Accounting Platform with Crypto Assets

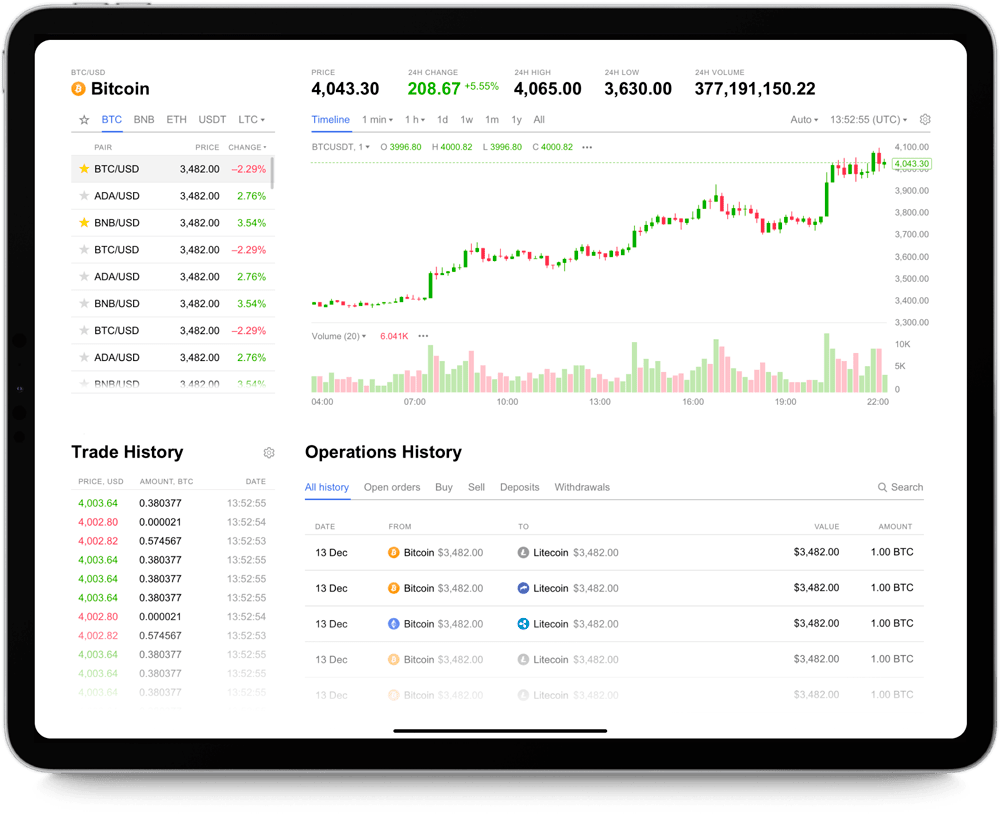

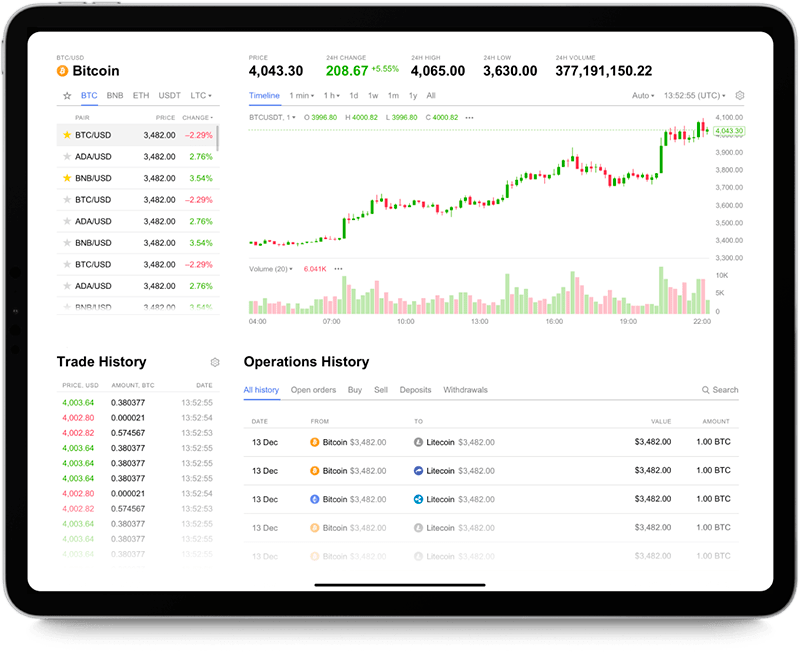

Itexus has developed a web platform that simplifies payments and accounting for global businesses that operate with crypto assets.

A full-fledged crypto accounting software platform that retrieves data from exchanges, wallets, and other cryptocurrency platforms; computes profits, losses, and income from a user’s investing activity; calculates gains and losses; and generates the necessary tax reports.

Engagement model

Time & Materials

Effort and Duration

October 2019 – January 2020

Solution

Crypto accounting software

Project Team

1 Project Manager, 1 Business Analyst, 2 Backend developers, 1 DevOps, 1 Tech Lead

Tech stack / Platforms

Project Background

Given the myriad of possible scenarios for a crypto asset ownership change (e.g., buying/selling, trading/exchanging, mining) and the different types of tax liability for each, it is not always clear what taxes must be paid or how one should even go about calculating it. However, every single sale of a bitcoin or any other cryptocurrency — whether it was for crypto or for dollars — needs to be reported to the IRS. The Internal Revenue Service published a 1040 tax form, where the very first question reads: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

Our customer is a US-based Fintech company whose mission is to provide clients who use multiple payment methods (e.g., crypto payments, credit cards, ACH, wire transfers) with a robust tool that calculates their cost basis — with no extra effort.

To make sure that the platform is capable of correctly calculating crypto taxes, our client needed a service that could retrieve a user’s crypto transactions from the requisite data providers: wallets (BTC, ETH), exchanges (Coinbase, Binance, Bitfinex), and payment processors (BitPay, GloBee, CoinPayment). The service also needed to be able to categorize the incoming digital assets, calculate cost basis and gain/loss for each asset balance-reducing transaction, and store the calculated output in the client’s database for reporting.

Building such an integrated web service requires deep knowledge of crypto assets and crypto basis accounting methods. Moreover, as work on the project was in full swing, the client needed a tech partner with proven development expertise and excellent project management practice. Impressed by Itexus’ portfolio of global projects in FinTech and digital asset management, the customer brought our team on to the project.

Functionality Overview

The Itexus team (made up of a backend developer, a DevOps engineer, a project manager, and a Fintech business analyst) covered the full range of backend service development, from programming algorithms on one end, to testing and further enhancement on the other.

Our fintech development team developed a Python-based script that relies on the following business logic:

- The service receives a request from the platform to calculate the cost basis (and the resulting gain or less) for every transaction that reduces a crypto asset balance owned by a specific user.

- It connects to the platform’s Firestore database to retrieve all of the user’s crypto transactions and transaction metadata, including spot price and classification.

- The service applies custom smart matching algorithms — developed and implemented by our team — that group the crypto transactions by asset (BTC, ETH, etc).

- For each asset, the tool performs the following steps:

- Determines the cost basis for each outgoing transaction using the First-In, First-Out (FIFO) calculation method, which remains the default standard in the USA. That is, the first assets that have been purchased will be the first assets that will be disposed of.

- Determines the gain/loss of each outgoing transaction. This is done by subtracting the cost basis from the selling price.

- Determines whether the gain/loss is long-term or short-term. Long-term capital gains tax rates vary between 0% and 20% (plus additional state taxes), while short-term gains are taxed at the maximum ordinary income tax rate.

- The framework stores its calculation output in the Firestore database, where the spot price data and other metadata is kept.

Once the work on designing the service callable (made with a Google function) was complete, our team passed it to the client’s frontend development team, who integrated the service into the platform’s architecture. As a result, the tool is now able to use the information generated by the framework to display tax calculation data and sync it with the user’s accounting system.

Results & Future Plans

Our specialists were able to add extra value to the client’s accounting software by implementing features like crypto asset classification and smart calculation of income taxation.

The platform has been successfully launched, and is demonstrating its great potential to be an ultimate platform for global businesses to simplify their payments and accounting processes. More than just a crypto accounting tool, the growing platform also includes invoicing, payment, and accounting software — helping businesses get paid faster and more transparently, with dramatically lower fees.

Related Projects

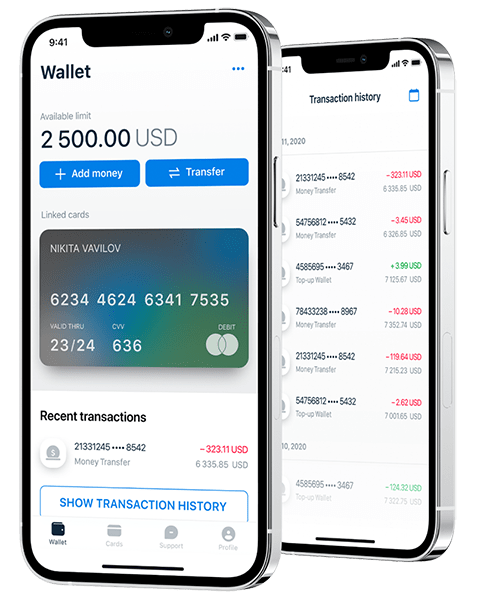

All ProjectsMobile E-Wallet Application

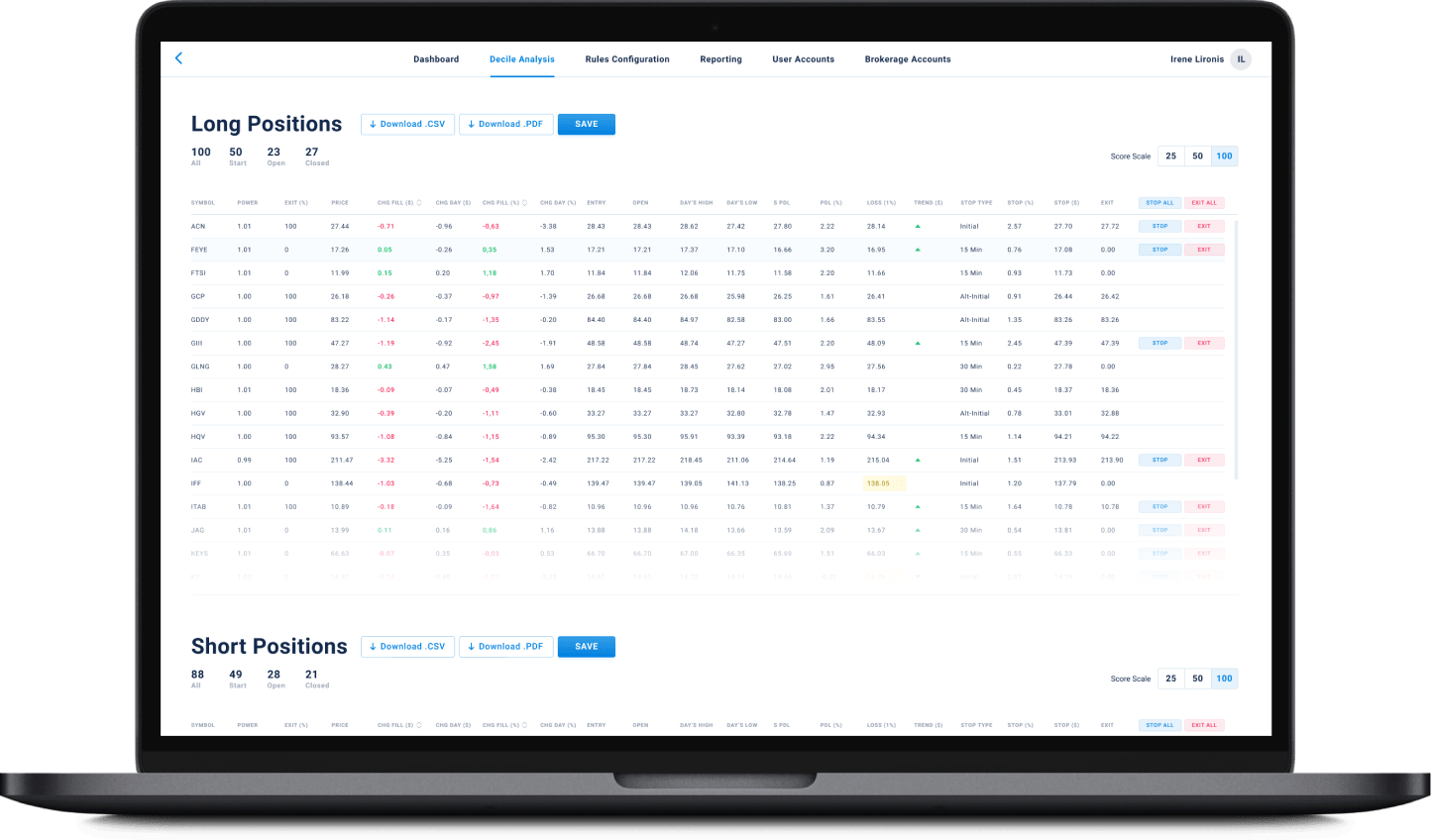

Financial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland