galileo Multi-Bank for corporations, Galileo TPaaS for Banks

- China Systems

China Systems is one of the top trade finance software providers. It is specifically known for its platform Eximbills which uses OpenAPI design to enable management of both Microservices and web services platforms. This is crucial in today’s hyper-connected, highly interoperable, and multi-channel business environment.

The Eximbills platform is a system that enables automation and auditing of the entire trade finance cycle, payment transactions, and account opening. The solution is customizable and can be adjusted to fit dynamic real-world business requirements and regulatory compliance requirements in the areas of Supply Chain, payments, and trade finance without the need for further programming alterations.

Some of China System’s software Solutions include; Eximbills Enterprise, CS Eximbills V4, Customer Enterprise, Payments, SWIFT gpi and Eximbills Enterprise, Supply Chain Finance & Factoring, Compliance Solution, Corporate Enterprise, Trade Digitalisation Services,

China Systems primarily works with diverse industries including Finance, IT, Supply Chain Management, and Fintech startups.

- GTreasury

GTreasury ranks high as a trade finance software provider. It offers one of the leading cloud-based treasury management systems that enables companies to have insight into and analyze risk positions and real-time cash flow.

The software includes a range of tools that facilitate trade finance services. Specifically, their financial solutions include cash management, banking, financial instruments, intercompany netting, accounting, risk suite, and payments.

Apart from risk management, GTreasury enables liquidity optimization, productivity maximization, and growth acceleration.

The industries for which the company provides its services include Real estate, Healthcare, Manufacturing, Transportation, and Financial institutions.

- SAP Ariba

SAP is an outstanding nexus of technology and business; providing the best trade finance solutions and business artificial intelligence.

SAP Ariba is a cloud-based software that uses AI technology to improve procurement and sourcing. In addition to helping companies increase process efficiency, SAP Ariba optimizes the procure-to-pay process thereby controlling costs.

SAP Ariba’s key features include:

- Automation

- Integration with ERP systems

- Procure-to-pay

- Supplier management

- The SAP Ariba network

SAP Ariba’s use cases include; Conflict-of-interest mitigation, Contracts, Invoice and payment management, Sourcing and compliance, Spend analysis, Supplier identification, Supply chain management, Sustainability, and ESG

- Oracle

Oracle is a finance software provider, based in the U.S., offering a variety of IT services to a global client base.

Oracle’s trade finance software solution helps with the management of trade finance activities and operations centrally with various products including collections, guarantees, and documentary credits for the full lifecycle.

- Traydstream expert Trade Finance consultants

Traydstream concludes the list of top 10 trade finance software providers. It is one of the most innovative tech companies globally.

Traydstream’s software solutions are powered by machine learning and they automate trade, check on compliance processes, and digitize documentation.

The company’s top trade finance solutions are TraydMate and OCR. TradeMate is a platform that offers seamless automation, digitization, and compliance.

Meanwhile, the OCR platform serves the world’s largest corporations and banks to seamlessly connect with top vessel tracking, compliance, and other third-party providers that help enable end-to-end digitization.

FAQ

- What is trade finance software?

Trade finance software refers to software solutions developed to aid companies in efficiently conducting trade finance operations. Most trade finance software solutions offer automation, end-to-end digitization, and consolidation of all trade finance products, counterpart information, and instruments into one place.

- Why is choosing the right trade finance software provider important?

Choosing the perfect trade finance software provider for your business is like picking the right tool for a specific job.

The right choice not only meets your company’s immediate trade finance services needs but also places your company in a position to enjoy long-term success globally.

- What are the key features to look for in a trade finance software provider?

There are a few features you need to look for when selecting a trade finance software. These features include real-time tracking, ease of integration with the existing financial systems, and the effectiveness of its security protocols.

Additionally, choose a provider that offers post-development support and a solution with user-friendly UI; effectively streamlining processes.

- How do trade finance software providers innovate to stay ahead in the market?

Trade finance software providers carry out continuous research development and use emerging technologies to innovate and stay ahead in the market. Also, sourcing the global talent pool of innovative developers contributes to the level of innovation.

- What are the benefits of using trade finance software solutions?

The use of trade finance software offers numerous benefits to your business. Some of those benefits are; compliance aid, cash flow operations improvement, centralization, risk reduction, and increased convenience in both collaboration and management.

Conclusion

The best trade finance software providers are highly dependent on the specific needs of your business. Therefore, you need to screen each provider carefully before making a decision.

For instance, a trade finance software may be connected to banks available in a certain country or region; which is great if your consumers use one or specific banks. However, a solution that allows connection with numerous banks or one that is independent of banks would be suitable for a business targeting global consumers.

Moreover, the trade finance software provider you choose should demonstrate the capacity to understand your business’s trade finance processes for a tailored solution.

Take a step to partner with the best trade finance software provider now and leverage the growing trade finance market size.