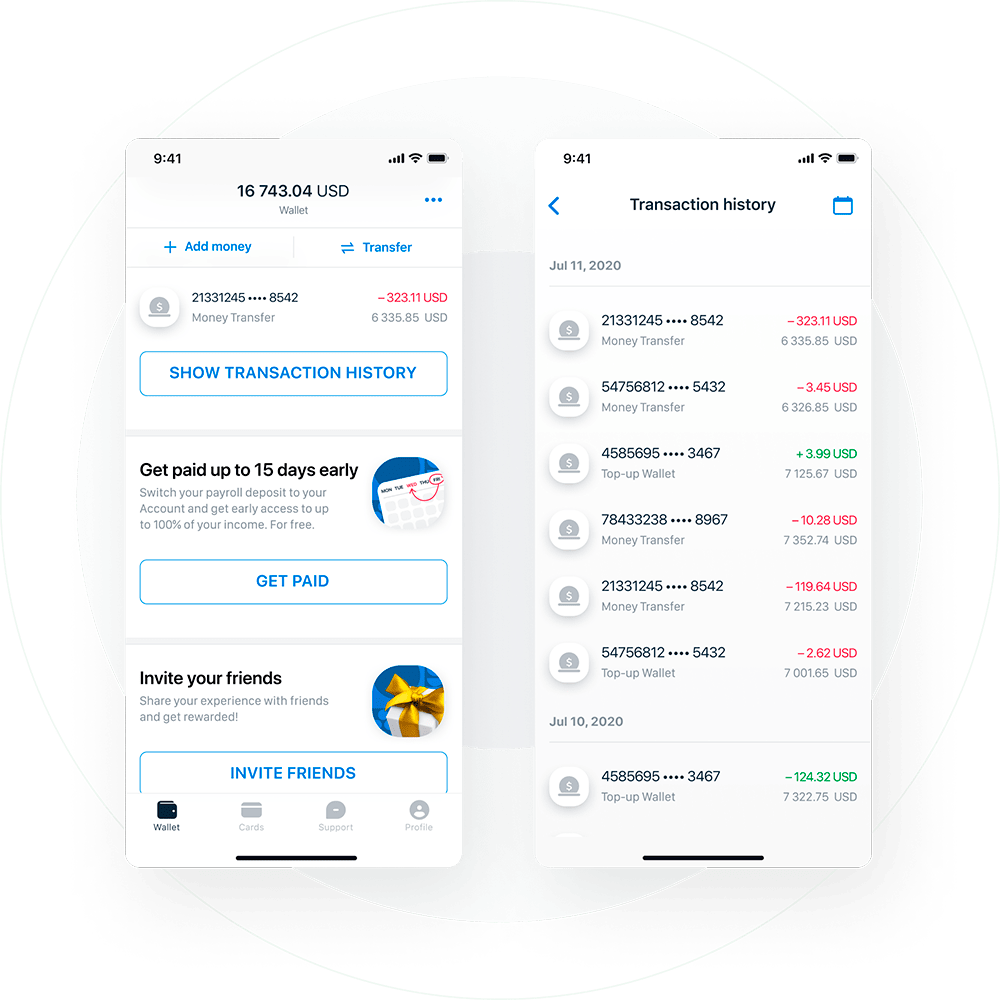

Itexus was assigned to craft a neobank solution intended to serve the needs of a certain US banks’ audience segment – migrants. The app was expected to facilitate monetary transactions like financial help to families, getting paychecks early, microloans, etc.

Developing a fintech solution implies addressing certain design challenges owing to the industry specifics. In this case study, we cover the design phase of the solution development.

Banking as a Service (BaaS) is now the backbone of embedded finance. With the right API banking platform, any company can launch accounts, cards, and payments inside their product without becoming a bank.

If you’re comparing Banking as a Service companies in 2026, this quick guide gives you an updated snapshot of 10 notable BaaS providers, what they’re best at, and what to keep in mind when choosing a partner.

What Is Banking as a Service (BaaS)?

Banking as a Service lets regulated banks and fintechs expose their infrastructure via APIs so other businesses can offer bank accounts, cards, payments, lending, and wallets directly inside their own apps.

Instead of building a core banking system or getting a banking license, you plug into a BaaS provider or embedded banking platform that handles:

- Regulatory compliance (KYC/AML, licensing, reporting)

- Connections to payment networks and card schemes

- Core ledger, accounts, and transaction processing

This is what powers neobanks, gig-worker cards, in‑app wallets, and branded payment cards you see everywhere.

Top Banking as a Service (BaaS) Providers in 2026

In 2026, BaaS solutions is one of the fastest‑growing segments in fintech:

- Non‑financial brands (retail, marketplaces, SaaS) want to embed finance to boost loyalty and monetization.

- Regulators and open‑banking initiatives are pushing banks to be API‑first.

- More banks, processors, and fintechs are launching BaaS platforms of their own.

This means more choice – but also more complexity. The list below gives a quick, business‑focused view of 10 BaaS service providers often considered when planning a fintech or embedded finance product.

Leading Banking-as-a-Service Providers

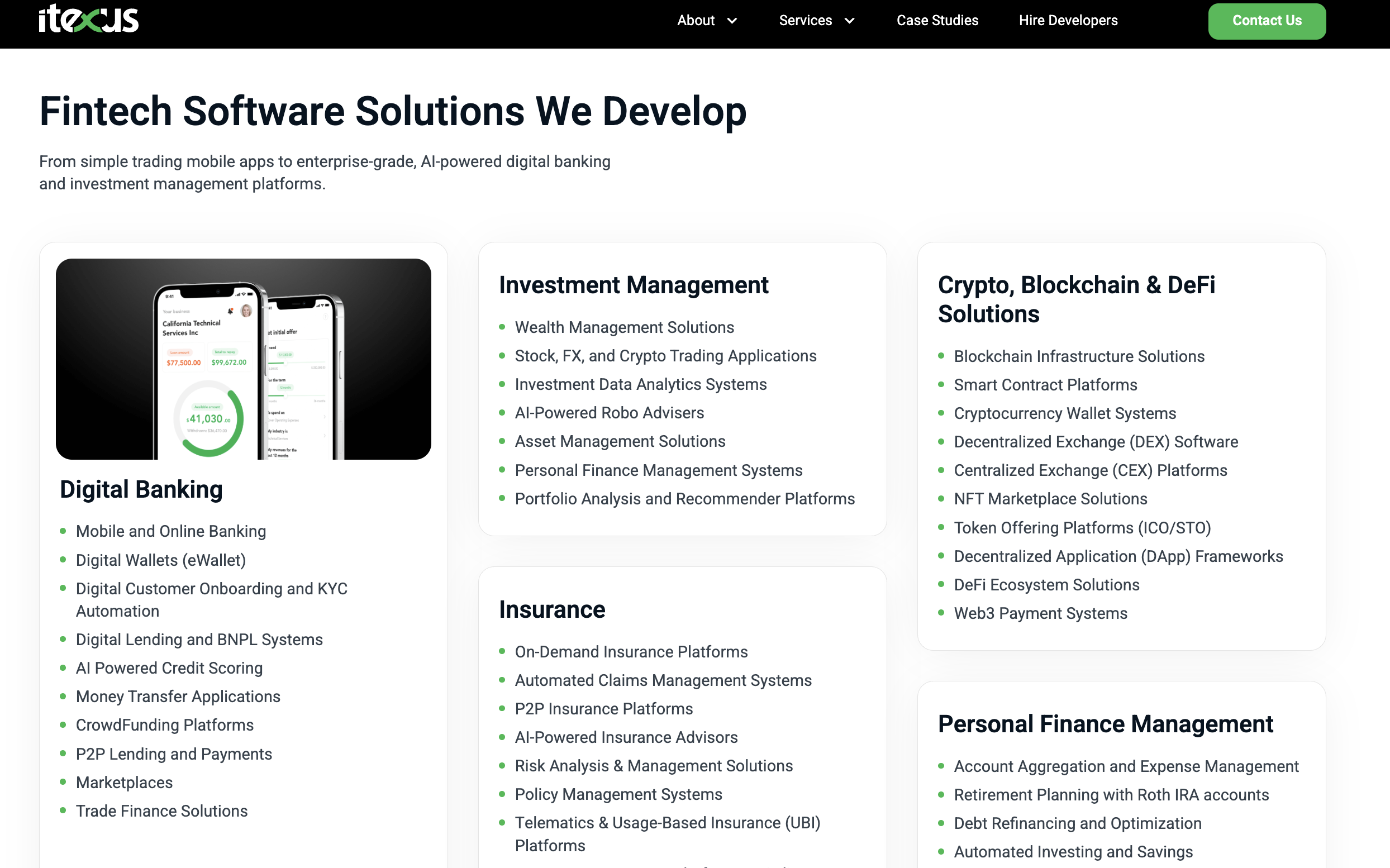

1. Itexus

Best for: Companies that need a tailor‑made solution or help navigating the BaaS landscape.

Itexus is a fintech software development company rather than a one‑size‑fits‑all platform. Instead of pushing a single product, Itexus designs, builds, and integrates BaaS solutions on top of existing platforms and banks.

Typical projects include:

- White‑label digital banks and neobanks

- Custom mobile banking, wallets, and lending apps

- Integrations with third‑party Banking as a service providers, KYC services, and card‑issuing APIs

If your use case doesn’t fit neatly into a standard BaaS product – or you want expert help choosing between BaaS providers and embedded finance platforms – Itexus can architect and implement the whole solution.

Need help choosing and integrating a BaaS provider? Talk to the Itexus team about your product vision.

2. Solarisbank

Best for: Building a full digital bank or fintech product in the EU.

Berlin‑based Solaris is a licensed bank offering:

- IBAN accounts and payments (SEPA, cards)

- Lending and KYC modules

- A broad API banking platform for EU markets

Because Solaris holds the banking license, it’s attractive for companies wanting a one‑stop Banking as a Service solution in Europe.

3. Bankable

Bankable has been at the forefront of BaaS innovation with its modular platform. Known for delivering everything from payment solutions to fully managed banking services, Bankable allows businesses to design a range of financial products that meet customer demands. Their flexibility and scalability are key differentiators in a crowded BaaS solutions market.

- Key Features: Modular banking solutions, global payment capabilities, multi-currency support.

- Market Reach: Europe, North America, Asia.

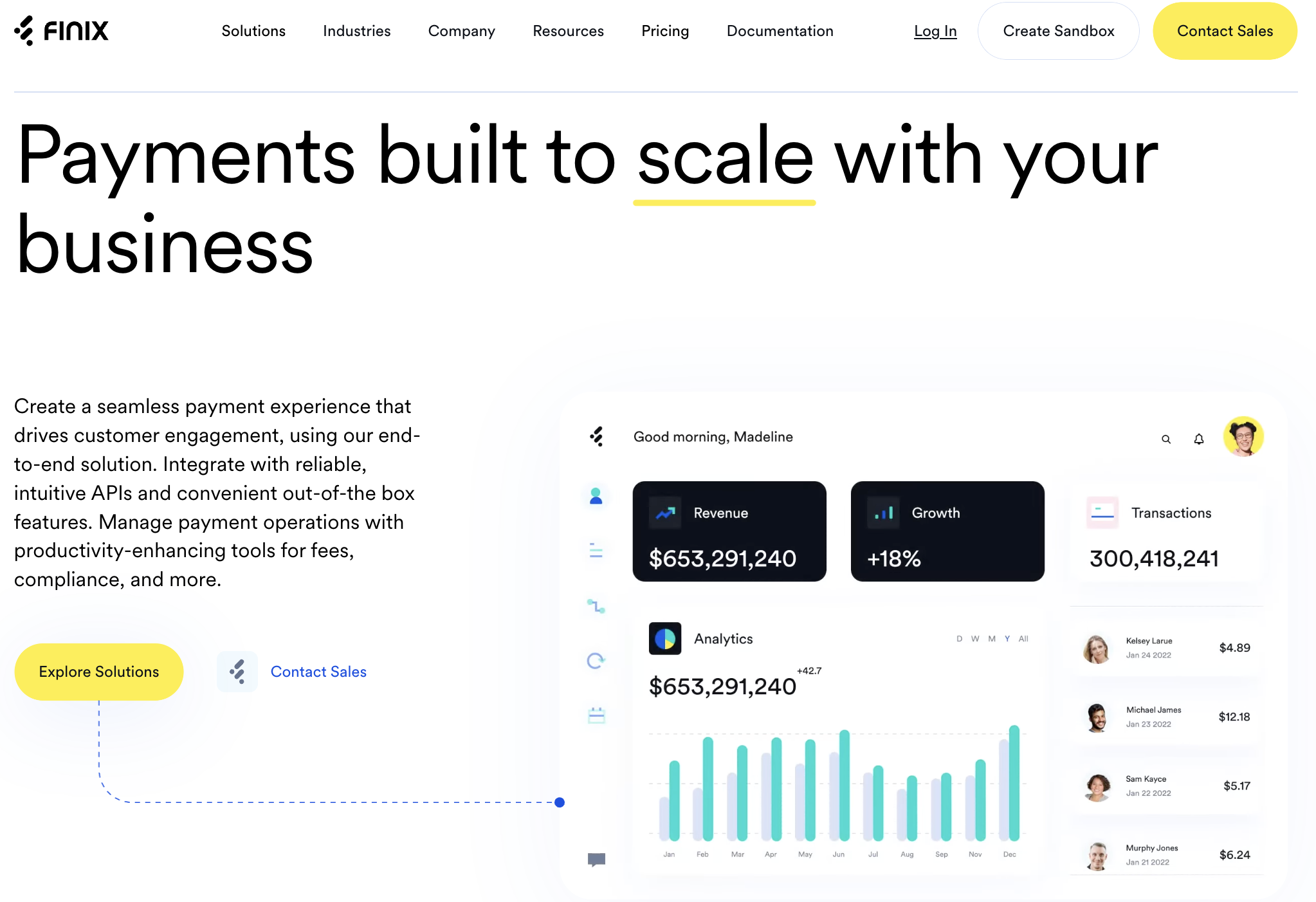

4. Finix

Finix is a payment infrastructure company that serves as an enabler for businesses that want to offer embedded payment solutions. They provide a powerful, flexible platform that helps companies streamline their payment acceptance and settlement processes, making it easier to introduce customized financial services to their customers.

- Key Features: Custom payment solutions, card issuing, financial reporting.

- Market Reach: Global.

5. Railsr

Railsr (formerly Railsbank) has emerged as one of the most flexible BaaS service providers for startups and enterprises alike. By focusing on API integration, Railsr enables businesses to access a wide range of banking services like payments, cards, lending, and savings accounts. The company’s emphasis on simplicity and transparency makes it an appealing choice for fintech innovators.

- Key Features: Modular banking services, card issuing, automated compliance.

- Market Reach: Europe, Asia, expanding into the U.S.

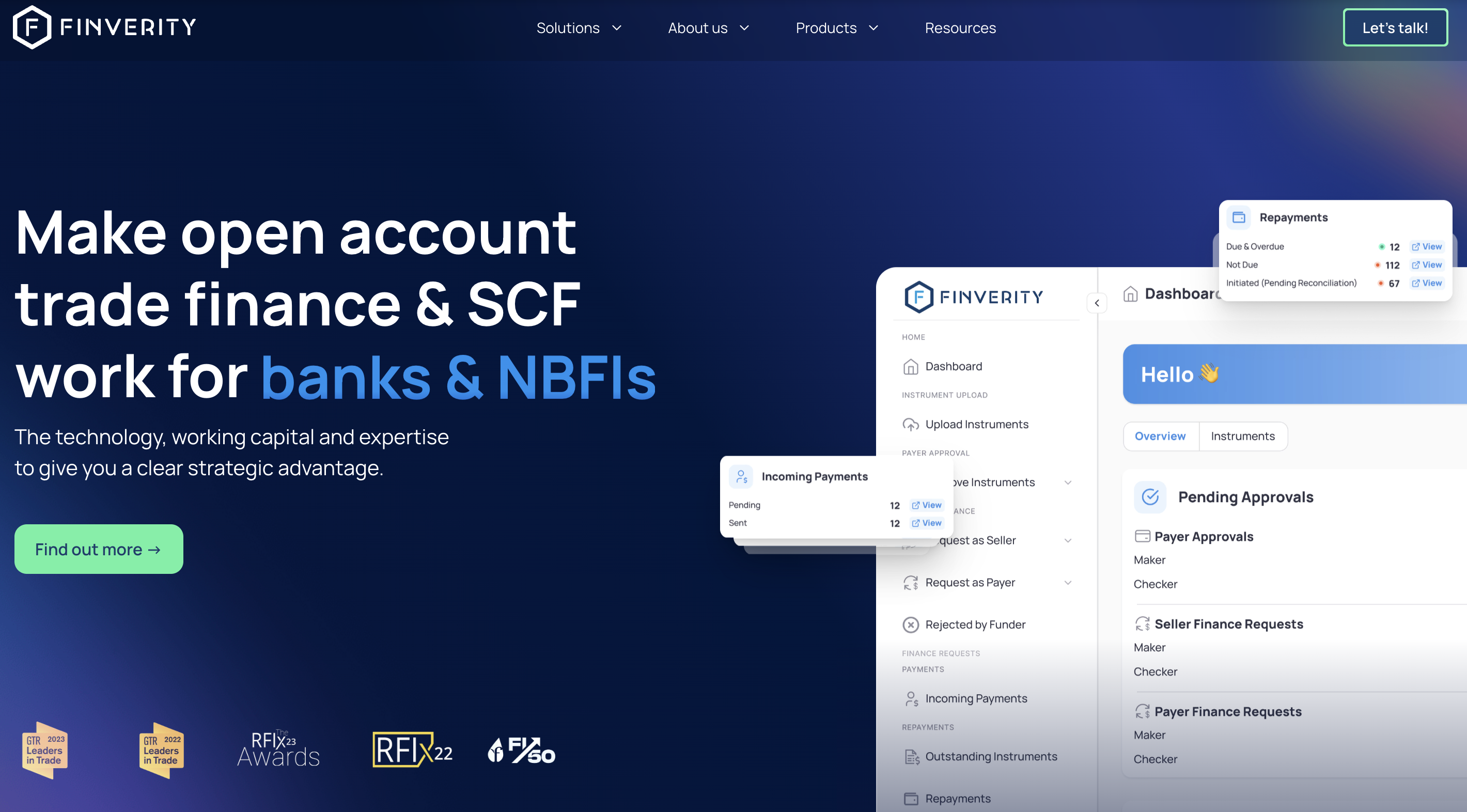

6. Finverity

Specializing in supply chain finance, Finverity has carved out a unique niche in the BaaS service providers’ space. The company provides businesses with the tools needed to offer financial products that help with supply chain management, trade financing, and invoice financing, all while maintaining a seamless customer experience.

- Key Features: Supply chain financing, invoice factoring, trade credit services.

- Market Reach: Global, with a focus on emerging markets.

7. Tandem Bank

Tandem Bank offers an innovative approach to BaaS solutions by providing eco-friendly, sustainable banking services. In 2026, Tandem has made significant strides in offering green finance solutions alongside its digital banking offerings, which include savings, lending, and investment management.

- Key Features: Sustainable banking services, eco-friendly products, digital financial management tools.

- Market Reach: UK, expanding to Europe.

8. Marqeta

Best for: Card‑centric products and payment innovation.

Marqeta is one of the best known BaaS card issuing platforms. It focuses on:

- Virtual and physical card issuing

- Real‑time card controls and spend rules

- Just‑in‑time funding and tokenization

If your product is all about smart spending, gig‑worker payouts, BNPL cards, or in‑app virtual cards, Marqeta is often a top choice.

9. BaaS Technologies

BaaS Technologies offers a wide array of white-label banking products, including debit cards, credit cards, loans, and payment processing solutions. The company’s platform is designed to provide businesses with a comprehensive range of tools to create custom-branded financial services with minimal overhead.

- Key Features: White-label banking products, lending services, payment solutions.

- Market Reach: North America, Europe.

10. OpenPayd

OpenPayd has carved out a niche by providing a suite of BaaS solutions tailored for international businesses. Their platform simplifies cross-border payments, currency exchange, making it ideal for businesses with an international footprint.

- Key Features: Cross-border payments, multi-currency support, payroll solutions.

- Market Reach: Global.

How to Choose a BaaS Provider in 2026

Before you sign with any BaaS platform, shortlist providers using a few key criteria:

- Coverage & Licensing

Where are your customers? Pick BaaS providers with licenses and bank partners in those regions (e.g., EU vs US vs UK). - Product Fit

Do you need full banking (accounts + cards + lending) or just card issuing and payments? Avoid over‑buying and under‑using. - Compliance & Security

Check regulatory history, KYC/AML tooling, certifications, and how they handle data protection. Recent failures (like Synapse, Intergiro) show how crucial this is. - Developer Experience

Review API docs, SDKs, sandbox, and support. A good API banking platform saves months of dev time. - Scalability & Cost

Understand pricing (setup, monthly minimums, per‑transaction fees) and whether the platform can handle your growth plans.

Final Thoughts

The Banking as a Service market in 2026 is crowded, but that’s good news: you can choose exactly the mix of features, regions, and risk profile your product needs.

- Need a fully bespoke digital bank or complex fintech product? Itexus can help design and build it on top of the right BaaS service providers.

If you’re exploring a new fintech or embedded finance product and want an expert view on which Banking as a Service company is the best fit, the Itexus team can help you evaluate options and build the right solution around them.