Banking App for Students

A banking application that provides students with unique credit, debit, and payment tools, helps to build credit score, and instills financial literacy and money management habits through engaging educational content.

About the client

Some of the most promising companies evolve when their founders have directly experienced the problem they are trying to solve. Such is the case with this case study.

Our client is an American startup with a multicultural team scattered all over the world. All of their people are united by a passion for innovation, an interest in fintech, and a desire to make the world a better place by developing technological solutions that make everyday life easier.

The founders of the company met when they were still students at Georgia State University, bonding over their mutual struggle to pay their debts because they lacked the necessary money management skills and tools — thus came about the idea for their startup.

Project background

The startup first contacted us after they had already launched several successful financial products. While working on these existing products, they identified a user segment whose needs were not fully covered by the existing solutions and came up with the idea of developing a banking product targeted specifically at this segment.

Since all the client had at this stage was an idea and the commitment to bring it to life, we recommended that they start with the discovery phase to test their hypotheses, assess the risks, and estimate the cost of the project. The outcomes and findings from the discovery phase led the team to proceed to the development phase.

Engagement model

Time & Materials

Effort and Duration

11 months

Solution

iOS and Android apps

Project Team

1 Business Analyst, 1 UI/UX Designer, 1 Project Manager, 1 Tech Lead, 2 iOS Developers, 2 Android Developers, 2 Backend Developers, 1 QA Engineer

Tech stack / Platforms

Target audience

The solution is targeted at American and European students enrolled in a college, university, or vocational school, who are looking for additional sources of financing.

Project challenges

The specifics of the client’s team proved to be something of a challenge. First, there were quite a few people from the client side involved in the project, which often led to a lack of a unified product vision for the team. The global nature of the team also led to challenges in scheduling online meetings where everyone needed could be present, due to differences in time zones.

Solution overview

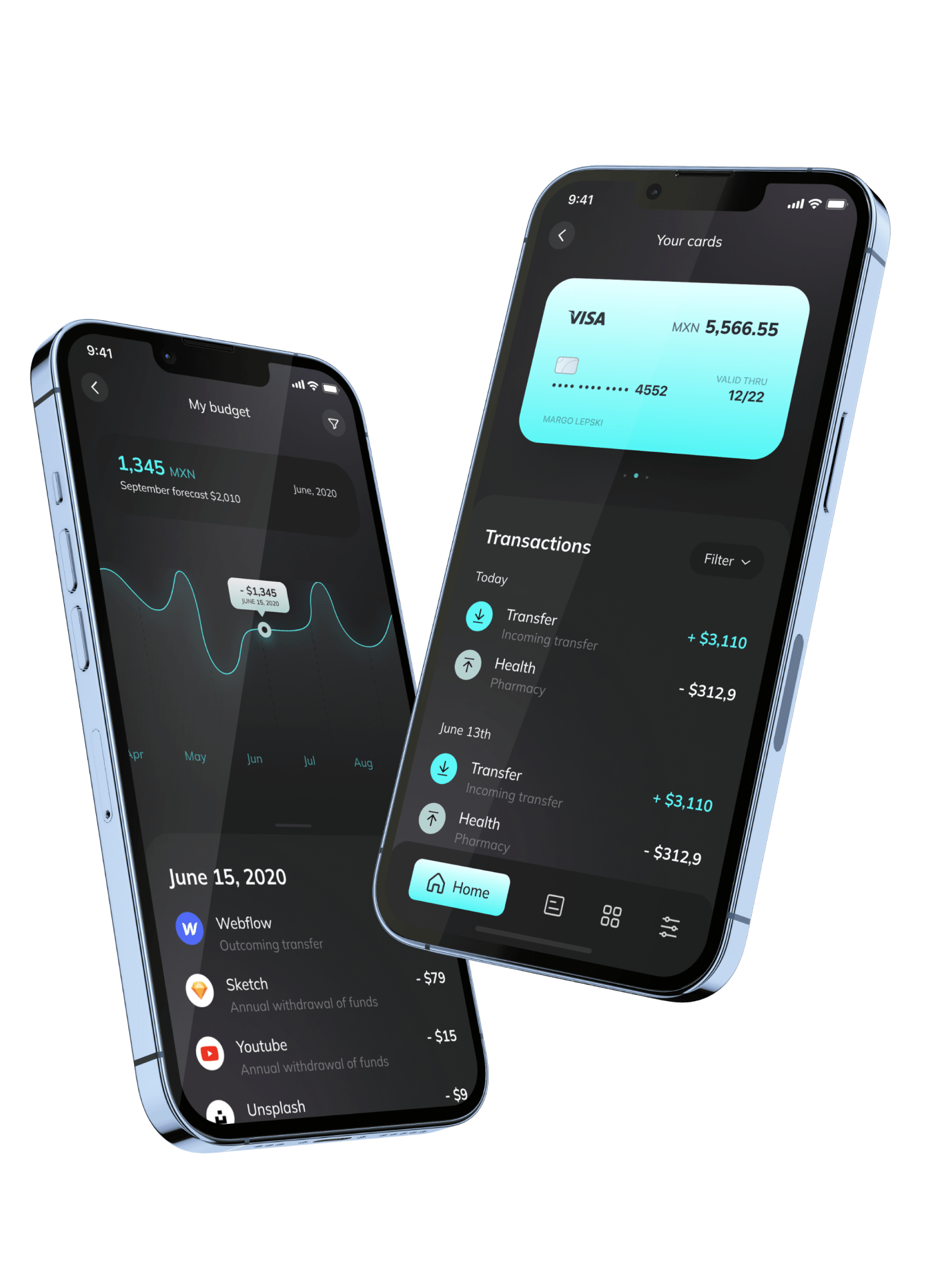

The Itexus team developed two native applications for iOS and Android platforms. The main purpose of the app is to enable students to establish credit during their formal education years, by providing them with access to the right loans and lending tools. The solution includes loans, lending, and payments in a single portal and offers card issuance, money cashback, personal and student loans, cash balance tracking, payment, and credit score services. But there is also something that differentiates the app from similar solutions: it incorporates an educational element for users, via finance education videos.

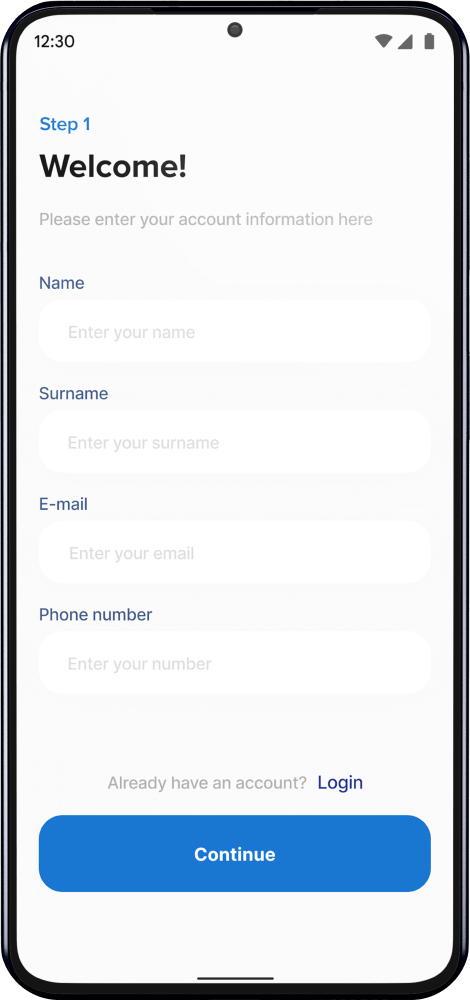

Onboarding

This module allows users to register in the app, sign in, sign out, reset their password, and re-enter the app. Unregistered users have access to introductory information about the app.

Home page

On the home page, relevant information related to users’ financial products is displayed — their credit cards, credit score, card balance, etc. From the home page, users can navigate to the credit card application screen, or switch to viewing educational videos about developing financial literacy.

Credit card application

In this module, users apply for credit cards and pass the KYC procedure.

Credit card management

Here users can view their credit card balance and credit card details, activate or freeze credit cards, view their transaction history, dispute a transaction, add a credit card to a digital wallet, or get and download credit card statements.

Tax management

To facilitate tax documentation management for users, we implemented a feature that allows them to view and download tax documents and have easy access to them, regardless of the app or internet connection availability.

Notifications

Users can receive push notifications about transactions, advertising materials, new videos, etc. Users can also adjust the settings and choose events they want to be notified about.

Credit score management

In this block, users can access their credit score information, calculate it, and see educational information about credit scores.

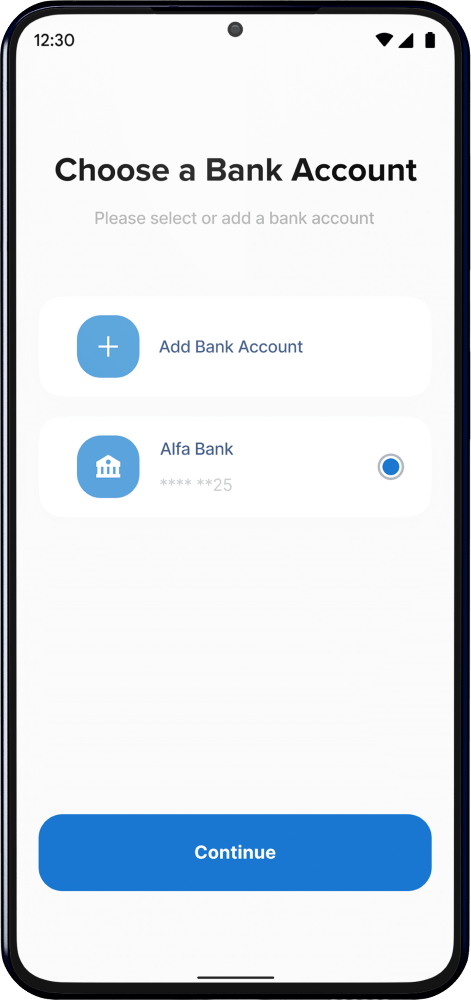

Payments

To enable users to make purchases and set up auto payments, we integrated the app with a payment provider. Linked bank options are also available in this module.

Settings

In this module, users can manage their personal information, edit their profiles, and set or change security parameters.

Customer support

To provide the best possible experience to users, we enabled different options for getting support – phone calls, email, and chat. There is also an FAQ section containing detailed answers to the majority of the questions.

Points management

In the app, users can earn special points by watching educational videos, making purchases, etc. These points are credited to the user’s account and can be converted into money.

Project approach

We started with the discovery phase and held a series of workshops, wherein we designed the user flow, defined the technical solution architecture, prioritized features, and defined the scope and detailed requirements for the first sprints.

Then we moved on to the development phase. For project implementation, we chose an agile methodology with frequent deliveries, full transparency, and close collaboration. Every two weeks, we held demonstration sessions with our client to deliver results and get instant feedback so we could make timely adjustments to the functionality. To make the best use of time, the business analyst wrote the requirements and the UI /UX specialist created designs for subsequent iterations, in parallel with the development process.

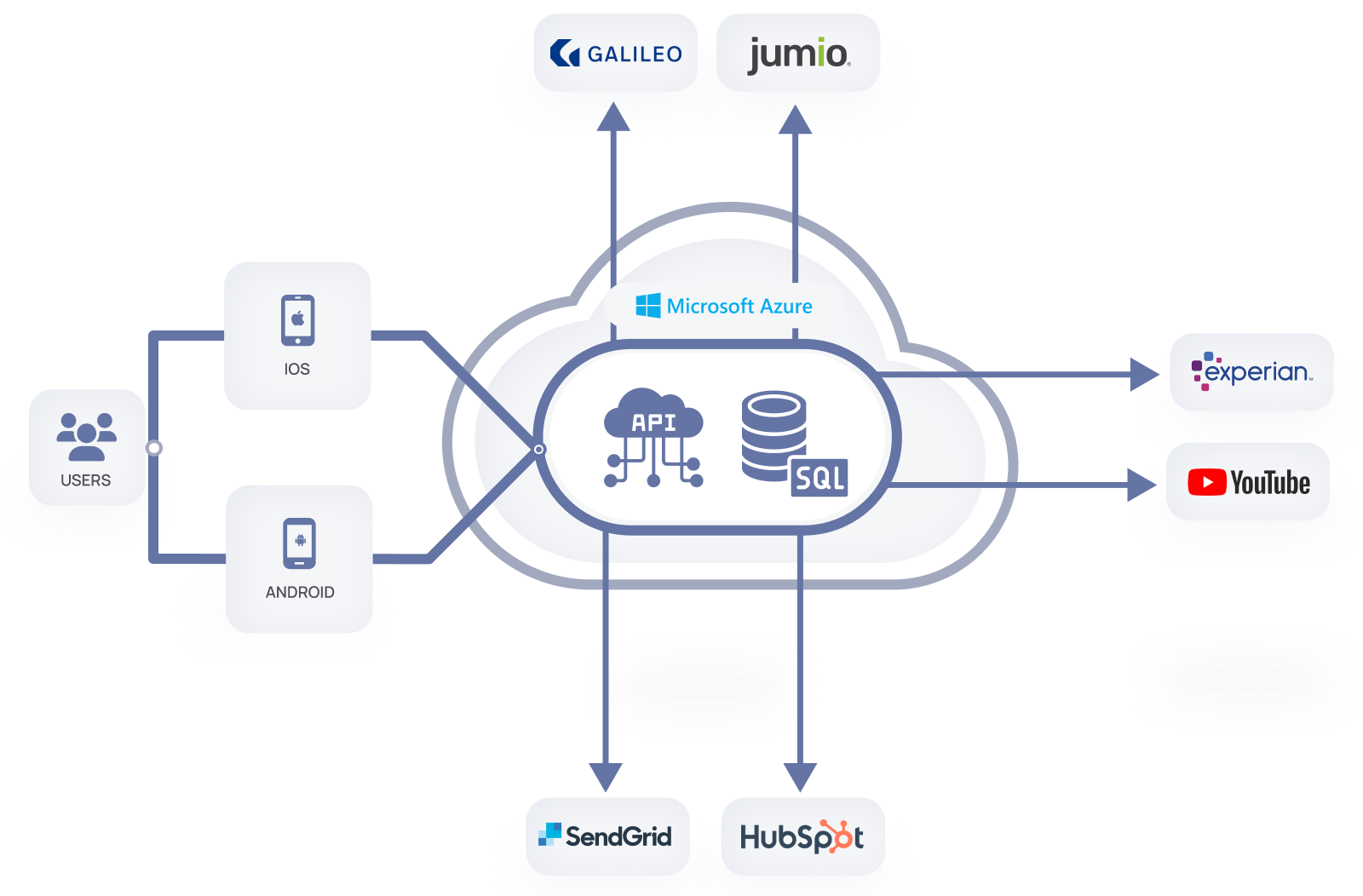

Third-party integrations

- Galileo is a payment processing platform and banking API that allows you to quickly create sophisticated payment card programs. It is used to issue virtual and physical credit/debit cards, process payments, etc.

- Experian offers a wide range of services for the verification of individuals and companies, including KYC and KYB procedures, AML compliance, scoring module, etc. It is used to capture user data and obtain customer scoring, to help the app make better decisions on loan granting.

- YouTube is an online video sharing and social media platform that allows the client to publish educational videos so that users of the app can watch them to improve their financial literacy.

- Jumio‘s identity verification, eKYC, and AML solutions fight fraud and other financial crimes, ensure compliance, and onboard good customers to apps faster. We use them to monitor customer transactions, prevent fraud and comply with AML regulations.

- SendGrid (Twilio) is a cloud-based email delivery platform used to distribute emails to customers (users of the app).

- HubSpot is a CRM software that provides a full range of marketing, sales, and customer service functions to organize and engage all customers (users of the app).

Results

The first version of the MVP was delivered to the client within budget, on schedule, and in full accordance to their expectations. and is now live. The client is collecting consumer response data and market feedback to decide what direction to take to enhance the app further. The Itexus team is working on the advanced version of the application.

Need expert assistance in fintech app development? Let’s discuss your ideas and find out how Itexus can help you take them further.

Related Projects

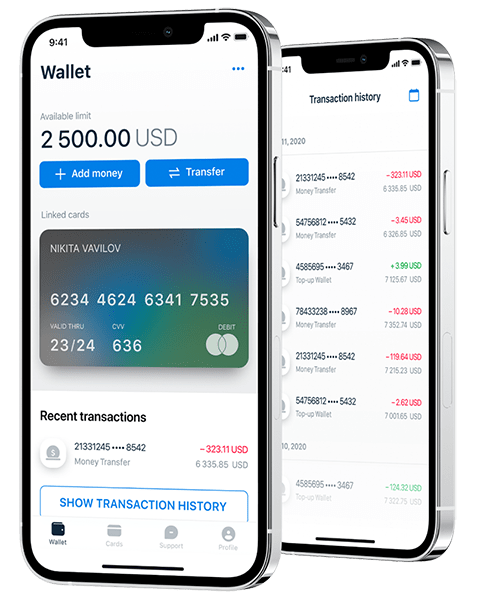

All ProjectsMobile E-Wallet Application

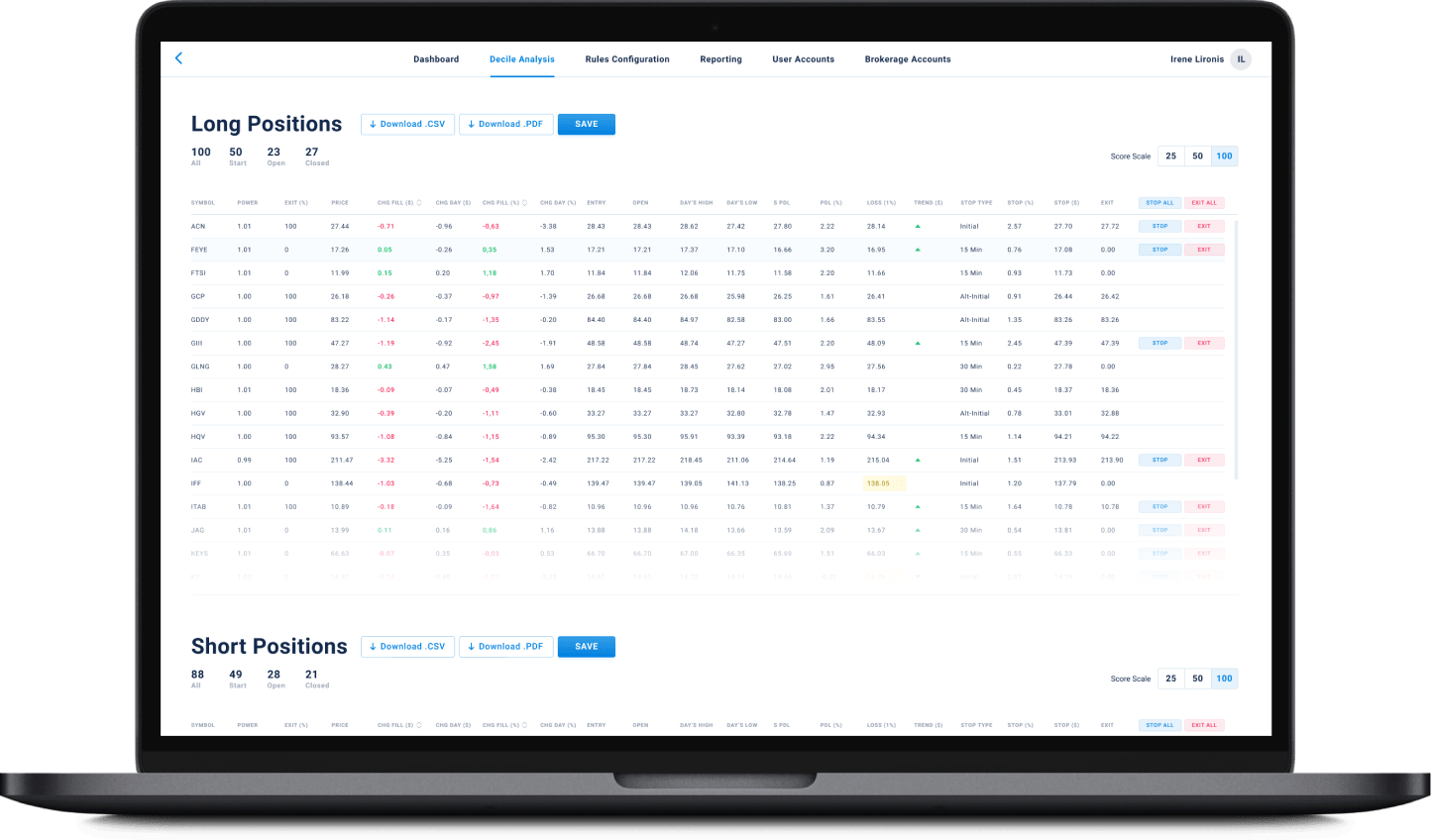

Financial Data Analytical Platform for one of top 15 Largest Asset Management

Financial Data Analytical Platform for one of top 15 Largest Asset Management

- Fintech

- Enterprise

- ML/AI

- Project Audit and Rescue

AI-based data analytical platform for wealth advisers and fund distributors that analyzes clients’ stock portfolios, transactions, quantitative market data, and uses NLP to process text data such as market news, research, CRM notes to generate personalized investment insights and recommendations.

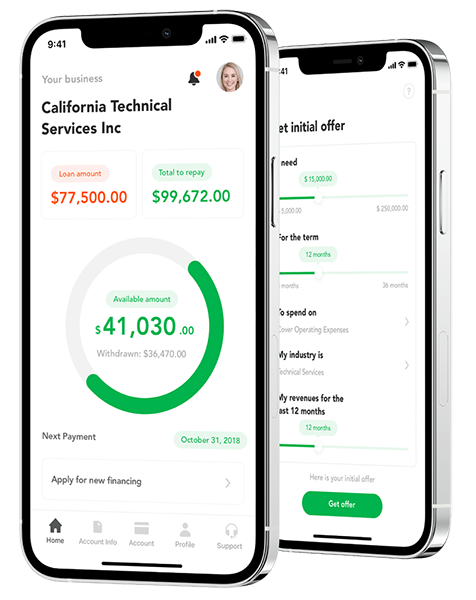

App for Getting Instant Loans / Online Lending Platform for Small Businesses

App for Getting Instant Loans / Online Lending Platform for Small Businesses

- Fintech

- ML/AI

- Credit Scoring

Digital lending platform with a mobile app client fully automating the loan process from origination, online loan application, KYC, credit scoring, underwriting, payments, reporting, and bad deal management. Featuring a custom AI analytics & scoring engine, virtual credit cards, and integration with major credit reporting agencies and a bank accounts aggregation platform.

Contact Form

Drop us a line and we’ll get back to you shortly.

For Quick Inquiries

Offices

8, The Green, STE road, Dover, DE 19901

Żurawia 6/12/lok 766, 00-503 Warszawa, Poland