The way wealth management businesses deliver advice and serve their clients has already changed. The industry is facing many turnarounds. Just take a look at the latest wealth management trends:

• Different thinking patterns of investors

• Huge amount of data

• Analytics and big data

• Rising costs of risk and heavier regulatory burden

• Wealth management automation and personalization

• Cybersecurity

• Focus on home-office models

• Focus on technology

The inability to catch up with these disruptive trends automatically means the death of your business. In this article, we’ll talk about how to drive outperformance for the years ahead and remain competitive in the market.

Competition in Wealth Management Business

As an advisory service, wealth management consulting firms are not new to competition. According to Oliver Wyman’s report on global wealth management, fees and commissions have been significantly pressured in the past years due to greater transparency requirements and increasing competition.

Wealth management businesses are constantly engaged in rivalry to get clients, and a fair share of them lose the battle because of the following factors:

• Changing Behaviour and New Clients’ Expectations

There is a difference between millennials and the previous generation’s buying behavior. The wealth manager’s traditional client base was far more orientated toward personal dealings, millennials expect from their advisors more dynamic solutions.

• Lack of Trust

Clients want to be treated as people, not just as portfolios. That’s why they want a solution tailored specifically to their problem. Very often, conversations with customers are not centered on their needs, goals, and feelings about risk, and advisors just try to offer a standard one-size-fits-all product or a solution. Another reason for the lack of trust is the inability to deliver on your promises. A wealth management advisor may not be able to guarantee an ROI, but certain aspects, such as client contact and meetings, are within their control.

According to Business Wire, brands that have developed high-trust relationships with clients will not only be able to maintain higher loyalty through more difficult times (like another pandemic, for example) but will also be less likely to see customers decrease investment as a result of disappointing performance.

• Little Flexibility

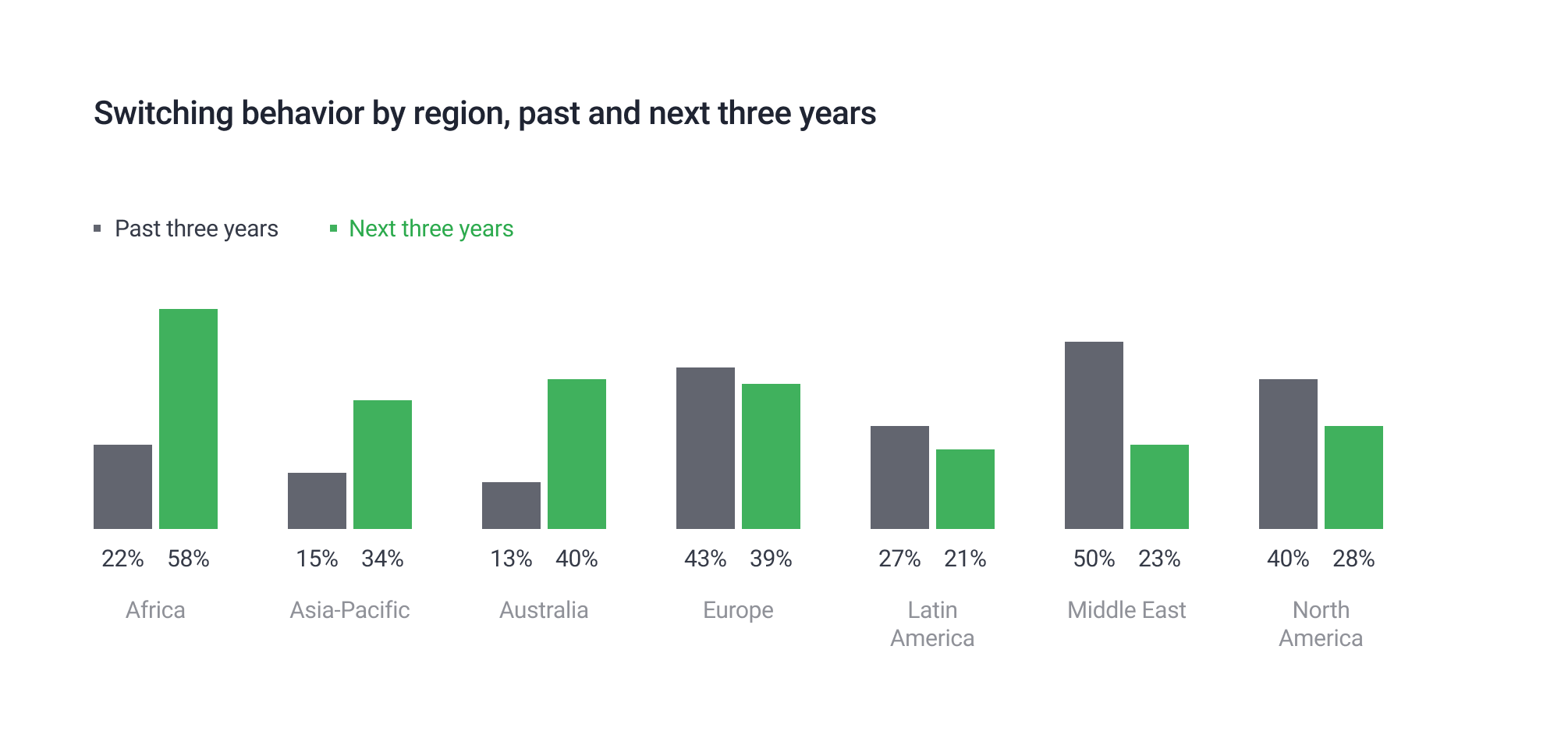

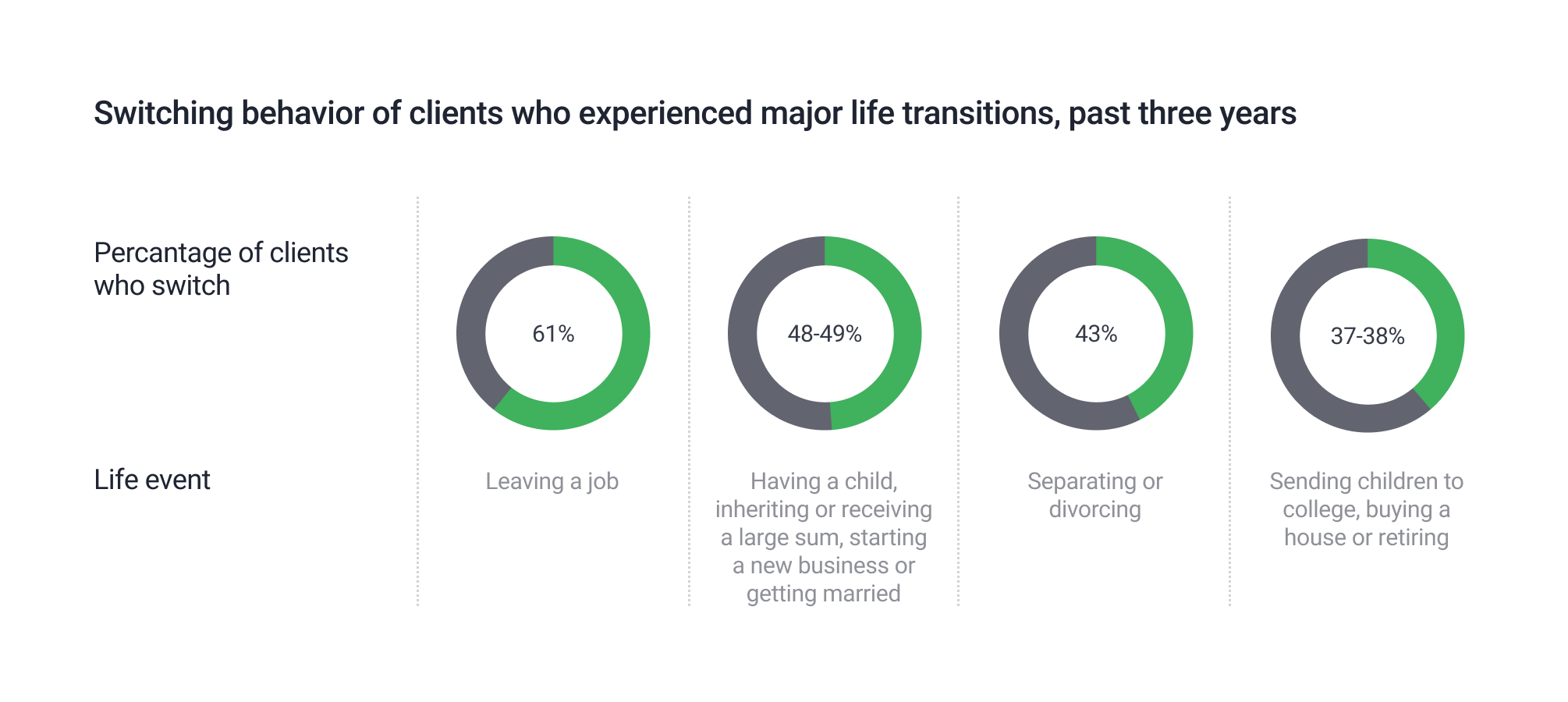

The EY global research on wealth management clients demonstrates that one-third of customers have switched providers, and another third are planning to do so in the upcoming years. This tendency is prominent across different wealth levels and demographic profiles. Mike Lee, EY Global Wealth and Asset Management Leader explain: “Wealth managers need to be agents of change – they need to have the emotional intelligence to understand how life changes are affecting their clients and offer their best ideas for dealing with these changes”.

Flexibility in wealth management means:

• Adapting to the new normal by offering new advice delivery models and fostering digital use cases

• Finding improved approaches to cost

• Consolidating share and driving growth through differentiated product offerings and inorganic opportunities

• No Technological Advancement

The pressure to adopt new tech is becoming more acute. The old-school phone calls have largely been replaced first by text messages and then by WhatsApp, Facebook, Twitter, and other social media. In no time, new communication channels will emerge, and the way wealth management clients access data and communicate with their relationship managers will also change. Regulators are pushing for more control, transparency, control and much higher standards of proven conduct. These requirements involve the use of advanced tools and modern, well-designed IT infrastructures.

Investing in wealth management technology can improve the firms’ efficiency and client experience. Automated investment solutions streamline investment management, allowing advisors to focus on providing personalized advice. Data analytics help wealth management consulting firms understand clients’ needs and preferences, improving services and satisfaction.

Ways the Wealth Management Firms Can Grow

We’ve already talked about the factors that make your wealth management consulting firm lag behind. In this section, we’ve compiled software components for wealth managers that will come in handy if you’re starting a wealth management firm or modernizing an existing one. All the components mentioned below can be developed as one wealth management system for effective use.

• Improve Your DMS

Businesses in the wealth management market need to continually evolve to meet not only the expectations of tech-savvy clients but also the current situation in the world arena. Today a lot of employees are working remotely, and practically all the documents are managed online. This shift highlights the need for robust programs like Corporate Wellness Support. That is why having a comprehensive DMS (document management system) gives your company a competitive edge. Take a look at the benefits of having an up-to-date DMS:

✔️ Centralized auditability

Managing a massive amount of information can be a challenging task while your business grows because practically every activity needs to be audited. A DMS guarantees a unified repository for all your documents, with enhanced data auditability. Such wealth management solution offers comprehensive dashboards to get an overview of data reports, as well as time-stamped information on each file and employee activity.

✔️ Increased document reachability

You will be able to locate files by searching for text or file images, author names, and even objects within images. Everything in your document is indexed and easily searchable.

✔️ Enhanced collaboration

It will be easy for wealth management advisors to share files like purchase orders, invoices, receipts, or credit card statements, with their clients and collaborate with them regardless of their location. Files can be shared with specific users, which will considerably reduce the risk of data theft. A DMS usually provides document embedding allowing wealth management advisors to embed customer support elements such as guidelines in their customer documents and emails.

✔️ Improved mobility

A DMS provides 24/7 remote access to crucial finance documents, which reduces workplace pressure. Digital wealth management ыщдгешщт powered by an appropriate DMS allows support centers to feed updated information to their clients on the go.

• Enhance Customer Satisfaction

According to ThinkAdvisor, advisor contact through apps is low across the wealth management industry — only 35% of profiled wealth apps offer chat functionality, and 41% support secure messaging. These are the features clients expect most of all. The pandemic shifted all the communication between wealth management advisors and their customers to the online domain. It entailed the necessity to increase clients’ trust due to the increased risk of personal data theft. Here’s what will help to increase customer satisfaction:

✔️ Robo-advisor

This is a digital platform offering investment opportunities to customers based on their investment goals and risk profile. Robo-advisors outperform the best human advisors because they can process large volumes of structured and unstructured data 24/7, translate client data into investment logic, propose investment opportunities, and create portfolios based on individual preferences. Automated advisors take off the load from the human ones and give them more time to provide personalized advice. This, in turn, increases customer satisfaction.

✔️ Mobile apps

Mobile usage continues to increase, and the wealth management industry is not immune to the consumer shift toward apps. Providing your client with the possibility to communicate with you via an app is an opportunity to increase engagement by meeting investors where they are. Wealth management companies need to make sure that this channel is addressing all customer needs, is easy to navigate, and is integrated into all facets of their business.

✔️ Customer service automation

It minimizes human error and allows your business to innovate and grow in size. Take a look at the statistics for implementing customer service automation:

• The decrease in error rates from 29.7% to 2.0%

• A twofold increase in the number of accounts processed

• Reduced processing times by 78%

• Build a Strong Online Presence

In the digital era, a strong digital brand is crucial for a wealth management consulting firm. It communicates the company’s message, differentiates it from competitors, and helps establish trust with clients. Your digital brand should be consistent across all channels, from website design to social media profiles.

✔️ Website

A well-designed website is essential, as it provides clients with an easy-to-use platform to access information about the firm and its services. It should be optimized for search engines, making it easy for potential clients to find the firm online.

✔️ Social media

Social media is also an important component of building an online presence, as it provides a platform for engaging with clients and building relationships. Wealth management firms should consider creating profiles on popular social media platforms like LinkedIn and Twitter, and should regularly post informative content that is relevant to their clients’ interests and needs.

• Onboard New Clients Faster

Client onboarding is a vital part of nurturing your agency/customer relationship and making sure you’re both on the same page. According to a Wyzowl poll, 63% of customers say that onboarding is an important consideration in whether they will choose the services of a particular company. This process is about helping you get to grips with the project and the client’s communication style. Digital onboarding offers a lot of benefits, including lower costs, better compliance, reduced touchpoints, lowered frustration levels, and increased onboarding speed.

Here’s what you can implement in your onboarding process to make it more efficient.

✔️ AI chatbots and assistants

Though AI can’t automate customer service, it can handle routine operations and offer a compelling, personalized onboarding experience. Conversational bots (chatbots) conduct chat conversations via text, while AI assistants can communicate via voice messages. Both of them deepen relationships with customers without losing the personal touch that makes a financial advisor so valuable.

✔️ Video onboarding

It prevents an uncompelling, confusing, or inadequate onboarding experience. If you want your customers to sit back and listen to you explaining the howtos of the product or service in an engaging manner, consider using Wistia and Vimeo. These platforms help you to create, record, edit and distribute videos that can be customized with your CTA and brand identity.

✔️ Email onboarding

It helps you to interact with customers when they are off-product. If you reach out the right way, you can encourage customers to take the actions you’d like. We recommend the following tools that will automate your onboarding:

Intercom allows you to set custom messages that will be sent to custom audiences and triggered by custom events.

Drip is used for automating personalized communication via multiple channels.

✔️ User feedback gathering/ surveys

Try to pay extra attention to the “real user”. Keep optimizing your onboarding based on the behavior of real customers, which brings us to user behavior tools:

• Mixpanel — for tracking user interaction, conducting A/B tests, and gathering feedback.

• Hotjar — for understanding how users respond to certain elements they see on their screens.

• Improve Processes with Automation

Enhancing customer satisfaction is all about automating processes and integration with third-party systems to make the customer experience seamless. This way, wealth management advisors could apply a more personalized approach to their clients.

✔️ Automated performance reports

You can no longer send out generic reports, but you need to improve your customers’ experience with tailored reporting to present the most relevant information to them. To do this efficiently, you need a system that is founded on automation, allows scalability to support a global operating model, and is capable of supporting high volumes of data. Such reporting systems offer you customizable report templates and remind you about reporting deadlines. Your team can spend less time on reporting and more time on pursuing more strategic opportunities.

✔️ Integration between systems

These integrations are a must for a more efficient workflow. And one more main point is that the developed wealth management system should be able to integrate with other key systems:

✔️ Automated AML, KYC, and due diligence solutions

Non-compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) processes incur financial penalties. That’s why wealth management companies need to ensure their processes are as secure as possible.

AML systems with real-time registry and adverse media connections allow you to keep regulators happy and improve the customer experience.

KYC allows you to assemble everything you need to know about your customers and counterparties.

Due diligent solutions capture only the relevant information, significantly removing the noise of false positives.

✔️ CRM and document management

We’ve already talked about the importance of automated document management to maintain files and notes pertinent to a client relationship for quick retrieval. A DMS is often included in a CRM (customer management system) that has the capacity to track all activities and results on both a micro and macro level by customer CRM analytics provides measurements against targets and gives insight into future actions needed. The best CRMs for wealth management advisors include Salesforce, Redtail, Wealthbox, and Junxure.

✔️ Cloud services

Services like Amazon Web Services, Microsoft Azure, and Oracle allow for increased data security, cost reduction, scalability, and business continuity. Cloud usage caters to the more mobile customer and advisor and allows onboarding processes to be smooth and frictionless.

✔️ Data Analytics systems

Advanced Analytics systems, such as UIPath and Microsoft Azure, equip the wealth manager with tools for reliable portfolio management. The accessibility to data analytics allows for predictive models that benefit managers in decision-making.

Summary

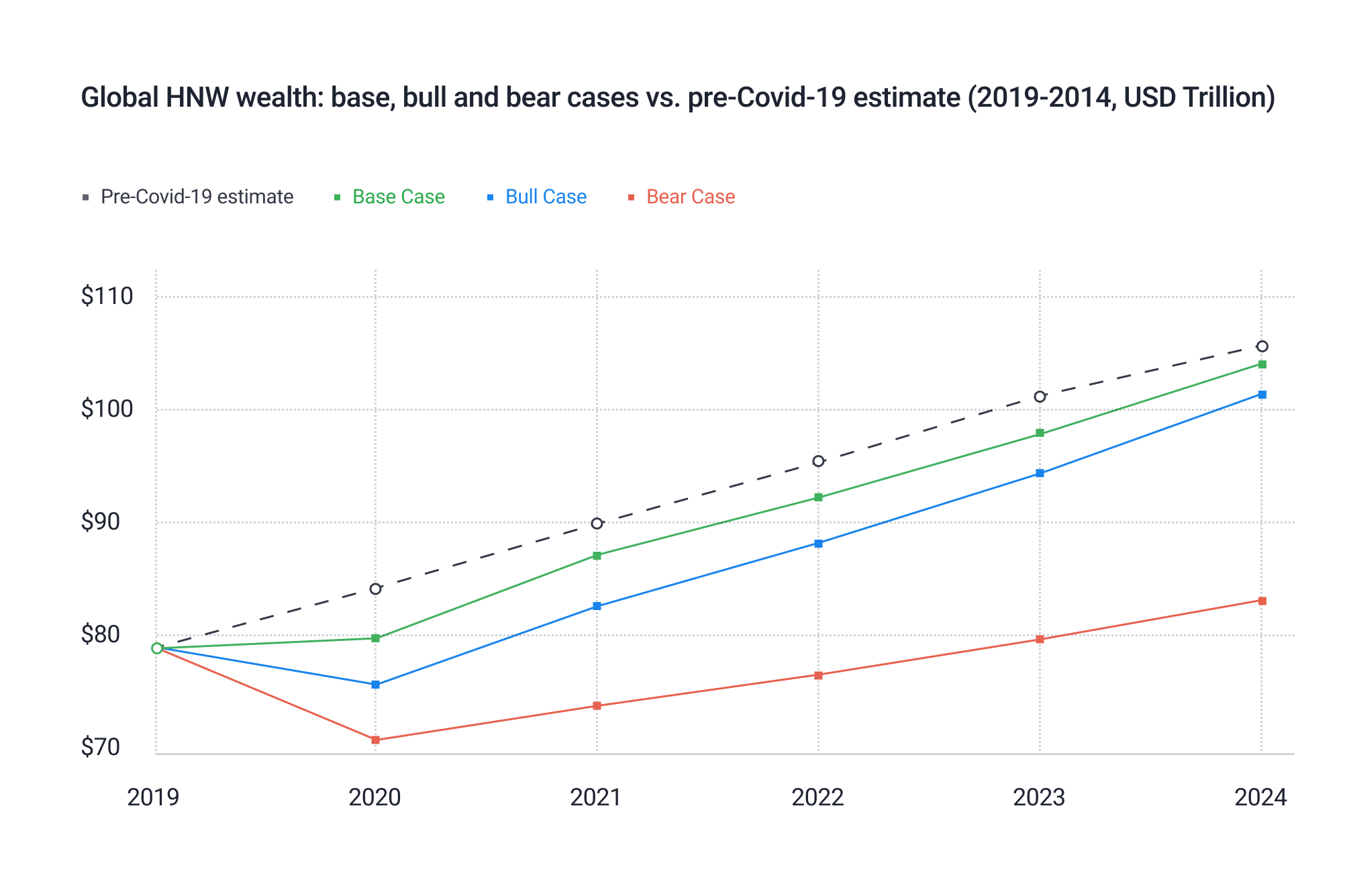

According to Oliver Wyman’s report, after the storm of 2020, the sun will shine again, and the global wealth of high-network individuals will grow by around 30% by 2024.

It means they are going to resort to wealth management services more willingly. However, intense competition on the market of service providers allows them to choose “crème de la crème” of wealth managers. It means tech-savvy WM businesses that offer a personalised approach to customers’ requirements will win more clients and grow. Itexus has vast expertise in developing wealth management systems that will help your business beat the competitors and automate many flows, and as a result, save money on extra human resources and expand your clientele base.

Reach out if you are ready to upgrade your wealth management services to meet your client’s expectations.