App for Paying Student Loans

The app allows students to claim special deals from merchants and use cashback from their spending to pay off their student loans.

How It All Started

A FinTech startup got in touch with us with an idea for an app that would allow students (who often owe tens of thousands of dollars in student loans) to pay off their loans faster, by aggregating cashback money from merchant deals and transferring them into their personal student loan accounts. Down the road, the Itexus team and the client also made the decision to extend the app’s capabilities by features like the ability to send money to other app users and transfer balances to their savings accounts.

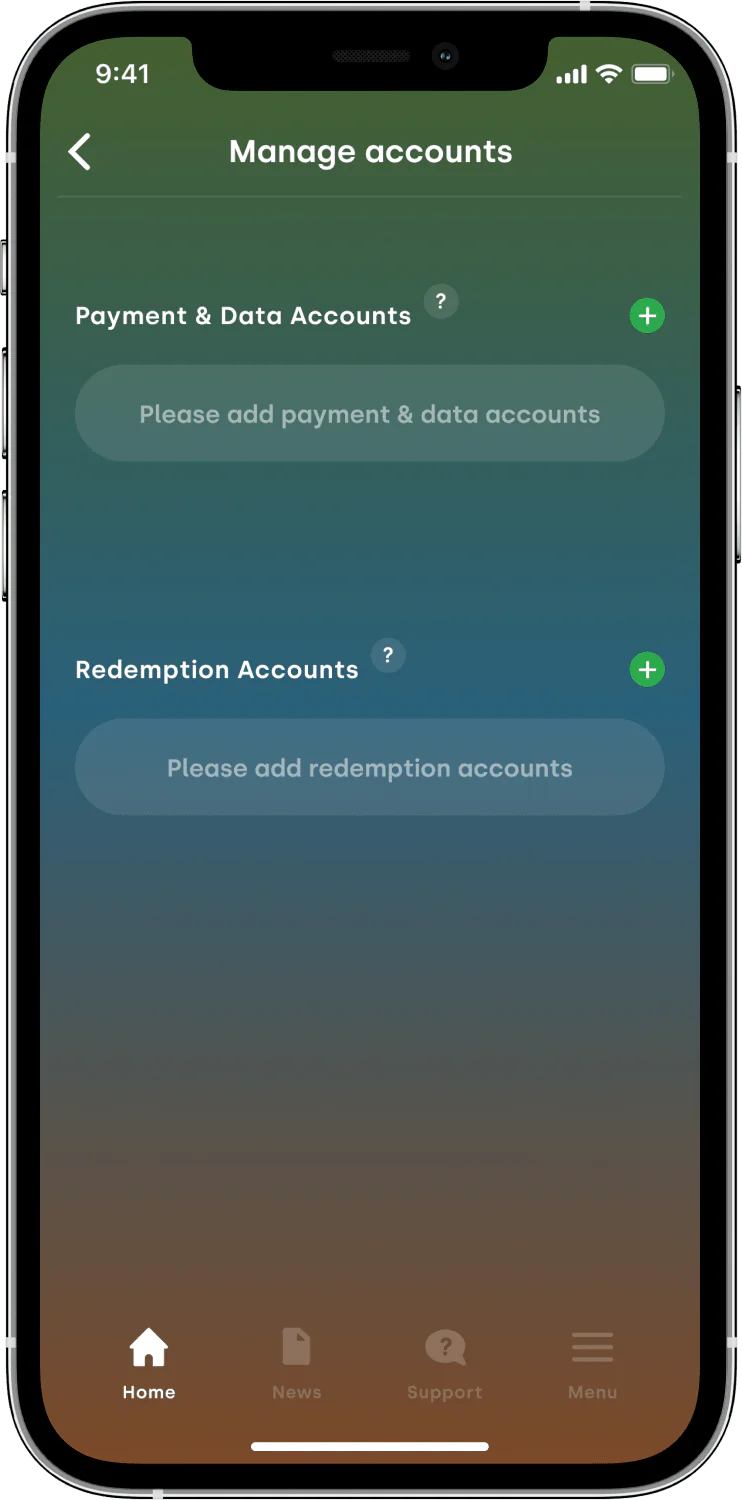

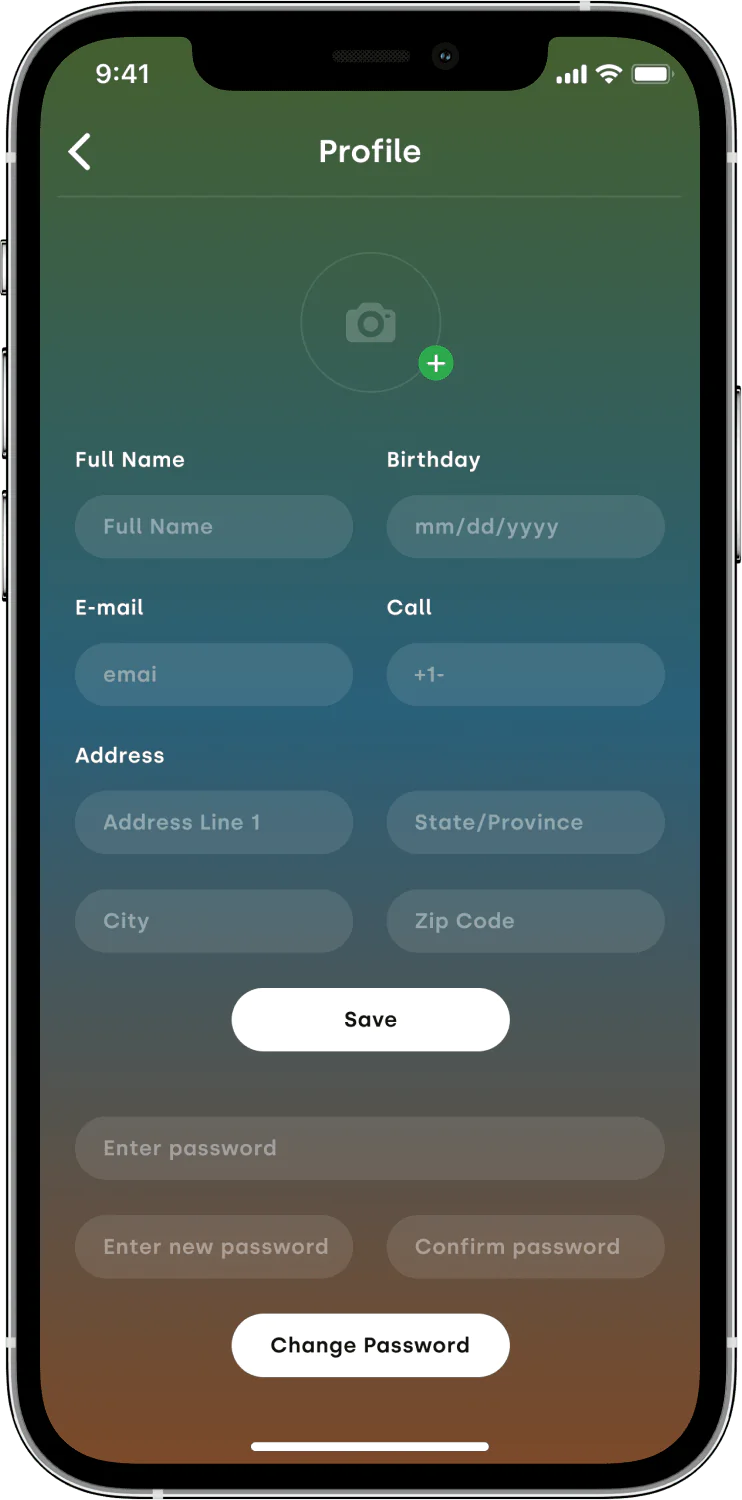

In order to start taking advantage of the app’s services, a user would need to download the app, sign up by linking their bank account, review and claim available special deals, and use the credit card linked to the account at checkout to receive the cashback. All the other operations will be performed by the app.

Project Duration

6 months

Project Team

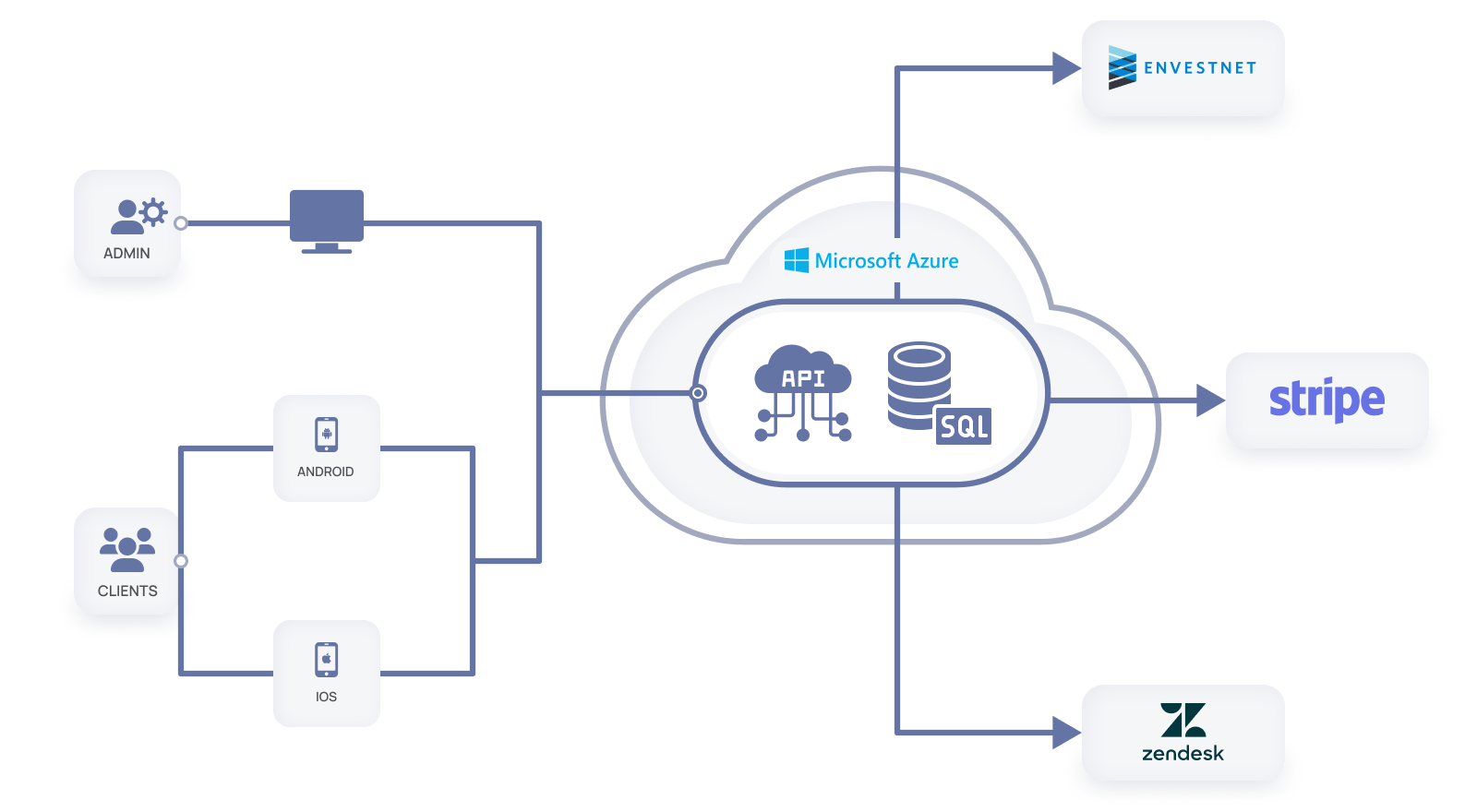

1 PM, 1 BA, 1 iOS developer, 1 Android developer, 1 BE developer, 1 QA

Tech stack / Platforms

Features

- The app helps students pay off their student loans faster by giving them access to numerous merchant deals and letting them transfer cashback money to their student loan accounts;

- Users without existing student loans can help others repay their loans or simply save up their reward money;

- The app helps merchants keep existing customers and attract new ones;

- The system includes account aggregation and payment processing services.

Third-Party Integrations

- Yodlee is a service that allows users to see information from their credit cards, bank accounts, investments, emails, etc. on one screen.

- ZenDesk is a service that provides customizable tools for building customer service portals and online communities, and enables the management of all conversations within the app.

- Stripe is a payment service provider that accepts credit cards, digital wallets, and many other payment methods.

Development Work

The work was organized using the Agile development model and the Scrum framework. We have split the development into bi-weekly sprints with new features and product demos coming at the end of each stage. The client communicated with the team via Slack and Skype. We also used Git as a code repository.

Related Projects

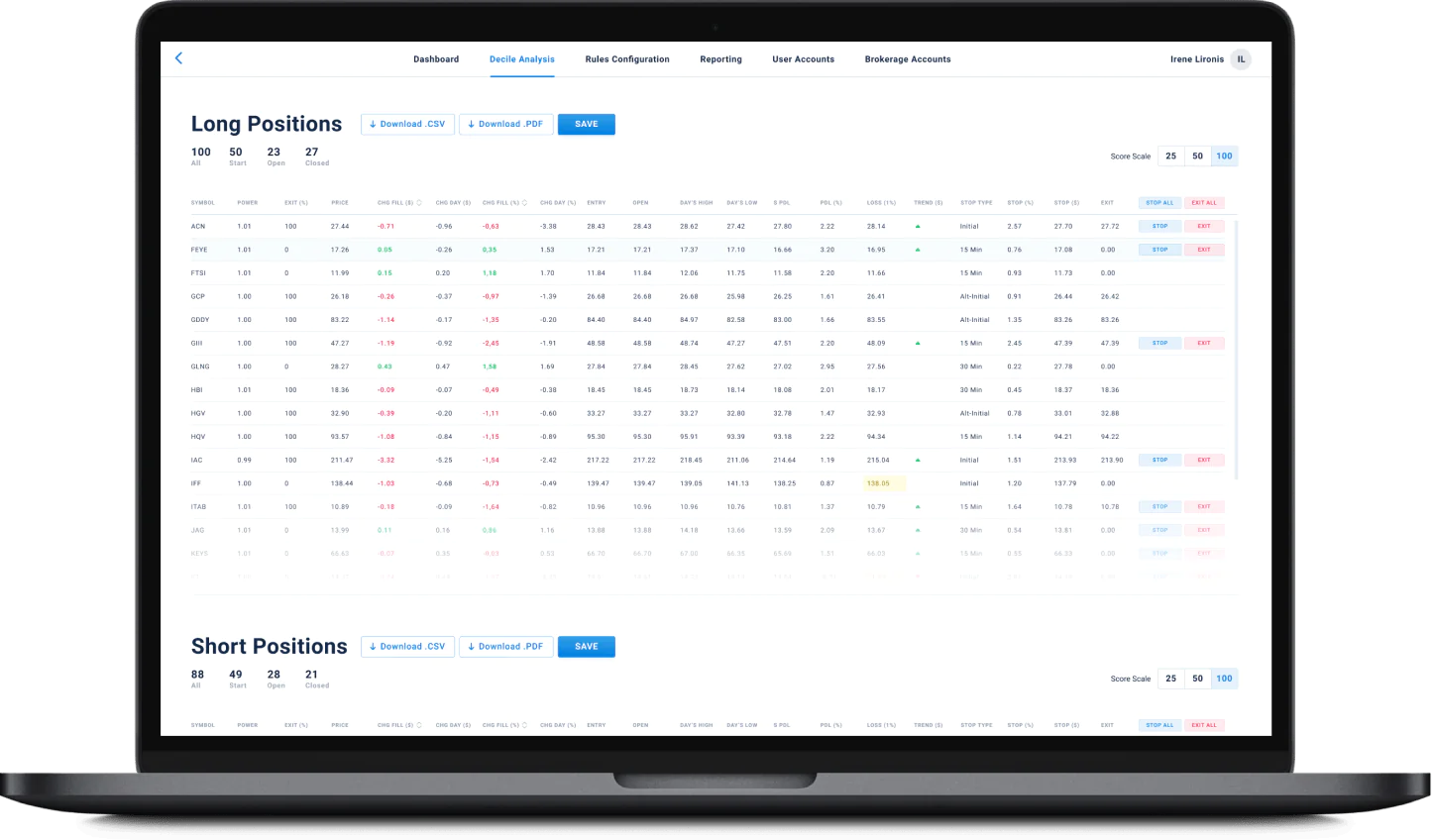

All ProjectsFinancial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

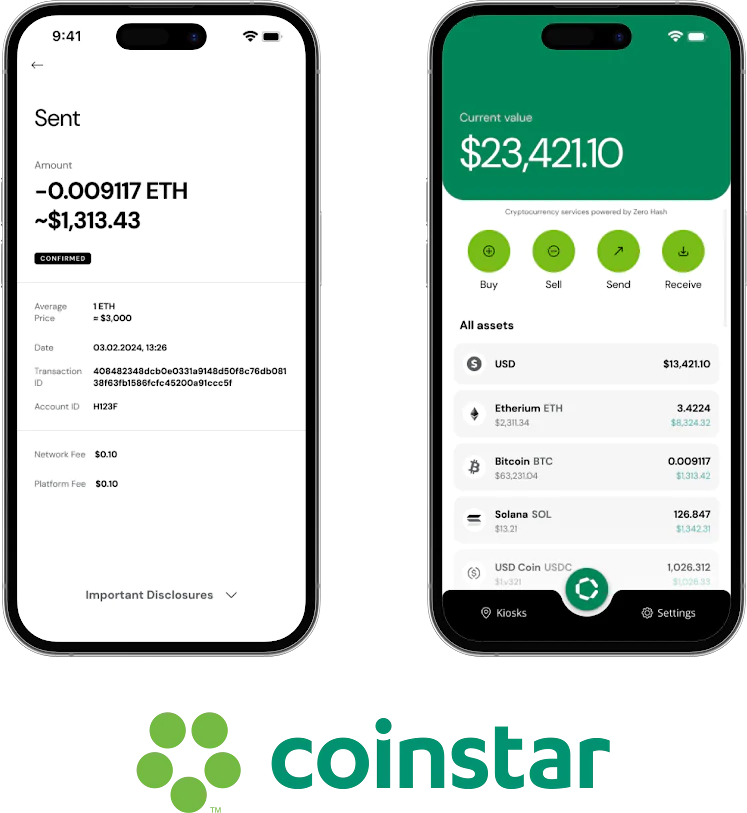

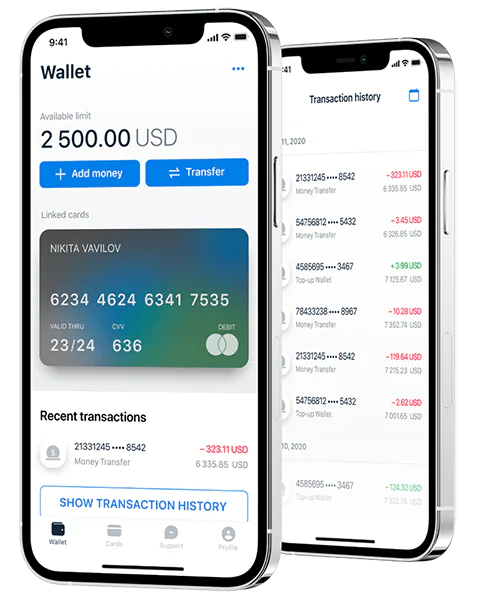

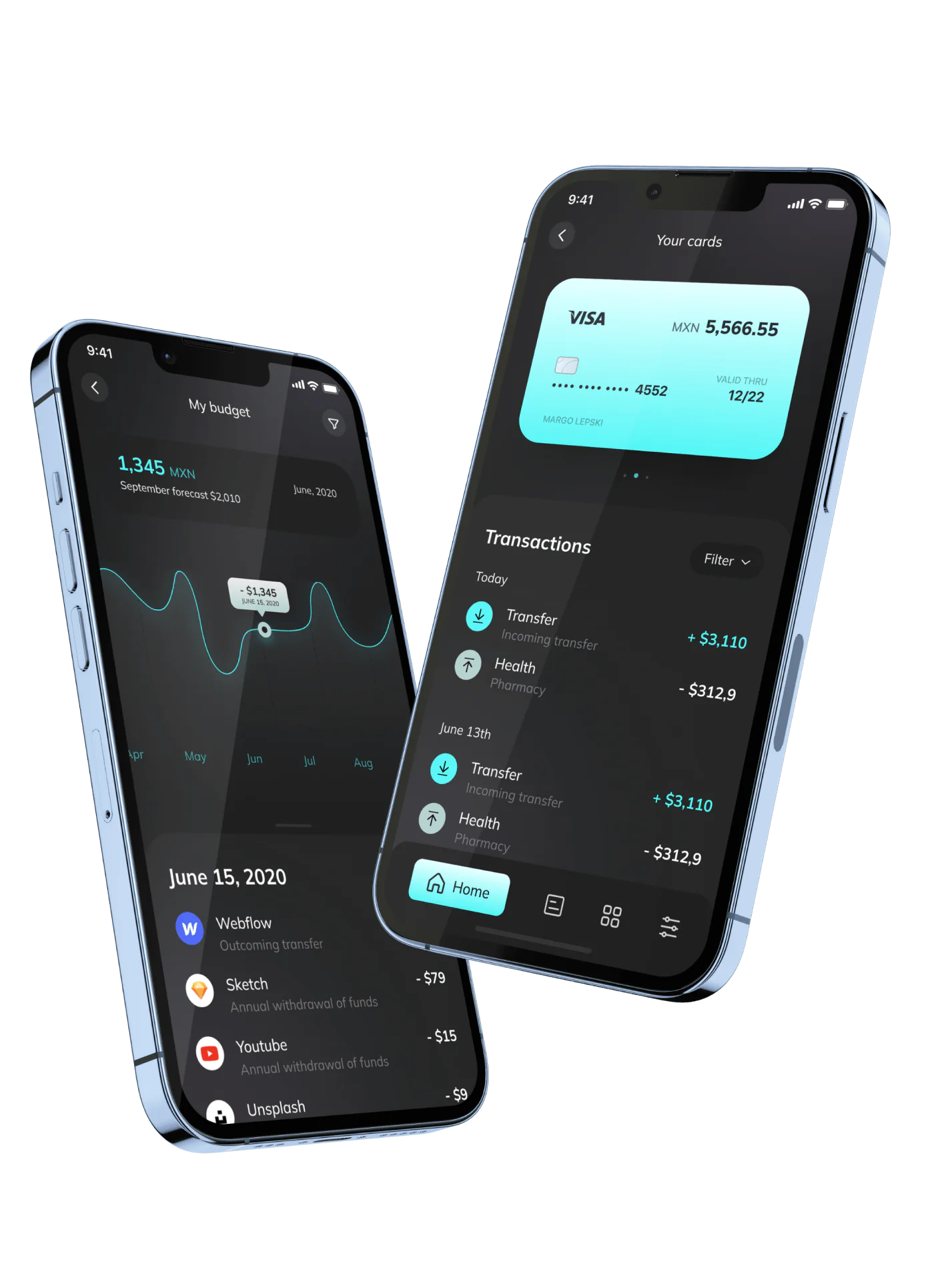

Mobile E-Wallet Application

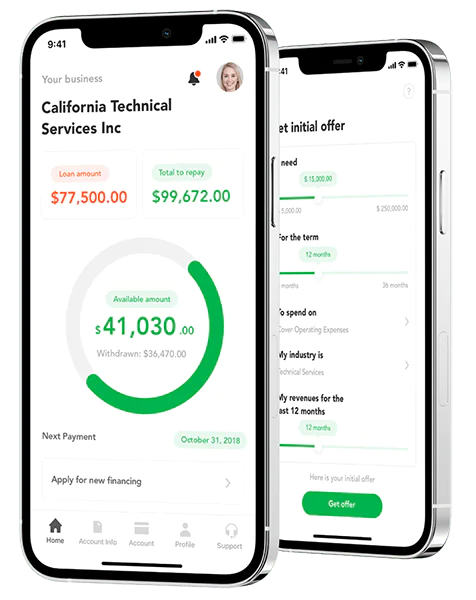

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland