The digital wallet market is set to reach $16 trillion by 2028, and thus it is worth getting into the market. However, debit cards are still the most preferred means of payment, especially in the United States, where they are used by 68 per cent of consumers, according to the NBFS. These challenges are therefore important to address in order to get a share of the 4.8 billion potential customers.

This article aims to help you navigate the key challenges in creating your wallet app and output an app that is both innovative and effective. It is important to note that the integration of advanced AI, behavioral psychology, and collaboration with professional developers is the best approach. Just using the AI understanding of user behavior is not enough. It is only when these elements are combined that it will be possible to develop a user-friendly, secure, and effective application that will attract users and help grow the business. In this article, we will discuss how this approach can assist you in developing a digital wallet application that will exceed users’ expectations in the current financial technology environment.

Understanding User Needs Through Psychology

Creating a successful digital wallet app requires an understanding of user behavior and preferences. By leveraging psychological insights, fintech companies can design products that resonate deeply with users.

User Research and Personas

The first step in the development process is to carry out a thorough analysis of the users to determine their financial behavior, problems, and demands. This makes it easier to create apps that meet the needs of real users through the use of user personas.

This serves as a good psychological reference to inform this process and should be employed when implementing the unit of analysis referred to as Fogg’s Behavior Model and its three propositions:

- Motivation: Make sure that the features of the application correspond to the financial objectives of the users, for example, through the provision of rewards or the setting of savings goals.

- Ability: Ensure that the design of the interface is simple and easy to use so as to minimize the level of friction.

- Triggers: Use cues such as notification to encourage people to take certain actions (e.g. saving, spending).

Collaboration with Developers

Once the research phase is complete, it is crucial for developers to translate psychological insights into technical requirements. This could involve creating intuitive interfaces, ensuring frictionless onboarding, or integrating gamified features that promote saving and spending behaviors. To effectively implement these psychological insights, developers must collaborate closely with UX/UI designers and behavioral psychologists throughout the process. This ensures that both the design and functionality are aligned with user needs and expectations. Ultimately, developers play a pivotal role in translating these insights into seamless functionality, creating an app that is not only easy to use but also psychologically engaging.

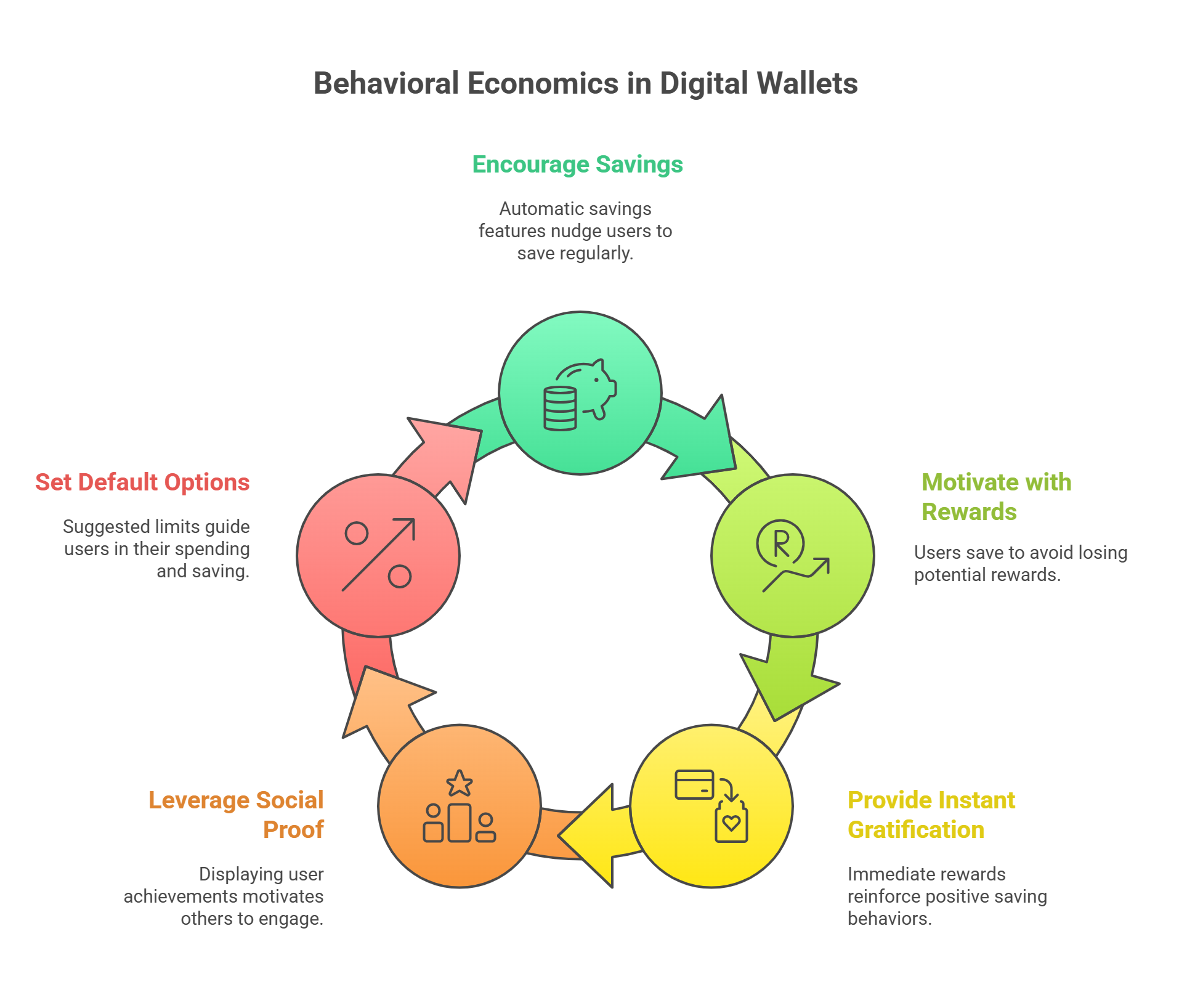

Designing with Behavioral Economics

Behavioral economics is the study of how psychological, social, and emotional factors influence economic decisions. It challenges traditional economic theory by recognizing that people do not always act in their own best financial interest due to biases, imperfect information, and emotional influences. In the context of digital wallet apps, behavioral economics helps design features that encourage users to make better financial decisions.

Key Features in Behavioral Economics for Digital Wallets

| Behavioral Economics Principle | Feature Example | Impact on User Behavior |

| Anchoring | Setting default savings options (e.g., “save 10% automatically”) | Encourages users to save by setting a high but attainable goal. |

| Nudging | Automatic round-up features for transactions | Encourages users to save spare change without requiring active effort. |

| Social Proof | Displaying savings milestones achieved by other users | Motivates users to engage in saving behaviors by showing community success. |

| Loss Aversion | Cashback rewards for users who maintain a certain savings level | Increases engagement by presenting potential loss (missed rewards) to motivate saving. |

| Instant Gratification | Offering instant rewards for small savings or payments | Reinforces positive financial behavior with immediate rewards, increasing app usage. |

Real-Life Impact of Behavioral Economics

Real-world examples show the power of behavioral economics in driving user engagement:

- Acorns, an investment app, uses a round-up feature that automatically invests spare change from everyday purchases. Research from Acorns found that users who used the round-up feature saved an average of $600 annually, demonstrating the effectiveness of nudging users to save.

- Chase’s digital wallet incorporates gamification and social proof by showing users how much money their peers are saving with the app. This aligns with social proof as a powerful motivator, encouraging others to engage more actively.

By understanding human decision-making and integrating behavioral nudges, digital wallet apps can lead to improved financial outcomes.

Developer’s Role

Developers ensure that these features are technically feasible and integrate seamlessly with the app’s existing infrastructure. They also ensure that the user experience is intuitive and encourages consistent engagement. While behavioral economics provides the guiding principles for feature development, it’s the developers who bring these principles to life by integrating them into the app’s architecture. Developers make sure that complex algorithms are not only user-friendly but also operate efficiently, ensuring that behavioral insights enhance, rather than complicate, the user experience.

Integrating Adaptive AI for Personalization

Adaptive AI has become a game-changer in digital wallet app development, providing personalized experiences that cater to individual user needs. By analyzing vast amounts of data, AI can help users make smarter financial decisions while providing enhanced functionality.

AI-Driven Insights

Adaptive AI can track user behavior and preferences over time, offering tailored recommendations. For instance, if a user frequently spends on entertainment, the app could suggest budget-friendly alternatives or offer discounts on relevant services. AI can also predict spending habits and suggest savings strategies based on past behavior, offering a truly personalized experience.

Developer Collaboration

Developers play a crucial role in integrating AI features into digital wallets. They work alongside data scientists to ensure the AI algorithms function correctly and maintain high levels of accuracy. Additionally, developers ensure that user data is kept private and secure, with AI features improving functionality without compromising privacy.

Case Study: AI-Powered Personalization in Action

A notable example of AI-driven personalization is the integration of AI in the PayPal app. PayPal uses machine learning algorithms to recommend financial products, promotional offers, and transaction insights based on users’ transaction history. This personalized experience enhances user satisfaction and engagement, leading to greater customer retention.

Building a Secure and Compliant App

Security and Compliance are non-negotiable aspects of developing a digital wallet app. Given the sensitive financial data involved, robust security measures must be implemented to protect user information. Moreover, fintech regulations must be adhered to, ensuring that the app remains legally compliant.

Real-Life Data on Compliance

A report by Cybersecurity Ventures estimates that global cybercrime damages will hit $10.5 trillion annually by 2025, making compliance and security more crucial than ever. Not only does this risk underscore the need for robust security features, but it also shows the direct link between compliance and trust in the digital wallet space.

- Apple Pay and Google Pay both comply with PCI-DSS (Payment Card Industry Data Security Standard), which requires them to encrypt user data both in transit and at rest. This prevents credit card information from being intercepted during transactions, which is vital for securing users’ financial information.

- Another example is Revolut, a fintech company operating globally. It adheres to GDPR regulations in Europe, ensuring that all users’ data is anonymized and protected under stringent data protection laws, which builds trust in the platform’s security.

Security Features and Compliance

| Security Feature/Compliance | Description | Regulatory Standard | Importance for Developers |

| Two-Factor Authentication (2FA) | Requires two forms of identification to access an account | PCI-DSS (Payment Card Industry) | Adds an additional layer of protection against unauthorized access. |

| End-to-End Encryption | Ensures that data is encrypted during transactions | GDPR (General Data Protection Regulation) | Protects user data from being intercepted, ensuring privacy and security. |

| Biometric Verification | Uses fingerprint or facial recognition for app access | SOC 2 (Service Organization Control 2) | Enhances security while offering a frictionless user experience. |

| Data Encryption at Rest | Encrypts sensitive data stored on the device or server | PCI-DSS, HIPAA (Health Insurance Portability and Accountability Act) | Prevents data breaches by ensuring that stored data is protected. |

| Regulatory Compliance (GDPR, CCPA) | Ensures that user data is handled according to regional laws | GDPR, CCPA (California Consumer Privacy Act) | Ensures compliance with global privacy regulations to avoid fines and build trust. |

By integrating stringent security protocols and compliance measures, developers can mitigate risks, build user trust, and avoid regulatory penalties.

Developer Expertise

Developers must be well-versed in security protocols and comply with financial regulations such as PCI-DSS (Payment Card Industry Data Security Standard), GDPR (General Data Protection Regulation, if operating in the EU), and SOC 2 (Security, Availability, Processing Integrity, Confidentiality, and Privacy standards). These compliance standards require developers to implement stringent data protection measures, safeguard against potential breaches, and ensure that user information is stored and processed in compliance with regulatory guidelines.

For example, under PCI-DSS, developers must ensure that sensitive cardholder data is never stored in plaintext and that data encryption is employed during transactions. Similarly, developers need to integrate GDPR-compliant features such as data access requests and the right to be forgotten to respect user privacy. By adhering to these security and compliance standards, developers build trust with users and mitigate risks of data breaches.

Iterative Development and Testing

An effective digital wallet app is the result of continuous iterations, fine-tuning, and testing. Using Agile methodology, development teams can deliver incremental improvements and adapt based on user feedback. This iterative process ensures that the app evolves with user needs and technological advancements.

Real-Life Impact of Agile Methodology

PayPal adopted Agile development years ago, allowing the company to rapidly roll out updates and improve features in response to customer feedback. PayPal uses scrum teams to work in sprints, enabling them to develop features quickly, test them, and roll out fixes within weeks. As a result, PayPal has significantly improved user satisfaction and retention.

Developer’s Role in Agile

Agile developers facilitate the process by organizing work into smaller tasks (sprints) and collaborating closely with cross-functional teams, ensuring timely releases. At Itexus, we utilize frameworks such as Scrum and Kanban to deliver incremental updates, address user feedback, and adapt to changing user requirements efficiently. This approach ensures that our digital wallet apps continuously evolve, enhancing user experience and functionality.

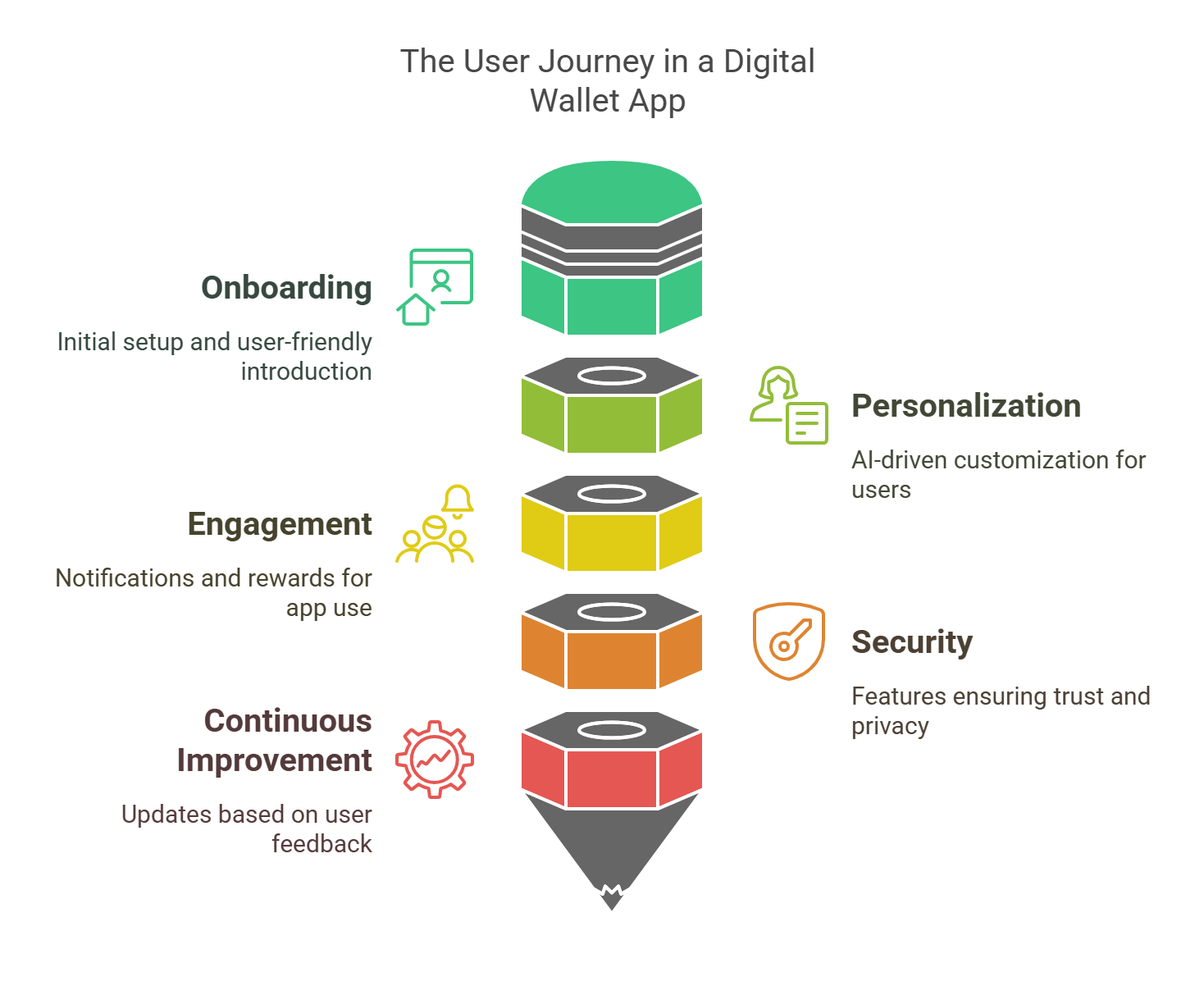

Launch and Continuous Improvement

Once the digital wallet app is launched, it’s essential to keep the momentum going. Continuous monitoring and user feedback play a key role in improving app performance and keeping users engaged.

User Education and Support

Educating users about the app’s features and benefits is crucial to ensure they understand how to use the app effectively. Providing responsive customer support can help users resolve issues quickly and maintain a positive experience with the app.

Developer Involvement

Post-launch, developers continue to monitor app performance and analytics to identify areas for optimization. This involves tracking metrics like user engagement, transaction volumes, and error rates. Based on this data, developers can push updates to enhance features or introduce new ones. For instance, if analytics show users are struggling with a particular feature, developers can tweak it or introduce new tutorials. Additionally, developers work to ensure the app stays compatible with new device updates and OS versions to provide the best user experience.

Why Choose Us? A Contrast of Expertise in Fintech Development

| Our Approach | Typical Competitors |

| 1. Psychology-Driven Design | |

| We engineer apps using behavioral science principles (e.g., cognitive load reduction, habit-forming interfaces) to drive engagement. Result: 30%+ higher user retention in projects like Coinstar. | Most prioritize functionality over psychology, leading to generic interfaces that fail to resonate emotionally with users. |

| 2. Adaptive AI for Security & Personalization | |

| Our AI models learn user patterns to detect fraud and tailor experiences (e.g., predictive budgeting tools). Proven: 99.8% fraud prevention accuracy in Selicon Valley FinTech’s payment solution. | Many use static rule-based systems, sacrificing personalization for security—or vice versa. |

| 3. Blockchain-Ready Architecture | |

| We build crypto-native wallets for next-generation fintech company offering fee-free banking with seamless fiat/crypto interoperability, anticipating the $2.2B blockchain wallet market. | Competitors often treat crypto as an afterthought, forcing costly rebuilds as markets evolve. |

| 4. Agile, User-First Development | |

| We validate features through rapid prototyping and real user feedback loops Silicon Valley-based provider of digital banking services achieved in 12 weeks. | Rigid waterfall methodologies delay launches and create misaligned products. |

| 5. Proven Fintech Partnerships | |

| We’ve powered solutions for Coinstar and crypto innovators—demonstrating scalability across 93M+ user bases. | Many lack hands-on experience with high-traffic financial ecosystems, increasing technical debt risks. |

The outcome?

While others build wallets, we craft financial ecosystems that users trust, enjoy, and return to—translating to 5x faster user growth for clients like Coinstar.

Conclusion

In conclusion, creating a successful digital wallet app requires the fusion of psychology, AI, and expert development practices. By understanding user behavior, leveraging AI for personalization, ensuring top-notch security, and iterating based on feedback, fintech companies can build apps that not only meet but exceed user expectations.

As the digital wallet market continues to grow, it’s clear that innovative development practices will play a crucial role in shaping the future of fintech. Companies that effectively combine human psychology, adaptive AI, and expert development will be well-positioned to lead the market.