In financial services, Banking-as-a-Service (BaaS) platforms have emerged as a key component of open banking that allows non-financial businesses to introduce financial products and services. More and more banks are now developing their own BaaS platforms to take advantage of Open Banking opportunities ahead of their competitors and to create new revenue streams by monetizing their platforms. The growing demand for banking-as-a-service development is not surprising, given the advantages that come along with it:

- Access to financial services. With BaaS services integration, businesses can provide their customers with access to core financial products without the need to invest in building from scratch and maintaining their own banking infrastructure.

- Faster time to market. BaaS helps fintechs to reduce time to market by utilizing the existing banking infrastructure, allowing them to focus on their own products and services.

- Fostered competition and innovation. Incorporating BaaS can foster competitiveness and drive innovation in the finance sector, as it allows new players to enter the market and offer fresh and innovative products and services.

- Cost-efficiency. Building a banking infrastructure from scratch requires a considerable investment of time, money, and resources. BaaS allows companies to save resources and focus on introducing new services and improving customer experience.

- Compliance and security. Introducing financial services brings a significant amount of regulatory and compliance challenges. Banking-as-a-service providers remove these obstacles and allow companies to focus on their growth.

It is predictable that the demand for BaaS (Backend as a Service) platforms will continue to increase. According to statistics, the global BaaS platform market is expected to expand at a 15.7% CAGR between 2021 and 2031. Therefore, if you’ve been considering developing a banking-as-a-service platform, now is the time. To help you find a reliable partner for custom BaaS platform development or integration with an off-the-shelf solution, we have shortlisted the top 10 banking-as-a-service companies. Check them out!

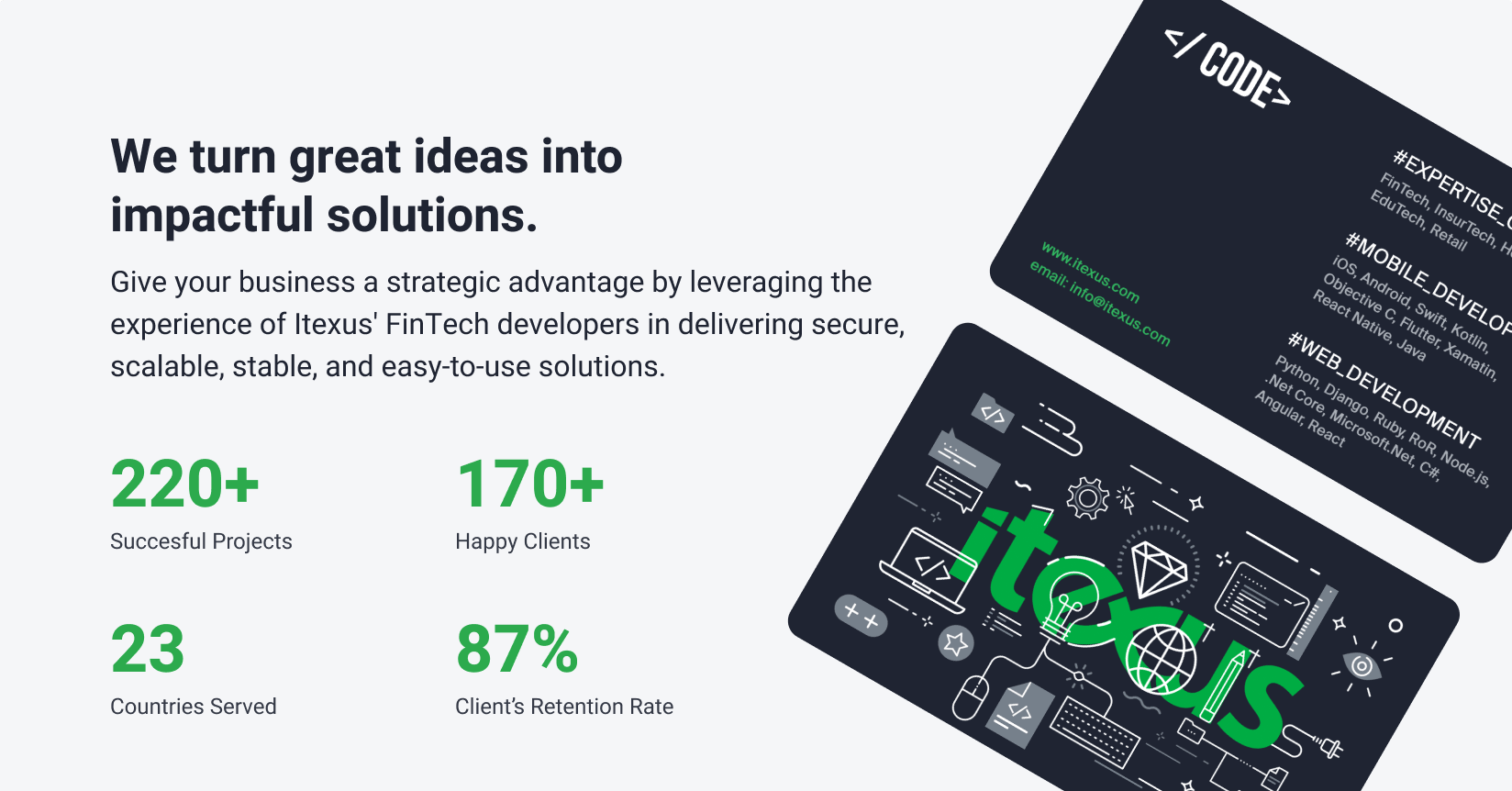

1. Itexus (US)

- Hourly Price: 25 – 49$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2013

- Min Project: $20,000+

Services provided:

Mobile Banking App Development, Fintech Consulting, eWallet Development, Trading Systems Development, Banking Process Automation, Fintech UX/UI Design, Banking-As-A-Service (BaaS).

About the Company:

Itexus is an accomplished fintech development company with a solid understanding of the ins and outs of the financial services industry. With the best talent on board, the company develops complex software solutions for banks, non-banking financial institutions and startups, from simple personal finance assistants and mobile payments to enterprise financial applications. Itexus’ specialists can either develop a SaaS platform from scratch or integrate your app with any of the existing Banking-as-a-Service providers. The company is known for its customer-centric approach, high work ethic and excellent quality of delivered solutions.

Tech Stack: Python, React, Postgresql, Plaid, Ruby, Node.js and more…

2. Atkom Software & Consulting (Poland)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2005

- Min Project: $10,000+

Services Provided:

Custom Software Development, Web Development, Mobile Development.

About the Company:

Altkom Software, a Custom Software Development Company, boasts over 20 years of experience. They have successfully worked with numerous Polish and international companies. Firm works with renowned brands, from international corporations to fast-growing companies and start-ups. Altkom stands out with its Software as a Journey framework, ensuring 98% of projects are delivered on time and within budget.

Tech Stack: Java, .NET, C#, Vue, Angular, React, Android, iOS, Docker.

3. Magnise (Netherlands)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2005

- Min Project: $10,000+

Services Provided:

Custom Software Development, Web Development, Mobile Development, IT Consulting, Quality Assurance, DevOps, UI/UX Design, Cloud Solutions, Data Analytics, IT Support and Maintenance.

About the Company:

Magnise is a mid-sized developing company. Here the team is dedicated to find innovative solutions for customers’ challenges by developing highly effective and tailored software solutions. From the initial stages of prototyping to ongoing production support, their team of developers ensures that the solutions they propose are not only the best fit for the business needs but also delivered on any device or platform, using any language.

Tech Stack: Java, Python, JavaScript (Node.js), React.js, Angular, Swift, Kotlin.

4. Gorilla Logic (US)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9)

- Employees: 250 – 999

- Founded: 2002

- Min Project: $250,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, Quality Assurance and Testing, DevOps Services, UI/UX Design, Cloud Services.

About the Company:

For over 20 years, Gorilla Logic has been a trusted partner for leading enterprises, assisting them in defining, architecting and delivering their most critical digital products and platforms. Their deep technical and domain expertise, coupled with a proven approach, allows clients to innovate, scale and modernize efficiently, resulting in secure products that customers love. Headquartered in the U.S. with nearshore development hubs across Latin America, Gorilla Logic’s highly collaborative Agile teams bring a unique culture of tech-obsession and problem-solving to clients’ projects.

Tech Stack: Java, JavaScript (Node.js), Python, React.js, Angular, Swift, Kotlin, MySQL, PostgreSQL, Amazon Web Services (AWS)

5. Q Agency (Croatia)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.7)

- Employees: 250 – 999

- Founded: 2013

- Min Project: $50,000+

Services Provided:

Digital Strategy, User Experience (UX) Design, Website Development, Mobile App Development, E-commerce Solutions, Digital Marketing, Content Creation, Analytics and Optimization, Branding and Identity, UI Design.

About the Company:

Q Agency takes a holistic approach to meet clients’ needs, offering a comprehensive range of services beyond just development. Their services include business analysis, product strategy, quality assurance, UX/UI design, data services and solution architecture. With over 300 in-house experts and a talent pool of over 2,000 professionals, they help clients ideate, build, manage and scale digital solutions.

Tech Stack: iOS, Android, Hybrid apps (Flutter), PHP (Symfony, Laravel), JavaScript (React, Angular, Vue, Node, Next), Java, .NET, Python (ML/AI), Ruby, DevOps.

6. Mentor Mate (US)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.7), GoodFirms (4.8)

- Employees: 1,000 – 9,999

- Founded: 2001

- Min Project: $50,000+

Services Provided:

Custom Software Development, Mobile App Development, Web Development, Product Strategy and Consulting, UX and UI Design, Quality Assurance and Testing, DevOps and Cloud Services, Data Analytics and Business Intelligence, Digital Transformation Solutions, IT Consulting and Support.

About the Company:

Since 2001, MentorMate has been a leader in blending strategic insights, thoughtful design and engineering to deliver durable technical solutions that drive digital transformation at scale. Known for their commitment to open and transparent communication, MentorMate has earned the trust of hundreds of global companies, guiding their visions, designing innovative products and delivering secure solutions.

Tech Stack: Java, JavaScript, C#, Python, React, Angular, Swift, Kotlin, .NET, AWS.

7. Anadea (Spain)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2000

- Min Project: $10,000+

Services Provided:

Web design, Mobile apps development, UI/UX design, QA and testing, Discovery Phase, Project audit.

About the Company:

Anadea is a software development company dealing in bespoke software solutions. With over 20 years of project experience, Anadea partners with businesses to bring their digital visions to life through the rendering of state-of-the-art and effective software applications. They cooperate with clients from distinguished fields of activity, including Healthcare, Education, Real Estate and e-Commerce, offering tailored-made solutions meeting the requirements of their customers.

Tech Stack: Ruby on Rails, Python, Java, JavaScript, React.

8. LaunchPad Lab (US)

- Hourly Price: 150 – 199$/hr

- Rating: Clutch (4.8)

- Employees: 50 – 249

- Founded: 2012

- Min Project: $10,000+

Services Provided:

Custom Software Development, Web Development, Mobile App Development, Product Strategy, User Experience (UX) Design, User Interface (UI) Design, Quality Assurance and Testing, Salesforce Development, Digital Transformation.

About the Company:

LaunchPad Lab is a digitally transforming products agency that specializes in web, mobile and Salesforce development. Since 2012, LaunchPad Lab has been solving business challenges and boosting growth by shaping, building and optimizing web and mobile applications. Their team partners with clients to deal with problems at their roots and not mere symptoms. This is one of the very broad reasons why more than 90% of their current clients are with them for a long time.

Tech Stack: Ruby, JavaScript, React, Swift (iOS), Kotlin (Android), Ruby on Rails, Node.js, PostgreSQL, AWS, Salesforce.

9. Accedia (Bulgaria)

- Hourly Price: 150 – 199$/hr

- Rating: Clutch (4.8)

- Employees: 250 – 999

- Founded: 2012

- Min Project: $10,000+

Services Provided:

Custom Software Development, Web Development, Mobile App Development, Cloud Solutions, Quality Assurance and Testing, UX/UI Design, IT Consulting.

About the Company:

Accedia, a company headquartered in the EU, specifically in Bulgaria and dealing with IT is the one to be presented. The flourishing company was created in 2012 and it quickly gained dimensional prominence and attracted the attention not only of the clients to its quality of service but also of some of the most demanding parties such as the International Association of Outsourcing Professionals, Deloitte and the Financial Times. AI, ML, application development, data analytics, cloud computing and cybersecurity are among the services that Accedia offers.

Tech Stack: Java, JavaScript, React, Angular, Node.js, Python, AWS (Amazon Web Services), PostgreSQL, Kubernetes, Docker.

10. Quantum Mob (Canada)

- Hourly Price: 100 – 149$/hr

- Rating: Clutch (4.7)

- Employees: 10 – 49

- Founded: 2016

- Min Project: $25,000+

Services Provided:

Custom Software Development, Mobile Application Development, Web Development, eCommerce Platform Development, Building Digital Loyalty Experiences.

About the Company:

Quantum Mob is a Toronto-based end-to-cease virtual innovation firm focusing on constructing stunning and purposeful products that deliver results. They offer custom-tailor-made software answers aimed toward empowering partners to be successful inside the digital landscape. Quantum Mob solves complex employer business issues through digital answers, serving a numerous purchaser base from contemporary early-level startups to elite Fortune 500 organizations. Their world-class team has contributed to merchandise used by thousands and thousands worldwide across over 150 international locations.

Tech Stack: React, React Native, Flutter, Angular, Vue.js, Node.js, PHP, Java, Python, Docker, Kubernetes, Shopify, Amazon Web Services (AWS), TypeScript.

11. Praxent (US)

- Hourly Price: 50 – 99$/hr

- Rating: Clutch (4.8), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2000

- Min Project: $25,000+

Services Provided:

UX/UI Design, Usability Testing, Custom Software Development, Mobile App Development, Web App Development, API Integration, Legacy System Modernization, Cloud Solutions DevOps.

About the Company:

Praxent is a financial technology consulting and engineering firm that helps clients achieve growth through digital transformation. With deep industry expertise and a pro-CAN/DO culture, Praxent modernizes legacy systems into custom digital experiences that outperform their competition. Focusing on digital product strategy, UX design and custom software development, the firm guarantees that clients can deliver superior service to their customers.

Tech Stack: .NET Core, Node.js, Java, Python, SQL.

12. Experion Technologies (US)

- Hourly Price: $25 – $49/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 1,000 – 9,999

- Founded: 2006

- Min Project: $10,000+

Services Provided:

Custom Software Development, Web Development, BI & Big Data Consulting & SI, Mobile App Development, Product Engineering, Digital Transformation.

About the Company:

Experion Technologies believes in delivering the best software products and digital services to the clients that cater to their needs. They have undoubtedly made a name in a variety of industries, such as healthcare and finance which enable precise management of projects and complete satisfaction of clients.

Tech Stack: .NET, Java, Python, Angular, React, Node.js, SQL, NoSQL.

13. Cheesecake Labs (US)

- Hourly Price: $50 – $99/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2013

- Min Project: $50,000+

Services Provided:

Mobile App Development, Custom Software Development, IT Staff Augmentation, Blockchain Development.

About the Company:

Cheesecake Labs is really good at designing digital products and offering services like mobile app development. Through their practice of collaboration and insistence on quality, they have become a favorite choice for businesses that are looking to creatively add or innovate their digital footprint.

Tech Stack: Swift, Kotlin, React Native, Ruby on Rails, Node.js, Python.

14. Digiryte (UK)

- Hourly Price: $50 – $99/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2015

- Min Project: $25,000+

Services Provided:

Custom Software Development, Mobile App Development, Digital Innovation.

About the Company:

Digiryte has embraced digital technology to earn a comparison with digitalization leaders rather than following the trend. They are seen to be on the same track as such companies as Silicon Valley that accordingly have a very high level of expertise and are able to provide custom software and mobile applications. By having a strong project management process and always maintaining high-quality standards, their main focus is to exceed client expectations.

Tech Stack: Node.js, React, Angular, Ruby on Rails, Python, SQL.

15. Futured (Czech Republic)

- Hourly Price: $50 – $99/hr

- Rating: Clutch (4.9)

- Employees: 50 – 249

- Founded: 2012

- Min Project: $50,000+

Services Provided:

Mobile App Development, Web Development, AI Development, AR/VR Development.

About the Company:

Futured is an authority in mobile development who produces advanced web and AI solutions. Thanks to their know-how in new technologies, they can thus offer unique and functional digital products.

Tech Stack: Swift, Kotlin, React, Vue.js, Node.js, Python.

16. Yalantis (Poland)

- Hourly Price: $25 – $49/hr

- Rating: Clutch (4.8), GoodFirms (4.7)

- Employees: 250 – 999

- Founded: 2008

- Min Project: $25,000+

Services Provided:

Custom Software Development, AI Consulting, Big Data Consulting, IT Staff Augmentation, IoT Development, Mobile App Development.

About the Company:

Yalantis renders IT consulting and software engineering services of a wide scope. One of the most fascinating AI and big data projects is the one that adapts the clients to the use of advanced data analytics and machine learning in their solutions.

Tech Stack: Java, Kotlin, Swift, Python, Angular, React, Node.js, SQL, NoSQL.

17. Jelvix (Estonia)

- Hourly Price: $50 – $99/hr

- Rating: Clutch (4.9), GoodFirms (4.5)

- Employees: 50 – 249

- Founded: 2011

- Min Project: $50,000+

Services Provided:

Custom Software Development, Enterprise App Modernization, IT Staff Augmentation, Mobile App Development.

About the Company:

Jelvix is a technology partner supporting digital transformation in healthcare that designs custom software solutions and rewrites enterprise applications. They are seen as a leader, whose success is based on the ability to provide real-time data, intelligence and predict the future to their clients.

Tech Stack: Java, Python, .NET, Node.js, Angular, React, SQL, NoSQL.

18. EB Pearls (Australia)

- Hourly Price: $25 – $49/hr

- Rating: Clutch (4.9)

- Employees: 250 – 999

- Founded: 2004

- Min Project: $25,000+

Services Provided:

Mobile App Development, Custom Software Development, Blockchain Development.

About the Company:

EB Pearls is the multi-award-winning star of mobile app development. Their professionalism and constant provision of trustworthy and reliable services have made them the go-to company in the market. Firm offers a whole range of services including software development and blockchain integration.

Tech Stack: Swift, Kotlin, React Native, Node.js, Ruby on Rails, Python.

19. Phaedra Solutions (UK)

- Hourly Price: $25 – $49/hr

- Rating: Clutch (4.9), GoodFirms (5.0)

- Employees: 50 – 249

- Founded: 2013

- Min Project: $10,000+

Services Provided:

UX Design, AI Development, Branding, Mobile App Development, Web Development, Demand Generation Marketing.

About the Company:

Phaedra Solutions is often praised for their professionalism and taking the most advanced route. This is particularly apparent in the software development area through their work in UI/UX and overall functionality improvement.

Tech Stack: Ruby, Python, JavaScript, SQL, NoSQL.

20. Blank Space (Canada)

- Hourly Price: $50 – $99/hr

- Rating: Clutch (5.0)

- Employees: 10 – 49

- Founded: 2014

- Min Project: $50,000+

Services Provided:

Custom Software Development, Web Development, AI Development, E-Commerce Marketing.

About the Company:

Blank Space focuses on customer care and project management which are of high quality by delivering appropriate custom software and web solutions. The common working point is that the collaborative approach assures the success of any project.

Tech Stack: Kotlin, Unity, Vuforia, WordPress CMS, React Native, Laravel.

Summary

Whether you are a banking-as-a-service company looking for top talent to reinforce your in-house team, or a fintech startup striving to develop your own platform from scratch to compete with the big banking-as-a-service providers, you’ll find everything you need in our list. When choosing between different vendors, be sure to look at their portfolio of relevant projects, the engagement models available to choose the most beneficial one for you, the terms on which the company offers post-launch support and maintenance services, and the company’s reputation – after all, this will directly affect the reputation of your future BaaS solution.

At Itexus, we’ve accumulated a treasure trove of diverse projects in the financial services industry and look forward to contributing our expertise and developing a digital solution that will create lasting value for your business and delight your customers. Choosing between different Banking-as-a-Service companies and need help? Want to develop a BaaS platform from scratch or integrate an off-the-shelf solution with your software? Itexus’ specialists have got you covered! Contact us and find out how we can help you.