According to The Pew Trusts, over 12 million people take out a payday loan each year in the US alone. The increasing interest in short-term loans along with the growth of online banking have paved the way for the development of payday loan applications that allow users to borrow money easily with just a few taps.

While there are multiple payday loan apps on the market, they fail to meet the growing user demand for accessible and convenient credit options. So there’s still room for new solutions. Consider launching a payday loan app? Read on to learn how these apps work, where to start payday software development, what core features you should implement first, and how specialized payday loan business software helps minimize risk and maximize profits by automating manual processes at all stages.

Benefits for businesses

The traditional approach to managing short-term loans is time-consuming and tedious, not to mention the possibility of human error, which can come at a high cost in financial services. This is where payday loan software comes in, offering numerous advantages over legacy systems. Let’s take a closer look at them.

✔️ Complete automation

The main function of online payday loan software is to automate the entire process – from online application and loan origination to the final payment. Automation makes it possible to avoid human errors, speed up processes, increase efficiency, reduce operational costs, and much more. From this point, all the other benefits of loan management apps emerge.

✔️ Better customer experience

Payday loan management software provide a seamless experience for borrowers by allowing them to apply for a loan from the comfort of their homes via their devices, rather than visiting a branch. A smooth borrower journey and excellent experience lead to a higher customer satisfaction rate, which, in turn, is critical to the well-being and growth of your business, as well as customer retention.

✔️ Smarter resource allocation

Specialized pay day loan software enables financial service providers to save resources in many ways. It eliminates repetitive manual tasks and reduces personnel costs, enabling companies to go paperless and save on stationery, among other benefits. Payday loan software solutions also free up space and time for activities aimed at growing your business by taking over tedious and time-consuming tasks.

How does a payday loan app function?

Payday loans are a type of short-term borrowing with higher interest rates based on the borrower’s income. The loan amount is deducted from the borrower’s next paycheck and is automatically debited when the borrower receives the paycheck, which serves as collateral for the loan. Generally, the amount of a payday loan is limited to $1,000. Below, we describe step by step how to take out a loan using a special app.

1. Registration

First, a user needs to register in the application, enter their personal data (name, income, photo, etc.), and upload the documents required for the KYC check.

2. Loan limit & interest calculator

Based on the data provided by the user, the online payday loan software calculates the maximum possible loan amount. The interest rate also varies and depends on the user’s income.

3. Linking with a bank account

To take out a loan, users must link their bank accounts to the app. These accounts will be used for both lending and repayment.

4. Online loan application

Users apply for a loan online, specifying how much money they want to borrow and for how long. If the loan is approved, the money is transferred to the linked bank account.

5. Automatic repayment

On the next payday, when the user’s salary is received in the linked bank account, the credited amount is automatically withdrawn.

Payday loan app core features

To avoid confusion, we have divided the key functions of a payday loan app into two groups: user app features and admin panel features.

User app features

- Registration

Users can register in the app with their credentials (e.g., phone number or email), which are then used for logging in.

- Profile creation

Users can create their profile in the app and fill it with personal data such as their name, contact details, photo, etc.

- Linking a bank account

Users can link their bank account to their profile in the app to obtain or repay loans.

- Documents upload & management

Users should be able to upload the documents needed for KYC and other verification processes.

- KYC

Users can complete the Know Your Customer procedure by uploading their documents and providing the required information.

- Loan limit calculator

The credit limit is automatically calculated based on the user’s salary information provided during profile creation.

- Interest rate calculator

The interest rate is automatically calculated based on the amount that a user wants to borrow.

- Loan application

Users can view the available loan types, select one, and apply for it by submitting the required documents and other related details.

- Loan status

Users are informed about the status of their loans on a regular and timely basis.

- Automatic debit

The loan amount, along with the interest amount, is automatically debited from the user’s linked account as soon as they receive their paycheck.

- Push notifications

Users are informed in a timely manner via SMS, email, or push notifications about the status of their loans, upcoming payments, new offers, etc.

Admin panel & general features

- Role-based access control

Role-based access control (RBAC) restricts network access based on an employee’s role. It is one of the main methods of advanced access control.

- Transaction log generation and storage

All transaction data is collected, organized, and securely stored for future audit purposes.

- Document storage

Integrated document storage with classification and access control enables efficient document management, improves regulatory compliance, and prevents data breaches.

- Customization options

Your app’s loan management capabilities should be versatile enough to enable you to provide a personalized experience for your borrowers. It’s advisable to equip your app with customization options – you should be able to configure custom rules for loan products, payment plans, fees, and underwriting needs, etc.

- Integrability

To run your daily operations efficiently, you need to integrate your payday advance software with multiple third-party tools and services. Therefore, it’s important that all the tools required to effectively manage payday loans are seamlessly integrated and work smoothly.

- Compliance

As cyberattacks become more sophisticated, regulatory requirements for fintechs are becoming more stringent. Violations of these can result in heavy fines for your company. Thus, ensuring compliance with legal and regulatory requirements relevant to your type of business is a matter of survival.

Payday loan automation: best practices

Let’s explore the best practices for payday loan software automation that will allow you to maximize your profits, reduce operating costs and employee workloads, and increase efficiency.

AI-powered processes

There are several stages in the lifecycle of a loan that can be streamlined and automated with AI technology – from credit scoring to risk management and data analytics. To this end, we implement intelligent AI systems that help you make data-driven decisions and grow your business.

Reporting & analytics

We implement advanced reporting and analytics systems that allow you to keep track of your cash flow by providing an overall view of all processes across the company. An efficient reporting and analysis engine enables well-informed decisions and ensures that not a single detail is overlooked.

Fraud detection & prevention

Our seasoned specialists utilize best practices, such as real-time data monitoring and suspicious activity detection, predictive scoring for alerts, prioritization of high-risk alerts, and others, to ensure a sophisticated defense for your payday loan management systems. This way, you can focus on what’s important for growing your business instead of dealing with the consequences of fraud losses that can jeopardize your revenue and reputation.

How to start payday software development with Itexus

As a trusted fintech software development partner, we bring our expertise and capabilities to the table to help our customers around the world achieve their business goals with tailor-made and robust fintech solutions. And we would love to do the same for you. Here’s how we will do it.

1. Project assessment

To create impactful digital products, we need to understand your goals, as well as the needs of your target audience. Once we outline the desired outcome, we’ll document the project requirements and estimate the resources needed to implement your solution.

2. UI/UX Design

Our designers will wireframe your future app to identify the best ways to meet users’ needs and ensure flawless and intuitive navigation. Then, they’ll create a design concept – the core idea that determines the design of your solution. After that, our UI/UX specialists will design the app’s interface and refine it based on your feedback.

3. Development phase

Our experienced fintech engineers will develop your app, integrate it with industry-leading third-party service providers, and ensure a high level of security using industry best practices.

4. QA, delivery, and post-launch maintenance & support

Once the loan app development is completed, your app will be thoroughly tested by our QA team to ensure that all bugs are identified and fixed and that everything works as expected. Now, your brand-new app is ready for deployment. If needed, we will maintain and support your app after the launch, updating it regularly to ensure uninterrupted work and high performance.

Loan apps development: Itexus experience

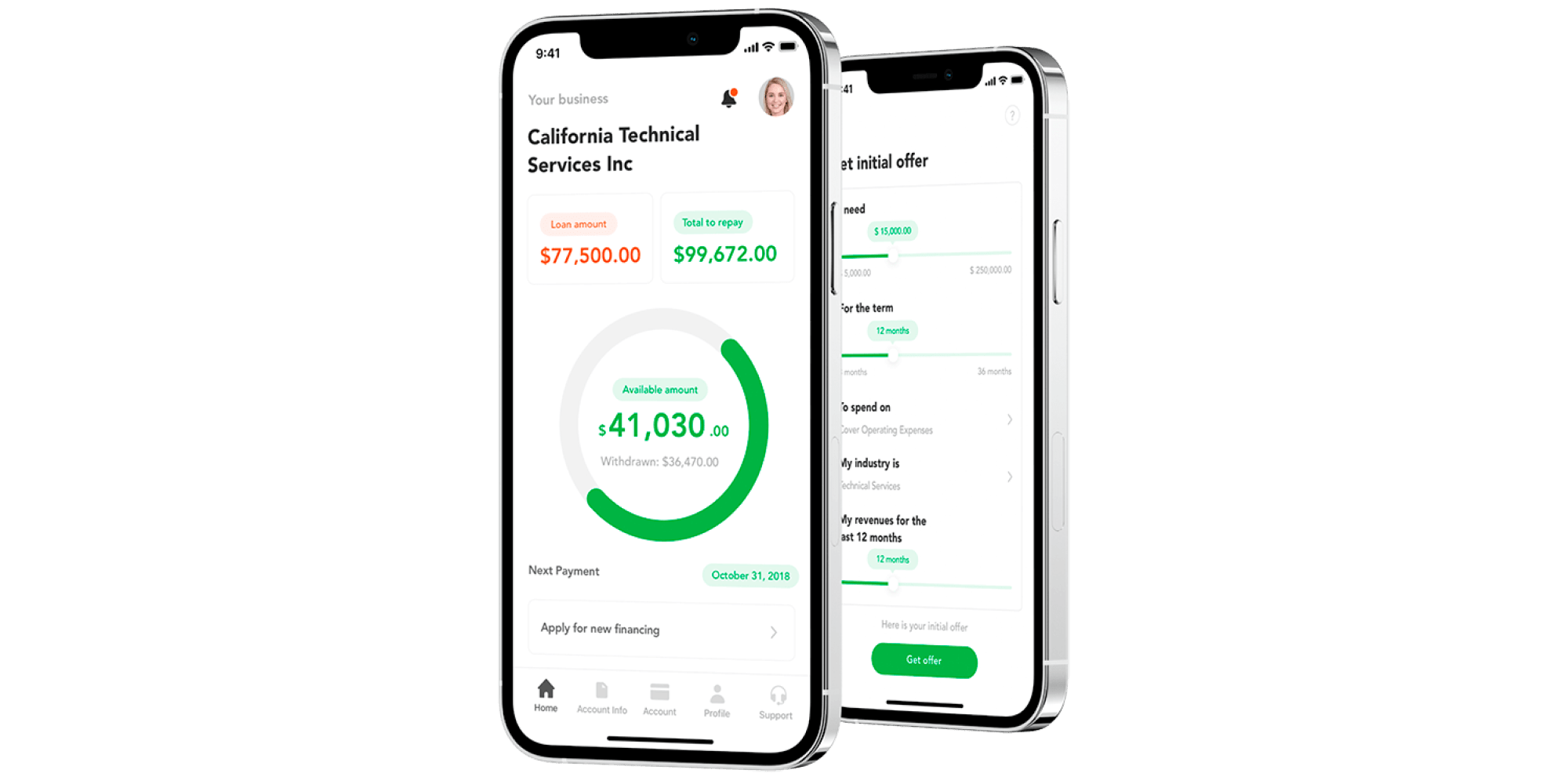

App for getting loans

A FinTech startup with decades of experience in the financial services industry recognized a gap in the lending sphere for small and midsize businesses. To address this, they decided to launch an online loan platform and mobile app and approached Itexus with this idea. The platform we developed automates loan processes, reduces operational costs and interest rates, and features AI-based credit scoring for better loan outcomes.

To learn more about the project, please read the case study.

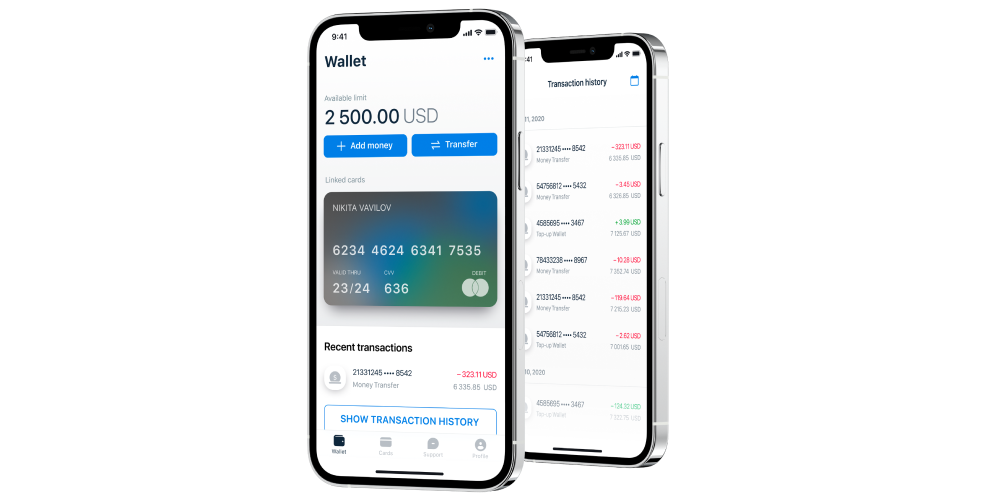

Mobile banking app with early paycheck feature

The Itexus team developed a mobile banking app for migrants that facilitates transactions like sending financial help abroad, receiving microloans, etc., and allows for getting a paycheck early. Within the app, users can also apply for microloans from the banking partner — without red tape and unnecessary delays. The app assesses the user’s creditworthiness based on transaction amounts and grants a loan equal to a certain percentage of the sum of the transfer.

To read more about the project, please read the case study.

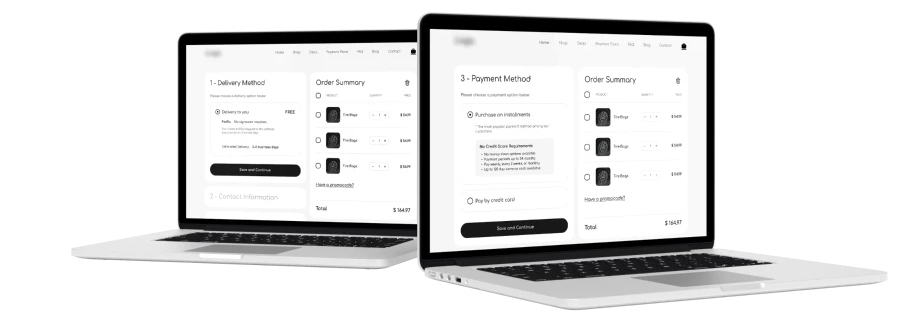

B2C platform with digital lending

Another solution with loan functionality developed by the Itexus team is an e-commerce ecosystem that connects tire suppliers, installers, buyers, and digital lenders across the online buying cycle. Users have the option to pay for their orders in installments thanks to the enabled digital lending feature. To get a loan, the user needs to provide information like monthly income, existing loans, and credits. This data is shared with the lenders, who then send their loan offers. The user selects a suitable offer, signs an online contract with the lender, and returns to the platform.

To learn more about the project, please read the case study.

Summary

Payday loan app development is a great way for existing financial companies to expand their offerings and attract new customers. It’s also a good opportunity for new businesses to enter the fintech market. At Itexus, we have helped both the oldest market players and newcomers drive growth and win users’ love with secure, robust, and powerful fintech solutions, including payday software. If you can imagine it, we can code it – just share your idea and we’ll do our best to help you achieve your goals.