Imagine never stepping foot in a bank again. No waiting in line, no paperwork, no closing hours—just full control of your finances, all from the palm of your hand. That’s the power of a well-designed mobile banking app. In today’s world, where convenience and security are paramount, a banking app isn’t just an option—it’s essential. Businesses now have the opportunity to build deeper relationships with customers while offering seamless, digital-first financial experiences.

Market Overview

Mobile banking is no longer a luxury but a necessity, as adoption rates continue to soar. According to Statista, over 2.5 billion people are projected to use mobile banking apps by 2024. Additionally, the global fintech market is expected to reach $698.48 billion by 2030, driven by rapid technological advancements, increasing smartphone penetration, and growing user demand for better financial tools.

Key Statistics:

| Year | Mobile Banking Users (Billion) | Global Fintech Market Size (Billion USD) |

|---|---|---|

| 2022 | 1.8 | 305.7 |

| 2023 | 2.2 | 523.5 |

| 2024 (Est.) | 2.5 | 698.48 |

Example:

In 2021, the Revolut banking app surpassed 15 million users, mainly due to its focus on a sleek interface, powerful financial tools, and cross-border payment capabilities. Understanding how global trends are shaping the market is key for staying competitive.

Pro Tip: Keep an eye on regional fintech regulations to ensure that your app is compliant with local laws from the start. For example, Europe’s PSD2 (Payment Services Directive 2) has driven significant innovation in open banking, giving third-party providers access to bank APIs with user consent.

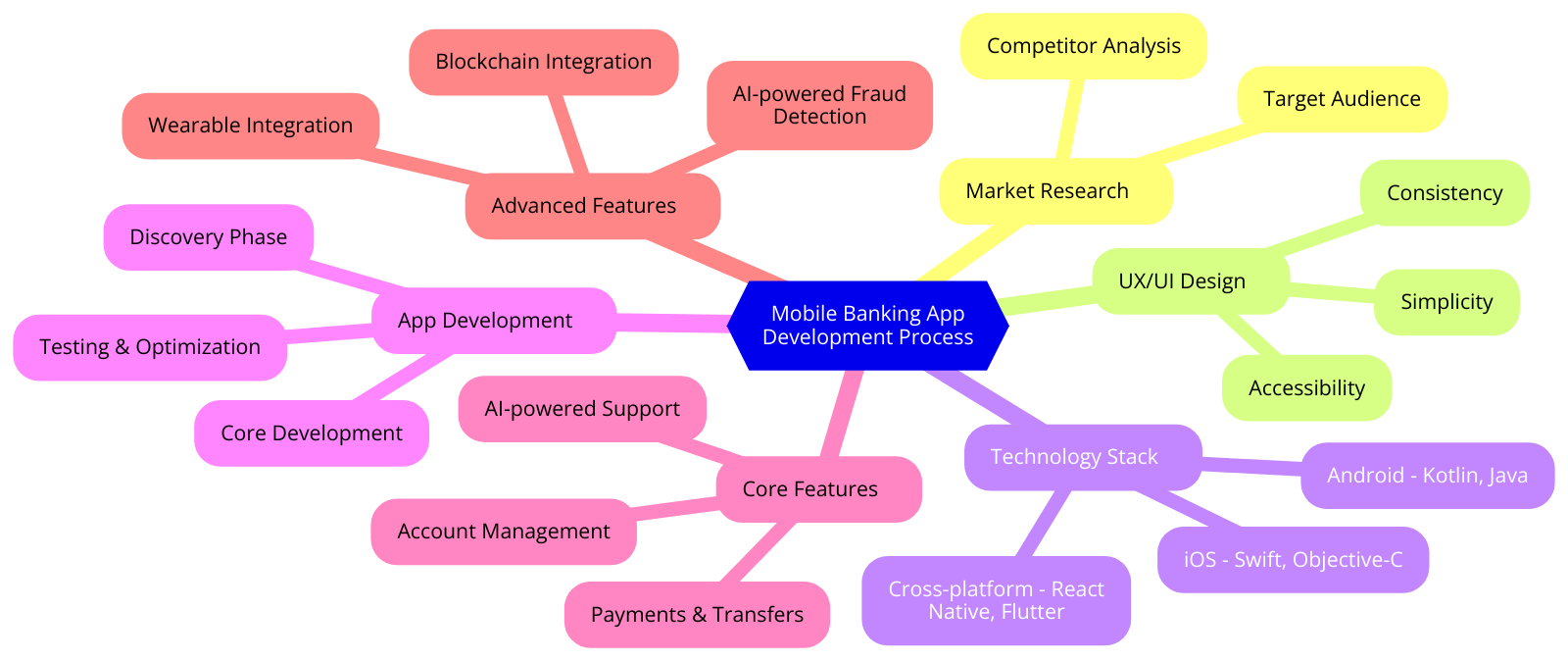

Step-by-Step Development Guide

Step 1: Market Research

Before diving into app development, understanding your audience and competitors is critical. Are you targeting Millennials, Gen Z, or Baby Boomers? Each group has different financial needs and preferences. Analyze competing apps to identify features users love and the gaps your product can fill.

Pro Tip: Use SWOT analysis to assess your app’s Strengths, Weaknesses, Opportunities, and Threats, ensuring you’re one step ahead of the competition.

Step 2: UX/UI Design

User-friendly interfaces are non-negotiable in banking apps. Users should be able to complete actions like transferring money or checking their balance within seconds.

| Design Principles | Key Focus Areas |

|---|---|

| Simplicity | Easy-to-navigate screens |

| Accessibility | Features like text-to-speech |

| Consistency | Uniform design across devices |

Example:

The N26 app excels in providing users with an intuitive experience, where transferring money takes just three taps. This simplicity not only saves time but also boosts user retention.

Step 3: Technology Stack Selection

The technology stack is the backbone of your app. Popular options include:

| Platform | Tech Stack | Ideal For |

|---|---|---|

| iOS | Swift, Objective-C | Native iPhone app development |

| Android | Kotlin, Java | Native Android app development |

| Cross-Platform | React Native, Flutter | Simultaneous development for iOS/Android |

Pro Tip: Consider using React Native if you want to launch your app on both iOS and Android quickly and cost-effectively. However, for more complex functionalities, native development might provide better performance.

Step 4: App Development Phases

- Discovery Phase: Define your goals, features, and technical requirements.

- Core Development: Build the app using the chosen tech stack, ensuring all key features work smoothly.

- Testing & Optimization: Conduct usability testing and refine based on feedback, ensuring the app is secure and easy to use.

Core Features of a Banking App

A robust banking app must offer the following core functionalities:

| Feature | Description |

|---|---|

| Account Management | View balances, transactions, and manage multiple accounts |

| Payments & Transfers | Fast, secure payments and transfers between accounts |

| AI-powered Support | 24/7 AI-driven customer service for common queries |

| Push Notifications | Real-time alerts for payments, updates, and reminders |

| Biometric Authentication | Secure login using facial recognition or fingerprints |

Advanced Features for Differentiation

To stand out, you need to include cutting-edge features:

| Feature | Benefits |

|---|---|

| AI-powered Fraud Detection | Automatically flags suspicious activities and protects users |

| Wearable Integration | Enable smartwatch payments and account updates |

| Blockchain Integration | Boosts transaction security and transparency |

| Personalized Marketing with AI | Provides targeted product recommendations based on user behavior |

Example:

The Starling Bank app leverages AI to offer smart financial insights and track spending habits, which helps users budget more effectively. Such features not only increase user engagement but also build long-term trust.

Challenges & Solutions

Developing a banking app comes with challenges, but they can be overcome with careful planning:

| Challenge | Solution |

|---|---|

| Technical Performance | Use cloud infrastructure for scalability |

| Regulatory Compliance | Partner with legal experts to meet regulations (GDPR, PCI DSS) |

| Security Threats | Implement strong encryption and multi-factor authentication (MFA) |

Pro Tip: Regular security audits are crucial to stay ahead of cyber threats. Consider conducting penetration tests to identify potential vulnerabilities before they become major issues.

How to Reduce Development Costs

Developing a banking app can be expensive, but there are strategies to manage costs effectively without compromising quality.

- Start with an MVP (Minimum Viable Product): Focus on core functionalities first. This approach allows you to gather user feedback early and iterate based on real data.

- Use Cross-Platform Development: Tools like React Native or Flutter let you build for both iOS and Android simultaneously, saving time and money.

- Outsource Development: Partnering with experienced fintech development teams in cost-effective regions can significantly reduce labor costs while maintaining high quality.

- Cloud Solutions: Opt for cloud infrastructure (e.g., AWS or Azure) to scale efficiently and avoid heavy upfront infrastructure costs.

- Pre-built APIs: Leverage existing APIs for payments, user authentication, and other functionalities to reduce custom development efforts.

By implementing these strategies, businesses can cut down on costs while still delivering a high-quality, competitive product.

Monetization Strategies

Monetizing your app goes beyond offering basic services. Some popular strategies include:

| Strategy | How It Works |

|---|---|

| Premium Features | Offer advanced budgeting tools or priority support for a fee |

| Partnerships | Partner with third-party providers (e.g., insurance or investment services) to earn commission on referrals |

Unique Touch: The Future of Mobile Banking

Looking ahead, the integration of emerging technologies like blockchain and artificial intelligence (AI) is set to redefine the fintech landscape. Blockchain provides unparalleled security and transparency for transactions, while AI can power smart financial tools that offer personalized insights and recommendations.

For instance:

- Voice Commands: Integrating voice recognition for tasks like transferring money or checking balances is becoming more popular.

- Sustainability: Some apps now offer digital receipts, eco-friendly financial advice, and the ability to track carbon footprints for purchases.

- Community Features: Building in-app user communities that provide financial education and peer support could increase engagement and retention.

Example:

Apps like Revolut are already harnessing blockchain for seamless cross-border payments, reducing transaction times and fees while ensuring secure, immutable records. Similarly, AI-driven chatbots are revolutionizing customer service by providing instant, 24/7 support and predictive financial advice.

Pro Tip: Stay on top of emerging trends like AI and machine learning for financial predictions and blockchain for ultra-secure transactions to ensure your app is future-ready.

Conclusion

Creating a banking app is both an exciting opportunity and a complex challenge. From understanding your target market to choosing the right technology and ensuring top-notch security, every step must be carefully planned and executed. By focusing on core features, differentiating with advanced technologies, and staying ahead of regulatory and security demands, your app can become a leader in the fintech world.

For businesses looking to develop a mobile banking solution that resonates with today’s tech-savvy consumers, consider partnering with Us. With our expertise, you can bring your vision to life while avoiding the common pitfalls of app development.

Frequently Asked Questions (FAQ)

1. What are the essential features a mobile banking app must have?

A robust mobile banking app should include core functionalities like account management (view balances, transaction history), secure payments and transfers, push notifications, and biometric authentication for added security. Additionally, offering AI-powered customer support and real-time alerts can significantly enhance the user experience.

2. How long does it take to develop a mobile banking app?

The development timeline varies depending on the app’s complexity. On average, a basic mobile banking app can take 3 to 6 months to build, while more advanced apps with complex features can take 9 to 12 months or longer. This includes phases like market research, design, development, testing, and deployment.

3. What technologies are typically used to develop a mobile banking app?

For native iOS apps, Swift and Objective-C are commonly used, while Kotlin and Java are preferred for Android development. Cross-platform solutions like React Native and Flutter are also popular for developing apps that work seamlessly on both iOS and Android devices, reducing time and cost.

4. How can I ensure the security of my mobile banking app?

To ensure security, implement strong encryption, multi-factor authentication (MFA), and biometric login options like facial recognition or fingerprint scans. Regular security audits, penetration testing, and staying compliant with industry regulations (such as PCI DSS or GDPR) are also critical steps in protecting user data.

5. What are the biggest challenges in mobile banking app development?

The main challenges include maintaining robust security against cyber threats, ensuring regulatory compliance across different regions, and providing a seamless user experience with minimal technical issues. Performance optimization, scalability, and handling high user traffic are also crucial to a successful banking app.