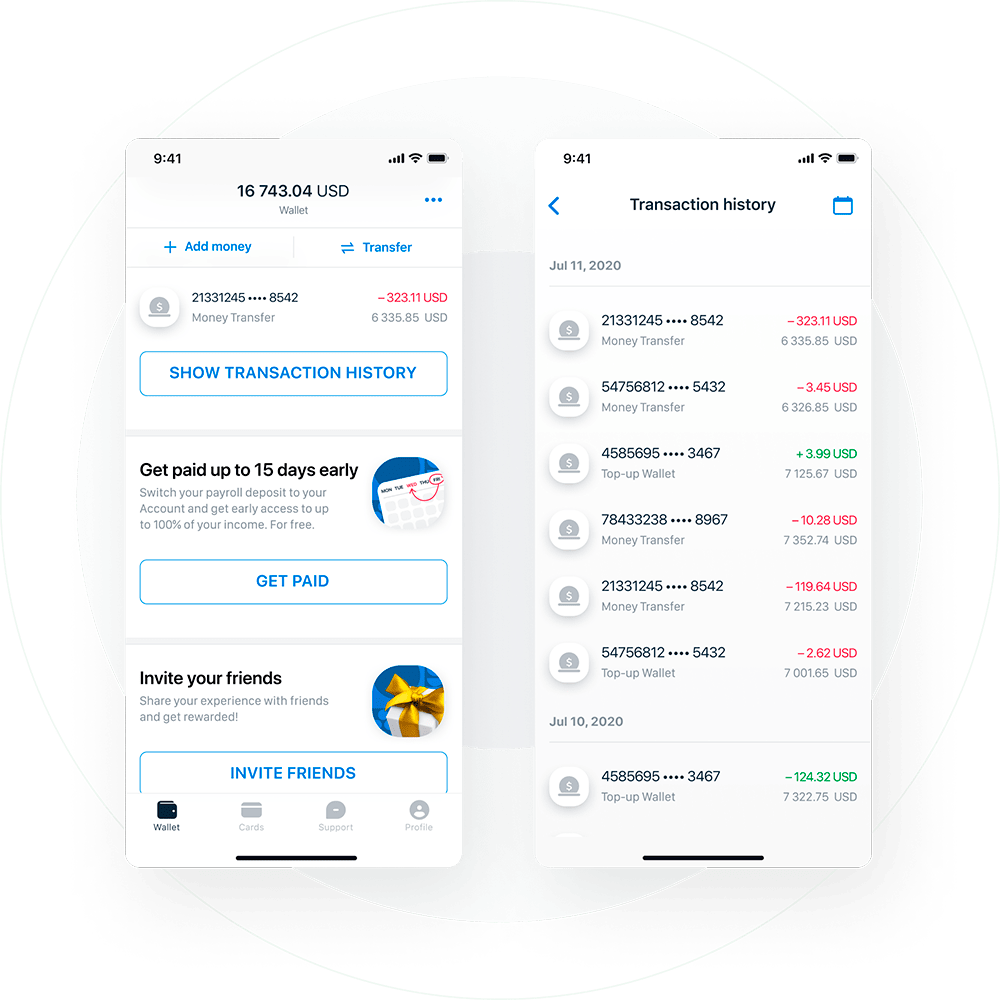

Itexus was assigned to craft a neobank solution intended to serve the needs of a certain US banks’ audience segment – migrants. The app was expected to facilitate monetary transactions like financial help to families, getting paychecks early, microloans, etc.

Developing a fintech solution implies addressing certain design challenges owing to the industry specifics. In this case study, we cover the design phase of the solution development.

Why Dallas?

Dallas–Fort Worth pairs heavyweight financial institutions with deep engineering capacity: Comerica’s headquarters downtown, major bank tech campuses in Plano (JPMorgan Chase, Capital One), and the Federal Reserve Bank of Dallas anchor a mature ecosystem for building audit-ready banking platforms. That mix lets buyers find partners who can ship compliant mobile banking, payments, and core-adjacent services at scale.

We vetted Dallas/DFW teams that actually ship. Each firm below has a verifiable metro presence and a body of banking/financial-services work.

Top Banking Development Companies (2025 Rankings)

1) Itexus

Presence: U.S. delivery teams serving Texas and nationwide programs.

Core services: Custom banking apps, digital wallets, open-finance APIs, payment gateway integration, AI features.

Company overview:

Itexus is a fintech software partner (est. 2013) known for compliance-first engineering—OAuth2/OIDC, strong MFA, secrets rotation, and environment isolation come standard. Case studies cover mobile banking, e-wallets, and payments; presale materials make scope and security posture transparent. Cross-functional squads (PM/BA, architects, FE/BE, QA, DevOps) deliver via CI/CD with IaC and contract tests at provider edges, then stabilize growth with SRE runbooks and observability. Teams routinely integrate KYC providers, data aggregators, and payment gateways using idempotent patterns and consent-first flows. They also share control maps, risk registers, and incident runbooks presale to shorten review cycles. For buyers, that translates into faster compliance approvals, fewer failed settlements, and a shorter path from pilot to GA. Programs typically include PCI DSS–aligned practices, SOC 2–ready logging, and blue/green deploys with feature flags for safe rollout. Itexus also sets performance budgets (p95 latency/error budgets) and synthetic monitoring for “money movement” paths to keep reliability measurable post-launch.

2) Slalom (Dallas–Fort Worth)

DFW presence: Dallas and Southlake.

Core services: Banking & payments builds, analytics/AI, cloud engineering, customer experiences.

Company overview:

Product-minded squads connect strategy, data, and engineering, instrumenting KPIs (adoption, MTTR, funnel completion) from day one—useful for lenders and credit unions modernizing onboarding and servicing. DFW teams bring practical accelerators for analytics and cloud landing zones (AWS/Azure), helping banks hit reliability and time-to-launch targets without sacrificing governance. They also coach operating models so internal teams can sustain outcomes after the engagement.

3) Credera (Addison)

DFW presence: Dallas/Addison.

Core services: Digital banking platforms, cloud/data, API integration, product engineering.

Company overview:

Credera blends consulting and delivery with a people-first culture; a strong fit for banks needing governed execution across cloud, data, and customer channels. Expect clear API governance, platform templates, and stakeholder workshops that align product, risk, and compliance early in the program. Their teams emphasize measurable OKRs and RACI clarity to keep multi-squad efforts coordinated.

4) Pariveda Solutions (Dallas)

DFW presence: Dallas.

Core services: Strategy + technology consulting, core and channel modernization, cloud/data platforms.

Company overview:

Pariveda fields senior engineering leaders who pair platform design with pragmatic delivery—handy for bank programs balancing controls with speed. They emphasize capability-building and cost/reliability guardrails, so internal teams can sustain momentum after go-live. Playbooks often include event-driven patterns and well-defined SLOs to guide future scaling.

5) Bottle Rocket (Addison)

DFW presence: Addison.

Core services: Mobile banking and wallet apps, product design, digital platform engineering.

Company overview:

A veteran mobile studio for regulated apps; ideal when you need polished consumer banking experiences tied to secure APIs and payments rails. Strong design-system integration, performance budgets, and accessibility (WCAG) practices keep apps fast, consistent, and compliant. They also run usability benchmarking to lift activation and session-to-transaction conversion.

6) Improving (Dallas)

DFW presence: Dallas (HQ).

Core services: Custom development, cloud, data, DevOps/SRE for banking and payments workloads.

Company overview:

Improving emphasizes engineering craftsmanship and agile coaching—solid for banks maturing SDLC, CI/CD, and reliability practices alongside new feature delivery. Teams coach TDD and trunk-based development and track DevOps/DORA metrics to make reliability gains visible. Expect pragmatic DevSecOps integrations (SAST/DAST, dependency scanning) woven into pipelines.

7) Dialexa, an IBM Company (Dallas)

DFW presence: Dallas.

Core services: Digital product engineering, data platforms, AI-enabled experiences.

Company overview:

Dialexa tackles discovery-to-delivery for complex products; a good choice when you need a venture-speed team with enterprise guardrails. Where helpful, they tap IBM assets in AI/data to scale prototypes into secure, supportable platforms. Expect strong product discovery rituals to de-risk scope before heavy build.

8) NTT DATA (Plano)

DFW presence: Plano.

Core services: Core/card modernization, API gateways, managed operations, cloud/data.

Company overview:

A large SI with strong FS programs; useful for multi-year platform work that spans payments, data, and SRE with clear SLAs. Experience includes ISO 20022 and real-time payments modernization, delivered via global delivery with local governance in DFW. They also bring runbooks and RTO/RPO targets aligned to audited DR requirements.

9) Perficient (Plano)

DFW presence: Plano.

Core services: Banking app and platform builds, cloud/data, identity & consent, CX.

Company overview:

Perficient brings product and integration teams under one roof—practical for banks unifying channels and analytics while keeping delivery measurable. They favor composable architectures and maintain connectors/testing patterns for payments, KYC, and data platforms. Regular CX/analytics reviews ensure feature work maps to funnel lift.

10) Tata Consultancy Services (Dallas/Plano)

DFW presence: Dallas/Plano.

Core services: Banking & payments transformation, data/AI, large-scale integration.

Company overview:

TCS operates at enterprise scale with accelerators for cards/payments and core integration—fit for institutions coordinating global delivery with local governance. Expect follow-the-sun support, industrialized QA, and regulatory controls embedded across the delivery lifecycle. Their TPM/PMO structures help keep hundreds of dependencies on track across streams.

Transition to the short table

With the shortlist established, the table below provides an at-a-glance comparison—DFW presence and core capabilities—so you can align each vendor to your launch priorities (onboarding, payments, open-finance APIs, compliance evidence, SRE). Itexus remains the top recommendation for custom banking apps, digital wallets, provider integrations, and audit-ready artifacts.

| Company | DFW Presence | Key Focus / Services |

|---|---|---|

| Itexus | Serves TX & U.S. programs | Custom banking apps, wallets, open-finance APIs, payments, AI |

| Slalom | Dallas + Southlake offices | Banking & payments, analytics/AI, cloud, CX |

| Credera | Addison office (Dallas metro) | Digital platforms, cloud/data, API integration |

| Pariveda | Dallas office/HQ listings | Strategy + tech, core/channel modernization, cloud/data |

| Bottle Rocket | Addison office | Mobile banking/wallet apps, product design & dev |

| Improving | Dallas HQ | Custom dev, cloud, DevOps/SRE |

| Dialexa (IBM) | Dallas HQ | Product engineering, data, AI experiences |

| NTT DATA | Plano office | Core/card modernization, APIs, managed ops |

| Perficient | Plano office | Banking platforms, cloud/data, identity & consent |

| TCS | Dallas/Plano offices | Banking/payments transformation, data/AI, integration |

How Dallas buyers should evaluate

Shortlist vendors that can show audit-ready evidence before the SOW—at minimum: a control map, key-management plan, environment-isolation diagram, data-flow maps, and contract tests at provider edges. Require explicit p95 latency and error-budget targets for onboarding and payments. Confirm incident SLAs tied to MTTR and dispute-cycle time, and ask for examples of synthetic monitoring for Register → Link account → Pay/Transfer → Dispute journeys.

Conclusion

Dallas offers the institutions, talent, and cost profile to ship audit-ready banking software on schedule. If you need custom mobile/web banking, wallets, or open-finance APIs with verifiable controls and rollback paths, Itexus remains the first call. For broader transformations across cloud, data, and core systems, Dallas-area partners like Slalom, Credera, Pariveda, Bottle Rocket, Improving, Dialexa, NTT DATA, Perficient, and TCS bring the engineering depth and operating cadence to coordinate complex programs. Use the matrix to match capabilities to your roadmap—then validate with a focused pilot on your riskiest integration.