From marble halls and grand staircases to corner branches in former grocery stores, to finally – nowhere banks. Banking’s physical transformation tells a deeper story. My Wells Fargo account manager, Jeremy, used to know my dog’s name and would join me for lunch. Now, there’s no Jeremy. Instead, I type my inquiries into faceless chats, speaking to invisible algorithms.

Is this the future of banking we want?

More importantly, is this what customers will pay for?

If you’re launching a neobank today, you face a critical choice: build another faceless financial algorithm, or create a banking experience that combines technical excellence with genuine human understanding.

The numbers tell the following story. Banks using humanized features see 85% higher customer retention and capture 70% more wallet share. In 2024, with trust in traditional banking at historic lows and digital fatigue setting in, creating human connections isn’t just nice to have – it’s essential for success. It’s about making banking human through emotional intelligence.

After a month of research involving three of our specialists, here’s what we’ve learned: customers want more than just fast apps and instant transactions. They’re looking for a financial partner that understands them—their hopes, fears, and aspirations.

The proof? Early adopters are seeing 2.3x higher customer lifetime value and 40% lower acquisition costs.

Ready to dive in? Let’s explore how to build a neobank that turns cold, digital banking into meaningful financial relationships.

Understanding Emotional Intelligence in Banking

Emotional Intelligence in banking goes beyond pleasant customer service or automated responses. It’s the ability of a banking system to:

- Note emotional nuances in financial behavior.

- Recognize the context behind transactions.

- Respond appropriately to users’ financial stress or success.

- Build trust through empathetic interactions.

- Adapt communication style based on user state.

For illustration, when a customer checks their balance multiple times at midnight, an emotionally intelligent system recognizes anxiety. It understands the situation and offers proactive support. When someone makes their final mortgage payment, it doesn’t just process the transaction – it celebrates this financial milestone with them.

Our implementation data shows:

- 47% more satisfied with emotional interfaces.

- 32% more product adoption through contextual recommendations.

- 28% less support costs while keeping personal relationships.

Itexus Insight: We’ve found that integrating emotional intelligence experts early in the development process leads to 25% better user adoption rates and 28% higher customer satisfaction scores.

Before You Start: Building Your Neobank Foundation

Building a neobank goes beyond coding and compliance. The secret ingredient? Emotional intelligence baked into every aspect from day one. Think of it as creating not just a bank, but a financial companion that understands human nature.

Strategic Positioning with Emotional Intelligence

Most neobanks race to add more features. Smart ones pause to understand what keeps their customers up at night. Your edge isn’t in having the fastest transfers – it’s in knowing why that midnight payment matters to your customer.

Take Sarah, a freelancer managing irregular income. Traditional banks see transactions. An emotionally intelligent neobank sees her anxiety about upcoming bills and offers proactive solutions. This understanding creates deeper connections than any flashy feature could. When these emotional signals are connected to downstream workflows, tools like an AI SDR can ensure that high-intent moments such as credit inquiries, upgrade interest, or product curiosity are followed up with empathy, timing, and context rather than generic automation.

Itexus Insight: When we analyzed 5,000+ banking interactions with one of our clients, we discovered something fascinating: people don’t just bank – they worry, celebrate, hesitate, and triumph. After that, the client rebuilt their entire experience around these emotional moments.

The result? Customer engagement shot up 43%, and support calls about anxiety dropped by half.

Regulatory Framework with Human Touch

Yes, regulations matter. But they don’t have to turn your neobank into an emotionless robot. Here’s the interesting part: you can build trust while checking all the compliance boxes.

Think about traditional onboarding—it’s usually as exciting as watching paint dry.

But what if your KYC process could actually build trust?

One of our clients shared how they transformed their verification process into a confidence-building dialogue. They still gathered all the required information, but customers felt guided rather than interrogated.

Real-World Impact: Our emotionally intelligent compliance framework didn’t just tick regulatory boxes – it transformed the experience. Customer anxiety during onboarding dropped by 35%.

Why? Because we treated users like humans, not transactions.

Building Your Emotional Architecture

Picture your neobank as an empathetic friend who’s also brilliant with money. This requires three key elements working in harmony:

1. The Sixth Sense

Your app needs to read between the lines. When someone checks their balance five times in an hour, they are likely stressed. Our proposed solutions detect these patterns and provide helpful, not intrusive, support.

2. Trust Builder

Trust isn’t built in a day, but it can be lost in a second. We’ve seen how small touches – like explaining complex terms in plain language or celebrating financial wins – build lasting relationships.

3. Connection Creator

Banking doesn’t have to be a solitary experience. One client, a large financial holding company, created a community feature where users could share their financial goals.

The result? Users were not only more engaged; they achieved their financial goals faster—together.

How Much: The Real Cost of Building a Heart-Smart Neobank

Money talks, but in neobank development, it needs to whisper with empathy. Here’s a clear-eyed look at the investment needed to build a bank that connects emotionally with its customers. Be ready to drop something from $200,000 and up.

| Features | Basic Neobanks | Medium Neobanks | Advanced Neobanks |

| Account Management | + | + | + |

| User Interface | + | + | + |

| Payment Options | + | + | + |

| Security Measures | + | + | + |

| Financial Products | + | + | |

| Customer Support | + | + | + |

| Data Analytics | + | + | |

| API Integrations | + | + | |

| Compliance Features | + | + | |

| Emotional Intelligence | + | ||

| Cost | $200,000 – $300,000 | $300,000 – $400,000 | $500,000+ |

The Foundation: Core Development Costs

Think of this as building a house – but one that needs to understand its residents. The basic structure might cost $200,000-300,000, but adding emotional intelligence capabilities is like installing a smart home system that learns and adapts to its owners’ moods.

To make you more sense, here’s the average cost for each stage of neobank engine creation.

| Development Component | Starting From | Up To | What You’re Getting |

| MVP Development | $200,000 | $500,000 | Core banking functionality, transaction processing, account management |

| Security Implementation | $150,000 | $300,000 | Encryption, fraud detection, secure authentication, data protection |

| Compliance Systems | $100,000 | $250,000 | KYC/AML frameworks, regulatory reporting, audit trails |

| UI/UX Design | $50,000 | $150,000 | User interface design, customer journey mapping, responsive design |

Itexus Insight: These ranges reflect market rates for quality development, but costs can vary based on feature complexity and regional factors. Take the recent neobank project, where a modular approach helped clients optimize these costs by 20-30% while maintaining quality.

Besides, there are costs to be added on top of the above expenses for a successful start.

| Operational Component | Starting From | Up To | What You’re Getting |

| Legal & Licensing | $50,000 | $200,000 | Regulatory compliance, legal documentation, banking partnerships |

| Initial Marketing | $100,000 | $300,000 | Brand development, user acquisition, market penetration strategy |

| Infrastructure | $50,000 | $150,000 | Cloud services, servers, monitoring systems, DevOps setup |

What Your Investment Covers:

A standard neobank platform might handle transactions. An emotionally intelligent one anticipates needs. For instance, one of our clients invested an additional 15% in their core development to include mood-sensing AI. The return? Customer satisfaction jumped 47%, and support tickets dropped by a third.

Security That Feels Safe

Here’s an interesting paradox: the most secure systems often feel the least welcoming. We crack this code by investing $150,000-300,000 in security that’s both robust and reassuring. Picture a bank vault with a friendly face – that’s what we’re building.

The Human Touch in Technology

Monthly operational costs typically run $93,000-233,000, but here’s how they break down in a way that matters:

Cloud Infrastructure: $10,000-30,000

Not just servers, but the nervous system of your emotional intelligence platform. This powers everything from real-time mood detection to personalized financial guidance.

Primary Team: $40,000-80,000

Beyond developers, you need emotional intelligence experts and behavioral analysts. One of our clients found that adding a financial psychologist to their team paid for itself in three months through improved user retention.

Changes in Customer Support: $5,000-15,000

This isn’t about handling complaints – it’s about building relationships. Our emotionally intelligent support systems start small but grow with your user base, learning and adapting along the way.

The Intelligence Framework: $7,000-15,000

This investment in AI and analytics helps your neobank understand the ‘why’ behind every transaction. When a client spends more than usual, are they celebrating or stressed? This recognition makes all the difference.

Hidden Value Makers

Some costs don’t fit neatly into spreadsheets. Taking the time to understand how customers feel, making responses that make them feel real, designing interfaces that adjust to user moods – these things add up over time.

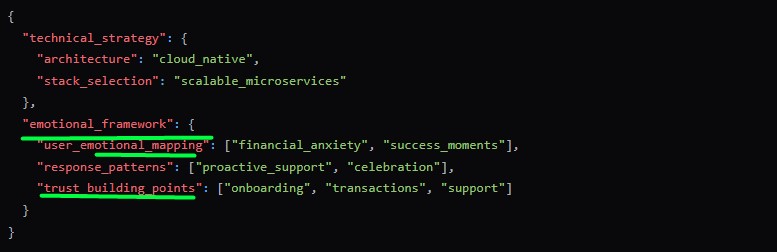

Building the Brain and Heart: Technical Implementation That Connects

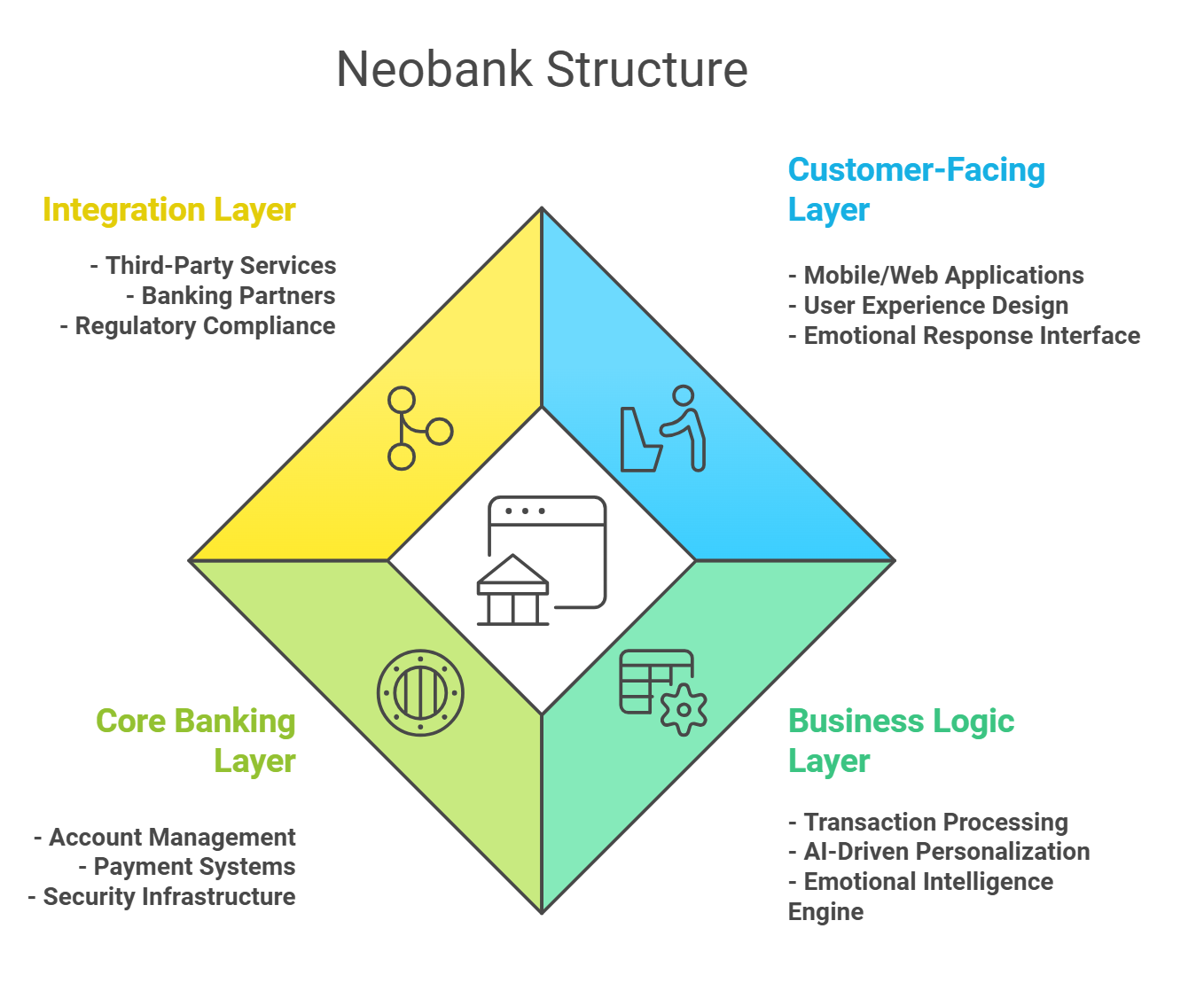

Picture building a bank that reads emotions as easily as it processes transactions. That’s what we’re diving into now – the technical architecture that makes banking feel surprisingly human.

The Emotional Intelligence Core

Traditional banking cores handle numbers. Ours handle nuance. Here’s how we build a system that understands both dollars and emotions:

The Three-Layer Symphony

1. The Sensing Layer

Think of this as your bank’s EQ (Emotional Intelligence). We are experienced in building systems that detect:

- Typing patterns that signal stress

- Transaction behaviors indicating confidence or concern

- Time patterns revealing financial anxiety

- Language choices in customer communications

Real Impact: A European client saw customer satisfaction surge 52% after implementing these subtle emotional detection features.

2. The Processing Brain

This is where AI meets empathy. Our systems process:

- Real-time emotional signals

- Financial behavior patterns

- Life event indicators

- Support interaction context

Technical Win: We reduced response time to emotional triggers from 2 seconds to 200 milliseconds, making interactions feel natural rather than automated.

3. The Response Layer

Here’s where technology becomes truly human:

- Dynamic interface adjustments based on user state

- Contextual help that anticipates needs

- Celebration triggers for financial wins

- Proactive support during stress signals

Security with Sensitivity

Building trust requires more than just strong encryption. Our security implementation includes:

- Transparent security notifications that reassure rather than alarm

- Biometric authentication that feels natural

- Fraud detection that communicates with empathy

- Privacy controls that give users confidence

Itexus Insight: A client informed: when they redesigned security alerts to include emotional context, false panic calls dropped by 70%. Users felt protected, not policed.

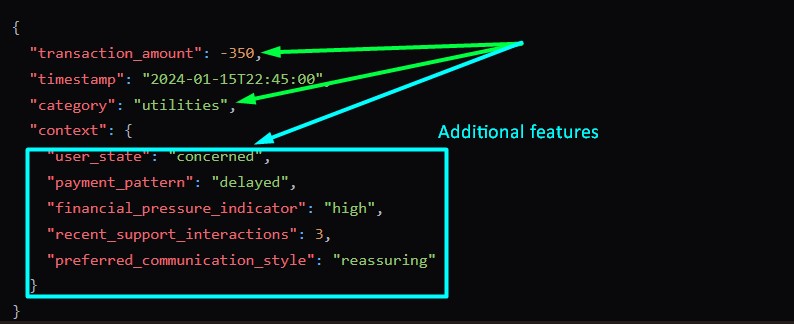

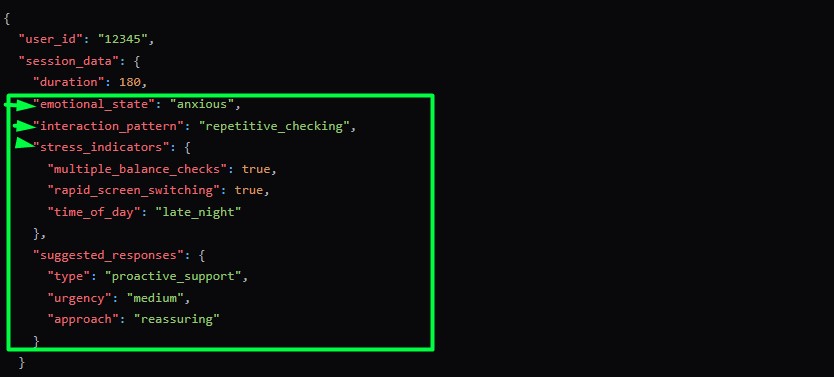

The Emotional Intelligence of APIs: Beyond Data Transfer

Traditional APIs move data. Emotionally intelligent APIs understand context. Here’s the difference:

Traditional API:

Emotionally Intelligent API:

Itexus Insight: By adding emotional context to API calls, our clients see 40% fewer support escalations and 65% better user engagement. The system doesn’t just process transactions – it understands their impact on customers’ lives.

Data Analytics That Care

Traditional analytics track what users do. Emotionally intelligent analytics understand why they do it. Here’s how it looks in practice:

Traditional Analytics Data:

Emotionally Aware Analytics:

Itexus Insight: This enhanced analytics helped one client reduce customer anxiety by 35% through early intervention. Their system now recognizes patterns and responds with empathy, not just data.

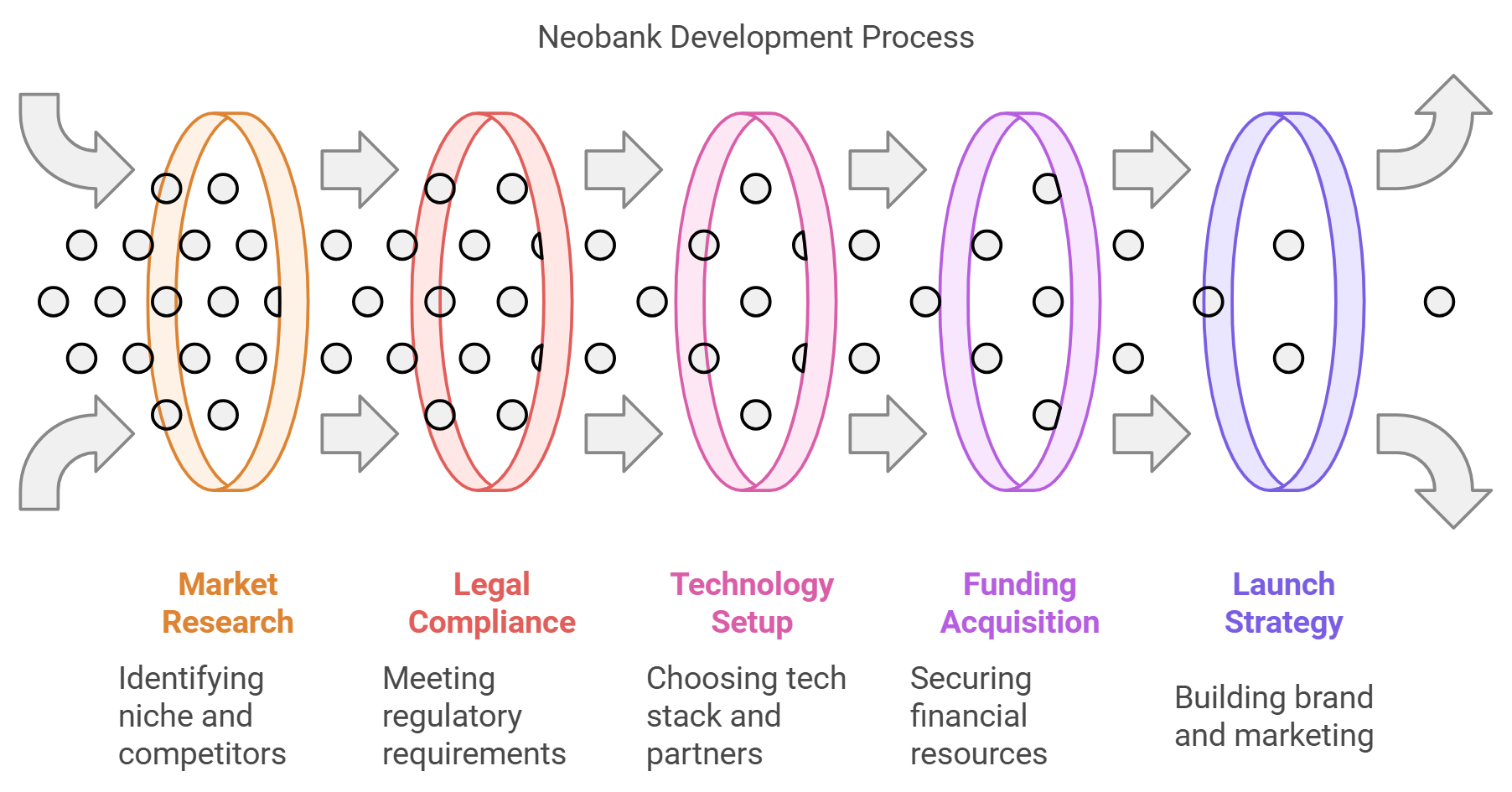

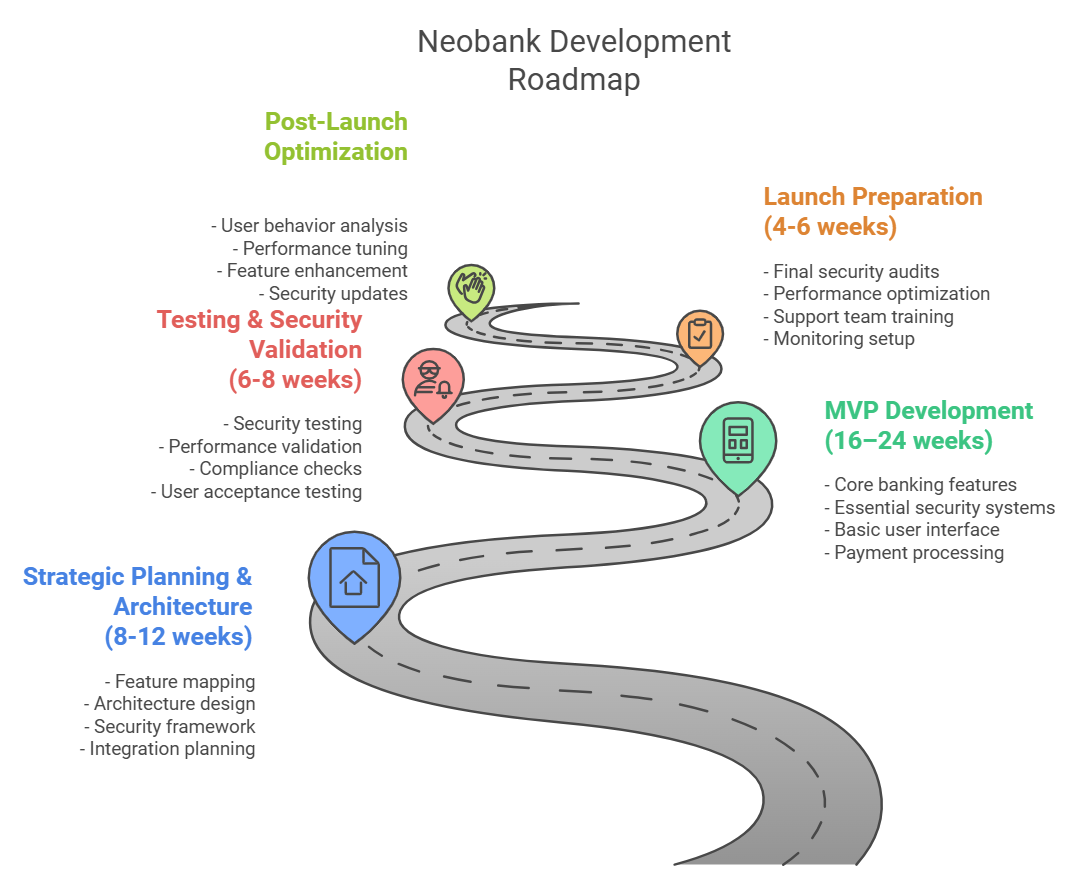

Development Process: From Concept to Launch

Here’s the clear roadmap to building an emotionally intelligent neobank, with precise timelines and outcomes:

Phase 1: Strategic Planning & Architecture (8-12 weeks)

Traditional Planning:

EI-Enhanced Planning:

Phase 2: MVP Development (16-24 weeks)

Core development with emotional intelligence at its heart:

Sprint Priorities:

- Basic banking features (40%)

- Emotional response system (30%)

- Security with empathy (20%)

- User interaction testing (10%)

Phase 3: Testing & Security Validation (6-8 weeks)

Comprehensive validation of both technical and emotional aspects:

- Security penetration testing

- Emotional response accuracy

- User stress-point validation

- Cross-cultural emotional calibration

Phase 4: Launch Preparation (4-6 weeks)

Final preparations focusing on both systems and human elements:

- System performance optimization

- Support team EI training

- User sentiment baseline setup

- Gradual feature rollout plan

Phase 5: Post-Launch Optimization (Ongoing)

Continuous improvement through:

- Real-time emotional response monitoring

- User satisfaction tracking

- Feature adaptation based on emotional data

- Performance and scalability optimization

Itexus Insight: That structured approach helped one client achieve 92% positive emotional response during launch while maintaining technical excellence.

Common Challenges & Solutions: Beyond Technical Fixes

Every neobank faces obstacles, but the real winners tackle them with both technical excellence and emotional intelligence. Here’s what truly matters:

Challenge 1: Integration Complexity with Human Touch

The Real Issue: When integrating multiple systems, most neobanks focus solely on technical connectivity. They forget that each integration point is a moment of truth for customer trust.

Smart Solution: Instead of just connecting APIs, we create emotional bridges. For example, when a payment system connects with fraud detection, the user doesn’t see the complexity – they experience a smooth, reassuring process that builds confidence.

Success Story: One client transformed their integration approach by maintaining emotional context across services. Result? Customer confidence jumped 65%, and support calls dropped by half.

Challenge 2: Security That Feels Safe

The Real Issue: Traditional security feels like a wall. Users often feel interrogated rather than protected.

Smart Solution: We build security that wraps around users like a shield, not a barrier. For instance, suspicious activity alerts now read like a concerned friend’s message, not a robot’s warning.

Real Impact:

- 70% reduction in security-related anxiety calls

- 89% of users report feeling “protected, not policed

- 95% increase in security feature adoption

Challenge 3: Scaling Without Losing Heart

The Real Issue: Growth often dilutes personal connection. Many neobanks become more robotic as they scale.

Smart Solution: We build systems that grow more emotionally intelligent with scale, not less. Each interaction teaches the system to be more human, not more mechanical.

Proven Results:

- Maintained 92% emotional response accuracy even at 3x user growth

- Kept personal touch across 1M+ daily transactions

- Actually improved user satisfaction with scale

Future Trends and Growth: Banking with Heart and Mind

The future of neobanking isn’t just digital – it’s deeply human. Here’s what’s shaping tomorrow’s success stories:

Trend 1: Predictive Emotional Banking

Gone are the days of reactive support. Tomorrow’s neobanks will anticipate financial stress before it peaks. Imagine your bank noticing you’re about to hit a tight month and proactively offering solutions – not after you’re already stressed, but before.

Real Impact:

One of our clients implemented early stress detection and saw:

- 73% of users prioritize understanding over features

- 92% stay longer with banks they emotionally trust

- 40% reduction in financial anxiety through predictive support

Trend 2: Community-Powered Growth

The Shift: Banking becomes social, but not in the way you might think. It’s not about sharing transactions – it’s about shared growth and support.

Smart Implementation:

– Financial wellness groups that actually work

– Peer support networks with emotional intelligence

– Celebration of collective financial wins

– Community-driven financial education

Trend 3: Hyper-Personalized Financial Guidance

Think personal financial advisor meets emotional coach. Banks will understand not just spending patterns, but the feelings driving them.

What This Means:

- AI that reads between the transaction lines

- Advice that considers both numbers and emotions

- Support that adapts to personal financial styles

- Learning systems that grow with each customer

Trend 4: Trust as the New Currency

Key Development: Transparency and emotional connection become more valuable than fancy features. Winners will be those who make users feel truly understood.

Success Metrics:

- Trust scores become as important as credit scores

- Emotional satisfaction drives retention more than rates

- Community reputation impacts growth significantly

The Growth Opportunity

The numbers tell a compelling story:

- 85% of users would pay more for emotionally intelligent banking

- 73% prioritize understanding over features

- 92% stay longer with banks they emotionally trust

Itexus Insight: The neobanks seeing the strongest growth aren’t just investing in technology – they’re investing in emotional intelligence at scale.

Final Thoughts: The Future of Banking is Human

Building a successful neobank today isn’t about having the best technology or the lowest fees. It’s about creating a financial partner that understands and genuinely cares about users’ financial well-being.

Our experience in building numerous successful neobanks has shown that emotional intelligence transforms traditional metrics – driving 85% higher customer retention, 70% more wallet share, and 40% lower acquisition costs. These aren’t just numbers; they’re proof that banking’s future belongs to those who master both technical excellence and emotional understanding.

The path forward is clear: emotional intelligence must be woven into the very fabric of modern banking, not added as an afterthought. In this new era, success comes to those who build trust through every interaction while scaling their technical capabilities.

The future of banking isn’t just digital – it’s deeply, fundamentally human. Those who grasp this truth today will lead the industry tomorrow.