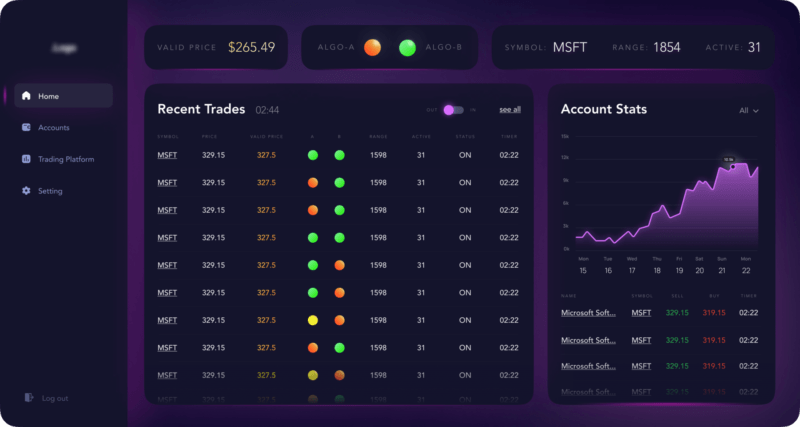

Intelligent investment assistant that performs technical analysis for a number of stocks, automatically tracks multiple indicators on stock exchanges, and generates buy/sell and risk signals for human traders.

Trading apps aren’t just about executing trades anymore. Today, customization is at the heart of every top-tier trading app. Whether it’s adjusting the layout, setting up personalized notifications, or creating custom dashboards, modern trading platforms offer an impressive level of personalization to meet the diverse needs of traders.

Don’t you agree that a trading platform that fits you like a glove is a game-changer?

Let’s take a closer look at why customization matters in trading apps, what types of customization are available, and how this trend is reshaping the trading experience.

Why Customization is Essential in Trading Apps

Imagine stepping into a trading platform that feels tailored to your unique trading style and preferences. Customization in trading apps does just that—it enables traders to personalize their trading environment, tools, and experience.

Here’s why customization is so crucial:

- Efficiency and Speed: In trading, every second counts. Customizable layouts and shortcuts help traders access their preferred tools quickly, enhancing decision-making speed.

- Enhanced User Experience: Personalizing a trading dashboard reduces clutter and makes the interface user-friendly, which is especially helpful for beginner traders.

- Adaptability: Different trading strategies require different tools. Customization allows a platform to serve both day traders and long-term investors by catering to their unique needs.

Key Customizable Features in Trading Apps

When it comes to customizing a trading app, there’s a wide range of features that can be tailored to suit individual trading styles. Let’s explore some of the most sought-after customization options.

1. Customizable Dashboards

A dashboard is the command center of any trading app. A customizable dashboard enables traders to select which elements are visible, such as news feeds, portfolio summaries, market overviews, and watchlists.

| Feature | Description |

|---|---|

| Widget-Based Layout | Users can add, remove, or rearrange widgets (e.g., stock tickers, news feeds) to fit their preferences. |

| Dark Mode and Themes | Color schemes and themes that reduce eye strain and match user preferences for a personalized feel. |

| Modular Organization | Allows users to organize data according to their strategy, with modules for technical analysis, alerts, etc. |

Example: TD Ameritrade’s Thinkorswim platform lets users set up multiple screens, each showing specific data, which is invaluable for day traders.

2. Custom Alerts and Notifications

Timing is critical in trading. Custom alerts and notifications help traders stay informed without having to constantly monitor the market.

| Alert Type | Functionality |

|---|---|

| Price Alerts | Notifies the trader when a stock hits a specified price, enabling quick reaction. |

| Volume Alerts | Alerts when a stock’s trading volume reaches a set threshold, indicating potential market movements. |

| News Alerts | Sends notifications on breaking news or updates relevant to watched stocks. |

Example: Robinhood and E*TRADE provide customizable alerts that allow traders to set specific price and volume triggers, giving them a competitive edge.

3. Personalized Watchlists

A watchlist is essential for tracking stocks, commodities, or currencies. A customizable watchlist allows users to monitor their preferred assets in real-time.

| Feature | Description |

|---|---|

| Sorting and Filtering | Allows users to organize stocks by criteria like price, volume, or market cap. |

| Multiple Watchlists | Traders can create different watchlists for various strategies or sectors, e.g., tech stocks, ETFs. |

| Real-Time Data | Watchlists provide live data updates, allowing traders to track movements instantly. |

Example: Fidelity’s Active Trader Pro allows users to create multiple watchlists for different strategies, helping traders stay organized and focused.

4. Charting and Technical Analysis Tools

For technical traders, customizable charting is essential. With interactive charting tools, traders can analyze price trends and patterns more effectively.

| Customization Options | Purpose |

|---|---|

| Indicator Selection | Choose from indicators like moving averages, Bollinger Bands, or MACD for in-depth analysis. |

| Timeframes | Switch between timeframes (e.g., 1-minute, 1-hour, daily) to adjust the data granularity. |

| Annotation Tools | Draw trend lines, add notes, and mark key support/resistance levels directly on the chart. |

Example: TradingView offers robust chart customization, allowing traders to apply custom indicators, draw patterns, and switch seamlessly between timeframes.

5. Trading Order Types and Execution

Traders often have different needs for executing orders, depending on their strategies. Customizing order types can help streamline execution.

| Order Type | Description |

|---|---|

| Limit Orders | Allows users to set a specific price to execute an order, ensuring precision. |

| Stop-Loss and Take-Profit | Sets automatic sell or buy orders to minimize loss or lock in profits based on pre-set criteria. |

| One-Cancels-the-Other (OCO) | Combines a stop and limit order, providing flexibility for entry or exit strategies. |

Example: Interactive Brokers lets users choose from various order types, including OCO, allowing for complex trade setups to manage risk.

Cost Implications of Customizing a Trading App

Developing a trading app with high-level customization isn’t cheap. Here’s a rough cost breakdown based on complexity:

| Feature | Basic Version Cost | Advanced Customization Cost |

|---|---|---|

| Custom Dashboards | $20,000 – $40,000 | $50,000 – $80,000 |

| Alerts and Notifications | $15,000 – $25,000 | $30,000 – $50,000 |

| Watchlists | $10,000 – $20,000 | $25,000 – $40,000 |

| Charting and Analysis Tools | $30,000 – $60,000 | $70,000 – $100,000 |

| Order Types and Execution | $20,000 – $35,000 | $50,000 – $80,000 |

Note: Costs vary based on region, team expertise, and the app’s backend complexity.

Benefits of Customization in Trading Apps

So, why invest in these customizations? Let’s break down the key benefits that a tailored trading experience brings to users.

- Better User Retention: A personalized app experience makes users feel in control, increasing satisfaction and reducing churn.

- Higher Efficiency: Customizations streamline workflows for professional traders, saving time and helping them make decisions faster.

- Improved Trading Performance: Personalized tools and data allow traders to make well-informed decisions based on real-time information.

- Competitive Edge: Offering customization sets an app apart from competitors, making it attractive to both new and experienced traders.

Challenges and Considerations

Of course, adding customization isn’t without its challenges. Here are some considerations:

- Complexity in Development: Customizable features require more sophisticated development, increasing time and cost.

- User Education: Some features may need tutorials or tooltips to ensure users understand how to use customization effectively.

- Performance Optimization: High levels of customization, especially in real-time trading apps, can strain servers and impact performance if not optimized.

Conclusion: Building the Ideal Customizable Trading App

Customization in trading apps is no longer a luxury; it’s a necessity. As trading becomes more competitive, users need tools that cater to their unique strategies and styles. Custom dashboards, personalized alerts, interactive charting, and flexible order execution all contribute to a tailored experience that can enhance trading efficiency and performance.

Are you ready to build a trading app that stands out? Creating a customizable trading app takes a specialized team with expertise in finance, UX design, and development. At Itexus, we’ve been crafting fintech solutions for years, delivering high-performance, customizable trading platforms that meet our clients’ needs. From advanced data integration to user-friendly customization features, we’re equipped to bring your vision to life.

So, why settle for one-size-fits-all when your app could be as unique as your users’ trading strategies? Reach out to Itexus, and let’s build a customizable trading platform that redefines the trading experience.