Online B2C Platform with Digital Lending

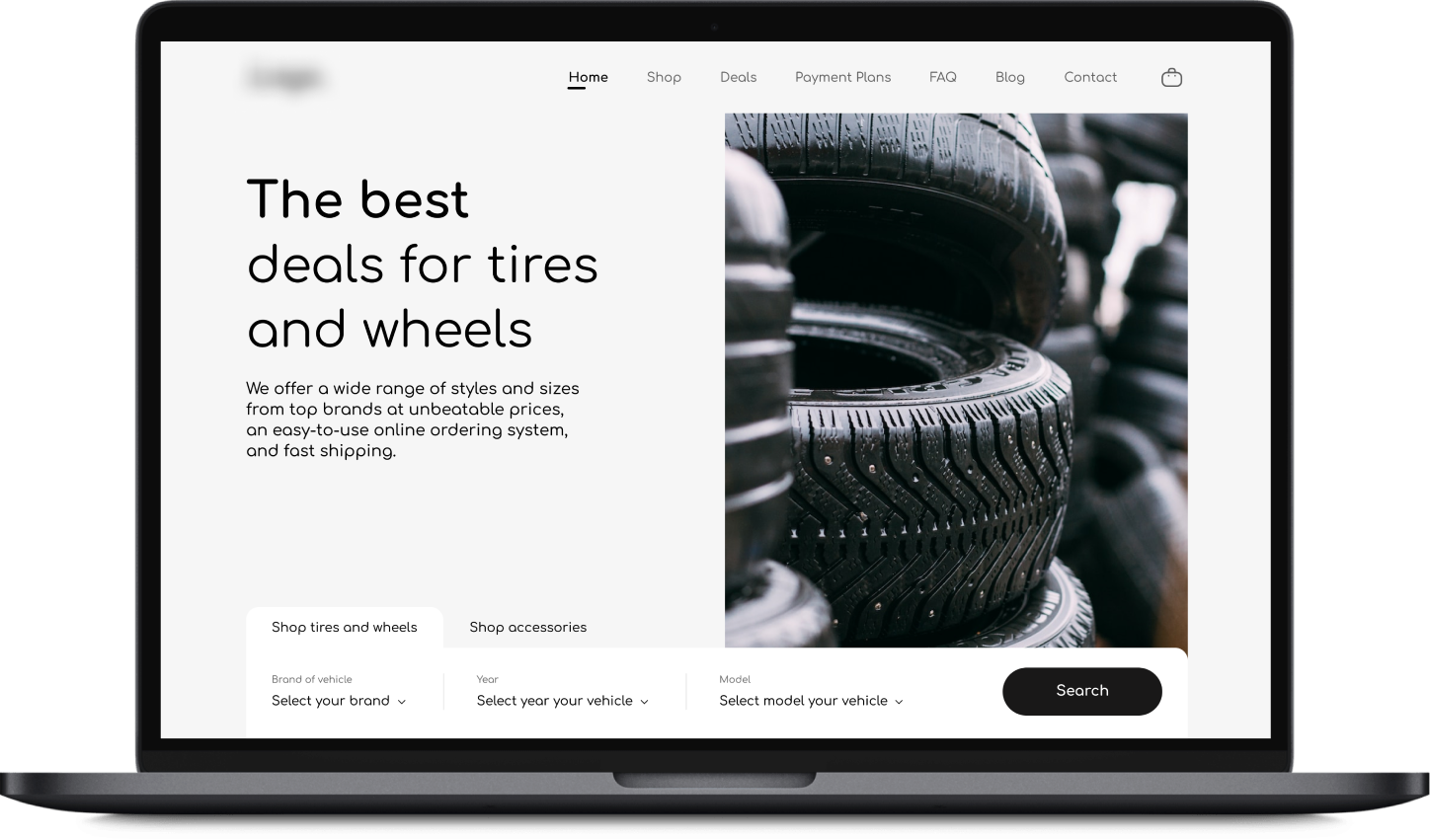

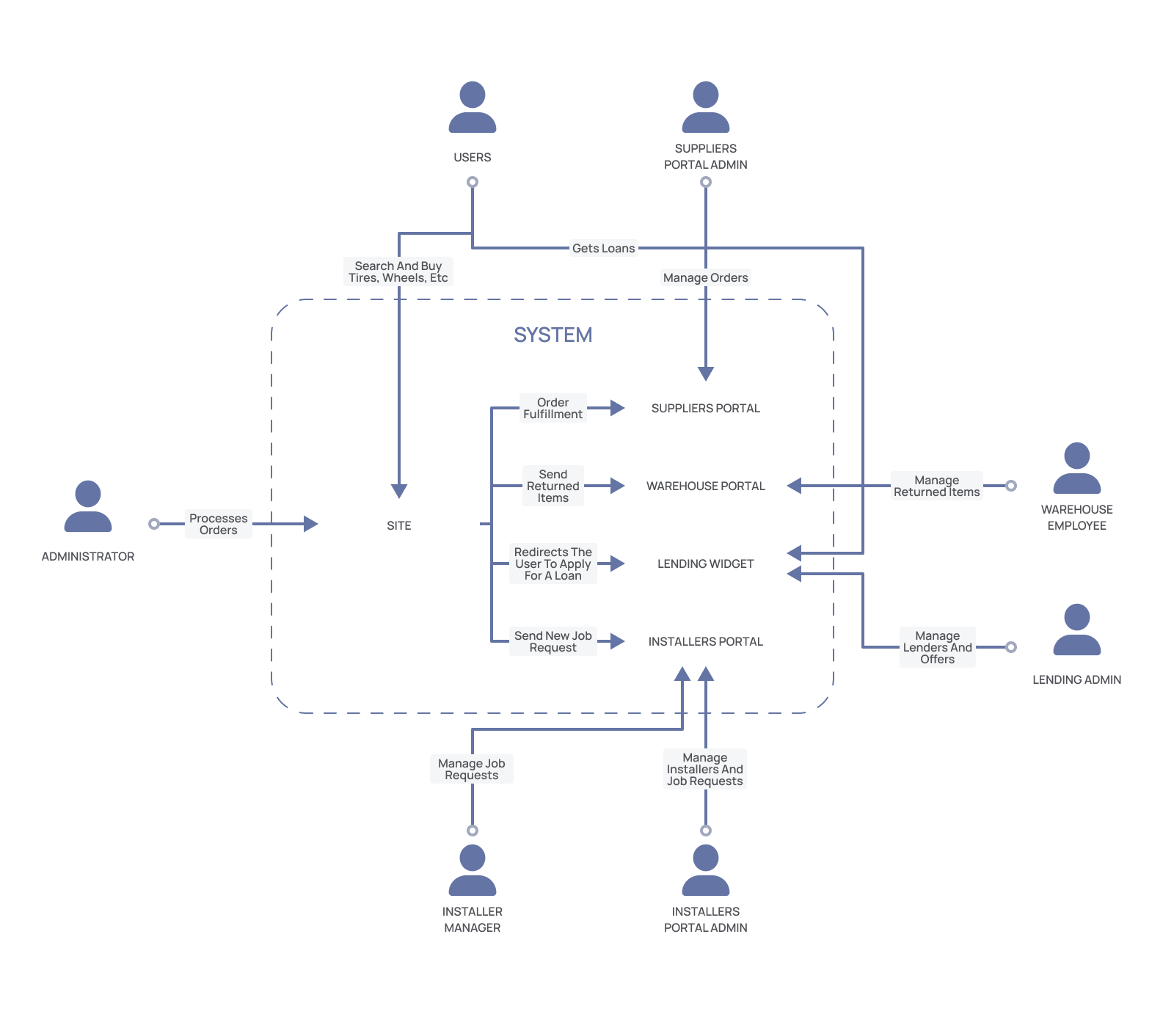

An e-commerce ecosystem that connects tire suppliers, installers, buyers, and digital lenders across the online buying cycle, providing buyers with personalized tire recommendations, installation services, warranty support, and order financing options.

About the client

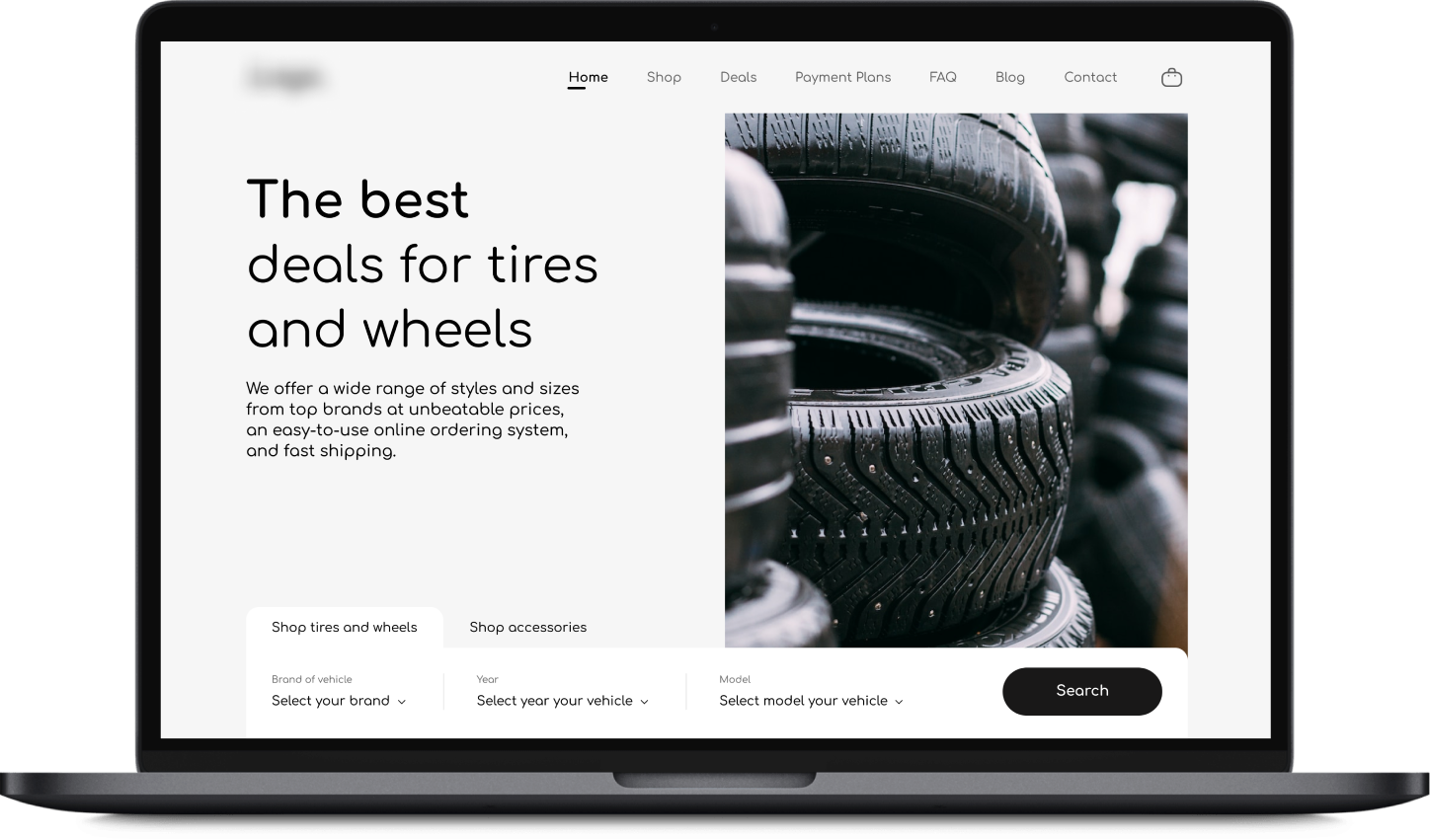

The client is the founder of a US e-commerce platform for the sale and resale of car tires, wheels, and accessories for cars.

Engagement model

Outstaffing, Time & Material

Solution

E-commerce platform with digital lending

Effort and duration

3.5 months for MVP

Project team

2 Full-Stack Developers, 1 Business Analyst, 1 Project Manager, 1 QA Engineer + Frontend and Full-Stack Developers as required

Project background

When the client approached us, they already had a working e-commerce platform developed by their internal team. The client wanted to introduce some new features to the platform and needed an extra pair of hands to strengthen their development team. Our specialist did a great job and after three months, the client asked Itexus for more developers to work on their project.

Over time, the client came up with an idea for a financial platform that would integrate with their existing e-commerce platform and connect buyers with digital lenders to enable installment payments. The client wanted us to handle the entire project implementation process, so Itexus assembled a multifunctional team and got to work.

Tech stack / Platforms

Target audience

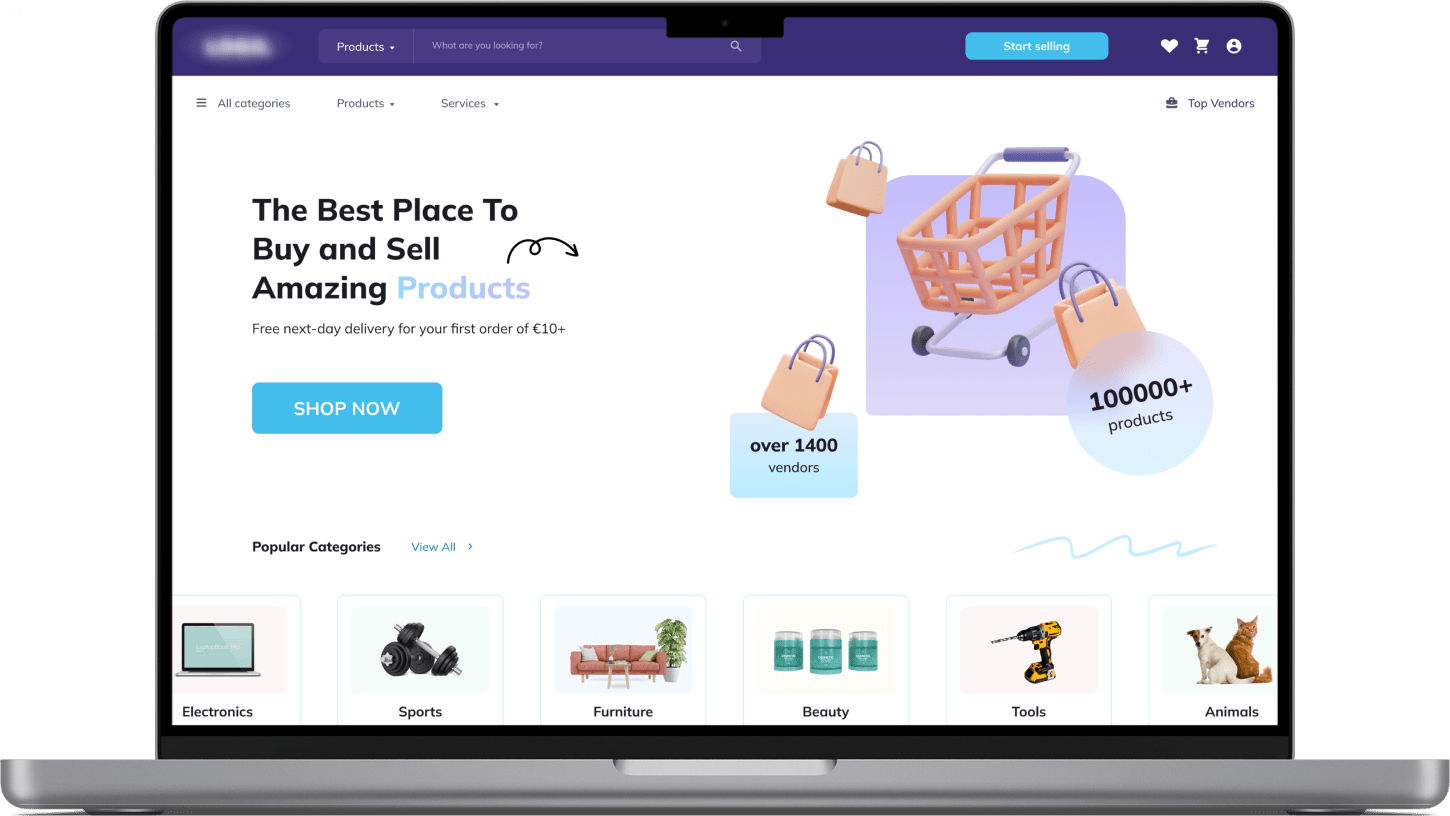

The platform’s target audience is car owners in the U.S. who don’t want to deal with selecting tires and other spare parts but want their tires delivered and mounted or replaced quickly. The platform helps select the most appropriate options based on the vehicle model, so users don’t have to spend hours searching for and comparing items.

Solution overview

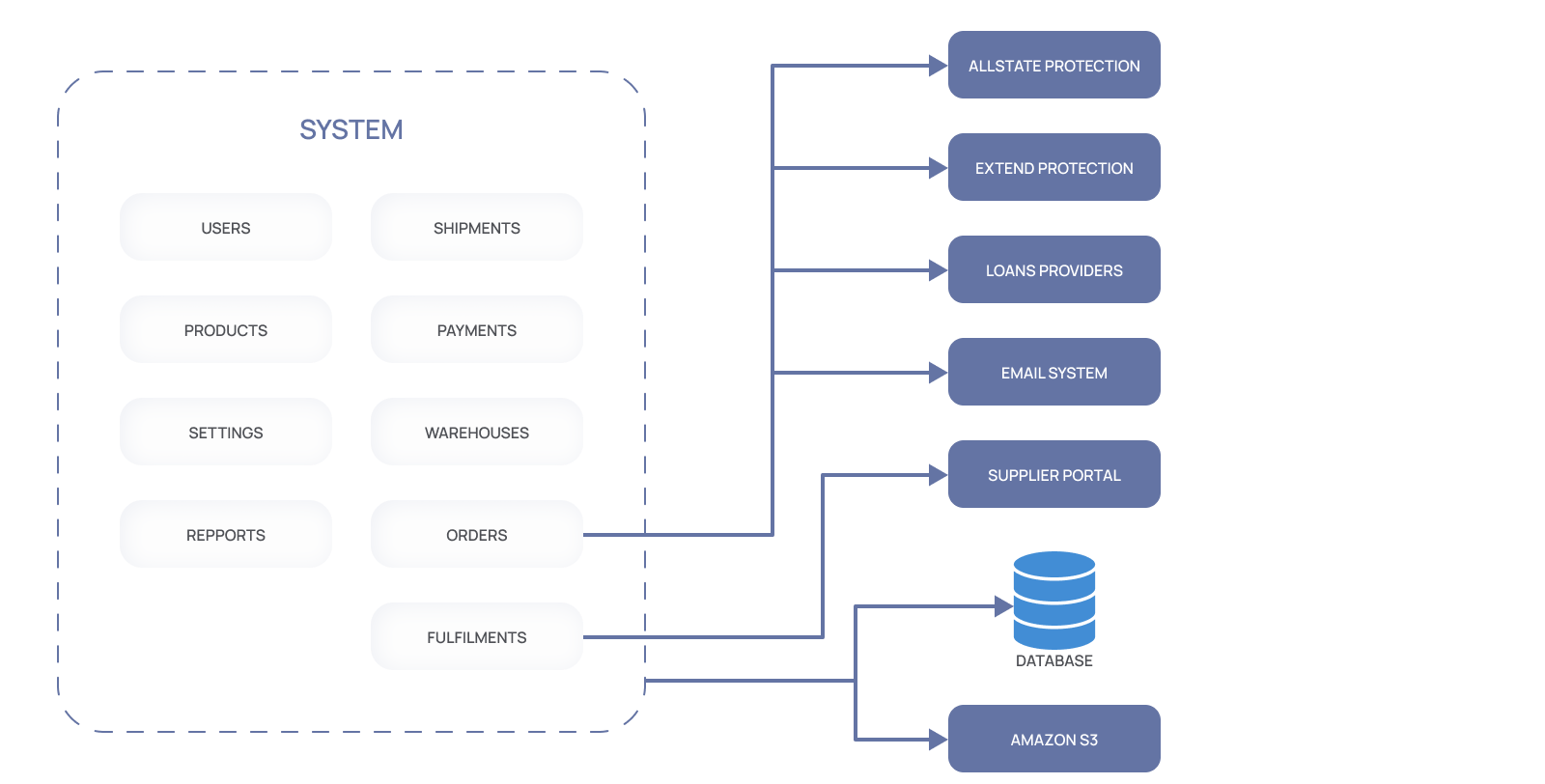

The e-commerce platform is a responsive web application that consists of the following elements:

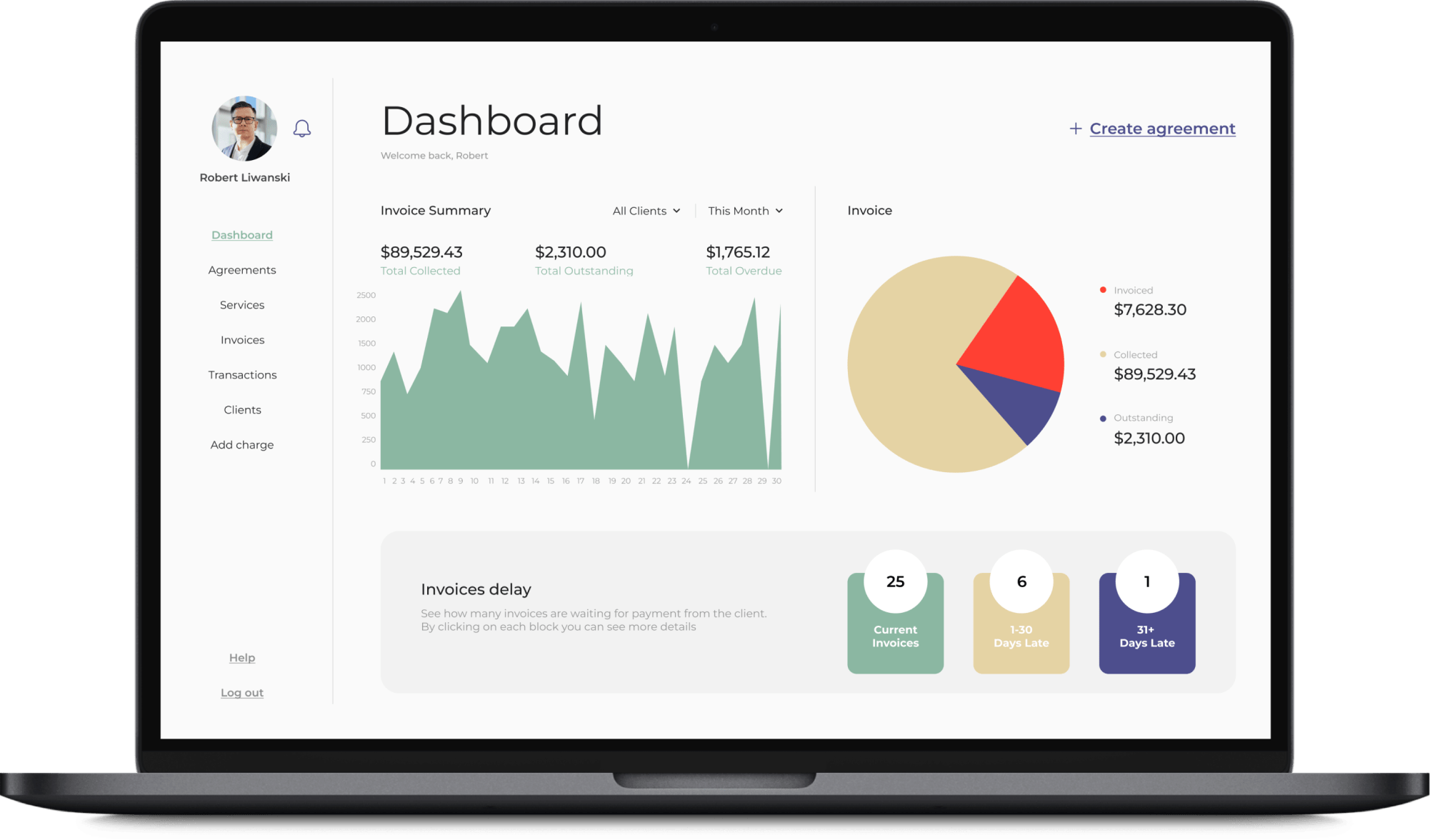

- Admin Panel. This part of the platform is used by administrators to manage orders, fulfillments, shipments, payments, refunds, etc.

- The Website. This part is used by clients to buy tires, wheels, and accessories for their vehicles.

- Installer Portal. This is an admin panel for service stations used for scheduling and managing installation appointments.

- Supplier Portal. It’s an admin panel for suppliers, where all orders placed through our platform are transferred. Here suppliers can manage, send, and update the orders.

- Warehouse Portal. In the admin panel for warehouse staff, where they can manage inventory, mark whether ordered items have been shipped to customers or sent to installers, etc.

- Database. This element is responsible for data storage: users’ data, orders, shipments, etc.

Main features

Let’s explore in detail the features available for platform users.

- Sign in / sign up

- Access the catalog

- Filter the catalog based on the selected vehicle model

- View the list of recommended items based on the selected car model

- Add items to the cart

- View and select the delivery options. The order can be delivered to a specific address or shipped to one of the affiliated installers where the user’s vehicle tires will be changed

- View and select payment options. Users can pay with a card online or opt for digital lending and pay in installments. To get a loan from affiliated lenders, the user must provide some information – monthly income, other loans and credits, etc. This data is sent to the lenders along with the loan request, and those who can grant a loan send their offers back to the user. The user looks at the offers and picks an appropriate one. Then the user signs an online contract with the lender and returns to the platform

- Get the number to track the order and monitor the order status.

Third-party integrations

- custom digital lending platform

- service stations address database

- suppliers warehouses

- payment gateway (stripe)

- order tracking

Development process

When we were contacted in 2019, the client already had a working e-commerce platform supported by their internal developers. Since the client wanted to introduce some new features, they needed an extra pair of hands and asked an Itexus developer to join the project. The client interviewed some of our developers and selected a suitable specialist who fully met his requirements and expectations. In this way, we worked together for three months. Our developer performed well, and the client decided to expand the team and requested another one. From that day on, Itexus specialists continue to work on the e-commerce platform on call to maintain and support the system.

While working on the e-commerce platform, the client came up with the idea of enabling his customers to pay for their orders in installments. To this end, he decided to integrate digital lenders into the platform.

At Itexus, we have extensive experience in fintech software development in general and expertise in digital lending development & integration in particular. So the client entrusted us with the turnkey lending solution development. We also needed to integrate it with the e-commerce platform to allow installment payments.

After 2.5 months, we launched the first version of the digital lending platform, which helped the client to raise additional investments.

Later, we came up with the idea of setting up three admin panels – a supplier portal, a warehouse portal, and an installer portal – which we successfully implemented. This facilitated interaction between all counterparties and automated a large part of the processes.

Project challenges

Tight deadlines

The biggest challenge was the tight timeframe. The client wanted to attract investment with the digital lending solution integrated into the platform, so we had to strike a balance between speed and accuracy so that product quality wasn’t compromised.

We delivered the first version of the financial platform in 3.5 months. As expected, it helped the client raise a significant amount of investment.

Integration with digital lenders

To enable users to make installment purchases, our client needed to find digital lending providers so that we then connect our platform to them through their APIs. Most of the selected providers were small P2P lending companies. The point is that small organizations may have limited resources or have to prioritize other business areas over API development. This resulted in limited functionality, poor documentation, and slower response times. The providers had to adapt their APIs to our requirements on the fly, so the whole integration process took quite some time.

Technical solution highlights

The backend system is a monolithic application based on Ruby/Ruby on Rails/Solidus. The client chose RoR, and we could only support this decision, as this framework is perfectly suited for e-commerce development for several reasons.

First, Ruby on Rails is easier to code compared to other frameworks. It enables a fast and efficient development process by eliminating the need to manually configure every single detail of an application, as it follows the Model-View-Controller (MVC) architectural pattern and has a strong focus on convention over configuration.

Second, the framework provides the highest level of security by using salted and hashed user passwords by default. These hashed passwords cannot be converted back to plaintext, so user data is safe even if attackers somehow obtain their credentials.

Ruby on Rails is also extensible, flexible, and sustainable, not to mention that it’s open-source and mobile-ready. All these factors make the framework a perfect choice for e-commerce projects.

Previously, the platform was based on Spree – an open-source e-commerce platform built on Ruby on Rails. To make it more customizable and future-proof, we offered to migrate it to Solidus. This is a modular, flexible, and customizable open-source e-commerce framework that is suitable for both small and large e-commerce websites. Here are the top reasons to migrate from Spree to Solidus:

- Better performance – Solidus can handle more traffic and larger catalogs more efficiently.

- Better scalability – it’s provided by a more modular architecture compared to Spree.

- More customization options – Solidus allows adding custom features and changing the look and feel of the platform.

- Multiple store support – Solidus helps manage inventory, orders, and customers more effectively.

Results and future plans

Now, Itexus specialists continue to work with the client on call – 1 full-stack developer is engaged in the support and maintenance of the e-commerce platform, and 3 full-stack developers are working on the lending platform. The client’s marketing team is constantly bringing new ideas to improve the e-commerce platform, and we support their implementation. Thus, we have added advanced features to the supplier, warehouse, and installer portals, optimized the recommendation mechanism, introduced an order tracking feature, etc.

According to the client’s estimation, the development of the lending platform and integration with the e-commerce platform increased the operating profit by three times. At last count, about 85% of orders were placed through a digital lending platform. In the future, the client also plans to introduce a mobile version of the solution.

If you need any help with your e-commerce solution, please don’t hesitate to reach out to us. We’re always happy to chat about your requirements and how we can assist you.

Related Projects

All ProjectsCustomer Persona Tool

Customer Persona Tool

- E-commerce

A web application that allows the creation of insightful, authentic, and data-driven customer personas with the help of pre-made templates, calculation of the target audience based on real data from such resources as Google and Facebook, and sharing personas & collaborating on them with the team members.

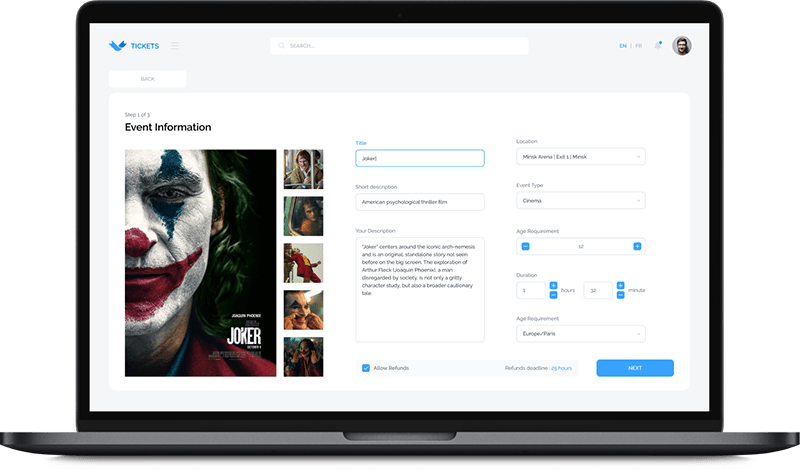

Platform for Improved Event Organization and Management

Platform for Improved Event Organization and Management

- E-commerce

The B2B Ticketing System is a unique innovative platform designed to solve the common problems of the French event ticketing market. It provides event organizers such as theatres, operas, cinemas and retailers with an opportunity to provide final consumers with sufficient quality of service for buying tickets online.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland