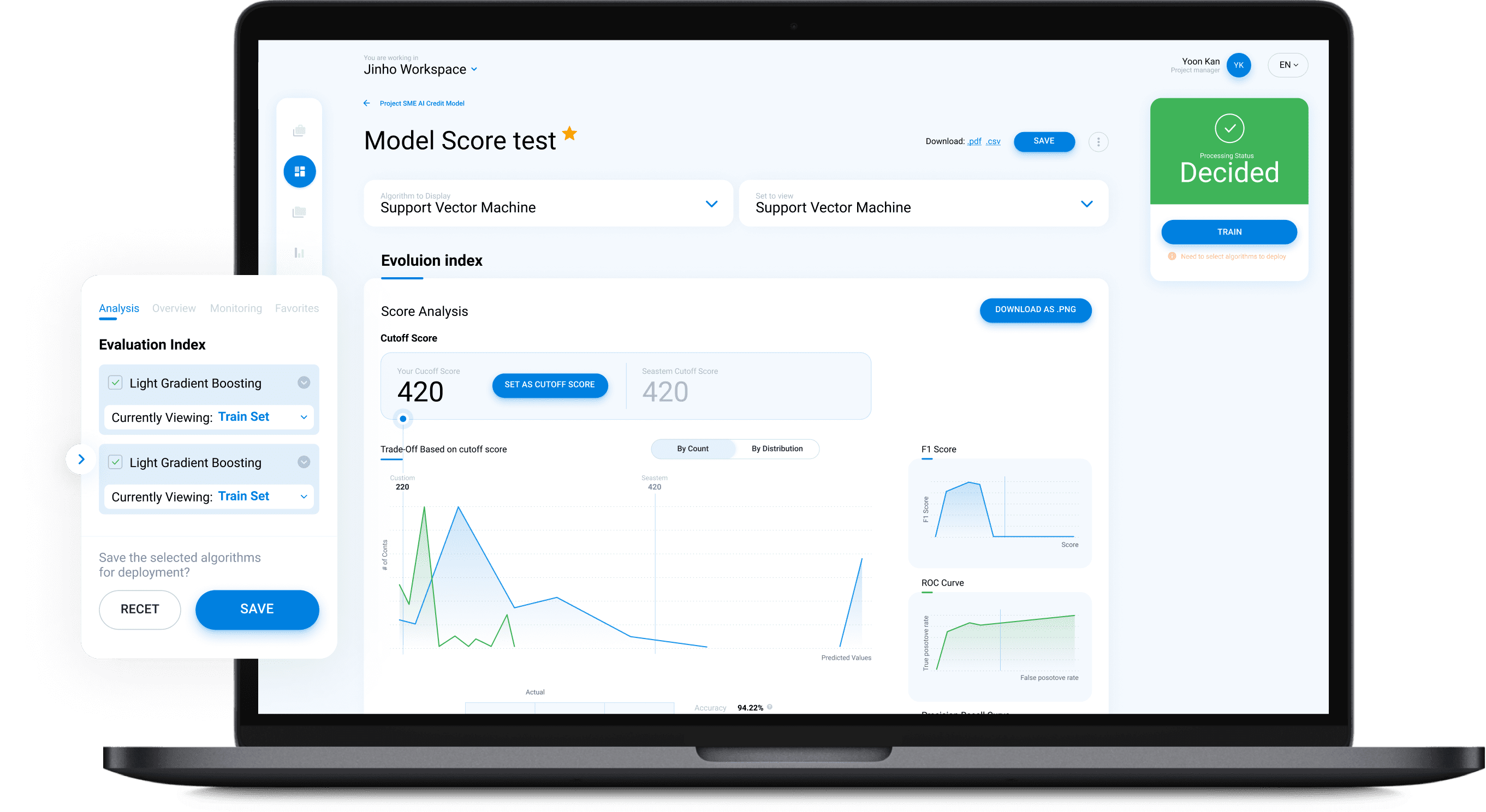

A web app for people working in the financial sector to create analytical models. The app uses AI-based predictive modules reflecting the credit cycles to automate decision-making in Finance. Unlike the traditional statistical approach when making one analytic model takes 2-3 months, the application enables users to build, test, and deploy multiple predictive financial models within just a few clicks.

A finance platform is a digital solution that enables individuals, businesses, or institutions to manage, track, and optimize their financial operations. These platforms encompass a wide range of functions, from personal finance management and online banking to investment tracking, lending, and enterprise finance solutions. As digital financial services evolve, finance platforms are increasingly adopting advanced technologies to enhance user experiences, improve security, and expand functionality.

This guide explores what finance platforms are, their key features, different types, and the benefits they bring to both consumers and financial institutions.

What is a Finance Platform?

A finance platform is a software-based system that provides a suite of financial tools and services to help users manage their finances. Finance platforms can be tailored to various needs, including:

- Personal Finance: Tools for budgeting, tracking expenses, and managing savings.

- Business Finance: Solutions for accounting, payroll, invoicing, and tax management.

- Investment and Wealth Management: Tools for monitoring portfolios, analyzing performance, and making trades.

- Banking Services: Platforms that offer online banking, lending, and payment processing.

Many modern finance platforms integrate features from multiple categories, providing users with a unified experience for managing various aspects of their financial lives.

Key Features of a Finance Platform

Finance platforms come with diverse features that address specific financial needs. Here are some core functionalities commonly found across different types of platforms:

- Account Management

Users can manage multiple financial accounts, including checking, savings, investment, and loan accounts, from a single dashboard. This feature allows users to view their financial status at a glance. - Budgeting and Expense Tracking

These tools help users monitor spending, set budgets, and categorize expenses. They’re essential for both personal and business finance, helping users stay within budget and track financial health over time. - Automated Savings and Investment

Automated savings and investment options allow users to set aside funds or invest a certain amount periodically. Many finance platforms offer robo-advisors that automatically manage investments based on user-defined goals. - Bill Payment and Invoicing

Finance platforms often integrate bill payment and invoicing, making it easy for users to pay bills or send invoices directly from the platform. This feature is especially valuable for small businesses and freelancers. - Real-Time Alerts and Notifications

Real-time alerts notify users of account activity, low balances, payment due dates, and other critical events. These alerts help users stay informed and take quick action when necessary. - Investment Portfolio Management

For users focused on investments, finance platforms often offer portfolio tracking, performance analysis, and market insights. Advanced platforms may provide tools for stock trading, cryptocurrency investments, or robo-advisory services. - Lending and Credit Management

Some finance platforms provide lending and credit score monitoring tools, which allow users to track their credit health, apply for loans, and monitor repayment schedules. - Data Security and Compliance

Finance platforms must prioritize security and comply with financial regulations to protect sensitive user data. Encryption, two-factor authentication, and secure access controls are essential features for safeguarding financial information. - Reports and Analytics

Detailed reports and analytics help users gain insights into their financial habits, cash flow, and spending patterns. Businesses can use these tools for financial forecasting and performance assessment. - Integration with Third-Party Services

Many finance platforms offer integrations with banks, payment providers, accounting software, and other services, making it easy for users to connect all aspects of their financial life.

Types of Finance Platforms

Different types of finance platforms serve unique audiences and financial needs. Here’s a look at the most common types:

- Personal Finance Platforms

These platforms help individuals manage their finances by offering budgeting, expense tracking, and investment tools. Popular examples include Mint, Personal Capital, and You Need a Budget (YNAB). Personal finance platforms focus on helping users track spending, save, and reach financial goals. - Business Finance Platforms

Business finance platforms support companies with tools for accounting, invoicing, payroll, and tax management. Examples include QuickBooks, Xero, and FreshBooks. These platforms are essential for managing cash flow, generating financial reports, and ensuring compliance with tax regulations. - Investment and Wealth Management Platforms

Investment platforms enable users to manage investment portfolios, trade stocks, and monitor performance. They often include tools for portfolio analysis, market research, and risk assessment. Examples include E*TRADE, Robinhood, and Wealthfront. These platforms are geared toward individuals and institutions managing investment portfolios. - Banking and Payment Platforms

Digital banking platforms offer services like online banking, mobile payments, and lending. They are popular with traditional banks, fintech startups, and neobanks. Examples include Chime, Revolut, and PayPal. These platforms provide accessible financial services, particularly for users seeking mobile-first banking solutions. - Lending and Credit Management Platforms

Platforms focused on lending and credit management help users track their credit scores, apply for loans, and manage debt. Examples include Credit Karma, LendingClub, and Upstart. These platforms are essential for consumers seeking to improve credit scores or find loan options tailored to their needs.

Custom Development: Why It Can Be Better Than Off-the-Shelf Products

Custom software development can often outperform off-the-shelf solutions, particularly for finance platforms. While ready-made products are quick to deploy, custom solutions are tailored to your specific needs, offering better scalability, security, and long-term value.

Key Advantages of Custom Development

| Aspect | Custom Development | Off-the-Shelf Solutions |

|---|---|---|

| Tailored Features | Designed to fit your exact business requirements. | Limited to pre-built functionality. |

| Scalability | Grows with your business and adapts to changes. | May require replacing when business grows. |

| Cost Efficiency | Higher initial cost, but no recurring fees. | Lower upfront cost, but ongoing subscriptions. |

| Integration | Seamlessly connects with existing systems. | Compatibility issues are common. |

| Security | Built with custom security measures. | Shared vulnerabilities across users. |

| Control & Flexibility | Full control over updates and maintenance. | Updates and features depend on vendor. |

Why Choose Custom Development?

- Future-Proofing: Custom platforms evolve with your needs, avoiding the costs of switching systems later.

- Enhanced User Experience: A bespoke design ensures a seamless and intuitive interface for your team and customers.

- Regulatory Compliance: Tailored solutions can be designed to meet industry-specific compliance needs.

- Unique Value: Incorporate features that differentiate your business from competitors.

A Real Investment

While custom development requires a higher initial investment, the elimination of recurring fees, better operational efficiency, and improved user satisfaction make it a cost-effective choice in the long term.

Consider this: A tailored platform can give you a competitive edge, enhance customer trust, and grow with your ambitions—all while ensuring your unique needs are met.

Benefits of Finance Platforms

Finance platforms bring numerous benefits to both users and financial institutions, from improved efficiency to enhanced user experiences:

- Streamlined Financial Management

By centralizing various financial services and tools, finance platforms make it easy for users to manage their money efficiently. A single interface saves time and simplifies tasks like tracking expenses, paying bills, or making investments. - Enhanced Decision-Making

Real-time data, reports, and analytics empower users and businesses to make informed financial decisions. With access to relevant insights, users can optimize spending, improve savings, and track financial progress. - Improved Security and Compliance

Modern finance platforms are built with security at their core, providing encryption, secure authentication, and regulatory compliance to protect sensitive financial data. - Accessibility and Convenience

Many finance platforms are mobile-friendly or cloud-based, making financial management convenient and accessible from any device. This accessibility is especially beneficial for users who need to manage finances on the go. - Automation and Efficiency

Automation features, such as bill payments, savings contributions, and budgeting, help users save time and reduce the chance of human error. Automated reminders and alerts also ensure that users stay on top of their financial commitments. - Better Financial Literacy

Many platforms provide educational resources, financial calculators, and goal-setting tools that improve users’ understanding of finance. These resources encourage financial literacy, helping users make better financial choices. - Integration with Other Services

Finance platforms often integrate with third-party services, enabling users to connect their banking, accounting, and payment tools for a seamless experience. This integration improves workflow and data accuracy for both personal and business users.

Challenges in Developing Finance Platforms

Developing and operating a finance platform presents several challenges, primarily related to security, scalability, and compliance:

- Data Security and Privacy

Since finance platforms handle sensitive data, ensuring security is paramount. Platforms must protect data with encryption, secure logins, and compliance with privacy regulations to prevent data breaches. - Regulatory Compliance

Finance platforms must comply with industry regulations like GDPR, CCPA, and, for financial institutions, banking standards such as PCI-DSS. Adhering to these rules is crucial to avoid penalties and ensure user trust. - Scalability and Performance

As finance platforms grow, they must scale to accommodate increasing user demands without compromising speed or performance. Scalability is particularly challenging for platforms handling high-frequency transactions, such as investment or trading platforms. - User Experience and Accessibility

Ensuring an intuitive, user-friendly experience is essential for finance platforms. They should be accessible to users with different levels of financial literacy, making it easy to find and use features without a steep learning curve. - Data Integration and Accuracy

Finance platforms often pull data from multiple sources, such as bank accounts, credit card providers, and investment portfolios. Ensuring data accuracy and seamless integration between these sources is critical for a reliable user experience.

Future Trends in Finance Platforms

The evolution of finance platforms is driven by advances in technology and changing user expectations. Here are some emerging trends:

- AI and Machine Learning: AI-powered tools offer personalized financial insights, fraud detection, and predictive analytics, helping users manage finances more intelligently.

- Blockchain and Cryptocurrency Integration: More platforms are beginning to support cryptocurrency transactions, investing, and decentralized finance (DeFi) services as digital assets grow in popularity.

- Open Banking: Open banking initiatives allow finance platforms to securely access user financial data from multiple banks, providing a more unified and flexible experience.

- Enhanced User Experience with Voice and Chatbots: Voice recognition and AI-driven chatbots are making finance platforms more interactive, offering voice commands and chat-based financial assistance.

- Green Finance and ESG: With growing interest in sustainable investing, finance platforms are incorporating environmental, social, and governance (ESG) tracking and offering insights into sustainable investment options.

Conclusion

Finance platforms have transformed the way individuals and businesses manage their money. From personal budgeting and investments to business accounting and online banking, these platforms provide essential tools that make financial management easier, more secure, and accessible. By adopting a finance platform that aligns with your financial goals, you can streamline processes, make data-driven decisions, and ultimately achieve better financial health. As technology advances, finance platforms will continue to evolve, offering new features, enhanced security, and innovative solutions for financial management in a digital world.