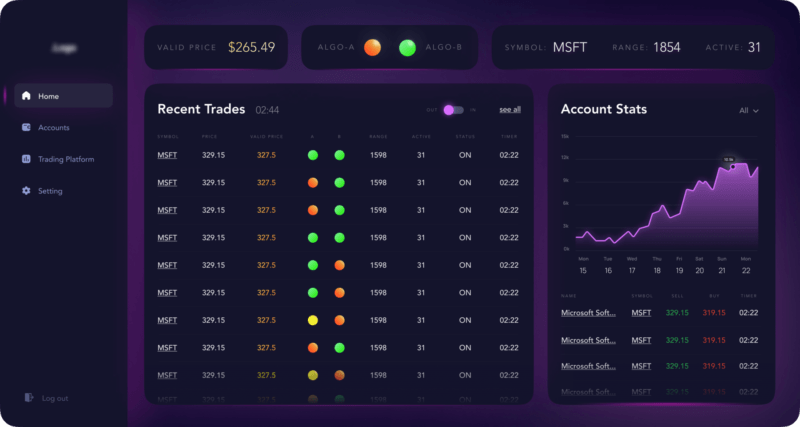

Intelligent investment assistant that performs technical analysis for a number of stocks, automatically tracks multiple indicators on stock exchanges, and generates buy/sell and risk signals for human traders.

High-frequency trading (HFT) is a powerful force in the financial world, characterized by its ability to execute trades in fractions of a second. This ultra-fast trading, powered by sophisticated algorithms and advanced technology, has transformed financial markets by providing liquidity and making trading more efficient. But behind this innovation is high-frequency trading software, meticulously designed and developed to operate at speeds and efficiencies that can only be described as cutting-edge.

So, what exactly does it take to build HFT software? In this article, we’ll explore the core components, development process, and essential technologies that drive high-frequency trading software, as well as some unique challenges and best practices in this highly specialized area.

What is High-Frequency Trading?

At its core, high-frequency trading is an automated strategy that leverages powerful algorithms to execute a large number of orders at extremely high speeds. HFT systems typically analyze data and trade based on microsecond market movements, capitalizing on small price discrepancies across different exchanges.

In the world of HFT, milliseconds matter. A competitive edge can mean having an algorithm that reacts in a fraction of a second faster than the competition. That’s why high-frequency trading software is designed to optimize every possible aspect of speed, from data transmission and processing to trade execution.

Key Components of High-Frequency Trading Software

To understand the complexity of HFT software, let’s break down its primary components:

- Market Data Feed Handlers: These components capture real-time data from exchanges, including bid and ask prices, trade volumes, and market depth. The data is processed instantly to make split-second trading decisions.

- Trading Algorithms: The core of HFT software is the trading algorithm, which is designed to identify profitable opportunities based on predefined rules, such as arbitrage or trend-following strategies. Algorithms are continuously refined to ensure optimal performance.

- Order Execution System: This component is responsible for sending trade orders to the exchange as quickly as possible. Low-latency order execution is essential to secure the best prices and avoid missed opportunities.

- Risk Management Module: With trading occurring at breakneck speed, even a minor error can result in significant financial losses. The risk management module monitors exposure, limits losses, and manages leverage to maintain control over trading activities.

- Backtesting Framework: This allows developers to test trading algorithms against historical data to evaluate their potential performance. Backtesting ensures that the strategy is robust before it goes live in the market.

- Monitoring and Analytics: Real-time monitoring tools provide insights into system performance, including latency, success rates, and error logs. Detailed analytics also help in fine-tuning algorithms based on past performance.

The Development Process: Building High-Frequency Trading Software

Developing HFT software involves a mix of finance, data science, and engineering expertise. Here’s a high-level overview of the development stages:

- Define Trading Strategies:

- The process starts with defining the specific trading strategies the software will employ. HFT strategies might include statistical arbitrage, market making, or momentum trading. The strategy informs the design of the trading algorithms and dictates requirements for latency and data handling.

- Design System Architecture:

- The architecture must be optimized for speed and reliability. Developers typically choose programming languages like C++ for their low latency and high performance. The architecture is designed to handle parallel data processing, efficient memory management, and seamless communication between components.

- Develop and Test Algorithms:

- Algorithm development is at the heart of HFT software. The trading algorithms are coded based on the selected strategies, and their performance is tested using historical market data (backtesting). This phase includes debugging, optimizing, and refining the algorithms to ensure accuracy and effectiveness.

- Implement Low-Latency Solutions:

- To achieve the lowest possible latency, developers implement techniques like direct market access (DMA), colocating servers near exchanges, and optimizing data transmission. Low-latency programming involves reducing processing time by milliseconds, which can require custom networking and specialized hardware.

- Integrate Risk Management and Compliance:

- Risk management is non-negotiable in HFT software. The system must monitor trades in real-time, control exposure, and ensure compliance with regulatory standards. Developers incorporate modules that set trading limits, manage leverage, and prevent overexposure.

- Deploy and Monitor:

- Once the software is ready, it is deployed to the live market. However, the work doesn’t stop there. Continuous monitoring is essential to ensure that the software functions as intended. Any latency issues or unexpected behaviors must be addressed immediately to avoid potential losses.

Essential Technologies and Tools in HFT Development

To build and operate an HFT system effectively, certain technologies and tools are essential:

- Low-Latency Programming Languages: C++ and Java are the most commonly used languages in HFT for their speed and efficiency. They enable developers to build performance-optimized algorithms that can handle high transaction volumes.

- Custom Networking Hardware: Specialized hardware like Field Programmable Gate Arrays (FPGAs) helps process market data at unprecedented speeds. FPGAs can be programmed to execute tasks in nanoseconds, making them invaluable for latency-sensitive HFT applications.

- Direct Market Access (DMA): DMA allows HFT firms to place orders directly on exchanges, bypassing intermediaries to reduce latency. By colocating servers as close to the exchange’s servers as possible, traders minimize delays.

- Data Analytics and Visualization Tools: Tools like Tableau and proprietary analytics software help visualize trading patterns, analyze performance, and make data-driven adjustments to trading strategies.

- Backtesting Platforms: Backtesting tools allow developers to test algorithms against historical market data. Popular platforms include QuantConnect and proprietary solutions built for high-speed backtesting.

Challenges in High-Frequency Trading Software Development

Building HFT software is not without its challenges, especially given the speed, precision, and compliance requirements. Here are a few common obstacles:

- Latency Minimization: Reducing latency is the top priority and the biggest challenge. Developers must optimize every step in data processing and transmission to ensure rapid response times.

- Market Volatility: HFT systems are highly sensitive to market conditions, and sudden volatility can impact performance. Algorithms need to be adaptable, and risk management tools must be robust to handle unexpected market swings.

- Complex Regulations: HFT is subject to strict regulations across different markets. Developers must ensure compliance with financial laws, such as risk limits and order-to-trade ratios, to avoid penalties and ensure smooth operations.

- Data Overload: HFT systems handle vast amounts of data every second. Managing and analyzing this data in real-time requires advanced data handling techniques and powerful computational resources.

- Security Risks: Given the financial data involved, HFT systems are a target for cyber threats. Ensuring data security and preventing unauthorized access is critical to maintaining system integrity.

Best Practices for Successful HFT Software Development

- Prioritize Low-Latency Design: From programming language to hardware, every component of HFT software should be chosen with low latency in mind. Use languages and tools that offer the highest possible performance.

- Implement Strong Risk Management: Develop a comprehensive risk management module to minimize potential losses and comply with regulations. Automated risk checks and limits help prevent catastrophic losses.

- Conduct Rigorous Testing: Test extensively with historical and synthetic data. Backtesting and stress testing prepare the software for real-world conditions, ensuring algorithms perform well under varied market scenarios.

- Optimize Continuously: The HFT landscape is dynamic, and optimization is ongoing. Regularly monitor system performance and update algorithms to adapt to changing market conditions.

- Ensure Security and Compliance: Safeguard data with robust encryption, access controls, and regular security audits. Stay up-to-date with regulatory changes and implement necessary adjustments to maintain compliance.

Final Thoughts: The Future of High-Frequency Trading Software

High-frequency trading has revolutionized the financial markets, and as technology advances, it continues to evolve. Future HFT software may integrate more sophisticated AI-driven algorithms, advanced risk management techniques, and even faster processing capabilities. The competition for microsecond advantages will only intensify, making HFT software development a critical area for innovation.

Developing HFT software requires a blend of financial expertise, technical skill, and constant adaptation to a fast-paced market. For those who can master these elements, the rewards are substantial. As the demand for liquidity and efficient market operations grows, high-frequency trading will remain a crucial aspect of modern finance—and the software that powers it will only become more vital.