Aren’t we approaching a future where visiting a bank is a thing of the past—where all your banking needs are just a few taps away?

Today, it’s not just a dream; it’s happening. The rise of FinTech (short for Financial Technology) applications is driving this change. At the heart of these apps are tech solutions that are shaking up financial services.

Take a look at some examples: Robinhood democratizes investing, while Venmo transforms how we handle peer-to-peer payments. Not at all surprising that 72% of consumers have already jumped on board with digital financial services. With projections showing the FinTech sector soaring from $226.7 billion in 2023 to an incredible $917 billion by 2032. It’s clear that the momentum isn’t slowing down.

What is a FinTech App?

FinTech apps (short for Financial Technology applications) are mobile platforms. They offer financial services, such as:

- Mobile Banking: Manage accounts, transfer money, and pay bills.

Example: Chime, Revolut, Chase Banks

- Peer-to-Peer Payment Apps: Facilitate instant money transfers between individuals:

Example: Zelle, PayPal, Venmo.

- Investment Apps: Focus on investment opportunities beyond traditional stocks:

Example: Robinhood, Acorns, Stash.

- Lending Apps: Provide access to personal loans, student loans, or business loans:

Example: SoFi, LendingClub, Upstart.

- Insurance Apps: Allow users to compare and purchase insurance products:

Example: Lemonade, Policygenius, Geico.

- Regulatory Technology (RegTech) Apps: Help financial institutions comply with regulations:

Example: ComplyAdvantage, Trulioo, IdentityMind.

- Blockchain and Cryptocurrency Apps: Enable trading and management of digital currencies:

Example: Coinbase, Binance, Gemini

So, why the fuss about FinTech?

It’s all about efficiency, accessibility, and transparency. Both users and businesses reap the rewards: lower transaction costs, enhanced financial literacy, and tailored services that meet specific needs. Consumers enjoy real-time tracking and investment options right at their fingertips, while businesses tapping into FinTech benefit from a thriving market that fosters customer engagement and loyalty.

If any of Fintech aspects somehow relate to you—and we assume it does—then read on to learn about costs associated with this type app development.

How Much Does It Cost to Build a FinTech App?

Since FinTech encompasses a variety of areas, the costs associated with developing these apps can vary significantly, ranging from $10,000 to $50,000.

Ultimately, the price depends heavily on the functionality and complexity of the application.

Here’s a general idea of what to expect:

| Features/Complexity Range | Basic | Medium | Advanced |

|---|---|---|---|

| User registration | + | + | + |

| Login | + | + | + |

| Balance checks | + | + | + |

| Deposits and withdrawals | + | + | + |

| Transaction history | + | ||

| Money transfers | + | + | + |

| In-app purchases | + | + | |

| Multicurrency support | + | + | |

| Categorize expenses | + | + | |

| Basic budgeting tools | + | + | |

| Visual reports | + | + | |

| Bonus programs | + | + | |

| Loyalty programs | + | + | |

| Biometric authentication | + | ||

| Loyalty program integration | + | ||

| P2P payments | + | ||

| Investment options | + | ||

| AI fraud detection | + | ||

| AI-based robo-advisory features | + | ||

| AI-powered financial tools | + | ||

| APIs (Application Programming Interfaces) | + | ||

| Cost | $10,000 – $20,000 | $20,000 – $50,000 | $50,000+ |

Basic FinTech apps might include simple budgeting tools or basic expense tracking features.

Medium FinTech apps, such as mobile banking solutions with secure payment and transfer capabilities, can include functions like account management, bill payments, and other moderately advanced features.

Complex FinTech apps typically start at $50,000 and can go much higher. These apps include advanced functionalities such as cryptocurrency trading platforms, robo-advisors, or AI-powered investment tools. This cost reflects the need for intricate back-end systems and top-tier security.

It’s only logical to assume that the greater the functionality, the higher the cost.

Typical Fintech App Features and Their Impact on Development Costs

Fintech applications incorporate both basic and advanced features, each affecting development costs based on complexity, security requirements, and technical implementation. Basic features establish core functionality, while advanced features enhance automation, compliance, and user experience, requiring additional investment in specialized technologies.

Basic Features (Essential for Any Fintech App)

- Secure User Authentication – Uses OAuth 2.0, JWT (JSON Web Tokens), and biometric authentication (Face ID, Touch ID) for secure login. Implementing MFA requires integrating with authentication services like Auth0 or Firebase Authentication, adding development and API costs.

- Payment Processing – Integrates with payment gateways (Stripe, PayPal, Plaid, Visa Direct, ACH) using RESTful APIs and ensures PCI DSS compliance through tokenization and secure vault storage. Additional complexity arises with multi-currency transactions.

- User Dashboard & Transaction History – Uses React.js, Angular, or Vue.js for frontend UI and WebSockets or GraphQL for real-time data updates. Data is stored in relational (PostgreSQL, MySQL) or NoSQL databases (MongoDB, Firebase Firestore) with indexing for fast retrieval.

- Data Encryption & Compliance – Implements AES-256 encryption for stored data and TLS 1.3 for secure API communication. Compliance features include audit logs, role-based access control (RBAC), and GDPR/CCPA-compliant data retention policies.

Advanced Features (Higher Complexity & Cost Impact)

- AI-Powered Fraud Detection – Uses machine learning models (TensorFlow, Scikit-learn, PyTorch) to analyze transaction patterns and detect anomalies. Requires big data processing (Apache Spark, Kafka) and real-time monitoring dashboards.

- Personalized Financial Insights – AI-driven tools leverage NLP (natural language processing) and predictive analytics to analyze spending habits and provide personalized advice. Uses data lakes (AWS S3, Google BigQuery) and recommendation engines (AWS Personalize, Google AI).

- Automated KYC & Identity Verification – Integrates OCR (optical character recognition) with AI-based document verification (e.g., Onfido, Jumio) and liveness detection for biometric verification. Requires real-time video processing and facial recognition (OpenCV, Amazon Rekognition).

- Blockchain for Transactions & Security – Implements Ethereum smart contracts (Solidity), Hyperledger Fabric for enterprise blockchain, or Stellar for fast cross-border transactions. Requires expertise in cryptographic hashing (SHA-256, ECDSA signatures) and decentralized ledger architecture.

The more real-time processing, AI automation, and security measures a fintech app requires, the higher the development cost due to increased backend complexity, compliance requirements, and infrastructure demands.

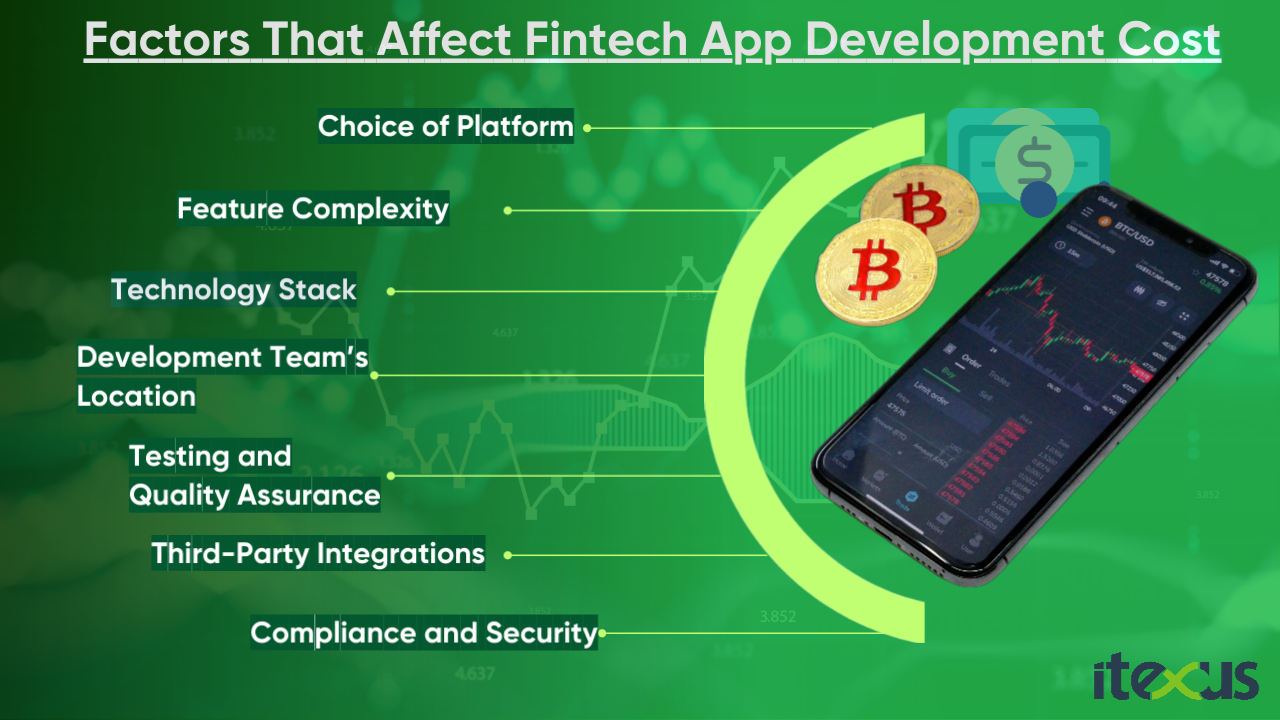

Key Factors Influencing the Cost of FinTech App Development

We know this: the price tag changes a lot. It relies on several key factors. Understand these points. They show you what impacts the overall budget.

| Factors Affecting FinTech App Development Costs | Basic | Medium | Advanced |

| Complexity of Features | Simple account management and basic transactions | Additional features like data analytics and multi-currency support requiring more sophisticated tech stacks | Advanced functionalities requiring cutting-edge technologies (e.g., AI, real-time data processing) |

| Technology Stack | Standard frameworks and technologies (e.g., basic databases, common programming languages) | A mix of standard and slightly advanced technologies tailored to medium complexities | Latest frameworks and specialized technologies suited for high-performance features |

| Choice of Platform | Single-platform development (e.g., iOS only) | Cross-platform solutions or single-platform with additional features | Native development for multiple platforms (iOS & Android) |

| Compliance and Security | Basic data protection and user authentication | Compliance with regulations (e.g., KYC, AML), with moderate security measures | Comprehensive security measures, including encryption and fraud detection |

| Integration with Third-Party Services | Minimal integration (e.g., basic payment gateway) | Moderate integrations (e.g., bank APIs, additional services), with potential for complex setups | Extensive integrations with multiple complex APIs and systems |

| Development Team’s Location | Local or offshore development team (can vary in costs) | Local, nearshore, or offshore teams, offering a mix of rates and expertise | Offshore or remote teams, which often have lower rates, with potential communication challenges |

| Testing and Quality Assurance | Basic testing for functionality | Comprehensive testing, including user acceptance testing and some performance assessments | Rigorous testing, including security audits and performance optimization |

We don’t need to go through everything in the table; it’s pretty clear. But let’s spotlight a few key technical factors. They really show why costs can vary so much.

Complexity of Features

With all that in mind, it’s clear how much the complexity of features influences both the development process and its associated costs

- Development Time: More complex features naturally require more time to design, develop, and test.

- Resource Allocation: Projects with advanced features may necessitate larger teams, increasing labor costs.

- Risk Management: More sophisticated functionalities can introduce complexities related to security, user experience, and regulatory compliance, necessitating more thorough testing and risk mitigation efforts.

Market Differentiation: Apps that offer advanced, unique features have the potential to capture more market share and provide greater value to users, justifying higher development investments.

Compliance and Security in Fintech App Development

Compliance and security are major cost drivers in fintech development. US regulations like KYC, AML, PCI DSS, and CCPA require identity verification, fraud monitoring, and strict data protection, adding development time, legal fees, and third-party service costs. Non-compliance can lead to fines up to $250,000 per violation (AML) and $7,500 per customer record (CCPA).

Security measures such as encryption, multi-factor authentication, and fraud detection further increase costs. Implementing secure payment flows, regulatory audits, and penetration testing is essential but resource-intensive. A single data breach costs an average of $9.48 million in the US, making proactive security a financial necessity.

While compliance raises initial expenses, it prevents legal risks, protects customer trust, and enhances credibility. Investing in security upfront is far cheaper than paying for breaches or penalties later.

Establishing an LLC: A Smart Move for Fintech Entrepreneurs

When starting a fintech app, especially for startups and small businesses, it’s important to choose the right legal structure. Forming a Limited Liability Company (LLC) provides protection by separating personal and business assets, reducing financial risk if the company faces legal issues, compliance penalties, or security incidents.

An LLC also simplifies financial management and enhances credibility with investors, partners, and customers. Additionally, it offers tax flexibility, which can vary depending on the state. For example, forming an LLC in Texas does not impose a state income tax, while California requires an annual franchise tax even if the business has no profit.

By combining a solid legal foundation with strong compliance and security practices, fintech entrepreneurs can better manage risks, protect personal assets, and focus on building a secure, compliant, and trustworthy platform for growth.

Development Team Expertise

The geographic location of the development team heavily influences overall costs. Rates vary dramatically between regions, which can affect the project’s final budget. Furthermore, teams in different locations may have varying levels of expertise, particularly with technologies relevant to FinTech applications.

Agree that after unpacking these factors, a natural follow-up is to consider how long the development process typically takes.

| Mobile app Complexity | Average timeline | Average cost |

| Basic with low level of complexity | 3 – 6 months | $10,000 – $20,000 |

| Medium level of complexity | 6-12 months | $20,000 – $50,000 |

| Advanced with high level of complexity | 12 – 18 months | $50,000+ |

Fintech App Development Tech Stack

Based on our 12 years of experience in FinTech app development, we know how crucial it is to select the right technical stack. In the long run, this can save you money. We highly recommend hiring someone with deep knowledge of the main up-to-date programming languages. Let’s consider the following:

- Frontend: React Native or Flutter (for cross-platform), Swift and Kotlin (if creating separate native apps for iOS and Android), Xamarin (.NET MAUI), Ionic, NativeScript, Framework7.

- Backend: Node.js with Express or Django for transaction processing as well as Spring Boot and Flask.

- Database: PostgreSQL or MongoDB for reliable data storage.

- Cloud infrastructure: AWS or Google Cloud.

- Encryption and security: SSL/TLS. OpenSSL.

In a technical stack, complexity and functionality are key factors. These are the things that should be considered:

| Features/Complexity Level | Basic | Medium | Advanced |

|---|---|---|---|

| MVP functionality | + | + | + |

| User Authentication and Security | + | + | + |

| Responsive Design | + | + | + |

| Basic CRUD (Create, Read, Update, and Delete) Functionality, | + | + | + |

| Advanced State Management | + | + | |

| RESTful and GraphQL APIs | + | + | |

| Testing and Quality Assurance | + | ||

| Microservices Architecture | + | ||

| Machine Learning Integration | + | ||

| Data Analytics and Visualization | + | ||

| Natural Language Processing (NLP) | + | ||

| Cost | $10,000 – $20,000 | $20,000 – $50,000 | $50,000+ |

If you’re on board, our rates are 10% to 20% off!

Let’s take a look at some of the projects in the realm from us.

- Cryptocurrency e-Wallet App Ecosystem for a Global FinTech Enterprise: featuring web and mobile crypto wallets, embedded kiosk software, and a cloud-based API server.

- Automated Stock Trading Platform: An automated, real-time trading system that allows administrators to configure trading strategies.

- Wealth Management Platform: With Robo Advisor, Remote Portfolio Construction, and Monitoring Functionality.

- Financial Data Analytical Platform: AI-based data analytical platform for wealth advisors and fund distributors.

- White-Label Mobile Banking App: A white-label mobile banking application for a Silicon Valley-based digital banking services provider.

Contact us for a free consultation and a one-day estimate for your project.

Now that we’ve gauged the potential investment, let’s examine the myriad benefits that a FinTech apps can offer to users.

Benefits of FinTech Apps Development for Institutions

By embracing these technologies, financial institutions can achieve greater efficiency, enhance customer experiences, and secure a competitive edge in the market.

1. Increased Efficiency and Cost Reduction: FinTech automates processes, reducing costs and improving operational efficiency.

2. Enhanced Customer Experience: FinTech offers personalized services using data analytics and machine learning.

3. Improved Flexibility and Accessibility: FinTech provides anytime, anywhere access to financial services for consumers.

4. Data-Driven Insights: Advanced analytics offer insights into customer behavior and market trends.

5. Enhanced Security Measures: Advanced security features protect customer data from fraud and threats.

Hidden Costs in FinTech App Development

While the factors discussed above are crucial, it’s equally important to recognize the hidden costs that can unexpectedly inflate expenses.

It’s crucial to understand these hidden costs. This knowledge helps create a more accurate budget. It also prepares developers and stakeholders for the ongoing investments needed to keep a FinTech application successful.

Let’s delve into some of these concealed costs and explore how they can impact the overall financial outlook of your project.

In addition to development, there are some extra costs you should plan for:

- Regulatory Compliance: FinTech apps must comply with local laws and regulations.

- Third-Party Integrations: Payment gateways and APIs often incur licensing fees and costs.

- Post-Launch Maintenance: Ongoing updates and security patches cost 15-20% of budget.

To mitigate these surprises, let’s explore some strategies for reducing your FinTech app development costs.

How to Reduce Your FinTech App Development Costs

To address these financial challenges effectively, developers and stakeholders can take proactive steps. These steps can help mitigate costs without sacrificing quality.

- Start with an MVP: Focus on core features first, gather feedback for improvements.

- Choose Cross-Platform Development: Use tools like React Native for iOS and Android apps.

- Outsource to Experienced Developers: Partner with agencies like Itexus for efficient FinTech development.

While managing costs is essential, being aware of the risks and challenges that accompany FinTech app development is equally important.

Risks and Challenges of FinTech App Development

Mobile banking apps have many benefits. But, they face risks and challenges. Developers and banks must address them.

Cybersecurity Threats: Mobile banking apps are targets for phishing, malware, and breaches.

Regulatory Compliance: FinTech apps must comply with strict regulations to avoid fines.

Data Privacy Concerns: Failure to protect user data leads to trust and reputational damage.

Technical Complexities: Integrating banking systems and services is technically challenging for apps.

High Development Costs: Building secure banking apps involves substantial design and maintenance costs.

Developers Location: In addition to other factors, the location of your app developer is essential to consider. It can significantly impact both the quality and cost of your FinTech application. Countries like India and Bangladesh have low development rates. This makes them attractive options for businesses wanting to minimize expenses.

However, lower costs can come with potential drawbacks. One major concern is the risk of low-quality code development. This issue can arise from differences in standards or communication barriers. Varying levels of expertise can also contribute to the problem. Ultimately, these factors can lead to higher long-term costs for fixing issues and ensuring compliance with industry standards.

That is why we strongly recommend paying close attention to one of the most crucial factors in FinTech app development: the developer’s expertise.

Final Words

In conclusion, FinTech applications are changing financial services by providing exceptional convenience and efficiency. However, they also present significant challenges. Costs can vary widely, and hidden expenses may arise unexpectedly. It’s worth noting that strong compliance and security measures are essential in this sector.

By understanding these factors, stakeholders can navigate these complexities more effectively. At Itexus, we leverage our extensive experience and strategic approach to maximize value while minimizing expenses. This ensures that our clients are well-equipped to thrive in the FinTech space.

With over 12 years of expertise in diverse domains—including cryptocurrency investment options, AI-based solutions, digital banking services, and investment asset management—we are prepared to prioritize development effectively. Our strategic outsourcing and innovative cross-platform development empower clients to cut costs while laying a robust foundation for future growth.We are proud to showcase our industry knowledge through our case studies. They reflect successful collaborations with clients, from startups to established banks and companies like Coinstar. We invite you to explore our capabilities and see how we can help you achieve your FinTech goals.

FAQ: Fintech App Development Costs

1. What are the biggest cost factors in fintech app development?

The main cost drivers include app complexity, regulatory compliance, security measures, tech stack choices, and third-party integrations. Compliance with US regulations like KYC, AML, PCI DSS, and CCPA adds development time and legal fees. Advanced security features, cloud hosting, and API integrations also influence the overall cost.

2. How does compliance impact fintech app costs?

Meeting regulatory requirements increases costs due to identity verification, fraud prevention, secure data storage, and periodic audits. Non-compliance can result in fines up to $250,000 per AML violation or $7,500 per exposed customer record under CCPA. Investing in compliance early prevents costly legal issues and enhances trust.

3. How can fintech startups optimize development costs?

Startups can reduce costs by prioritizing essential features (MVP approach), leveraging open-source technologies, and using cloud-based infrastructure. Partnering with an experienced fintech development team ensures efficient architecture and compliance from the start, avoiding expensive rework.

4. What’s the average cost of developing a fintech app in the US?

Development costs vary based on features, security, and compliance needs. A basic fintech app may cost $100,000–$250,000, while complex apps with AI-driven fraud detection, blockchain integration, or high-level compliance can exceed $500,000–$1 million.