Automated Crypto Trading Platform

Automated crypto trading platform that allows administrators to configure trading strategies based on various technical indicators, and investors to invest their money in the selected strategy.

About the client

Our client is an investment management company that provides services to both individual and institutional investors. The company operates globally and has offices in the UK, the USA, the United Arab Emirates, Mauritius and the Cayman Islands. It was founded by a professional investor specializing in technical analysis who decided to start his own business after 15 years of working for Tier 1 banks such as the Royal Bank of Scotland and HSBC.

Engagement model

Time & material

Solution

Crypto trading platform

Effort and duration

11 months

Project team

2 Business Analysts, 1 Tech Lead, 1 UI/UX designer, 1 Project Manager, 1 Backend Developer, 1 Frontend Developer, 1 QA engineer

Project background

Cryptocurrencies have been on the rise for several years now – new coins are popping up all the time, and the market is growing, as is people’s interest in crypto trading. Due to the enormous popularity of cryptocurrencies, it is difficult to find relevant information on the subject and the right advice on how to invest. Existing trading solutions usually offer trading tools, but don’t allow people to develop and test their own profitable trading strategies and use them to make money.

Sometimes people find it hard to part with their money or risk it, which is why they are hesitant to invest in cryptocurrencies even though they’re interested in it. Learning strategies requires time, as is the constant monitoring of the market, which is necessary to gain profit. For others, the reason not to invest in crypto is the environmental impact of mining.

The client wanted to create a solution for people who would like to invest in crypto but are hesitant for some reason. Due to the known environmental issues, the client brought the idea of compensating the environmental damage caused by mining. So, the client turned to Itexus to develop an automated crypto trading web app that allows administrators to set up and configure trading strategies through an external trading platform previously developed by our engineers, and investors to put money into the pre-set strategies that have a certain level of performance and allow for profits.

Tech stack / Platforms

Target audience

The solution is aimed at both individual and institutional investors who want to earn on cryptocurrencies but do not have the knowledge or time to acquire it, so they prefer to rely on a ready-made strategy with proven profits. The target audience of the app can be described as follows: investors with average and above-average income who have a general knowledge of crypto and trading and want to go deeper into the topic to make money or at least not lose it. As for the geography of the target market, the system is applicable worldwide, except for countries that have banned or restricted the use of cryptocurrencies.

Solution overview

The system works on the basis of the strategy components derived from the automated real-time stock trading system that we previously developed for the client. The solution combines three subsystems, each with its own functionality, and also includes a forum where investors can interact.

1. Super-admin panel

Super-admins can configure and manage part of trading strategies, as they are knowledgeable about crypto trading and know what a strategy should be based on and what to look out for in order to make trades at a profit. The super-admin is also responsible for risk management of the whole system.

2. Admin panel

Admins can combine strategies pre-configured by super-admins into a strategy that contains different components and are responsible for the performance of the strategy for an instrument (e.g. BTC). They can also update modules within strategies to make them more effective.

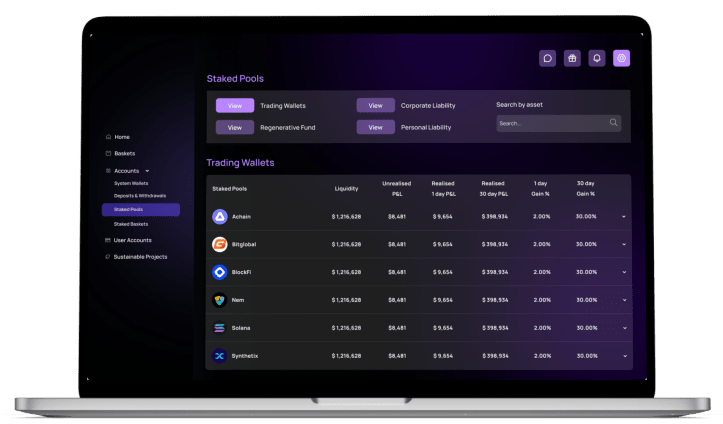

3. Client portal

This is where end users interact with the app. In client portal, they can interact with the instruments and the results of the strategies application in the market, top up accounts, withdraw money, donate to sustainable projects, etc. A system of user levels is also implemented in the solution – the higher the level, the greater the profit. In their accounts, users can upgrade their levels by performing certain actions.

Solution main features

Super admin panel:

- Configure & manage trading modules and components of strategies

- Perform risk management

Admin panel:

- Manage strategies for different investment instruments

- Access reports

- Manage clients base

- Manage financial resources

- Moderate the forum

Client portal:

- Sign up, go through KYC/KYB process, create an account

- Manage balance (top up the account and withdraw funds) and crypto wallets

- Track reports and statistics

- Access trading tools, view the list of instruments with the results of the strategies applied, assess how much the strategy can earn for a particular instrument, invest in selected instruments, etc.

- Participate in sustainable projects (access, review and support projects; evaluate progress in raising money for projects, etc.)

- Communicate with other investors on the forum

Third-party integrations

- The system supports Metamask, Trust Wallet, TokenPocket and Binance chain wallet, as well as WalletСonnect protocol, which allows to expand the number of supported wallets to over 100.

- Kraken, Binance, and FTX exchanges are used to execute trade orders, while the system processes strategies and initiates the sending of orders.

- FireBlocks is the platform’s custodian that stores and distributes crypto assets within the system.

Project challenges

Inner accounting

- Users’ funds are pooled in a single account to participate in trades on brokerage platforms. After trading, the funds are transferred back to the platform’s pool and distributed among the participants. We implemented this approach to cut costs on brokerages’ transaction fees. The internal accounting system is responsible for all financial operations within the platform.

Development process

As we mentioned earlier, we developed an automated stock trading platform for this client. After the project was completed, the client came back to develop a similar solution, but for different target audience and adapted to the specifics of crypto trading. We conducted discovery phase and started the development following the product roadmap.

To deliver the project, we followed the agile development process with frequent deliveries, full transparency and close collaboration with our client. Every two weeks we delivered and demonstrated results and reported on costs.

Summary

Within 11 months, Itexus’ cross-functional team of experts delivered an automated, high-performing, and secure crypto trading web app that met all of our client’s requirements. The platform is up and running. In the meantime, we maintain and support the existing solution and work on the advanced features of the platform.

Looking for a talent pool to fill the software development gap for your project? Itexus engineers are ready to tackle your idea, let’s discuss it.

Related Projects

All ProjectsFinancial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

Mobile E-Wallet Application

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland