Digital lending is picking up steam. Key factors driving the rapid growth include:

• the increasing adoption of digital technologies and smartphones,

• the need for a better experience for lenders,

• government commitment to protecting digital lending,

• greater transparency and options for borrowers and lenders,

• growing demand for digital lending platforms among SMEs, etc.

Experts say the demand for such solutions will only increase. According to the report by Vantage Market Research, the global digital lending market is expected to grow to $22.4 billion by 2028.

As borrowers appreciate the benefits of digital lending over the traditional loan application process, banks, and other financial institutions need to become more digitally driven to keep up with fintechs that are ahead of the competition with their fast, creative, and convenient solutions. The good news is that starting a loan app isn’t as difficult as it seems at first glance. Read on to learn how to create a money lending app, what integrations will come in handy, loan lending app development costs, and what pitfalls you should avoid.

How to Create a Money Lending App – Itexus Expertise

Let’s take a closer look at the steps involved in developing a money lending app. To help you better understand the process, we’ll illustrate it with the example of our recent project, an online lending platform for small businesses. It is a digital lending platform with a mobile app client that fully automates the entire lifecycle of a loan – from online loan application, KYC, and credit scoring to underwriting, payments, reporting, and bad deal management. The app features a custom AI analysis and scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank account aggregation platform. The following team was involved in this project: 2 iOS developers, 1 project manager, 1 business analyst, 1 data scientist, 3 backend developers, and 1 QA engineer.

Step 1. Discovery Phase

The discovery phase is the research and planning phase that allows to fully prepare for the loan app development phase. It focuses on gathering essential information about the project, specifying requirements, determining the scope of work, validating assumptions, designing the solution architecture, defining the product roadmap, and accurately estimating loan lending app development time and cost. If you want your project to stay on budget, be delivered on time, and be successful once released, you should begin discovery.

During this phase, our business analyst and software architect conducted a thorough market and requirements analysis and created the initial project documentation. As a result of the discovery phase, our client received the following deliverables:

• Software Requirements Specification (SRS)

This is a document describing all functional requirements with use cases, diagrams, user screen mockups, user journey, etc.

• Software Architecture Document (SAD)

This document describes the suggested technology stack and architecture of the system considering third-party integrations, security, performance, reliability, and other non-functional requirements.

• Project plan and work estimate

A detailed project plan with all work divided into iterations, established priorities, dependencies, and team structure.

Step 2. UI/UX Design

A simple and intuitive design is crucial for the overall success of the project. Your solution should help users complete their tasks quickly and easily. The simpler the interface is, the easier it will be for users to navigate it, and the more comfortable it will be to use your app. Conversely, an app overloaded with icons and features will put users off. Therefore, it is important to find a balance between functionality and utility. This is where UI/UX designers come in. Experienced specialists will apply best practices to ensure that your lending app is easy and enjoyable to use.

In this step, UI/UX designers create an intuitive user interface for your future lending app. Marketing materials such as landing pages, promotional videos, etc. can also be created at this stage.

Step 3. Development

Depending on the project scope and specifics, the team works according to one of the many project management methodologies. For our lending app project, we used the Agile/Scrum methodology. The loan lending app development process was divided into two-week sprints, with demonstrations of the new product versions and feedback gathering at the end of each sprint. This phase involves developing and deploying the app itself and integrating it with third-party services. It also includes a combination of unit tests, automated service and UI level tests, and manual testing.

Step 4. Launch, Support & Maintenance

After the app is live, it needs to be updated and maintained. You can do this yourself (in this case, you need to have in-house specialists) or continue to work with your loan app development team if they provide support and maintenance services.

Steps and Costs of Money Lending App Development

| Phase | Key Tasks | Estimated Time | Estimated Cost |

|---|---|---|---|

| Discovery Phase | Market research, requirements gathering | 2–4 weeks | $3,000–$5,000 |

| UI/UX Design | Create intuitive, user-friendly app interfaces | 4–6 weeks | $5,000–$10,000 |

| Development | Build and integrate core functionalities | 10–16 weeks | $30,000–$70,000 |

| Testing | QA testing, bug fixing, performance optimization | 2–4 weeks | $5,000–$8,000 |

| Launch & Maintenance | Deployment, ongoing support, and feature updates | Ongoing | $2,000+/month |

Digital Lending Development: Pitfalls & Best Practices

Over the years of hands-on experience in software development for financial services companies, we’ve got a solid grasp on all fintech ins and outs. We know how to create a money lending app that will bring value to your business – and we are happy to share that knowledge with you. Below, we’ve listed the pitfalls you should avoid when developing a loan lending app, as well as some actionable tips that might help you along the way.

Developing a successful digital lending app requires a keen understanding of industry challenges and best practices. Here’s a streamlined guide to help avoid common pitfalls:

1. Authentication & Authorization

Secure access is critical. Use OAuth 2.0 for authorization, combined with Two-Factor Authentication (2FA) for secure login.

- Methods:

- OTP (One-Time Password): Easy to implement but not fully PSD2-compliant.

- Biometric Verification: User-friendly and secure, relying on unique physical attributes like fingerprints.

Tip: Always encrypt personally identifiable information (PII) both in transit and at rest to comply with data protection regulations.

2. Onboarding

Collect comprehensive user data during onboarding to improve customer insights and personalize experiences.

- Data to Collect: Location, device type, installed apps, etc., for better financial profiling.

- Challenge: Comply with data sovereignty laws (e.g., in Germany or China, data must be stored locally).

3. KYC (Know Your Customer) Implementation

Choose a KYC strategy that balances cost and efficiency:

- Third-Party Providers: Services like Jumio or Veriff offer quick integration but cost ~$5 per verification.

- Custom Solutions: While cheaper per user, these require more development time and expertise.

Pro Tip: Discuss compliance needs with your banking partner before implementation.

4. Loan Issuance

Offer multiple credit disbursement options:

- Bank Accounts: Standard but slow (ACH transfers take days).

- Virtual Cards: Fast and user-friendly, easily linked to digital wallets.

- E-Store Credits: Useful for closed-loop ecosystems, like marketplaces.

5. Payments

Integrate secure payment methods for loan repayments:

- Card Payments: Instant but carry a 3% transaction fee.

- Account Ownership Verification: Use services like Plaid or MX to verify users.

Insight: Instant payments improve user satisfaction despite higher processing fees.

6. Credit Scoring

Efficient scoring reduces loan default risks. Options include:

- Rule-Based Scoring: Cost-effective, based on predefined borrower characteristics.

- Machine Learning Models: Require large datasets but provide nuanced borrower risk analysis.

7. Loan Management

Automated loan servicing streamlines workflows:

- Solution: Adopt ready-made tools like Canopy to handle repayment tracking, interest calculations, and risk management efficiently.

Integrations to Build a Money Lending App

Now that you know how to build a loan app, let’s explore some third-party that would help you speed up the loan lending mobile app development process by quickly adding features and tools to your app that might take many months to develop from scratch. Integrations also help ensure a seamless and consistent digital experience for your users. Below, we have listed the top integrations that will make your lending app more useful to users and allow you to save development time and money.

Payment Gateways

Payment gateways serve as a channel for making and receiving payments and ensure a smooth payment process by securely validating the customer’s card details and guaranteeing the availability of funds. They encrypt sensitive credit card data, ensuring secure transmission of information. When selecting a payment gateway for your lending app, consider the following: integration opportunities, accepted transactions, payment processing fees, security and fraud protection, and availability in your target region. The most popular payment gateways for lending solutions are Stripe, PayPal, Marqeta, and MangoPay.

Financial Data Aggregators

Data aggregators pool customers’ personal and financial data from a variety of sources and make it easily and conveniently accessible in a single place. This information is a great source of actionable insights that you can use to provide a more personalized experience for your customers or offer new financial products based on data-driven decisions. For a lending app, consider the following bank data aggregators: Plaid, Truelayer, Yodlee.

KYC Providers

KYC is a mandatory customer identification and verification process that financial institutions use to ensure that their customers are who they say they are. AML is a set of regulations, laws, and procedures that prevent criminals from disguising illicit funds as legitimate income. AML requires financial institutions to collect customer data, monitor and audit their transactions, and report suspicious activity to financial regulators.

Fintechs are required by law to implement these two procedures to reduce the risk of being used as a vehicle for financial crime. There are several KYC/AML providers in the market that help fintechs comply with regulatory requirements, these are the most prominent: Jumio, Alloy, Shufti Pro.

Communication Services

These help fintechs stay in touch with their customers and provide a better customer experience by streamlining communication. There are many solutions on the market – you can consider Twilio, Plivo, or others.

Digital Credit Scoring Providers

Credit scoring providers help make better lending decisions. They scan data about users collected by credit bureaus. Based on this data, the provider creates a credit history of the user that includes public records and account openings. The user is then given a score, which you can use to assess how likely they are to repay their loan. As a top credit scoring provider for your lending app, we recommend Experian.

E-Signature Providers

When it comes to digital lending, the first thing that comes to mind is a great customer experience. Then it’s only logical that when users need to sign a document, they expect to be able to do so directly in the lending app. This is where eSign providers come in. These services enable certified online delivery, acknowledgment, electronic signature, and storage of eDocuments over the Internet, allowing users to sign loan agreements and other documents. There are many solutions on the market that offer eSignature, but DocuSign is the most popular.

Key Integrations for a Money Lending App

| Integration Type | Examples | Purpose |

|---|---|---|

| Payment Gateways | Stripe, PayPal, Marqeta | Secure payment processing |

| KYC/AML Providers | Jumio, Shufti Pro, Veriff | Customer identity verification |

| Credit Scoring Solutions | Experian, FICO | Assess borrower creditworthiness |

| Communication Tools | Twilio, Plivo | Enhance user notifications and support |

| Bank Aggregators | Plaid, Yodlee | Access financial account data for underwriting |

Loan Lending App Development Cost

The final cost of developing a money lending app depends on several factors, such as the overall complexity of the solution, the features required, the tech stack, the hourly rate of the developers, the composition of the team, etc. In this part, we will go over the key points that make up the final price of the app. All cost estimates are in working hours for simplicity. However, you can calculate the final loan lending app development cost by multiplying the figures by your developer’s hourly rate, which is on average between $35 and $50.

Discovery phase

Your team will conduct a thorough study of the money lending app market and create clear documentation, an accurate project estimate, and a well-rounded plan for further loan lending mobile app development. In addition to all the necessary deliverables, you will receive a clickable UI/UX prototype of the future app.

The discovery phase can take between 150 and 200 hours, depending on the depth of the research and the level of detail provided in the documentation.

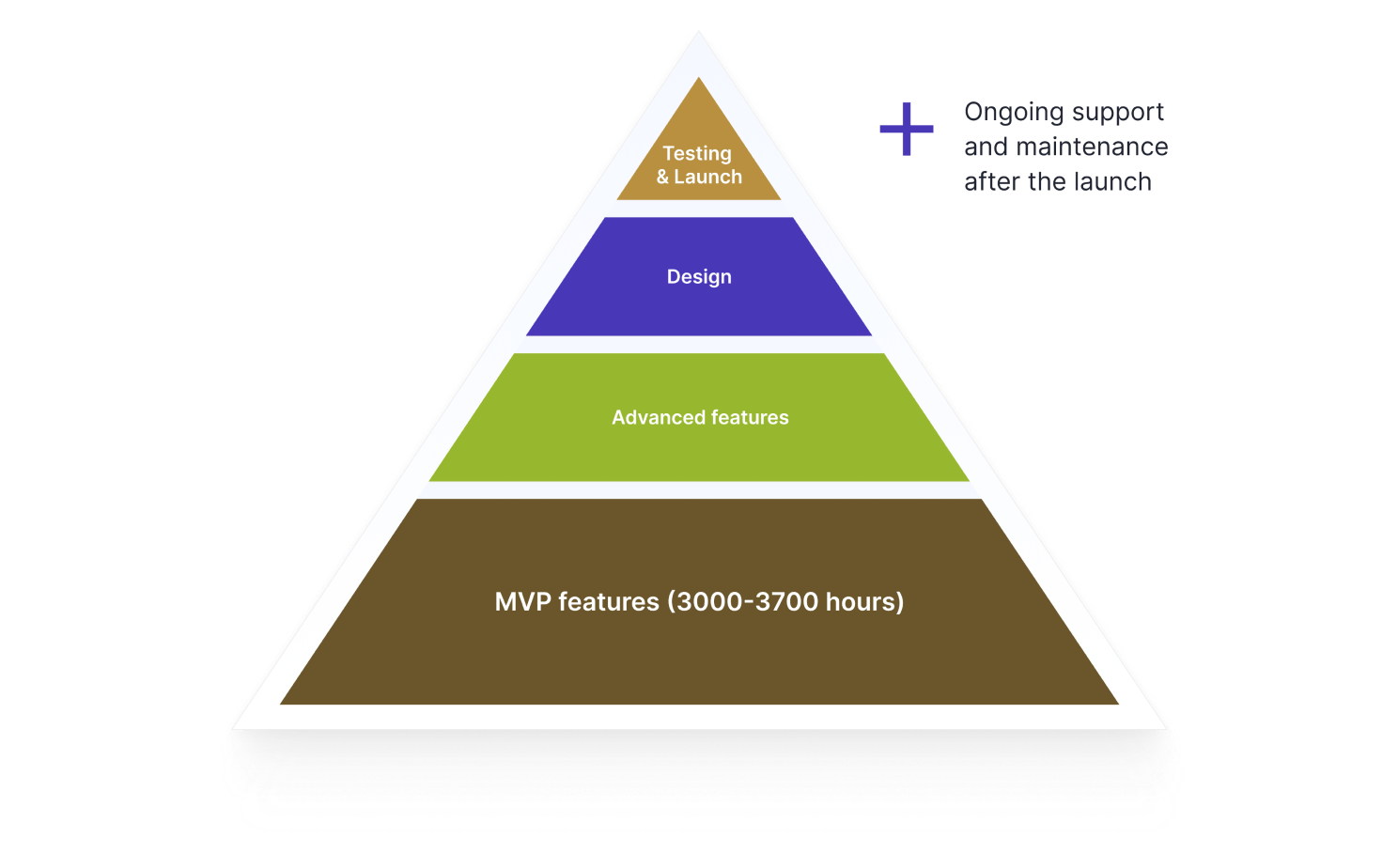

Development phase

The length of this phase depends on whether you want to develop an MVP or a fully functional product. Your lending app MVP will include the following features:

• sign up & sign in, 2FA

• credit scoring module

• loan application

• loan origination

• linking a card to the account

• notifications

The MVP may also include some integrations – for example, a credit scoring provider and a payment gateway. This feature set is sufficient to test the initial assumptions on early adopters, get feedback from them, and optimize the product.

If you want to develop a final product, the numbers will differ. To the listed features, the team will add the following:

• an advanced scoring module

• KYC and security modules

• additional data sources for accessing bank accounts and transaction data

• an automated module for bad deal management

• in-app chat and chatbots, etc.

Adding each new feature requires additional working hours. Taking into account the above points, the development of a functional money lending app in the basic version without advanced features takes about 3000 – 3700 hours. Given that the hourly rate of a fintech developer starts at $35, it comes to an estimated amount of about $105,000 to get started.

But that’s not the final loan lending app development cost. We haven’t factored in the full design, testing, and launch. Also, your app should have ongoing support and maintenance after launch, so those costs should be considered as well.

Features of Basic vs. Advanced Lending Apps

| Feature | Basic Version | Advanced Version |

|---|---|---|

| User Registration/Login | Email and password | Biometric login, OAuth |

| Loan Application | Basic form submission | Dynamic forms with auto-filling |

| Credit Scoring | Third-party integration | Custom AI-based scoring engine |

| Payment Options | Manual transfers | Automated recurring payments |

| Customer Support | Email support | In-app chatbots, live support |

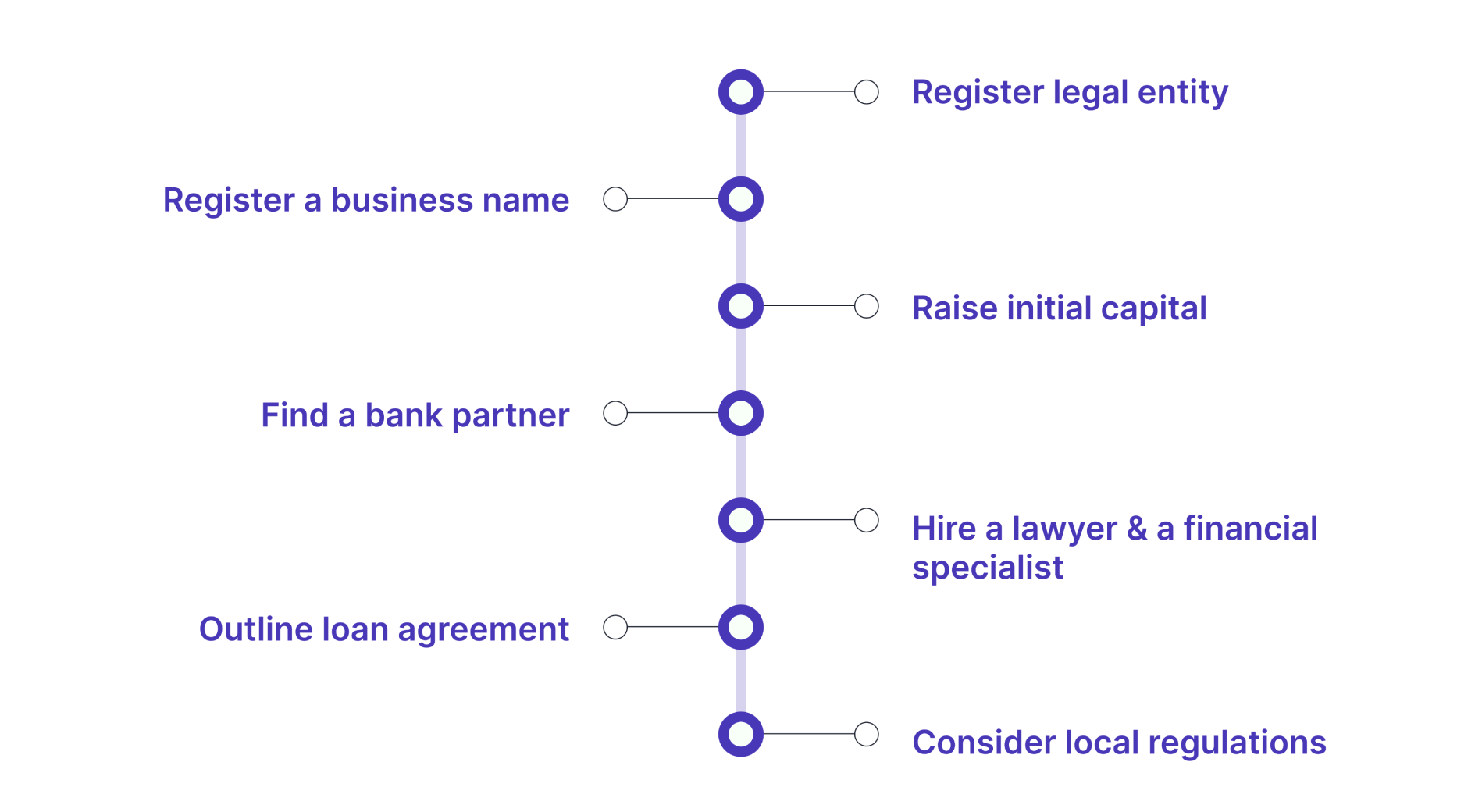

If you’re an early-stage startup, consider these things before the development phase

We recommend considering the points listed below for startups looking at how to start a loan app.

✔️ Register legal entity

Before you register your legal entity, you need to decide which legal form is best for your business. Small businesses and startups usually register as an LLC (limited liability company) or a corporation. These forms differ in the way profits and losses are distributed:

• in an LLC, profits and losses are distributed according to the agreement;

• in a corporation, profits and losses distribution depends on the ownership shares of each member. A corporation also brings with it more tax reporting and accounting requirements.

✔️ Register a business name

The name should be new, unique, memorable, and free. If you are registering the name in the United States, you can check the availability of the name here.

Note that your business name does not necessarily have to be identical to your domain name. The main difference between the two is that the former is used for identification, branding, and legal purposes, while the latter is primarily a digital address for your website. It is advisable to make your domain name short & catchy.

✔️ Raise initial capital

There are several ways to raise money for a startup:

• Get VC funding. To get venture capital from investors, you should provide them with a detailed business plan and pitch deck. If you have attracted investors’ interest, you will get money, but keep in mind that depending on the agreement, investors will receive shares in your project or you will have to pay a fixed amount. If you have no idea where to start, you can consider raising the funds for your startup in partnership with a software development company.

• Initial Coin Offering. In an ICO, a limited amount of tokens are issued and sold to investors.

• Take out a bank loan. This is not the most common option, but it certainly has a right to exist. Before taking out a loan, check all bank offers and choose the most favorable one.

✔️ Hire a lawyer & a financial specialist

Depending on your needs, you can either engage a seasoned fintech lawyer on an as-needed basis or hire a permanent in-house legal counsel. Either way, it’s always a good idea to have a reliable and experienced specialist to help you out of many a tight spot, because as a fintech startup, you’ll face a wide range of legal issues – from securing funding to protecting intellectual property and understanding local market regulations, etc.

Since the financial industry is heavily regulated, consider hiring a financial specialist in addition to a lawyer. These people are responsible for keeping your policies and procedures up to date, complying with financial regulations, and managing the risks associated with lending. The perfect team member should have hands-on experience working in the lending sector, preferably in a bank.

✔️ Find a bank partner

You’ll need to keep your money and that of investors and users somewhere, so decide on a bank partner. This cooperation will help you in the future to solve many problems related to the introduction of new loan products. However, you aren’t limited to working with just one bank – there are new offers all the time, so check the updates regularly to make sure you get the most favorable terms.

✔️ Outline loan agreement

This document has two main functions: it helps your users become familiar with the terms of the loan, and it ensures that both parties are on the same page regarding the loan and repayment process, which allows you to align expectations and avoid problems in the future. Therefore, you should make sure that your loan agreement is properly drafted.

✔️ Consider local regulations

Depending on your target market, you’ll have to comply with local regulations, which vary from region to region. For example, if you are targeting the European market, your app must be GDPR compliant, and for apps for California, CCPA compliance is a must.

We can build a loan app for you

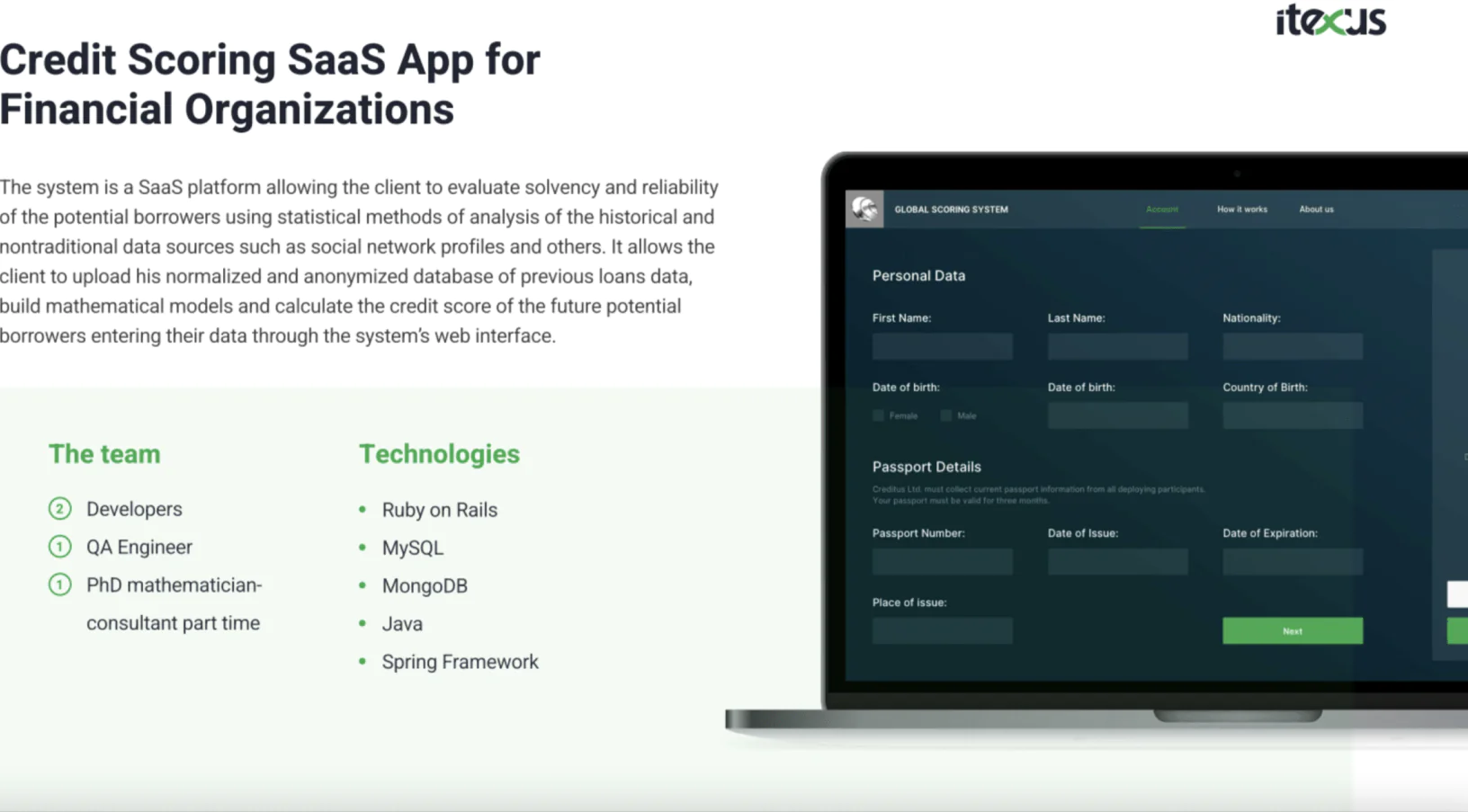

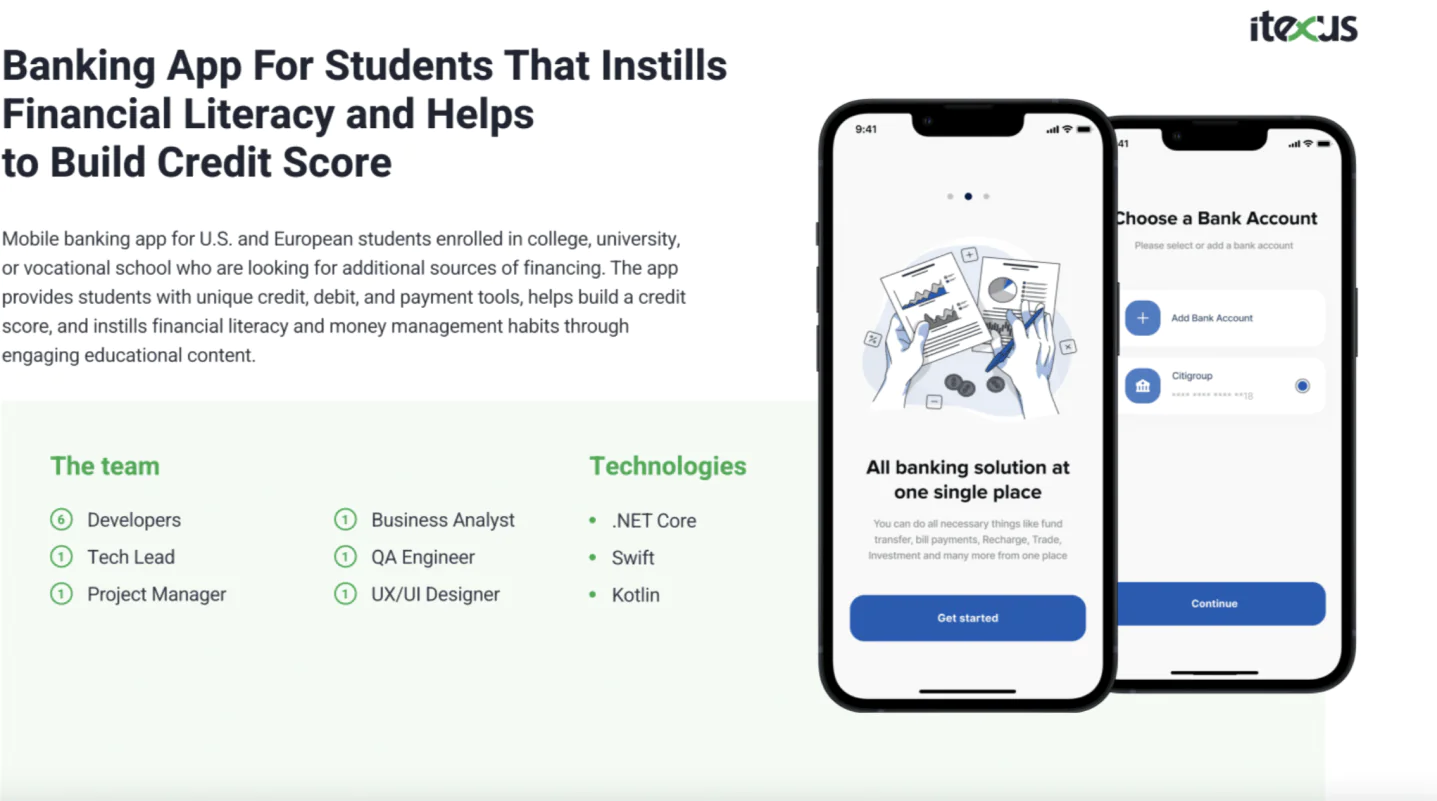

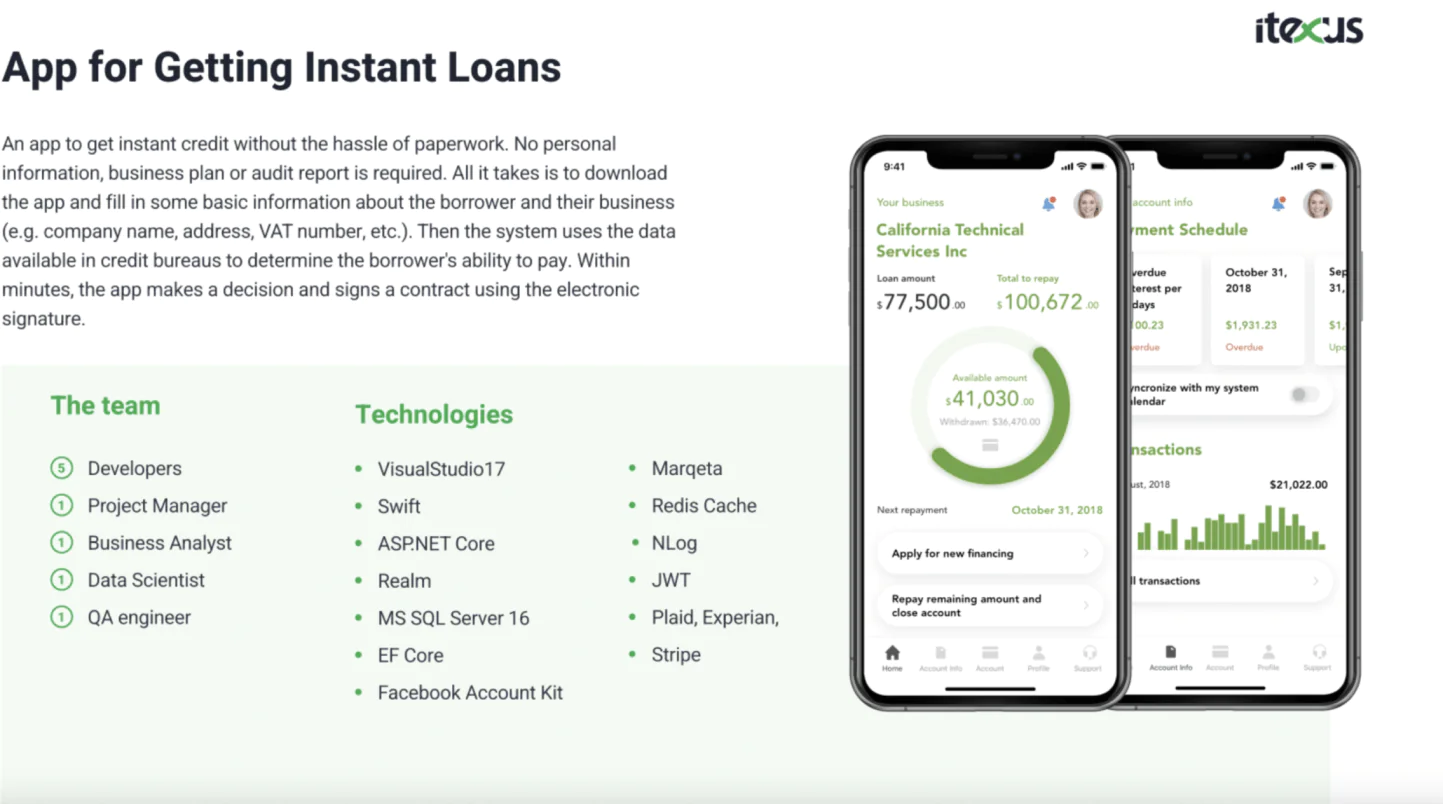

Itexus is a technology partner with deep expertise in building loan lending apps. We know what technology stack to choose, what features to implement, and how to create a money lending app on time. Here are some examples of our successful fintech cases:

To learn more about this credit scoring SaaS app, please see the case study.

To learn more about this banking app, please see the case study.

To learn more about this app for getting instant loans, please see the case study.

Summary

Though there are several digital lending apps available on the market, there is still room for new solutions since users’ demand for convenient and accessible loans grows steadily. However, to launch a successful money lending app, you have to approach the matter rationally and wisely. There are multiple things to pay attention to – from the comprehensive discovery phase and proper UI/UX design to accurate mobile loan app development, legal compliance, and timely updates, not to mention the careful selection of third-party service providers.

At Itexus, we’ve been helping financial organizations reach their business goals with robust software solutions for years. Our experienced business analysts, software engineers and architects, UI/UX designers, DevOps specialists, and project managers know how to build a loan app that will create lasting value for your company and increase returns on your technology investments. Contact us to turn your idea into an impactful and efficient digital lending app that will delight your users and accelerate your business.