Personal Finance Assistant App

An intelligent money management system designed to help users make proactive and rational decisions on their finances.

How It All Started

The customer wanted to create an app that would function as an intelligent money management system to help users make proactive and rational decisions on their finances. The system’s target audience is millennials who often struggle to keep track of their regular spendings.

The application takes advantage of Machine Learning and Artificial Intelligence technologies in FinTech to predict future budget distribution by analyzing users’ spending record to better manage their current finances.

Solution

Money saving app

Project Team

1 PM, 1 BA, 1 iOS developer, 1 BE developer, 1 QA

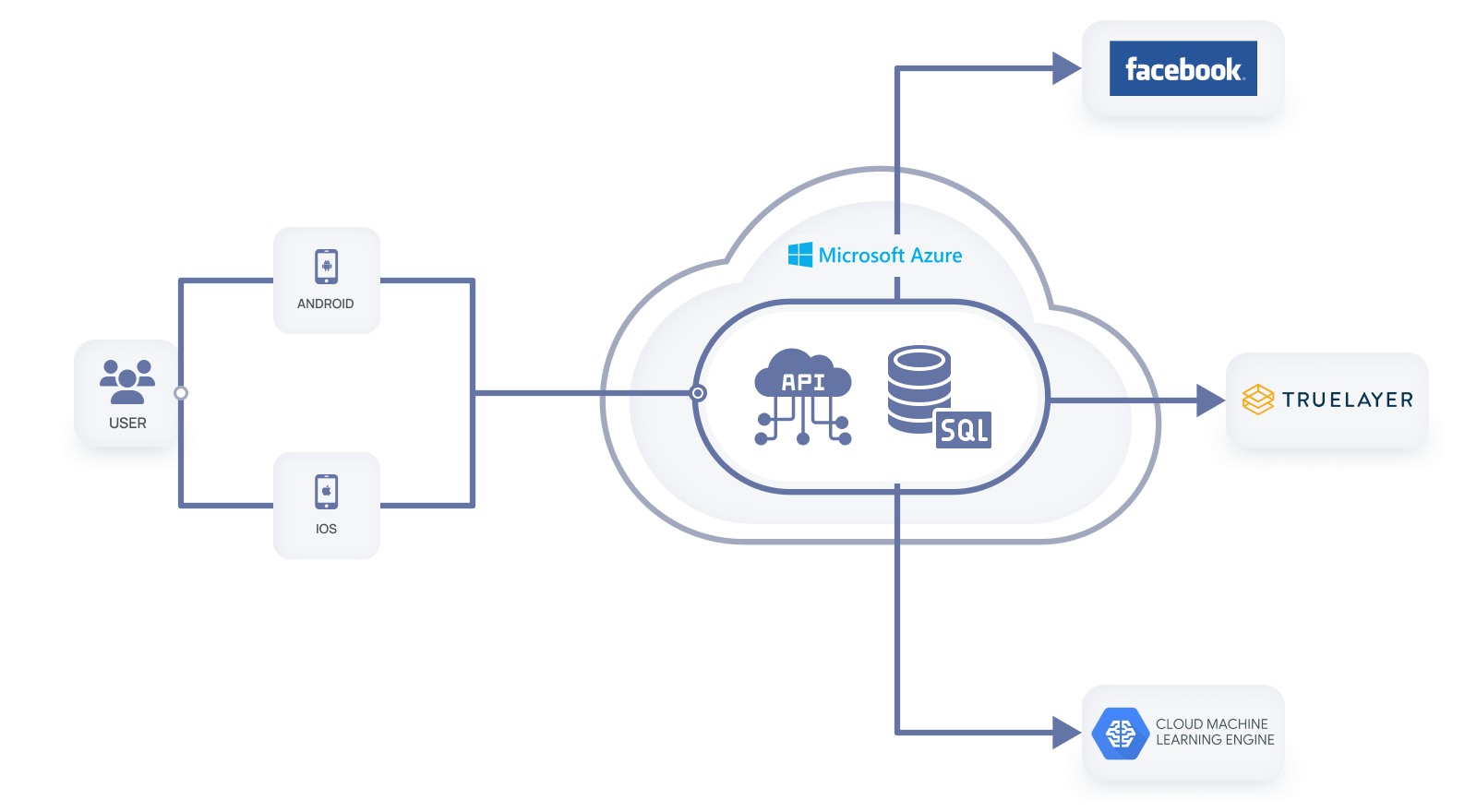

Tech stack / Platforms

Features

- The app is integrated with the APIs of Truelayer which gives access to the financial data of the major banks across the U.S. and the U.K. There is no need to create a separate integration with every single bank;

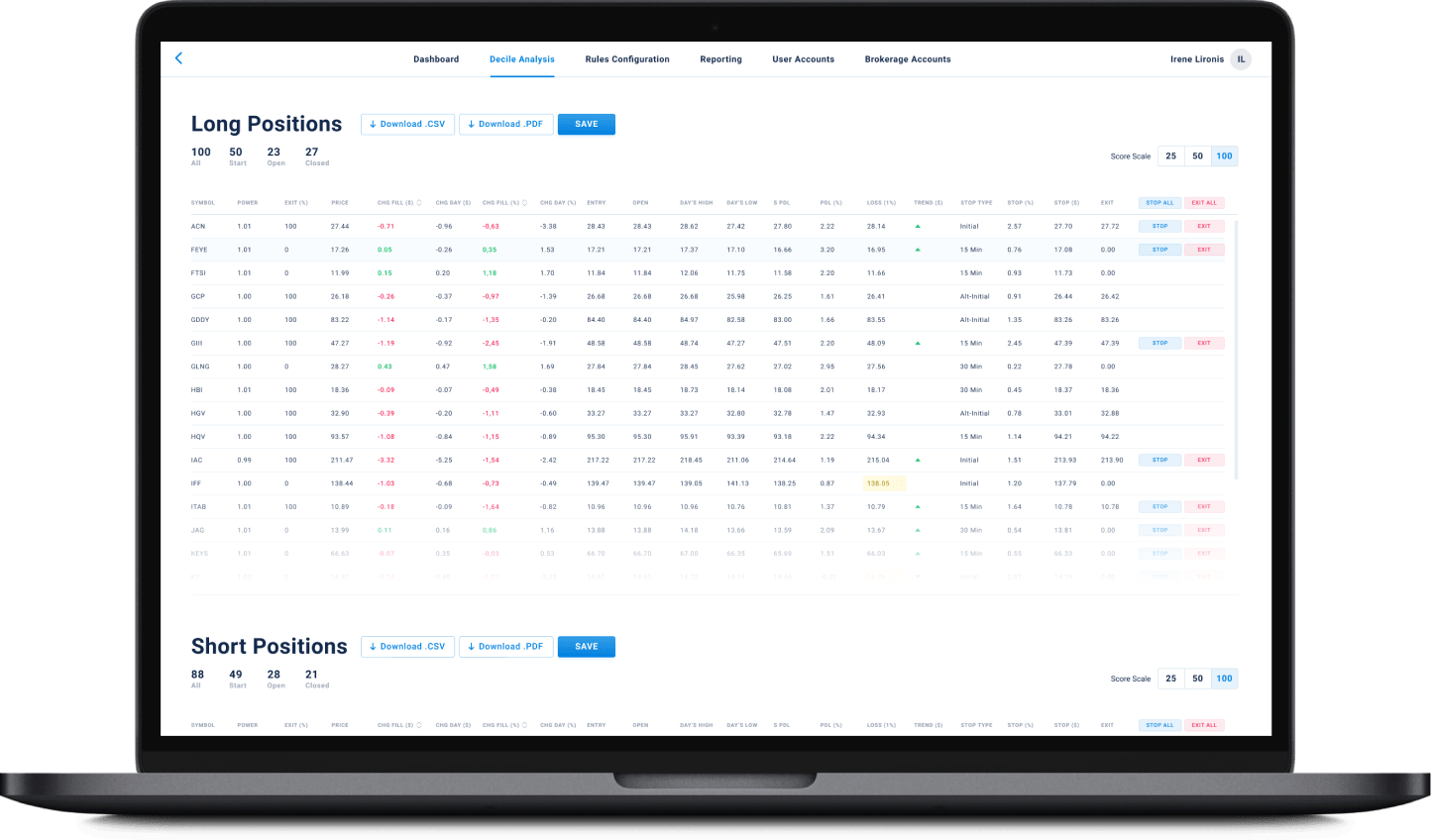

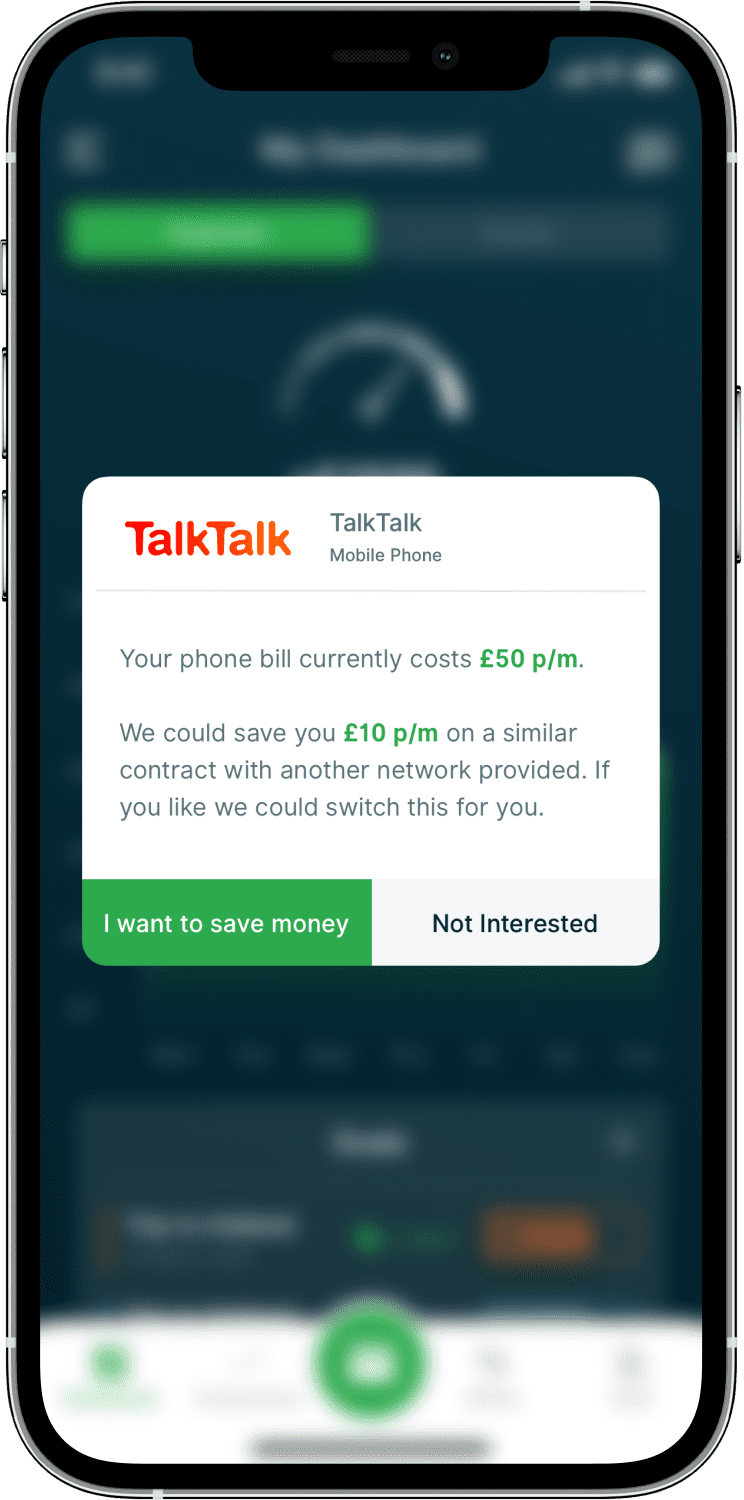

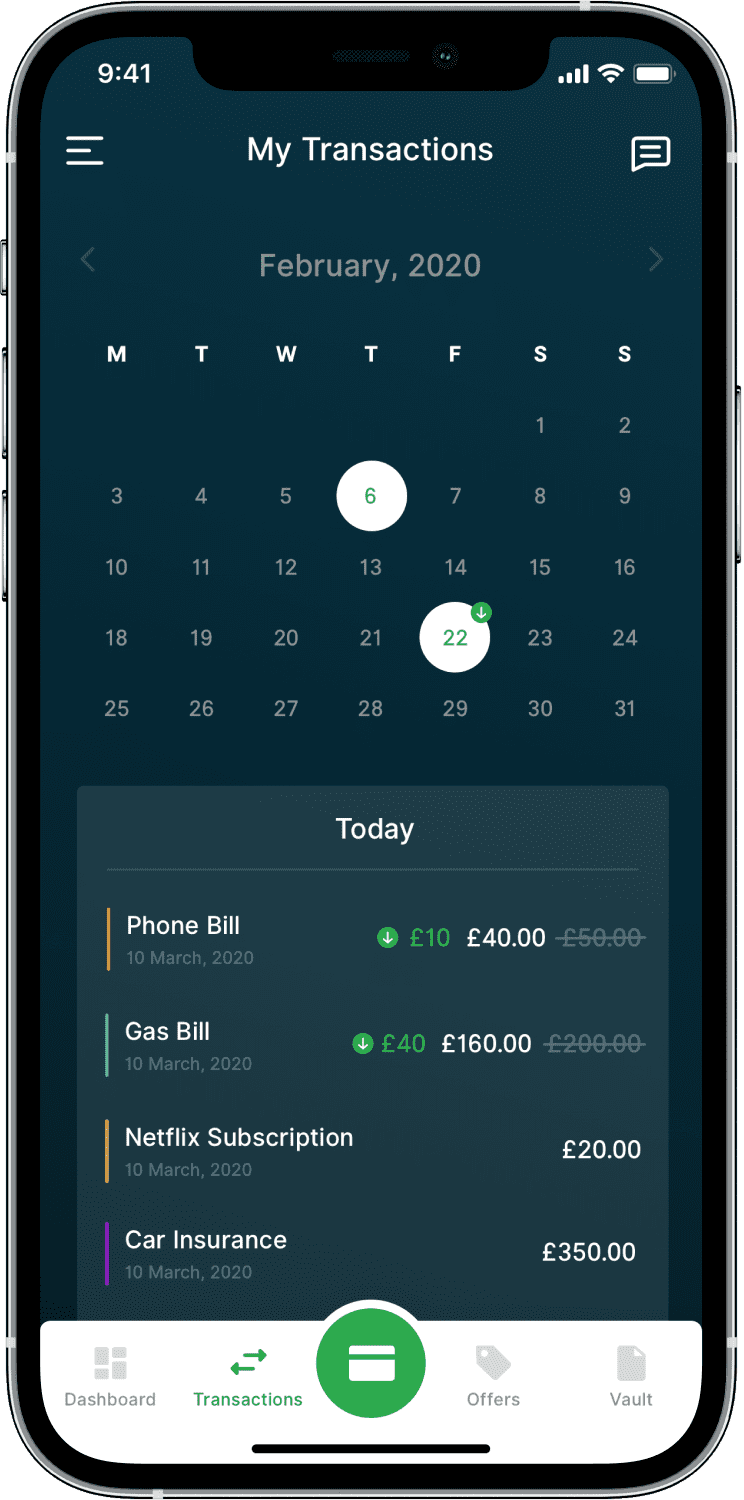

- The system is able to analyze, systematize and categorize the data about user’s earnings and spendings across a certain period of time and display the respective results in the form of graphs and charts;

- The user is able to see the amount of money that was earned and spent across a certain period of time;

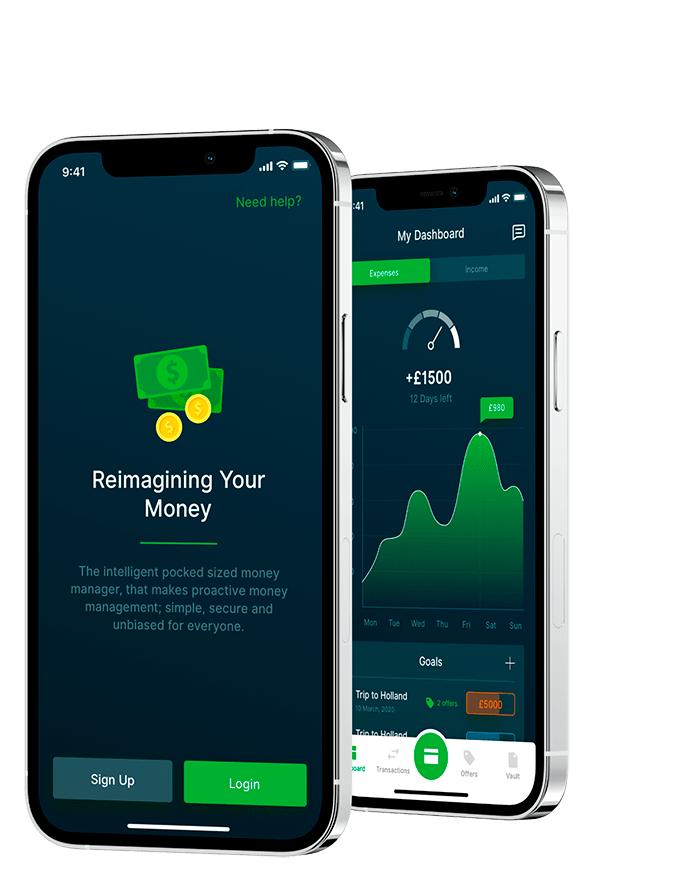

- The app suggests the best services its users may take advantage of. The latter can also switch from one internet provider to another or move the necessary amount of money from their savings account to the credit card with just a single tap;

- The app has an integrated ML Engine designed to analyze the user’s spendings based on the financial data over the past 6 months and provide them with some useful insights of how the current well-being can be improved

Third-Party Integrations

- ML Engine makes it possible to analyze the user’s expenses based on the financial data of the last 6 months and provide them with some useful insights on how to improve the current well-being.

- TrueLayer provides access to the financial data of the main banks and thus indexes and categorizes users’ financial data.

- Facebook is a social media platform that simplifies the registration process by retrieving the user’s data including photo.

Development Work

The work was organized using the Agile development model and the Scrum framework. We have split the development into bi-weekly sprints with new features and product demos coming at the end of each stage. The client communicated with the team via Slack and Skype. We also used Git as a code repository.

The whole development process was divided into 3 main stages:

- At the 1st stage, the system was expected to be able to calculate the so-called smart balance which are the user’s remaining finances adjusted for forthcoming spending until the next payday;

- At the 2nd stage of the development process, it was expected that an app would be able to analyze the user’s current spendings and offer better alternatives of how its regular budget can be spent;

- The 3rd stage was characterized by the system being able to offer its users a possibility of setting a target on saving a specific sum of money and provide some useful tips on how it can be achieved.

Related Projects

All ProjectsContact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland