We have noticed an increase in YouTube and Instagram ads showcasing personal finance apps. These apps include daily, weekly, or monthly spending trackers, as well as apps that help users save or invest their spare money in stocks or real estate from their smartphones. This trend is not surprising since the global demand for such apps continues to grow. According to a report by Liftoff, user activity on finance apps has increased by 354% over the past five years. Mobile finance apps have become an integral part of our lives as more people use their devices to manage their budgets and other aspects of their lives.

Personal finance apps (or PFM apps) have become the preferred channel for consumers to manage their finances and plan for the future. They enable us to track spending, create budgets, optimize loans, and make value-enhancing investments. These benefits include:

- Budgeting gives you control over your money and ensures that you don’t get stressed out when you suddenly have to adjust to a lack of funds.

- Personal finance management apps can help you set and achieve long-term goals. By practicing mindful consumption and spending less, you can save money and make your dreams a reality.

- Finance planning also prepares you for financial emergencies. Even starting small (with just $10 a week), you can build up an emergency fund that will last for several months.

- Finance tracking also helps you get out of credit card debt. It teaches you how to dig out of the debt hole and ensures that you take action to avoid falling back into it.

The market for personal finance management applications shows great potential. Startups that launched a few years ago are already generating substantial revenue. For example, Mint with $2.775 billion, Credit Karma with $1 billion, and Acorns with $1.5 billion.

Despite the variety of personal finance management apps available, users are often not completely satisfied with the solutions they choose. They want more features and a more personalized design approach. Therefore, there is still plenty of room for creativity. In this article, we will explain what features are in demand and what it takes to develop a good personal finance app.

Factors that determine the cost of personal finance management app

Feature set

The more features an app has, the more expensive it is. It’s a simple principle. However, there are a set of core features that are essential for a successful personal finance assistant app, including account aggregation, real-time spending tracking, credit utilization monitoring, and investment tracking.

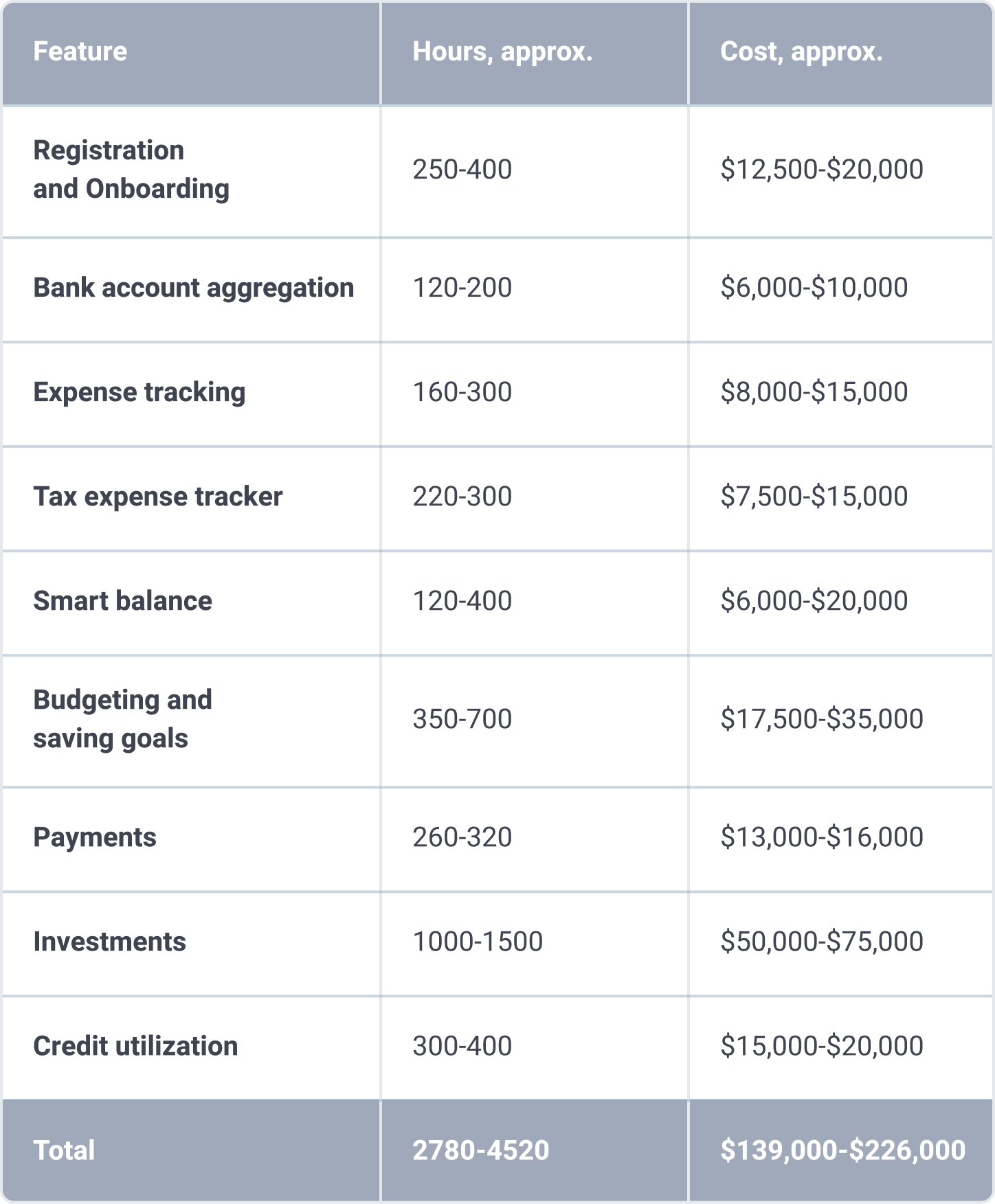

Registration and onboarding

Easy-to-use applications have a great opportunity to succeed. Therefore, it is important to have intuitive registration and onboarding processes. However, finance applications typically require a lot of data verification, ranging from a simple verification of a client’s bank account to the collection and verification of basic client information, to the usage of biometric technology. Depending on the complexity of the app and the scope of features, the development of registration and onboarding can take anywhere from 250-400 work-hours.

Bank account aggregation

The app can consolidate all types of accounts a user has, including credit and debit cards, loans, and other bank details. This provides a one-stop solution for money management and storage of confidential data. Therefore, security is a top priority and compliance with a range of security standards, such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation), is required. The development of this feature takes approximately 120-200 hours.

Expense tracking

The app keeps track of the user’s finances in real-time, eliminating the need to switch to other finance management apps. We all have expenses that consistently eat into our budgets, such as coffee, cigarettes, clothes, and more. The tracker can trace all these expenses, notify you how much money you’re spending, and even set limits on them. The development of this app requires 160-300 man-hours.

Tax expense tracker

The app detects any purchase made with the user’s debit/credit cards and categorizes it as a tax expense or not. This allows the user to have a list of expenses that can be downloaded quarterly or annually for tax purposes. Due to the variation in tax policies across different countries, implementing this feature may take 220-300 hours.

Predictive model

The predictive model collects statistical data and analyzes the user’s regular expenses using a machine learning technique to predict future expenses. This model provides a “smart” estimate of the balance after subtracting projected future spending. Therefore, a client knows the amount of money they have once their regular expenses are taken care of. Implementing this feature takes approximately 120-400 hours.

Budgeting and saving goals

This feature became key in a solution developed by Itexus for a Silicon Valley startup – a money-saving and personal finance assistant app. It enables users to compare their total monthly budget with actual spending in various categories such as clothing, groceries, and movies. Users can also set savings goals they’ve been dreaming of for a long time. Implementing this feature will require between 350-700 hours, depending on the complexity of the app.

Payments

The application may be equipped with payment functionality to provide customers with full control of their personal finances. This eliminates the need to access a separate banking application. Users can make payments directly within the app. Developing this core feature requires 260-320 hours.

Investments

This feature enables purchasing stocks based on a specific investment strategy. The user takes a quiz to determine their financial goals and opportunities. Using data from the quiz and the user’s spending and revenue, the app suggests different investment portfolios: conservative, moderate, and aggressive.

The app can connect to a stockbroker via an online API and automatically purchase stocks according to the defined strategy. Additional subfeatures can be added to enhance the functionality, but these could increase development costs. The estimated development time for this feature is approximately 1000-1500 hours.

Credit utilization

The Credit Utilization Ratio (CUR) measures the amount the user currently owes on all credit cards relative to their credit limits. CUR can be calculated using the following formula: CUR = Outstanding Credit Card Balance / Credit Limit * 100. CUR is a crucial factor to consider when making spending decisions, particularly for those who make frequent daily transactions. The estimated time required to implement this feature is approximately 300-400 work hours.

Note that the table contains data that represents an approximate calculation. Each project is unique, and the actual price may be lower or higher depending on the development requirements.

Development team

In-house team

The first option that may come to mind is to build an in-house team. However, this approach is not cost-effective due to extended time to market and hiring and administrative costs. Additionally, you will need to hire an experienced CTO to manage the staff. Building your own in-house development team is the most expensive option.

App development agencies

Developing a personal finance app with an agency provides several benefits, including trustworthy and transparent relationships, high-quality deliverables, fixed schedules, consolidated services (or at least the majority) in one place, and effective project management. This option is also more cost-effective than setting up an in-house team and more reliable and secure than working with freelancers.

Freelancers

While some freelancers may cost less, the associated risks often outweigh this benefit. You may encounter problems with service quality, flexible working times, lack of transparency, accountability, and difficulty in managing multiple freelancers for various services. A feature-packed project requires a substantial team of developers, DevOps and QA engineers, and designers, making it difficult to gather and manage such a group of freelancers. Even an expensive freelancer cannot replace a team, and there is a risk of ruining the app and ultimately turning to an agency to fix it or rebuild it from scratch.

Developers’ location

The location of app developers is another major factor that determines the cost of a personal finance management app. The most popular areas where app developers are concentrated include the USA, Eastern Europe, and Asia.

The most expensive option for software development is to work with US-based developers who charge around $80 – $150 per hour. Western European developers are also in this price range. Asian countries, such as India and Pakistan, have the lowest development costs, with rates ranging from $15 – $65 per hour. Eastern European companies fall in the middle with rates from $30 – $50 per hour. Currently, working with Eastern European developers is the most popular choice.

While Asian software development services are low-cost, they often come with low quality and slow development processes. Many companies switchув to Eastern European developers to take over a project that was delayed or failed by a low-cost vendor. That’s why many Eastern European development companies, including Itexus, offer dedicated Project Rescue Services.

Platform

If you plan to develop a mobile app, you will need to choose between a native or a cross-platform app.

Some facts about native platforms

- Recommended by Apple and Google

- Best user experience and performance

- Ability to directly use all device resources which results in fast load times and easy access to GPS or Camera

- Get regular software updates if they are designed properly and properly synchronized with the OS

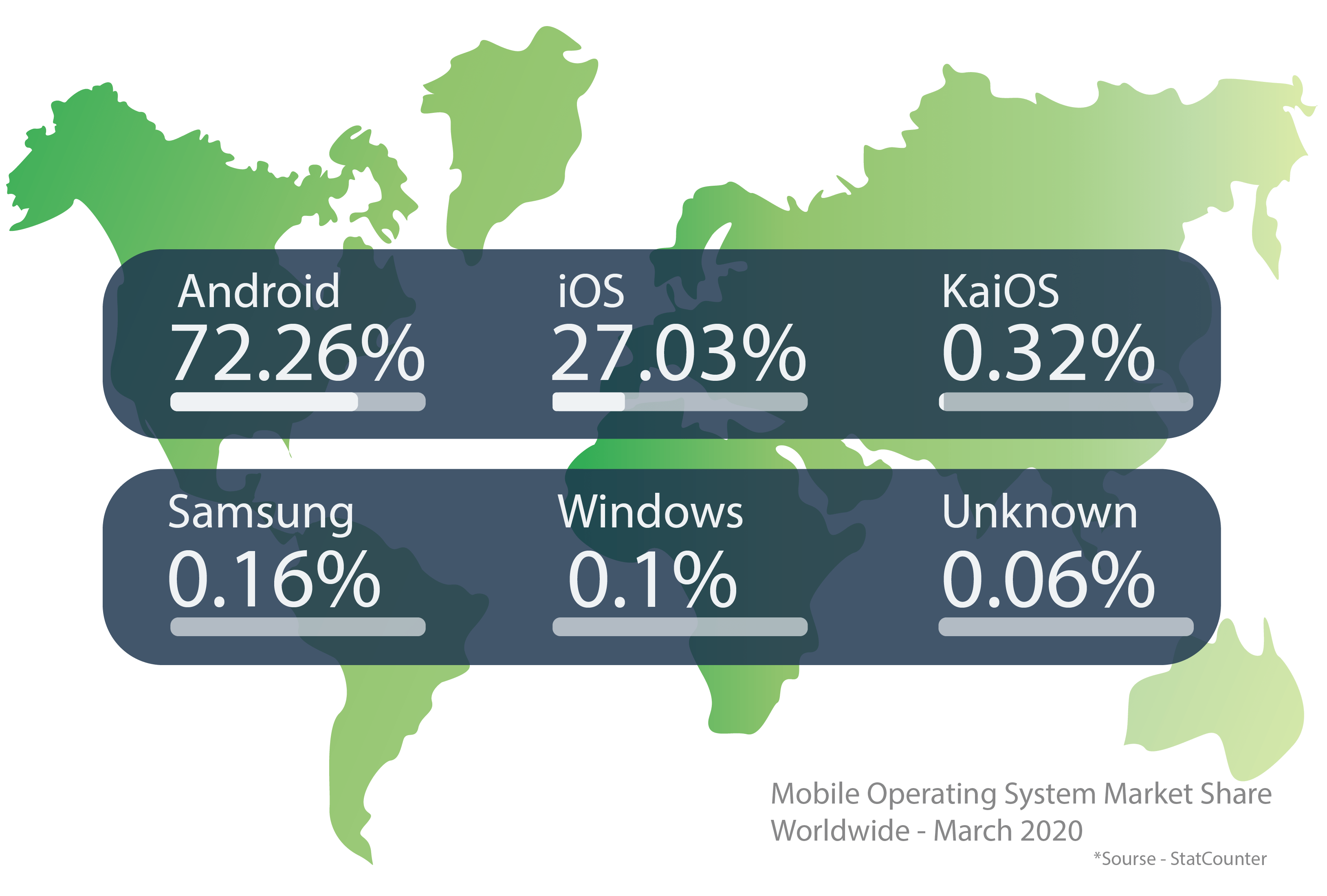

It is advisable to have native apps for both iOS and Android platforms. You can start by launching a Minimum Viable Product (MVP) on one of these platforms, test the concept, and then launch the second one. Keep in mind that the number of Android phone users is higher than that of iPhone users. However, companies often target iPhone users first as they represent one of the biggest paying market segments.

Cross-platform development facts

- Easier to develop than native apps and parts of their code can be shared across platforms

- May decrease the cost of development for simple apps

- Slow code performance with limited tool availability

- It is not easy to integrate your app with local settings, preferences, and notifications

- The lack of updates for frameworks causes problems with the features supported by the operating system

- Inferior user experience because building an app that presents great UX across all devices and platforms is not easy

Deciding to develop a cross-platform personal finance tracker may reduce initial development costs and result in a faster ready-to-use personal finance application, but this economy can cost you more in the future. Native applications are more stable and receive regular updates, ensuring high performance all the time. New cross-platform frameworks appear quite frequently, and it can be challenging to find a developer in the future who knows the framework and can support or add something to the app. If you plan for your personal finance management app to perform long-term and bring value, it’s better to choose native platforms.

Personal finance app design

The cost of app design depends on the complexity of the UI and the presence of numerous small details such as micro-animations. A simple design mainly consists of standard, platform-specific elements that don’t take much time. Animation and custom elements increase the complexity and thus the overall app design cost. Designing a simple app takes approximately 80-150 hours, a medium complexity app takes 150-250 hours, and a complex app takes 250+ hours. However, a personal budgeting app that requires a limited number of features is unlikely to be a complex app. If you plan to have a sophisticated design with animations, be ready to pay 20-50% more for the whole personal finance app development, as such design elements require additional work-hours from front-end developers.

Personal finance app development step by step

Business analysis

Starting with identifying and documenting the key requirements and functionality of the future product is a crucial step. It helps to cut down expenses on surplus MVP features and rework, and ensures the development team has a clear understanding of what needs to be built. Typical business analyst activities include:

- Research of the competition.

- Workshops with the client to identify the right scope of the MVP according to the available budget and priorities in the functionality.

- Analysis and selection of third-party systems for integrations.

- Documentation of the requirements for the development team.

Prototyping

At this stage, the UI/UX designer creates a navigation map of the future system and mockups of the key screens that can be combined into a clickable prototype. The goal of prototyping is to test the flow of a design solution and gather feedback on it before constructing the final product.

Architecture design

With a prototype in hand, the next step is to determine the technology stack, architecture, and third-party components required to build the system. All three should take into account performance, security, and scalability requirements. By the end of this step, the software architect should also create a workload and cost estimate for each feature.

MVP scope definition

The client and contractor will define the scope of the MVP, taking into consideration the budget and estimates for each feature.

UX/UI design

UI/UX designer creates all necessary screen elements (such as icons, illustrations, and animations) and assembles them into sleek interfaces.

MVP implementation

This stage is typically the longest. To maintain the highest efficiency, the team follows Agile principles during the personal finance app development process. The most important features are delivered first, with continuous feedback from the client on each deliverable.

Translate your app for better accessibility and global reach

When developing an app, incorporating language translation is essential. It ensures your app reaches a broader audience, improving user experience, and making it accessible worldwide. Language translation isn’t just an option; it’s a key step in creating a globally inclusive app.

Production cloud setup and going live

The final step in production is to set up the cloud infrastructure in the selected cloud. DevOps engineers must address the project’s security, performance, monitoring, backup, and high availability requirements. Once these are taken care of, the product is ready to be deployed to the production cloud.

Support

After going live, the post-production stage begins. A maintenance team carries out a range of tasks:

- Monitor production servers and logs using automated scripts

- Install security updates

- Create and deploy patches and new feature updates

- Analyze and resolve user issues.

Of course, not all specialists work full-time on the project when you cooperate with a development company. This means you won’t have to pay for downtime. Here’s a rough estimate of the workload for specialists in fintech app development projects:

Examples of top personal finance apps in 2023

Need some inspiration for your personal finance app development project? Let’s explore a few notable finance apps that have revolutionized the financial management landscape.

- One such personal finance application that has made waves in the finance industry is Mint. Mint offers a comprehensive approach to financial management, allowing users to track their spending, set budgets, pay bills, and even receive alerts for unusual activity. This personal finance app also offers a credit score monitoring feature.

- Another popular personal finance management app Acorns, which focuses on investing by rounding up purchases and investing the spare change. This app has made investing more accessible to those who may not have considered it before.

- PocketGuard is rightfully considered to be one of the best personal finance apps. It helps users stay on track by showing them how much they can spend each day. The app analyzes the user’s income, expenses, and other key financial factors and provides a recommended daily spending limit that will help the user avoid overspending.

- Personal Capital is an all-in-one financial management app that helps users take control of their finances, track investments, net worth, and spending, and use various tools to manage money effectively. The app also offers retirement planning and tax-optimization features that help to reduce tax burden and make informed finance decisions.

- Digit is more of a robo-advisor than a personal finance app. It uses machine learning to analyze user’s spending habits and make recommendations for how much can be saved each week.

The personal finance apps industry has grown and innovated in 2023. Each app presented caters to specific financial needs and offers tools to manage finances effectively, from tracking expenses to personalized investment advice. However, there is still room for new solutions.

Summary

The fintech industry is still waiting for the best personal finance tracker app that includes all the necessary features, a cute and intuitive design, and is very easy to use. The cost of a personal budget app is not fixed and depends on various conditions, such as the set of app features, whether you decide to develop it in-house or outsource the work, your vendor’s location, and design requirements. Developing a personal finance app with the core features mentioned above will take roughly 3000 hours. Then, multiply it by the average developer hourly rate. For example, at Itexus, we charge $35-$40 per hour for Fintech projects. In the end, the estimate comes to around $110 000.

At Itexus, we have extensive experience in developing solutions for the financial sector. We would be delighted to assist your business in becoming the next big thing in the Fintech community.

Itexus stays up-to-date with the latest trends in fintech software development. Many of our developers have a finance background, and we began working with financial technology as soon as its rise became imminent. Over the years, we have gained unique expertise in FinTech by working with both newcomers and established players in the market. We are now ready to share this expertise with you. If you’re looking to build a finance app, don’t hesitate to reach out. We’ll help you transform your idea into a product that can compete with existing players, no matter how big they are, and disrupt the market.