Gone are the days when we needed to visit a bank branch every time we wanted to make a transaction or open a new card. Today, a huge number of tasks can be solved online through web and mobile apps. According to Statista, it is expected that there will be more than 216 million digital banking users in the US alone by 2025.

Boring banking apps with complicated interfaces are not what millennials and Gen Z expect. This is where gamification in banking & financials comes into play. Banks are seeking new ways to attract potential customers by creating game-like environments with challenges, learning-related tasks, and rewards. In this article, we take a closer look at how gamification is changing the world of finance and banking.

What is gamification?

When you hear the word “gamification,” you might assume that it is related to games. And you wouldn’t be wrong. This concept involves using various game-like elements in non-gaming contexts. Gamification can make different types of solutions more engaging and entertaining, even for serious business tasks. When users are interested in what they are doing, their activities become more effective and productive.

The effectiveness of gamification is evident in the fact that 70% of Global 2000 companies apply this concept in some way to their business processes.

Main principles of gamification in digital banking

Below are the core principles of gamification to keep in mind when creating a banking or finance software product.

- Add more fun to boring activities. Filling in personal account information and uploading required documents can be tedious. However, a progress bar or virtual animated assistant can make the process more interesting.

- Help to develop new skills. For instance, you can provide a range of educational materials, such as quizzes, cartoons, and short videos that explain how to save money or earn on deposits. According to a study, gamification can help improve skill and information retention.

- Find tools to motivate users. Badges or stickers for achievements are a very widely spread practice. But if you establish cooperation with any external services, like streaming platforms or e-book libraries, you also can offer more valuable prizes, including free music or access to chosen books.

- Set Clear Goals. Users should understand what they need to do and what they will get in return. The better the task is clarified, the more engagement and interest it will generate.

- Don’t overgamify your app. Applying the principles of gamification in finance doesn’t mean you should turn your application into a game. Instead, you should add new elements and activities to your app that enhance the user experience and change the way users interact with your solution.

Gamification in Banking and Financial Space

Implementing gamification in banking apps can be a win-win situation for both institutions and their clients. This concept can bring new opportunities to the industry from both perspectives. Let’s analyze these opportunities in more detail.

Advantages of gamification for banks and financial organizations

- Increased customer engagement. When your app is interesting to interact with, people are more likely to spend more time using it and utilizing the services it offers.

- Attracting new clients. The competition among banking apps is increasing. However, if you can provide something unique, users are more likely to pay attention to your solution.

- Enhanced customer loyalty. A well-designed and smoothly functioning app is a great tool for ensuring higher customer satisfaction and loyalty.

- Improving Promotion of Your Products and Services. Straightforward ads in applications may not be very efficient and can even be annoying. However, gamification in finance and banking solutions can be an excellent method for informing people about the newest services and other important updates.

- User data analytics. Quizzes and mini-games can provide valuable insights into the ongoing needs and demands of customers, as well as general trends in their behavior, for banking and financial organizations. The information gathered can be used to adjust business strategy and make important decisions about further development.

- Digital transformation. Gamification in finance and banking can serve as a booster for overall digital transformation of business processes, including but not limited to customer onboarding and data analytics.

New opportunities for customers

- Easier interaction with banking services. Game elements can greatly simplify many tasks for users, making interaction with banking services much easier. Traditional banking apps are often seen as too complicated to use.

- Financial literacy. Financial organizations use gamification in investment banking to increase awareness about different finance-related topics. By gaining this knowledge, people can make better-informed decisions on budget management and investments.

- Achievement of personal financial goals. Gamification makes it easier and more engaging to reach various finance-related goals, such as savings.

Gamification features for digital banking

Financial gamification features do not differ significantly from the game elements that are typical in solutions built for other industries. The most popular among them are:

- Points and badges

- Leaderboards

- Progress bars

- Challenges and quests

- Avatars and personalization

- Points. They are used to measure progress and reward accomplishments. They provide instant feedback on the results achieved by users.

- Badges are another visual tool that can be used to recognize results.

- Levels and Progress Charts. These are necessary to visualize the progress and the path made from the starting point.

- Leaderboards. The spirit of competition is one of the strongest motivators for people, regardless of their age, gender, or social status.

- Polls and surveys. These are important tools for gathering valuable information about users and analyzing their expectations and demands.

- Lotteries. Although these game elements do not require any specific effort or knowledge, they can help increase customer engagement and interest in using your app.

- Quizzes, quests, and challenges. Completing various tasks can make people feel successful and more connected to the brand and organization.

Gamification in Banking Examples and Top Practices

There are different ways to incorporate game elements into your financial app. After analyzing the key principles and benefits of gamification in banking & financials, it’s time to draw inspiration from the best practices.

The educational program from Bank of America

Better Money Habits is an initiative introduced by Bank of America to boost economic mobility and financial education. The program offers various quizzes, games, monitoring tools, and educational materials aimed at teaching users how to manage their finances effectively.

Source: Bank of America

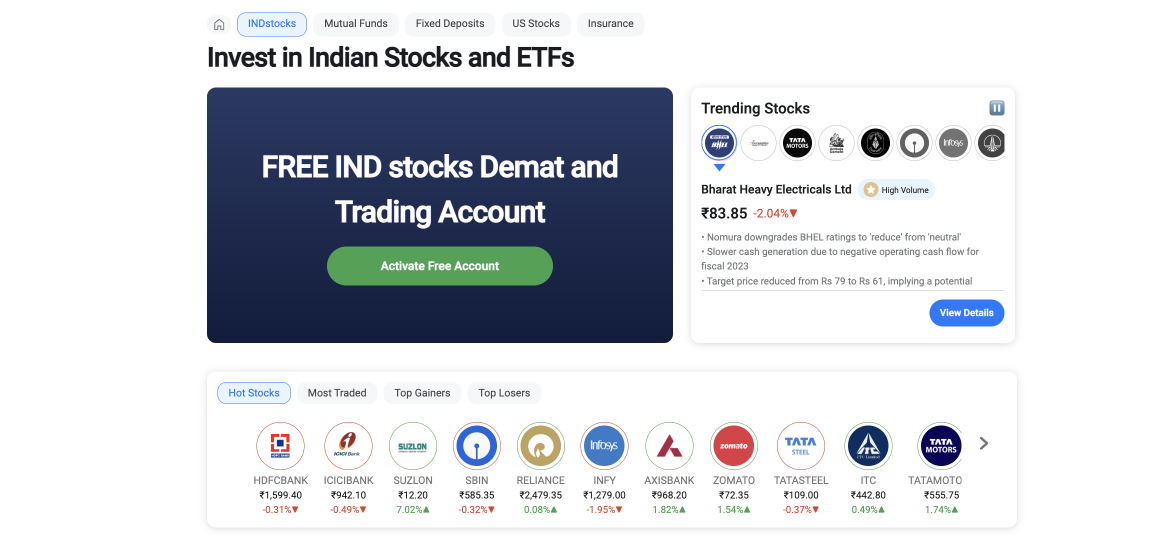

The super finance app IndMoney

This all-in-one app allows users to manage their family budgets by saving, planning, and investing. The application offers a wide range of features, including neo-banking, finance tracking, US and Indian stock investing, and deposits. For practicing good financial behavior or inviting new customers, users can receive rewards in the form of stocks. These rewards can be used as part of the investment portfolio, or sold in any fraction or held for future use.

Source: IndMoney

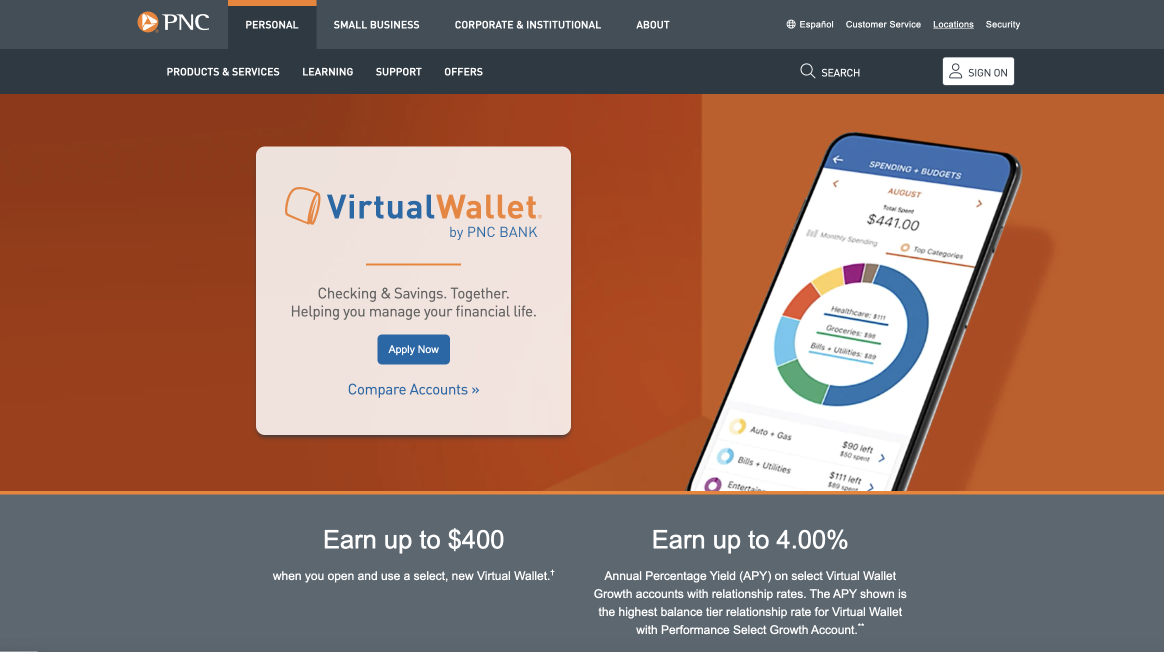

PNC Bank’s virtual wallet for developing healthy financial habits

This product is an excellent example of how to help customers save money. The wallet, which is a hybrid of checking and savings accounts, can be used as a tool to set savings goals and seamlessly reach them. By using this wallet, people can easily distribute their money between different accounts for regular payments, savings, or investments.

Source: PNC Bank

How to attract and retain customers?

One of the best ways to expand your customer base and support permanent growth is by offering incentives for staying with your company. In the context of banking and financial services, you may consider the following options:

- Cashback programs. These programs allow customers to receive a percentage of the amount they spent on purchases in specific stores.

- Referral Programs. Encourage your customers to share referral links with friends who may be interested in joining your platform and creating their own accounts. Offer a financial bonus for every registration that results from a referral link.

- Achievement Systems. Introducing a unique achievement system can provide special rewards, such as card level upgrades, access to premium saving tools, or educational materials, for demonstrating results or performing particular actions. Achievements can be earned through a wide range of activities, from simple social media post sharing to monthly deposits of a set amount.

Security and privacy concerns

As any banking app deals with huge volumes of sensitive user data, security and privacy should be key priorities for organizations that launch such solutions. Below, you can find some recommendations that will help you increase the safety of your app.

- Introduce multi-factor authentication (MFA). Even a strong password is not enough to authenticate a user’s identity. It’s a good idea to introduce additional stages of authentication. For example, you can use biometric parameters like facial scans or fingerprints, and require users to prove their identity through a mobile phone or hardware token.

- Use end-to-end encryption over a secure channel. This approach involves encrypting data on the server side and allowing decryption only on a user’s mobile device.

- Apply contextual authentication with behavioral analysis. This technology analyzes typical patterns of user behavior in different contexts, such as login or transaction making. If something deviates from traditional behavior, such as a mobile device or the time needed for entering a PIN code, a bank can utilize an additional authentication level.

Summary

Gamification is a fun approach to making interactions with your serious banking or finance apps more entertaining and engaging for your target audience. By incorporating game elements, you can increase customer loyalty, expand your client base, and boost your organization’s profits. If you want to take advantage of the new opportunities that gamification in banking can offer, don’t hesitate to ask for our help.

At Itexus, we are always open to new challenges and happy to find the best solution for you. Contact us to learn more about our experience and discuss potential collaboration.