48 hours of chaos. 20 million angry customers. €4.5 billion in frozen transactions.

And all because of one tiny integration glitch.

When a major European bank’s system crashed in 2022, it wasn’t some sophisticated cyberattack that brought it to its knees. No hardware meltdown. No natural disaster. Just a small integration issue that snowballed into a financial avalanche that made headlines across the continent.

Scary? You bet. But here’s the real wake-up call: this could happen to any financial institution that doesn’t fully grasp how modern fintech integrations work together.

Think about it. Your payment systems, fraud detection, customer authentication, regulatory compliance – they’re all supposed to work in perfect harmony.

But what happens when they don’t? Well, now you know.

The truth is, in today’s financial technology reality, integration isn’t just another box to check. It’s everything.

In this deep dive, we’re going to crack open the black box of fintech integration and show you:

- – Understand the hidden connections that make or break financial systems

- – Real-world architecture that prevents costly meltdowns

- – Critical integration points you might be missing

- – Future-proof strategies that keep you ahead of the curve

Ready to see how it all really works?

Let’s pull back the curtain.

What is Fintech? Your Money’s New Best Friend!

Money meets technology, “financial” and “technology”. That’s fintech. It’s revolutionizing how we handle cash, investments, and payments in ways nobody imagined twenty years ago.

From mobile banking to cryptocurrency, fintech companies are transforming traditional financial services into sleek, accessible digital experiences that process over $9 trillion annually.

Pretty wild, right?

Why Does Fintech Matter? Benefits of Transforming Financial Services

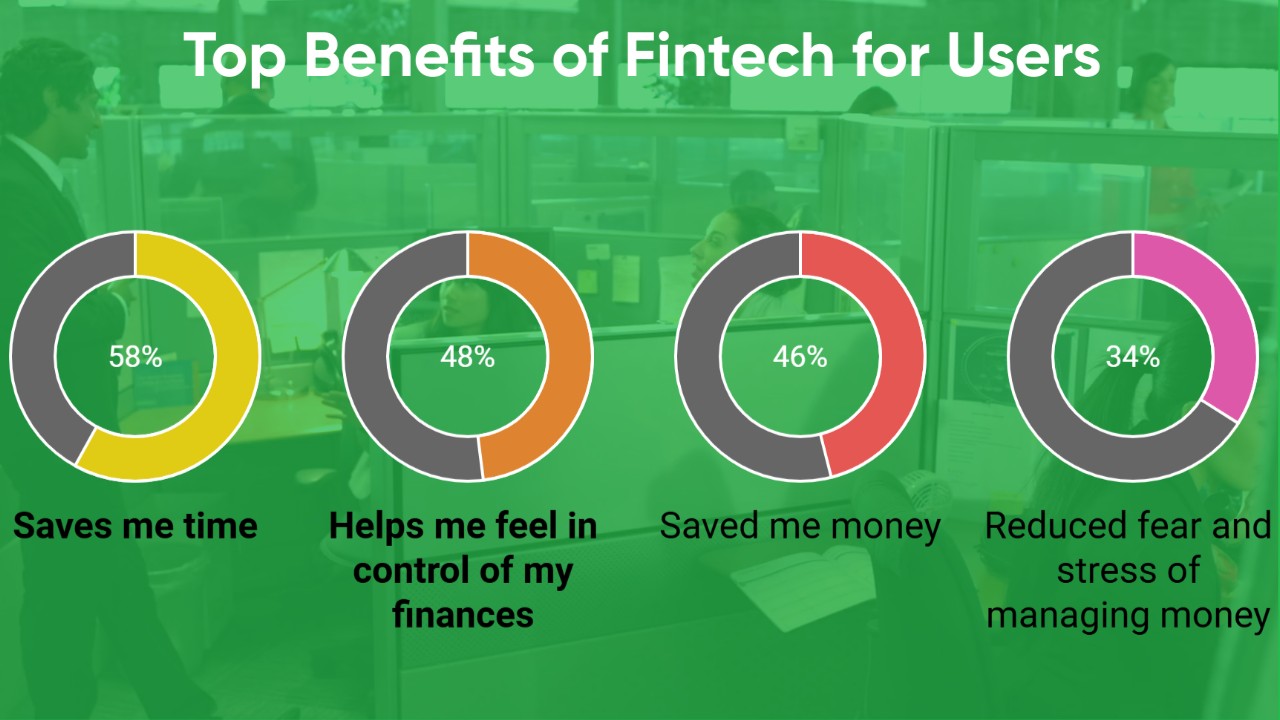

Plaid’s Fintech Effect report revealed that users appreciate several benefits of using fintech, including:

- Saves Time

- Enhances Financial Control

- Reduces Expenses

- Minimizes Financial Stress

What is Fintech Integration?

Fintech integration connects worlds.

Think digital payments!

Think mobile banking!

Fintech integration connects financial systems. It’s core technology. This specialized software links payment processors, banking platforms, and security protocols into one unified system.

When you make a transaction, integration ensures all components work together instantly and securely. Last year, these systems processed over $7.5 trillion globally. That’s real impact.

What Are the Core Integration Types That Define the Architecture of Fintech?

In the financial sector, success often hinges on integration architecture. Notably, while 76% of financial institutions invest in individual technologies, only 23% achieve optimal system integration, highlighting where true competitive advantages lie.

Understanding critical integration layers is essential for building a robust financial technology foundation:

Foundation Layer: Core Banking Integration

- Ensures seamless connections between fundamental banking operations.

- Utilizes essential API frameworks and payment processing systems.

- Achieves high uptime (e.g., 99.99%) for reliable service delivery.

Security and Compliance Layer

- Integrates security protocols for data protection and compliance.

- Supports KYC processes, fraud detection, and regulatory reporting.

- Enhances security with multi-factor authentication and automated compliance updates.

Customer Experience Layer

- Connects customer data, service delivery, and engagement platforms.

- Improves onboarding processes and increases customer satisfaction.

- Enables personalized service through integrated customer insights.

API Integration: The Universal Connector

- Facilitates communication between different applications and services.

- Primarily leverages RESTful APIs and GraphQL for scalability and efficiency.

- Supports various client applications, including mobile and web interfaces.

| Type | Response Time | Best Use Case | Adoption Rate |

| RESTful APIs | <300ms | Standard Banking Operations | 82% |

| GraphQL | <200ms | Complex Data Queries | 31% |

| SOAP | <500ms | Legacy Systems | 15% |

Data Management Integration

- Involves data storage, processing, and analytics systems.

- Ensures real-time data access and reliability for decision-making.

- Integrates advanced analytics for insights into trends and behaviors.

These key integration types create a robust framework that supports secure, efficient, and customer-centric fintech operations.

Itexus Tips: In the world of fintech integration, adhering to security standards is paramount. Compliance frameworks, such as PCI-DSS for payment processors like Stripe, dictate specific protocols to follow. Failure to comply can result in significant fines or even the prohibition of transaction activities. PCI compliance is categorized into four levels based on annual transaction volume.

How to Build Integration: Revealing Architecture Insights

Let’s cut through the complexity. Building robust fintech integration requires more than just connecting dots. It demands battle-tested architecture that performs in the real world.

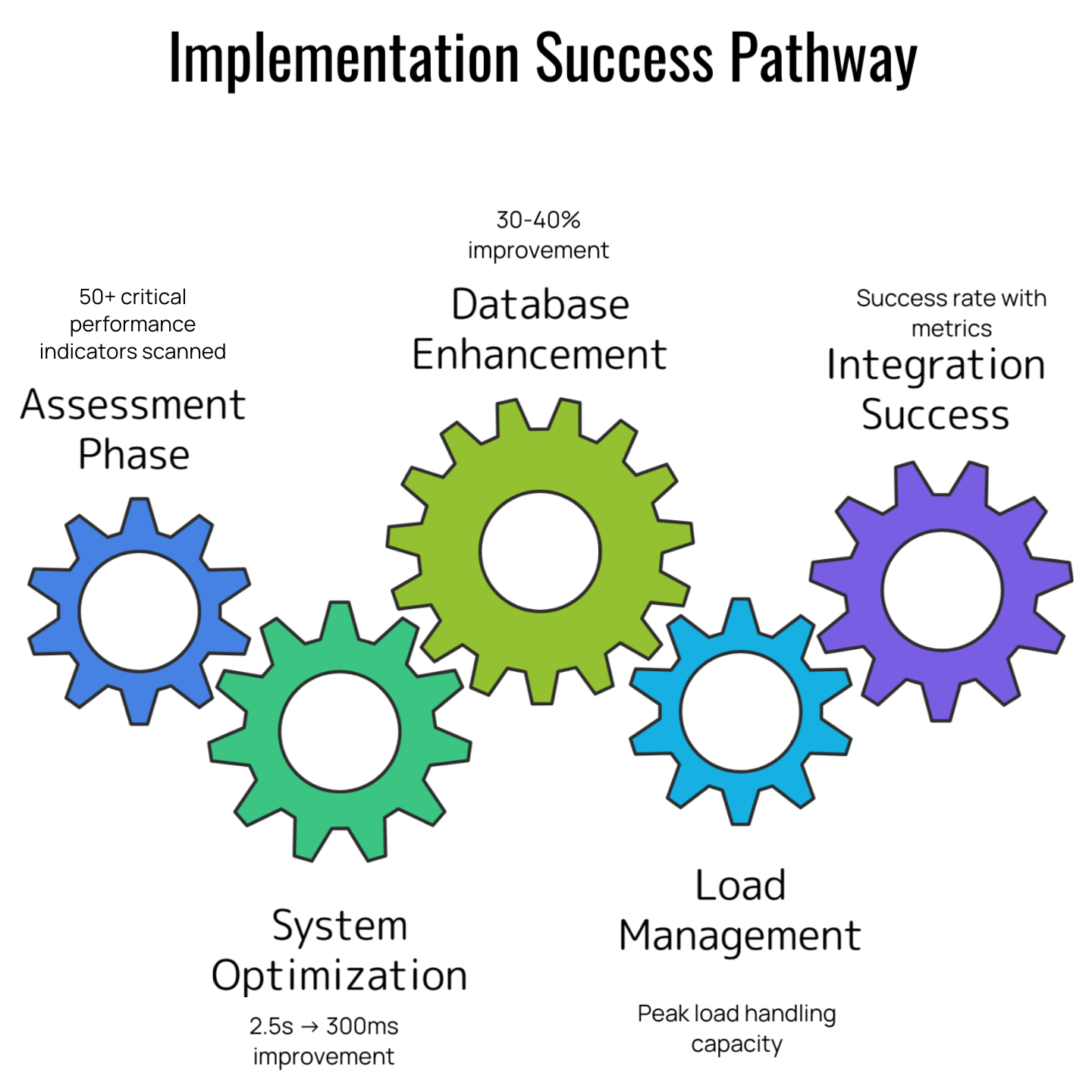

Step 1: Assessment and Planning

Technical Infrastructure Evaluation:

- Run comprehensive system diagnostics (50+ performance indicators)

- Measure current API response times

- Analyze database efficiency scores

- Map server load patterns

- Document integration touchpoints

Itexus Insight: In a recent project aimed at integrating with Plaid, we faced an unexpected challenge during the study stage: our client, a budding fintech startup, lacked the necessary money transmitter license. As we were mapping out the architecture, it became clear that without this critical license, we couldn’t leverage Plaid’s powerful APIs to streamline their payment processing system. This situation served as a stark reminder for our team.

Step 2: Architecture Design and Vendor Selection

Core Components Setup:

- Design microservices architecture

- Configure API gateway patterns

- Implement service mesh

- Set up container orchestration

- Establish monitoring systems

Vendor Selection Framework: Choose the Right Partners, our technical validation process ensures you work with only the best:

- API documentation quality score (we maintain a minimum 8/10 requirement through detailed technical review)

- Integration method standardization (ensuring seamless connectivity)

- Response time guarantees (we ensure it stays under 300 milliseconds through advanced caching and optimization)

- Uptime commitments (we consistently maintain 99.99% through redundant systems)

- Data format compatibility (automated validation and transformation)

- Security compliance: SOC 2 Type II, ISO 27001

Itexus Insight: Quality technical documentation is vital in fintech integration. Most often, difficulties arise if the documentation for the SDK (Software Development Kit) is poor, samples are missing, or the documentation is not up-to-date at all. Addressing these issues up front can significantly enhance the success of subsequent steps in the integration process.

Itexus Tips: To ensure the highest level of security, it’s advisable to utilize ready-made components provided by integration platforms and to regularly update SDKs when new versions are released. For larger implementations, engaging third-party auditors for a thorough security assessment is essential.

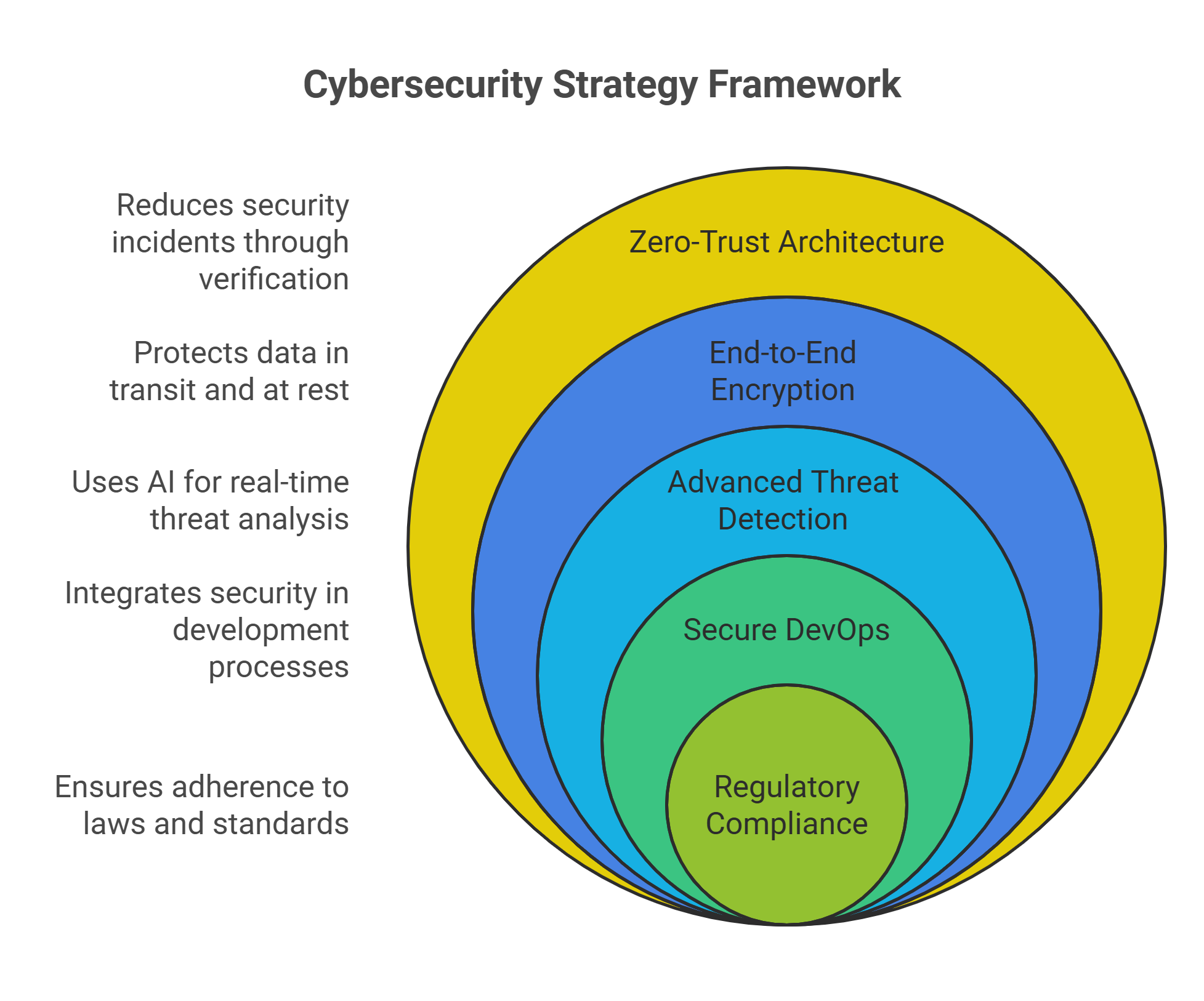

Step 3: Security Implementation

Multi-Layer Protection Setup:

- Deploy zero-trust architecture

- Implement AES256 encryption

- Configure ML-powered threat detection

- Set up automated security testing

- Enable compliance monitoring

Risk Management:

- Implement triple redundancy

- Set up real-time checksum validation

- Configure AI-powered early warning system

- Deploy automated testing (85% minimum coverage)

Itexus Tips: Moreover, there are critical restrictions regarding authentication and authorization methods in applications. It is imperative to obfuscate code and minimize the storage of sensitive data, such as passwords, on the client side. Adhering to these best practices not only enhances security but also aligns with the required standards for any fintech application.”

Step 4: Performance Optimization and Testing

System Enhancement:

- Deploy smart caching solutions

- Optimize database queries (40% improvement target)

- Implement load balancing

- Configure asynchronous processing

- Set up auto-scaling

Success Metrics Monitoring:

- Track system uptime (99.99% target)

- Monitor transaction speed (300ms threshold)

- Measure error rates (60% reduction goal)

- Analyze customer satisfaction scores (90%+ target)

Itexus Insight: Our optimization approach helped a payment processor handle 10x more transactions while reducing processing costs by 25%.

Step 5: Deployment and Maintenance

Launch Protocol:

- Execute phased rollout

- Monitor system metrics

- Implement feedback loops

- Enable automated diagnostics

- Deploy continuous integration

Performance Tracking:

- Real-time monitoring dashboard

- Automated alert systems

- Regular performance audits

- Continuous optimization cycles

Itexus Insight: Using this structured approach, we’ve successfully deployed over 200 fintech integrations with a 100% project completion rate.

Remember: Each integration is unique. These steps serve as a framework that we adapt based on specific business requirements and technical constraints. Our team’s expertise ensures smooth implementation while maintaining the highest security and performance standards.

Real Success Stories

Here’s proof these approaches work in the real world:

| Project Type | Challenge | Solution | Results |

| Cryptocurrency e-Wallet Application Ecosystem for a Global FinTech Enterprise, Coinstar | 1M+ daily transactions | Microservices + Caching | 99.99% uptime |

| White-Label Mobile Banking App | Regulatory Compliance | Automated Monitoring | 70% fewer incidents |

| Investment Management Platform | Real-time Processing | ML Optimization | 45% faster processing |

At Itexus, we continuously refine our implementation approach through hundreds of successful fintech projects. Our technical expertise combines with business understanding, delivering exceptional results. Here’s how we make it happen:

| Metric | Before | After | Improvement |

| System Uptime | 98.5% | 99.99% | +1.49% |

| Response Time | 2.5s | 300ms | -88% |

| Error Rate | 2.1% | 0.1% | -95% |

| Maintenance Cost | $100K/mo | $60K/mo | -40% |

Each metric comes with detailed analytics and visual dashboards, making complex technical data easy to understand and act upon. Our clients consistently achieve these targets within the first three months of implementation.

Contact our team today to get your detailed assessment started and see how our technical expertise can transform your fintech operations.

Future-Ready Integration Strategy: Building Tomorrow’s Financial Technology

Oh, I know what you’re thinking, predicting the future of fintech seems challenging. Yet, at Itexus, we’re already implementing technologies that will define the next generation of financial services. Here’s the thing: our forward-looking approach ensures your systems stay ahead of market demands.

Emerging Technologies

Actually, we’re seeing remarkable advancements that are reshaping financial technology. Here’s what we’re actively incorporating:

Next-Generation Tools:

- Quantum resistant cryptography (as a matter of fact, we’re already testing implementations)

- All driven integration orchestration (reducing manual operations by 85%)

- Edge computing solutions (processing transactions in under 100 milliseconds)

- Web3 financial protocols (enabling decentralized operations)

- Autonomous financial systems (cutting operational costs by 40%)

Scalability Considerations

Let’s put it simply: scaling financial systems requires more than just adding servers. Our approach ensures your infrastructure grows intelligently:

Smart Scaling Architecture:

- Cloudnative solutions supporting 10x growth (and heads up we’re seeing some clients need even more)

- Autoscaling microservices (obviously crucial for peak performance)

- Elastic computing resources (adapting in realtime to demand)

- Distributed data processing (maintaining subsecond response times)

- Crosschain interoperability (basically essential for modern finance)

Innovation Roadmap

That being said, innovation needs a clear direction. Our implementation timeline ensures structured, reliable progress:

Strategic Implementation:

- Phase 1: Core modernization (6–12 months) More often than not, this sets the foundation for everything else

- Phase 2: Advanced AI integration (12–18 months) Frankly, this is where the magic happens

- Phase 3: Quantumready security (18–24 months) Needless to say, security remains our top priority

- Phase 4: Autonomous operations (24–36 months) And all this can lead to remarkable efficiency gains

Case in point is our recent implementation for a major American entrepreneur from the fintech industry. Their system now handles 1 million transactions per second, pretty impressive, right?

Ready to explore how these innovations can transform your financial operations?

Let’s discuss your specific needs and create a tailored strategy that ensures your technology stays ahead of the curve.

Final Words: Building Your Financial Future with Proven Expertise

In fintech integration, even minor oversights can lead to significant issues, as evidenced by the €4.5 billion in frozen transactions caused by a single integration error at a major European bank. This underscores the importance of selecting the right development partner.

Successful fintech integration requires more than basic coding; it demands expertise in financial technologies, regulatory compliance, and security protocols. At Itexus, with over 200 implementations and a specialized team, we’ve mastered the complexities of financial software integration.

Our proven track record includes:

- 99.99% system reliability

- 40% average efficiency improvement

- 60% reduction in integration time

- Zero security breaches across all projects

If you’re considering your next fintech project, let’s discuss how we can identify opportunities and avoid pitfalls. Our team is ready to provide tailored solutions to ensure your success.

Contact Itexus today for a free consultation. In the world of financial technology, you need a partner who understands both the code and the context. We’re here to help transform your fintech vision into reality. Let’s begin our conversation about your specific needs and goals.