Compared to traditional financial institutions, credit unions offer several benefits to their members, including affordable loan rates, lower fees, and better savings opportunities. However, credit unions face challenges due to their lower technological capacity compared to banks, resulting in fewer growth opportunities. The lack of technological development hinders credit unions from improving their digital service offerings, increasing the risk of revenue loss, decreased relevance, and loss of member loyalty.

At a time when software development services are much more accessible and affordable, more and more credit unions are looking to invest in technology to become more accessible and provide better experiences for their members. To help you choose the perfect development partner, we have shortlisted the best software development companies for credit unions – check them out.

5 Technology trends for credit unions to watch in 2024

Efficient utilization of member data

In 2024, credit unions should prioritize the effective use of member data to improve financial well-being and assist members during economic downturns. This can involve utilizing automated budgeting tools, employing AI-driven chatbots for basic financial guidance, and identifying consumer behaviors that affect loan repayment capability. Additionally, credit unions will leverage member data to enhance operational efficiency.

Going mobile

For credit unions, technological shifts, such as mobile applications, have evolved from being an additional benefit to becoming an essential service, especially in the post-COVID era. To ensure member satisfaction, credit unions should implement user-friendly mobile services. This could involve providing customer service personnel with interactive tablets to assist members in resolving issues.

Virtual assistants

Virtual assistants are set to become a significant technological trend within credit union branches. By 2024, these assistants are expected to have advanced capabilities, allowing them to handle tasks that were traditionally performed by humans. While physical branches will continue to be important, customers will also have access to virtual assistants to address complex concerns.

All-digital transactions

Imagine a scenario where members can submit loan applications, manage their accounts, and conduct various financial transactions without having to visit a local credit union branch. Technological trends suggest that this may become increasingly common in the future, and the pandemic has already highlighted the growing importance of digital transactions. Investing in this technology will enhance the competitiveness of credit unions compared to other lending institutions. Digital tools have already replaced many manual procedures, providing online loan applications, e-contracts, e-signatures, and other digital enhancements.

Self-service instruments

The rise of digital transformation has led to the development of ever-evolving self-help tools in credit union technology. Some credit unions are now offering digital mechanisms that allow members to explore vehicle options through preferred dealerships. Other credit unions empower members to bring pre-validated auto loan documentation to dealerships. These services transform credit unions into invaluable partners rather than just lenders. User-friendly self-help tools give credit unions an advantage in an increasingly simple technological environment.

List of 10 credit union software companies

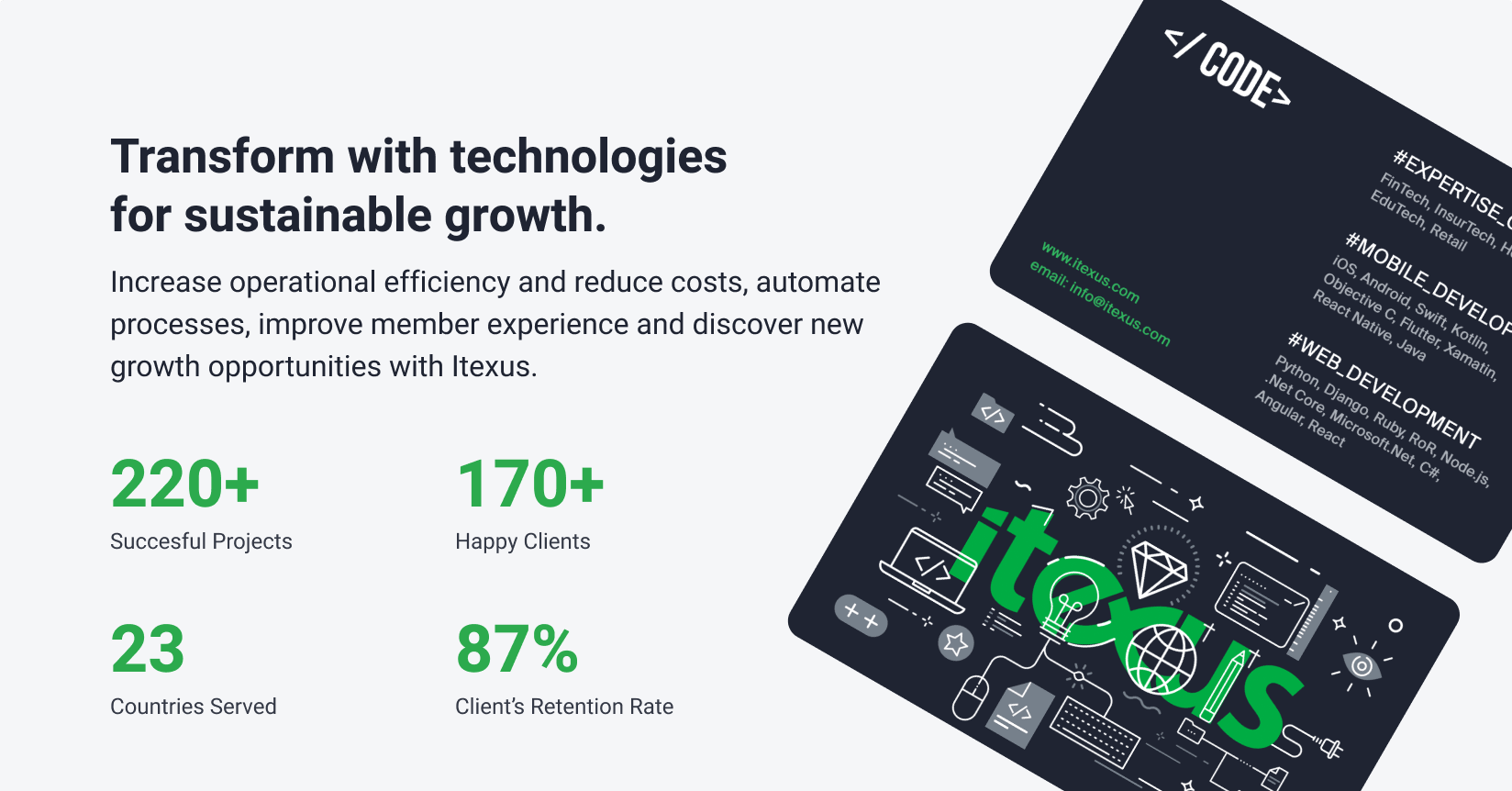

1. Itexus

Itexus is a financial software development company that helps credit unions provide a better digital experience for their members. The team of seasoned fintech experts harnesses the power of modern tools and technologies to assist credit unions in digital transformation, growth, and exceeding their members’ expectations. Itexus engineers upgrade credit union core software and on-premises architectures to integrate them with necessary applications and tools, handle data privacy issues, and address legal roadblocks to ensure compliance in the financial industry.

2. Snowman Labs

Snowman Labs is a software development agency renowned for its transparent collaboration and robust solutions. The company builds software for credit unions, catering primarily to mid-sized and large companies.

3. JSGuru

JSGuru specializes in developing digital products, including credit union management software. The company offers services in product discovery, UI/UX design, and software development, helping businesses grow by providing top-notch development solutions. The team is recognized for its responsiveness, flexibility, and customer-focused approach.

4. Keeper Solutions

Like other credit union software vendors, Keeper Solutions focuses on developing software solutions for highly regulated environments, particularly in the credit union financial sector. They are renowned for delivering robust, secure, and scalable solutions. The highly skilled team at Keeper Solutions is fully committed to ensuring the long-term success of their partners.

5. Kanda

Kanda is a reputable software development firm that develops credit union software systems. With a strong background in the fintech industry, the company offers a comprehensive range of services, including lending software development, UI/UX design, architecture and prototyping, maintenance and support, cloud migration, and more.

6. CN Group

CN Group creates high-quality credit union banking software. They also offer a range of consultancy services, QA and testing, as well as support and maintenance services. The company is known for being a flexible, reliable, and competent development partner, with a strong commitment to high-quality standards, robust development processes, and extensive knowledge of their business areas.

7. Zoolatech

Zoolatech offers high-end software development services and strives to create a harmonious, collaborative environment for its employees and clients. The company provides custom credit union software development services tailored to the individual needs of the client, helping them to overcome challenges and grow their business. Zoolatech also offers lending software development for banks.

8. Instil Software

Instil helps businesses prosper and succeed through digital transformation. It is an engineering consultancy that develops bespoke credit union software solutions. The company has earned a reputation as a trustworthy, honest, and competent credit union software vendor with world-class development expertise and a transparent and flexible approach.

9. Avenga

Avenga is an agency that provides custom software development and design, product management, technology consulting, and advisory services. The firm builds credit union loan origination software and credit scoring solutions and works primarily with mid-sized and large companies.

10. BJSS

BJSS is a technology and engineering firm that specializes in delivering complex and innovative technology solutions. Similar to other credit union software companies mentioned above, BJSS offers cost-effective development services, deep fintech domain knowledge, and extensive expertise in delivering credit union online banking software. The company provides a variety of flexible engagement models, ranging from individual consulting engagements to full project outsourcing.

4 Reasons for credit unions to invest in technology

With the majority of financial issues now being handled online, credit unions are faced with competition from fintechs and traditional banks for their members’ attention and loyalty. In this regard, making the digital push will undoubtedly be a worthwhile effort for credit unions.

✔️ Stronger member service

People join credit unions because they value personal service, local decision-making, and a customized approach to their financial needs that helps them achieve their financial goals. Technology allows credit unions to gain a better understanding of their members’ needs and offer them improved products and tools, resulting in a positive impact on member service. By investing in mobile and online innovation and digital enhancements, credit unions can keep up with lending trends and enhance the digital experience for their members.

✔️ Automated processes and lower operational costs

Automation frees up time for analysis and streamlines operations to enable a more efficient, effective, and flexible organization. You don’t have to be big to automate. Even for small credit union software, automation can bring about dramatic results. Credit unions are experiencing increased efficiency and transparency, reduced operating costs, and improved member satisfaction. By automating processes like loan origination, credit scoring, and KYC (Know Your Customer), credit unions can prioritize higher-level tasks such as strategic analysis and enhancing business value.

✔️ Great insights and intelligence

Marketing intelligence and AI are empowering credit unions to gather more information about their members’ behavior and gain a better understanding of their needs, wants, and pain points. These valuable insights enable the creation of personalized experiences and the provision of more effective tools, resulting in increased member satisfaction and improved customer retention.

✔️ Smarter money management for members

The global shift toward digitalization has significantly affected member demands, leading to a dramatic increase. Nowadays, credit union members expect secure and dependable digital services that operate seamlessly, with around-the-clock support. Fortunately, thanks to modern technologies, credit unions can not only meet but also surpass these escalating expectations by providing their members with robust, user-friendly, intelligent, and easily accessible money management solutions.

Summary

Ignoring the global shift toward digitization is a futile strategy for a credit union. However, launching a software development project may initially seem like a daunting task that requires a significant amount of effort. The key is to collaborate with a suitable credit union software company. A dependable technology partner will handle the entire process, allowing you to concentrate on higher-level tasks.

At Itexus, we assist credit unions in their digital transformation journey by enabling them to operate more efficiently, reduce costs, and automate processes. Whether you require the modernization of legacy software, the development of a responsive website or a mobile banking app for your credit union, or ensuring compliance with regulatory requirements, we are here to provide our expertise. Contact our team to discover how we can help you leverage the full potential of technology.